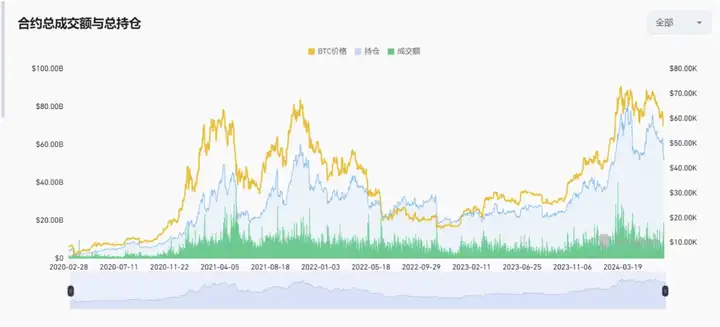

The past month has been a torment for most coin holders. The repeated convergence of volatility and the resonant downward trend of asset prices have detonated downward under the stimulation of various external selling pressures in early July. The decline in contract holdings on a single day is close to that of FTX on the same day. The market stabilized on the basis of macro data on Friday and formed an inertial rebound on Saturday. Currently, Bitcoin has also rebounded to the key position of 6.5.

For more information, please visit Weibo Tuantuan Finance here .

The following phenomena occurred in this round of leverage liquidation:

① A large number of Altcoin stabilized for the first time after a sharp drop;

② Bitcoin is supported near the middle track of the previous upward channel and the miners’ cost line;

③ The overall structure of SOL is relatively strong, but ETH has given up all the gains stimulated by ETFs;

So far, Bitcoin has formed a diffuse consolidation structure, but it has not fallen below the upward trend. The diffusion here is conducive to the re-consolidation of chips, which is healthy for the long-term trend. Considering that interest rate cuts are inevitable this year, I believe that around US$50,000 is a good medium- and long-term chip reabsorption position. For most cottage industries, the short-term increase in volatility does not form a reversal trend, but there are also strong currencies among them, which still need further observation.

In summary, the market is healthier than last month, but the accumulation of momentum still needs to occur through fluctuations and re-convergence. It is a good idea to remain patient and hold on to good stocks.

Sector ecology

ETH ecology and Defi: The Defi sector is still weak, and the entire ETH sector has been unable to rebound. Only Ethereum has risen due to the ETF news.

Funds in the circle will be attracted by SOL and TON, and there is little buying of ETH. In addition, due to the continued low gas fee on the ETH chain, which has been below 10gwei for a long time, ETH is in a state of net issuance, and the potential selling pressure is 2x that of BTC.

The net inflow of funds for BTC ETF is 50 billion USD, which absorbed the selling pressure of GBTC of 15 billion USD in 6 months. The scale of Grayscale ETH is 1/3 of BTC, which means that ETH ETF needs to have 1/3 of the attractiveness of BTC ETF to achieve the same effect as BTC. However, the inflow of ETH ETF may be difficult to exceed 1/3 of BTC.

Overall, the ETF will be mainly BTC net inflow, supplemented by ETH. ETH's net inflow will be much worse than BTC, so the price performance will not be as strong as BTC. At the same time, ETH's output selling pressure cannot be digested, and the continuous issuance will also weaken the confidence of ETH ETF holders.

Layerzero: ZRO has a good chip structure, retail investors have almost no chips, and there may be a market in the future. The best buying point is below 3

TON: As one of the two alpha ecosystems in this round, the TON ecosystem is still worthy of attention. Currently, the only secondary target of the TON ecosystem is NOT. Market makers are buying in large volumes at the bottom, and we can continue to pay attention to it in the future.

SOL: Solana is still a promising ecosystem in this round, and SOL’s strong support level of 120-130 is still confirmed to be valid.

The better alpha tokens in the SOL ecosystem are JUP and JTO. Some good memes to follow: Billy/Aura/Retardio

AI: The AI sector basically followed the overall market this month and its performance was average. However, I believe that as the main line of this round of speculation, we should still pay close attention to the subsequent performance of the AI sector. The leading projects in the sector are TAO and RNDR.

Later, I will bring you analysis of leading projects in other tracks. If you are interested, you can click to follow. I will also organize some cutting-edge consulting and project reviews from time to time. Welcome all like-minded people in the crypto to explore together. If you have any questions, you can comment or private TTZS6308. All information platforms are Tuanzi Finance .

I plan to accept four more one-on-one classes at the end, but I won’t accept any more. To be honest, I can’t handle too many. After all, my energy is limited.

Currently, there are basically no good opportunities for retail investors to get on board BTC. The focus is to lay out high-quality copycats in the later stage and strive to achieve an overall return of no less than 10 times this year.