In April , ChainCatcher sorted out the re-pledge agreement and LRT protocol on Ethereum, "With frequent capital support, airdrops of projects, and re-pledge, the LRT track has become the "New Nuggets Holy Land"", including EigenLayer and the LRT protocol based on it, such as Renzo, Ether.fi, Kelp DAO, EigenPie, YieldNest, Swell, Pendle Finance, and more.

Although expectations such as Renzo’s token issuance and EigenLayer’s airdrop have been realized, in the past three months, the market enthusiasm for the re-staking track has remained the same. “Points war + one fish to eat more” is still enthusiastic in the crypto community, with thousands Large-amount financings in the tens of thousands range often occur.

For example, on June 18, Renzo announced the completion of US$17 million in financing led by Galaxy Ventures and others; on June 11, re-pledge project Symbiotic announced the completion of US$5.8 million in seed round financing, led by Paradigm and Cyber Fund.

Data shows that 16.3% of all pledged ETH has participated in re-pledge by Eigenlayer, Karak_Network, etc.

Perhaps because of the opportunity to re-pledge wealth, the narrative position of the re-staking track has been spilling out recently, from the main position of Ethereum to Bitcoin, Solana and other ecosystems.

It is reported that at least 6 teams in the Solana ecosystem are building Solana re-staking projects.

Recently, there have been two financings of more than 10 million yuan in the Bitcoin ecosystem. On May 30, Babylon completed a US$70 million financing led by Paradigm; on July 2, the Bitcoin re-pledge protocol Lombard completed a US$16 million seed round of financing. , led by Polychain Capital.

Three major re-pledge protocols on Ethereum: EigenLayer, Symbiotic, Karak Network

EigenLayer airdrop tokens are non-transferable and controversial

As the pioneer of the restaking concept, EigenLayer has always been the leading project on the restaking track. However, since EigenLayer announced the EIGEN token economic model on April 30 and stated that the airdrop tokens are not transferable, it triggered a series of public opinion storms.

What is most criticized by users is that EigenLayer stated in the white paper that the transfer rights of EIGEN tokens are restricted in the initial stage and do not support user transfers or transactions. This means that users cannot buy, sell or trade EIGEN tokens in the secondary market.

The official explanation is due to lack of liquidity, but in the eyes of users, this is undoubtedly a rogue project. The Ethena project, which just completed the airdrop and released the stable currency, posted on social media, "Tokens are transferable, we love you." Innuendo.

In addition to the non-transferability of tokens, EigenLayer also restricted users’ IPs during the airdrop, which made users even more dissatisfied because EigenLayer did not use IP restrictions on the early pledge deposit page, and did not announce IP restrictions until the airdrop was released. Participating users have a sense of seeing things done.

However, judging from changes in data, the airdrop public opinion has not affected TVL on EigenLayer. On the contrary, it has increased, from a peak of US$14 billion on May 9 to US$19 billion on June 16. Now it has fell back to $14.9 billion.

EigenLayer supports native re-pledge and liquidity re-pledge: 68% of the assets are native ETH and 32% are LST. Currently, EL has approximately 161,000 re-hypothecaters, but approximately 67.6% (approximately $10.3 billion) of assets are entrusted to only 1,500 operators.

On July 3, EigenLayer posted on the social platform X that "major projects will be promoted in Q3." Community users speculate that it is likely that the EIGEN token will support transactions.

As of July 12, EIGEN tokens still do not support transfer or trading, and are quoted at $5.39 on the Whalesmarket, an over-the-counter secondary points trading market.

Symbiotic, a new re-pledge project backed by Lido and Paradigm

While EigenLayer was in deep public opinion due to airdrop rules, on May 15 it was revealed that Lido co-founders and Paradigm were secretly funding a new project, Symbiotic, to compete in the re-staking track. From the community's perspective, the timing of Symbiotic's emergence is more like a counterattack against EigenLayer's dominance.

On June 11, Symbiotic announced its official launch and completed a $5.8 million seed round of financing. This round of financing was led by Paradigm and Cyber Fund.

