Bitcoin (BTC) has performed consistently well over the past few days, rising 10.77% over the past week . While this is good news for some traders, it also carries the risk of losing money if the coin continues its upward trend.

This analysis pinpoints the potential price levels Bitcoin could reach and the impact of trends on open positions in the derivatives market .

Bitcoin's Recent Rise Threatens Short Expectations

Over the past 24 hours, Bitcoin has fluctuated between $65,000 and slightly above $66,000, and is currently trading at $65,302. But before that, Bitcoin reached $66,250 and then fell again.

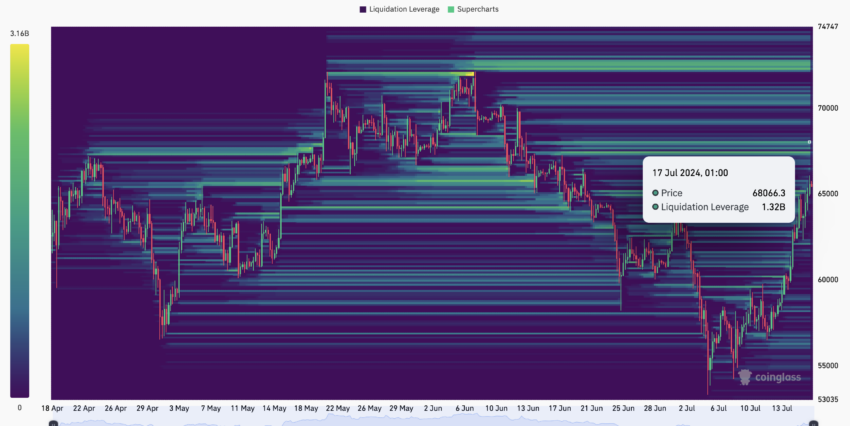

However, according to data from Coinglass, short positions risk liquidation worth up to $1.32 billion if BTC reaches $68,066.

This is according to the liquidation heatmap. For those unfamiliar with the term, liquidation occurs when an exchange liquidates a trader's position due to insufficient margin balance to maintain the contract.

This is to prevent further losses, but it can also be due to high volatility as prices move in the opposite direction of traders' expectations.

Specifically, a long position is a trader who bets that the price will rise, and a short position is a trader who bets that the price will fall.

Read more: 7 Best Cryptocurrency Exchanges in the US to Trade Bitcoin (BTC)

So the image above shows how much short selling loss would be incurred if Bitcoin reached the above price. This heatmap also identifies areas where large-scale liquidations can occur and areas where liquidity is concentrated.

When liquidity is concentrated in a specific region, cryptocurrency prices are likely to move towards that region. According to data obtained from Coinglass , the price of Bitcoin could range from $67,469 to close to $68,000.

If this zone is broken, the next zone of interest will be $72,599, which will bring it closer to the all-time high (ATH).

Bitcoin selling halted by major players

Aside from the heatmap , the large inflows into Bitcoin ETFs this week are another piece of data supporting the price rise. The massive influx of money into these products played a major role in Bitcoin's surge to its ATH in March.

Lack of liquidity in this respect also played a significant role in the decline experienced in the second quarter (Q2). Therefore, if more funds continue to flow into ETFs, Bitcoin may continue to rise.

Regarding this situation, analyst Timothy Peterson said that BTC could soon reach $71,000.

“Last week, cumulative net ETF liquidity reached a new ATH. This is the second indicator that puts the price of Bitcoin at $71,000. This marks the sixth consecutive day of positive inflows totaling more than $1 billion. “This does not include the huge amounts of money that are believed to have flown in today.” He X.

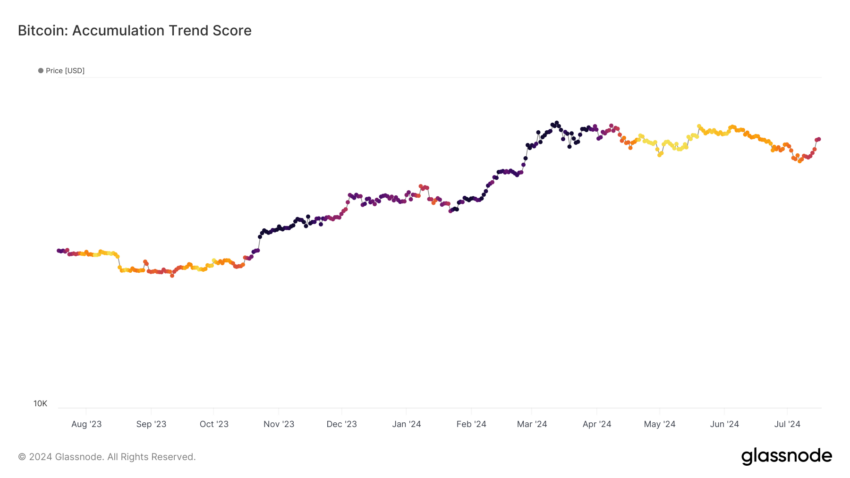

From an on-chain perspective, the cumulative trend score shows that Bitcoin is exiting the circulation phase. Trend scores range from 0 to 1, providing insight into the behavior of large players in the market.

A cumulative trend score close to 0 means that, on average, market participants are selling.

This can be seen by looking at the trend between April and June. However, the score at press time was 0.55, indicating that the volume of coins being purchased on-chain is increasing.

BTC Price Prediction: Confirming Bullish Trend

According to the daily chart, Bitcoin confirmed a bullish trend after rising above the 20 (blue) and 50 (yellow) moving averages.

EMA stands for exponential moving average and indicates the direction of the trend over a certain period of time. If the EMA is above the price, the trend is bearish.

However, since the opposite is true for BTC, it is bullish, which means the price may trade higher. If this trend holds, the next price Bitcoin will reach could be around $68,235, as shown below.

Additionally, spot cumulative volume delta (CVD) is positive. CVD represents the net difference between buy and sell volume. If this value is negative, it means that the BTC you sold is more than the amount you bought.

Therefore, positive values mean that market participants have been buying more Bitcoin since July 13th. This is also repeated in moving average convergence divergence (MACD).

MACD is a technical tool that shows the relationship between the 12 EMA (blue) and the 26 EMA (orange) to measure trend momentum and price acceleration. If the number is negative, the trend is bearish and prices may fall.

Read more: How to Buy Bitcoin (BTC) and Everything You Need to Know

However, the MACD at press time is in the green zone, suggesting that Bitcoin price may continue its upward trend.

In conclusion, any potential price gains could be negated if large institutions or whales begin circulating coins again. If this happens, Bitcoin could fall to $60,899.