At the beginning of this year , one of the most important events in the crypto was that the U.S. Securities and Exchange Commission (SEC) approved a number of Bitcoin spot ETFs to be listed in the United States, marking the cryptocurrency market entering a new stage, making it easier for traditional financial markets to obtain Bitcoin. currency investment exposure.

Since then, the price of BTC has continued. This move is regarded as an important milestone for the Bitcoin market. However, it also poses new challenges for on-chain data analysis.

1. Changes in trading models

Bitcoin spot ETFs allow investors to trade through traditional financial markets rather than directly on the blockchain. This will cause some Bitcoin transactions to be conducted off-chain, reducing the representativeness of on-chain transaction data.

At the same time, the Bitcoin holdings of ETFs are usually concentrated in custodial institutions, and these Bitcoins may not move for a long time, thus affecting the accuracy of indicators such as the number of active addresses and on-chain transaction volume.

According to Glassnode data, there is a certain correlation between the number of active Bitcoin addresses and the price, as shown in the figure below. However, since this year, the price of Bitcoin has fluctuated significantly, but the number of active addresses has shown a downward trend (the portion marked in the red box). This trend may reflect the impact of some trading activities moving off-chain after the listing of the Bitcoin spot ETF.

2. Transfer of liquidity

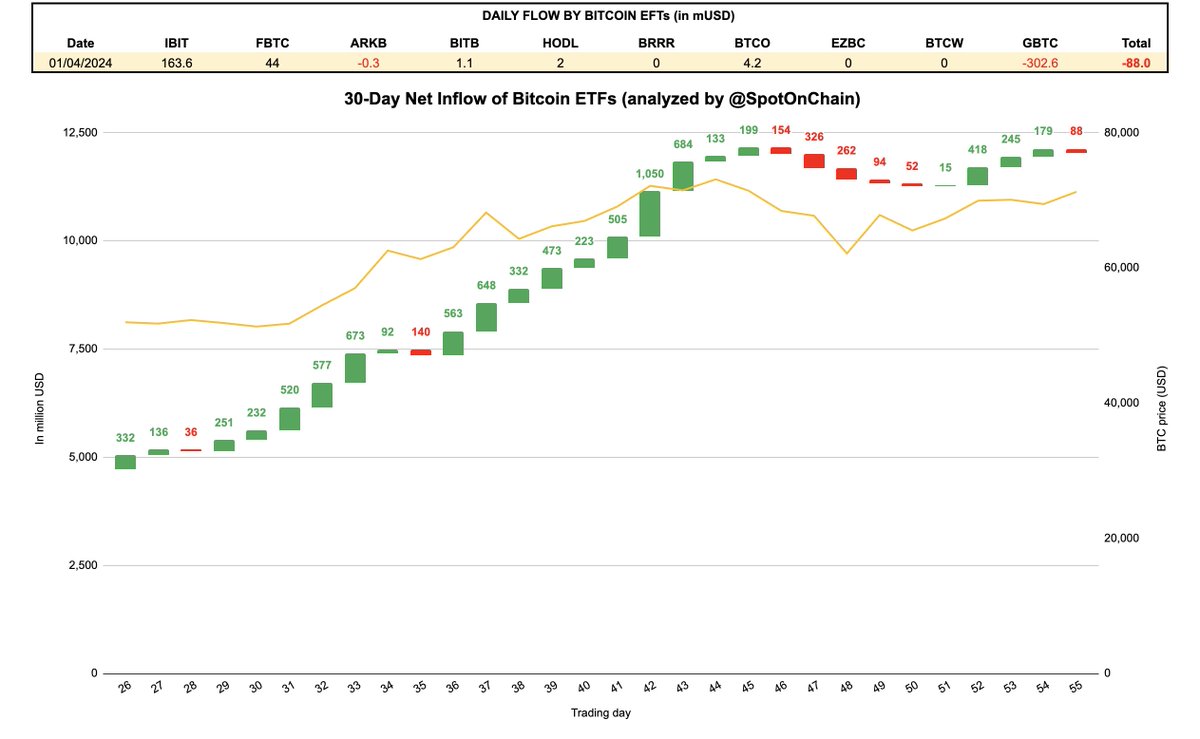

After the listing of spot ETFs, some liquidity may be transferred from cryptocurrency exchanges to traditional financial markets, which may lead to a decline in on-chain trading volume and liquidity, making the analysis of market sentiment and price trends less accurate. The data in the chart below shows the recent changes in net inflows of Bitcoin spot ETFs.

3. Changes in investor behavior

Spot ETFs provide a simpler and regulated way to hold Bitcoin, attracting a large number of traditional institutional investors to the market. These investors usually do not conduct frequent on-chain transactions, changing the characteristics of on-chain data. In addition, institutional investors tend to hold Bitcoin for the long term, reducing short-term transaction volume and affecting the activity of on-chain data.

Countermeasures against data distortion

If more and more investors turn to holding Bitcoin through ETFs in the future instead of directly purchasing and holding actual Bitcoin assets. This may lead to a reduction in on-chain transaction activity, making traditional analysis methods that rely on on-chain data unable to fully reflect market conditions. Specifically in:

- Reduced transaction volume : The transaction volume on the chain decreases, resulting in distortion of transaction volume-related indicators.

- Reduced address activity : The number of active addresses decreases, which affects the judgment of market participation.

- Distortion of liquidity data : Some funds are transferred off-chain, and on-chain liquidity indicators cannot accurately reflect the actual market liquidity.

But I think there is no need to worry too much. After all, more and more investors are choosing ETFs, and I believe more people will choose to hold cryptocurrencies themselves. It’s just that you may really need to consider whether the on-chain analysis methods you are currently using will be affected, and whether you need to supplement off-chain data to improve the accuracy and comprehensiveness of data analysis.

Conclusion

Regardless, the listing of the Bitcoin spot ETF represents a major milestone in traditional finance’s acceptance of cryptocurrencies. If you are used to using on-chain data to analyze the market, you should always consider whether you should introduce new data to more accurately reflect market dynamics.