Among them, Symbiotic’s second largest investor, Cyber Fund, was co-founded by Lido co-founders Konstantin Lomashuk and Vasiliy Shapovalov, and the Symbiotic platform publicly stated that it supports users to use Lido’s stETH and other assets that are incompatible with EigenLayer’s native Pledge.

Therefore, Symbiotic is also considered to be Lido's fill-in for the vacancies in the re-pledge track and is a direct competitor of EigenLayer.

Unlike EigenLayer, which only supports ETH and its (LSD-like ETH) derivatives, Symbiotic supports more diverse types of re-pledged assets, supporting the deposit of any ERC-20 token as re-pledge. For example, re-pledged assets not only support Lido’s stETH, LSD pledge certificate assets such as cbETH also support the governance token ENA and stable currency USDe of the stablecoin protocol Ethena.

This means that cryptographic protocols can enable native staking for their native tokens through the Symbiotic platform to improve network security.

In terms of product form, Symbiotic supports developers to customize according to business needs. For example, if you use Symbiotic's protocol or new network, you can choose its pledged asset type, node operator, reward and reduction mechanism, etc. Eigenlayer adopts a centralized management method, with the official managing the commission of pledged ETH, and the node operators verifying various AVS, etc.

With the support of Lido and Paradigm, in just one month after Symbiotic was launched, the value of crypto assets deposited has exceeded US$1 billion.

As of July 12, the TVL of the Symbiotic platform was US$1.09 billion, of which the value of wstETH deposited in Lido was US$760 million, accounting for approximately 70% of the TVL.

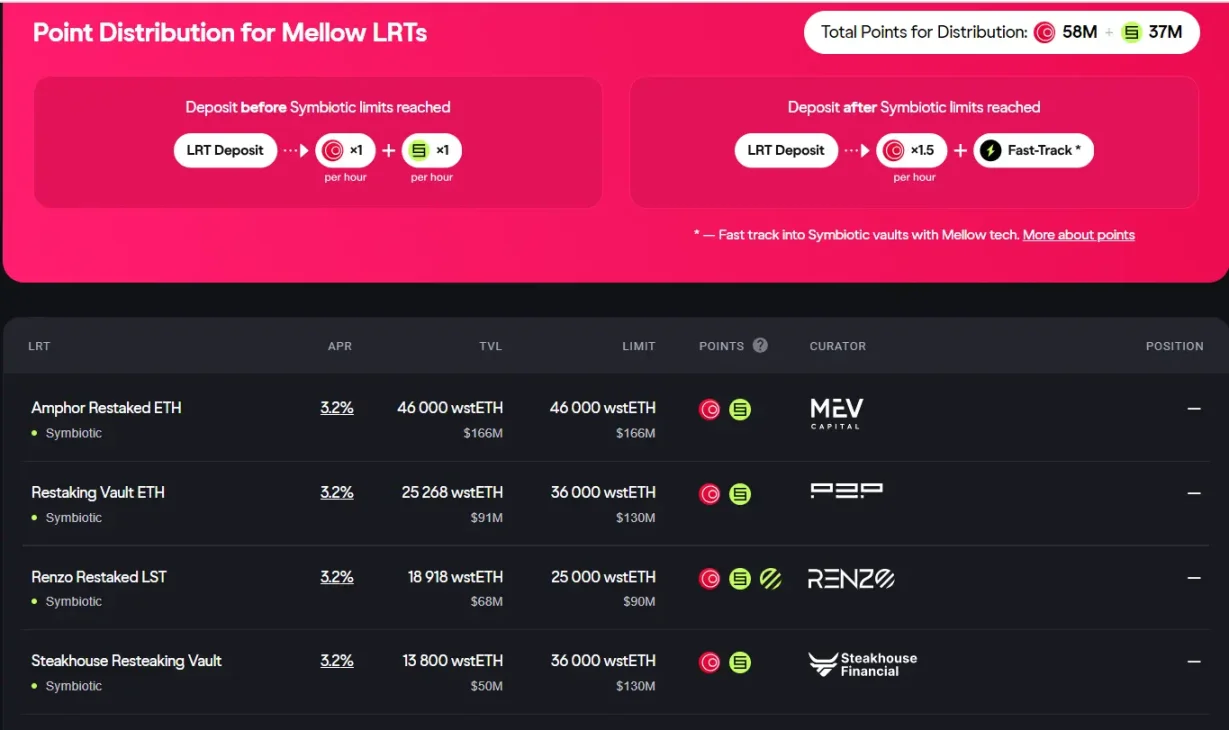

Currently, LRT protocols such as Ether.fi, Renzo, YieldNest, Swell, and Pendle Finance have been integrated with Symbiotic, allowing users to earn Symbiotic points by depositing assets on LRT.

LRT protocol Mellow based on Symbiotic

Mellow was originally a liquidity solution and a partner of the Lido Alliance, allowing users to stake ETH on the platform to obtain stETH and earn additional Mellow staking points. In addition, Mellow also helps Lido operators launch their own LRT to increase the usability of stETH and increase revenue for Lido DAO members.

On June 4, Mellow announced its cooperation with Symbiotic and launched it as a modular LRT liquidity re-hypothecation project in its ecosystem.

Compared with common LRT protocols, Mellow is more like a modular LRT infrastructure, allowing anyone to deploy or build LRT with different risk or return ratios, such as traditional hedge funds, staking providers (such as Lido), etc. , supporting pledge users to choose different risk configurations according to their own needs to achieve flexible risk management and income optimization.

For users, they can directly deposit ETH into the Mellow platform, and the platform will automatically transfer the ETH to Lido. The user will receive stETH and deposit stETH into Symbiotic. Users who deposit ETH in Mellow can obtain double points from the Symbiotic+Mellow platform at the same time.

On July 15, the TVL on the Mellow platform was $488 million, and 37 million Symbiotic points were earned.

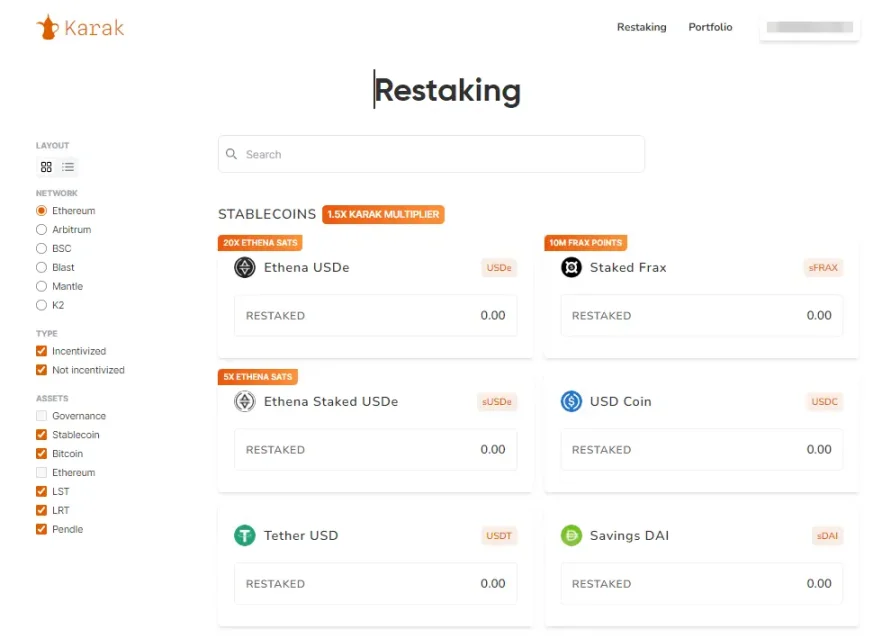

Karak Network, a re-pledge protocol that supports multi-type assets and multi-chain deployment

The working principle of Karak Network is similar to the Eigenlayer protocol, except that it calls its AVS service decentralized security service DSS and has also launched its own Layer2 network K2.

Unlike Eigenlayer, Karak aims to support the re-pledge of any asset. Currently, the re-pledged assets supported on the platform include ETH, various LST and LRT assets, as well as stablecoins such as USDT, USDC, DAI, USDe, etc.

In addition, Karak is deployed on multiple chains and is designed to be deposited on any chain. Currently, it has been deployed on Ethereum, Arbitrum, BSC, Blast, Mantle, etc. Users can distribute their assets across multiple chains Situation deposit assets.

However, the TVL on the Karak platform currently exceeds US$1 billion, and new fund deposits are not currently supported.

Re-pledge protocols on the Bitcoin chain: Babylon, Lombard, BounceBit

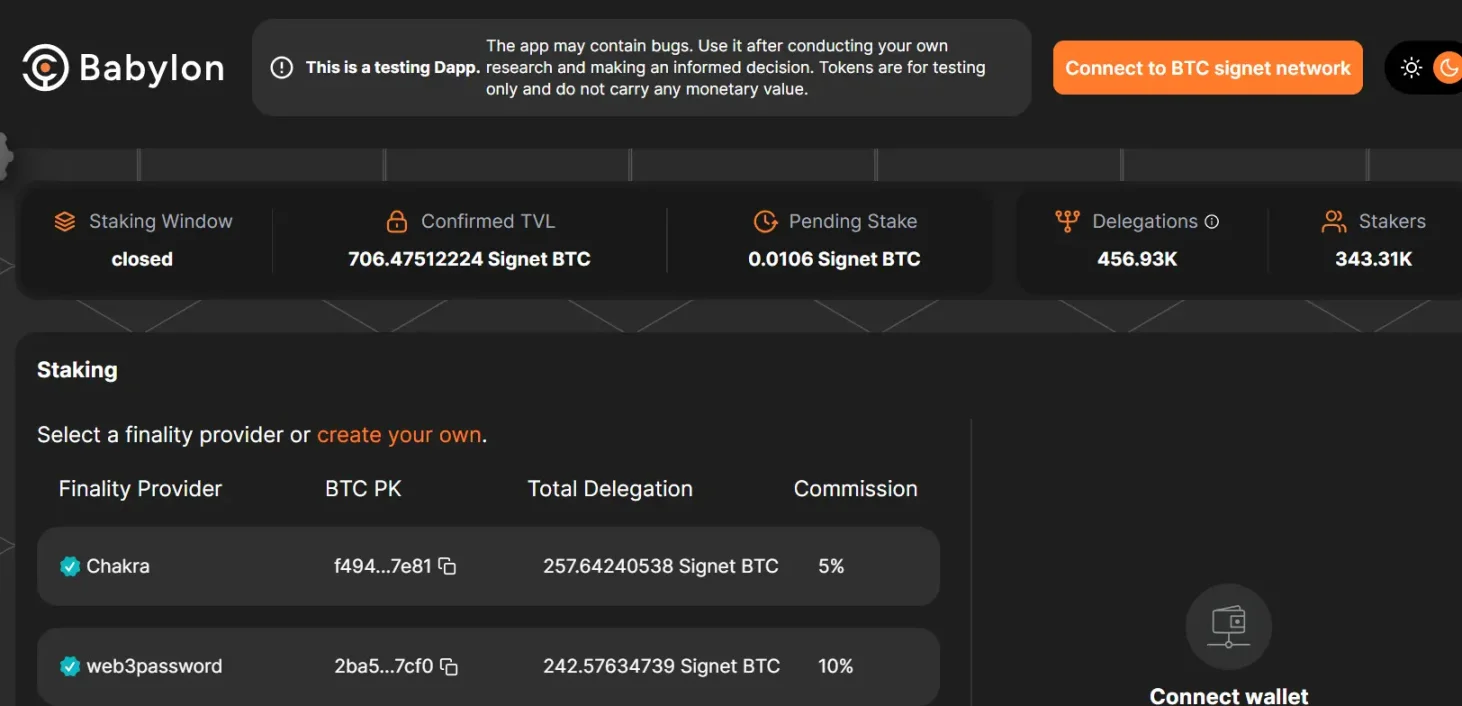

Bitcoin re-pledge protocol Babylon

Babylon is a re-pledge protocol based on Bitcoin. It introduces a staking function to Bitcoin, allowing BTC holders to pledge their assets to other protocols or services that require security and trust without trust, thereby obtaining PoS. Pledge income and governance rights also transfer Bitcoin security to various intermediary software, data availability layers, side chains and other protocols, allowing them to enjoy Bitcoin-level security at a lower cost.

From the perspective of business scope, Babylon covers two aspects: first, BTC holders can pledge BTC to provide security and trust layer for other protocols, and earn income from it; second, let PoS chain or other Bitcoin ecology New protocols in the system may be able to utilize BTC stakers as verification nodes to improve security and efficiency.

The co-founder of Babylon once said in an interview with ChainCatcher that in terms of working mechanism, Babylon is consistent with Ethereum’s re-pledge protocol EigenLayer. However, since Bitcoin does not support smart contracts, Babylon needs to do one more step than EigenLayer to allow unpledged Bitcoins to be used first. Becomes stakeable, and then can be staked again.

On May 30, Babylon once again announced the completion of US$70 million in financing led by Paradigm. According to Rootdata data, as of July 12, Babylon’s public financing amount has totaled US$96 million, with investment institutions including Paradigm, Polychain Capital, Framework Ventures, Polygon Ventures, Binance Labs and many other well-known capitals.

Currently, users can experience the process of staking BTC through the Babylon Testnet4 test.

Liquidity re-pledge protocol based on Babylon

1. Lombard raised US$16 million in seed round financing

Lombard is a liquidity re-hypothecation protocol built on Babylon. On July 2, it announced the completion of a $16 million seed round of financing led by Polychain Capital, with participating investors including BabylonChain, Foresight Ventures, Mirana Ventures, Nomad Capital, etc.

The relationship between Lombard and Babylon is similar to the relationship between Renzo and EigenLayer. The BTC pledged by users to Lombard will be automatically re-pledged to the Babylon platform to earn income.

The Lombard platform uses LBTC to release the liquidity of BTC pledged in Babylon. That is, users deposit BTC on the Lombard platform and will receive an equal proportion of the re-pledged certificate asset LBTC. The LBTC held can be used in DeFi protocols, such as lending, Transactions and pledges, etc., to improve the efficiency of fund use.

Currently, users can use their email addresses on the Lombard platform to apply for the waitlist for the white test.

2.Lorenzo

Lorenzo is also a Bitcoin liquidity re-pledge protocol based on Babylon. Users can directly deposit BTC into Babylon through Lorenzo. This platform has received support from Binance Labs.

On May 28, Lorenzo announced the launch of the pre-staking Babylon activity. Users can stake BTC on the pre-staking Babylon activity page to obtain stBTC. All BTC received by Lorenzo will be pledged as soon as Babylon is launched.

Currently, users can earn dual Lorenzo and Babylon points by staking BTC on Lorenzo.

Bitcoin re-pledge chain BounceBit

BounceBit is a BTC re-pledge chain designed specifically for Bitcoin. Its main products include BounceBit Portal, BounceBit Chain, and BounceClub. Among them, BounceBit Portal is the user interaction portal, BounceClub aims to become a combined ecosystem of CeFi and DeFi, and BounceBit Chain is the main module of the re-pledge function.

BounceBit Chain is designed as a carrier to realize the re-pledge function in the BounceBit ecosystem. It is protected by the Bitcoin pledged by the verifier and the BounceBit native token BB. Intermediary software such as cross-chain bridges, oracles, etc. can be obtained by introducing the liquidity of BounceBit safety.

Specifically, after users transfer native assets to BounceBit, new B-Token assets will be minted. Taking BTC as an example, after users deposit BTC, they will receive BBTC assets operating on the BounceBit mainnet.

Currently, BBTC assets can be used for two main on-chain activities: First, in BounceBit’s hybrid staking mode, use BBTC+BB to participate in node staking, and the LST tokens generated at the same time can be used for further re-staking activities to amplify Staking returns; second, BBTC can be used to interact with various DeFi applications on the chain to obtain income.

In April, BounceBit announced the completion of a strategic round of financing invested by Binance Labs. As early as February, it was announced that it had completed a US$6 million seed round of financing, with investors including Blockchain Capital, Bankless Ventures, NGC Ventures, DeFiance Capital, OKX Ventures, etc.

On July 12, the BB quotation was US$0.4 and the FDV was US$800 million.

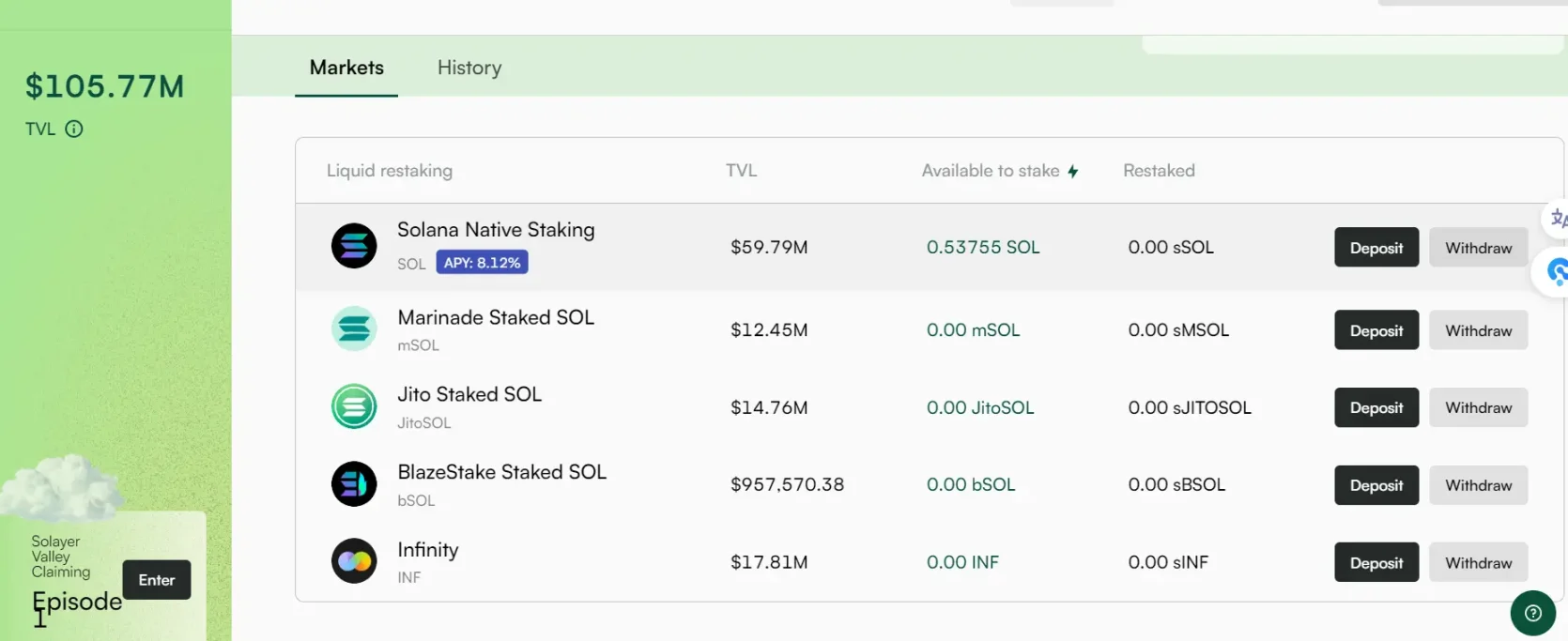

Solana ecological re-pledge protocol: Solayer, Cambrian, Picasso

Liquidity re-pledge protocol Solayer

Solayer is the re-pledge protocol of the Solana ecosystem. It supports SOL holders to pledge their assets to other protocols or DApp services in the Solana ecosystem that require security and trust, thereby obtaining more PoS staking income. Its function is similar to EigenLayer.

On July 2, it was announced that it had completed the builder round of financing. The specific investment amount was not disclosed. Investors include Solana Labs co-founder Anatoly Yakovenko, Solend founder Rooter, Tensor co-creator Richard Wu, Polygon co-creator Sandeep Nailwal, etc. It has been previously revealed that three VCs familiar with the situation stated that Solayer hopes to complete a US$8 million seed round of financing at a valuation of US$80 million. Rachel Chu of Solayer Labs said it is close to raising $10 million, with Solana founder Anatoly Yakovenko participating in the investment.

Currently, Solayer supports users to deposit native SOL, mSOL, JitoSOL and other assets. On July 15, the TVL on the Solayer platform exceeded US$105 million, of which SOL accounted for about 60%.

Re-pledge Agreement Cambrian in Financing Negotiations

Cambrian is also a re-pledge protocol of the Solana ecosystem, supporting SOL and LST assets to be pledged to intermediary software or Dapp applications to earn more income.

It is reported that Cambrian founder Gennady Evstratov said that the team is finalizing US$2.5 million in financing. Three investors said the valuation is about US$25 million. Cambrian plans to launch the re-pledge network at the end of the second quarter or the beginning of the third quarter and go online. Points program concurrent coins.

As of July 15, Cambrian has not launched any staking products.

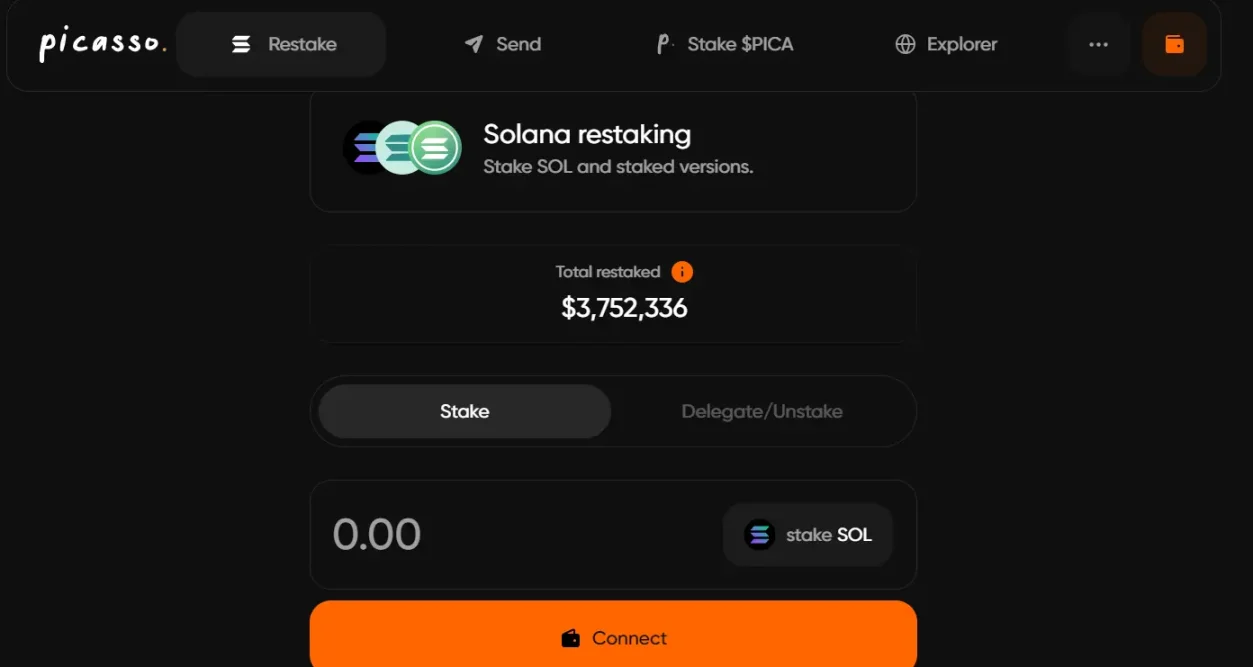

Red-pledge protocol Picasso

Picasso was originally a cross-chain protocol of the Polkadot ecosystem. On January 28, it announced the launch of SOL's re-pledge service to support SOL and LST liquid pledge assets for the protection of AVS (active verification services) such as intermediary software, dApps and L2 Rollups.

Currently, the re-pledge product on Picasso supports re-pledge of LST assets such as SOL and JitoSOL, mSOL, bSOL. However, the current re-pledged assets participating in the lock-up on the platform are only US$3.75 million.