According to “The Block”, prior to obtaining approval from the U.S. Securities and Exchange Commission (SEC) to begin trading, multiple issuers of Ethereum spot exchange-traded funds (ETFs) have submitted revised S-1 registration statements and disclosed Their management fee rates.

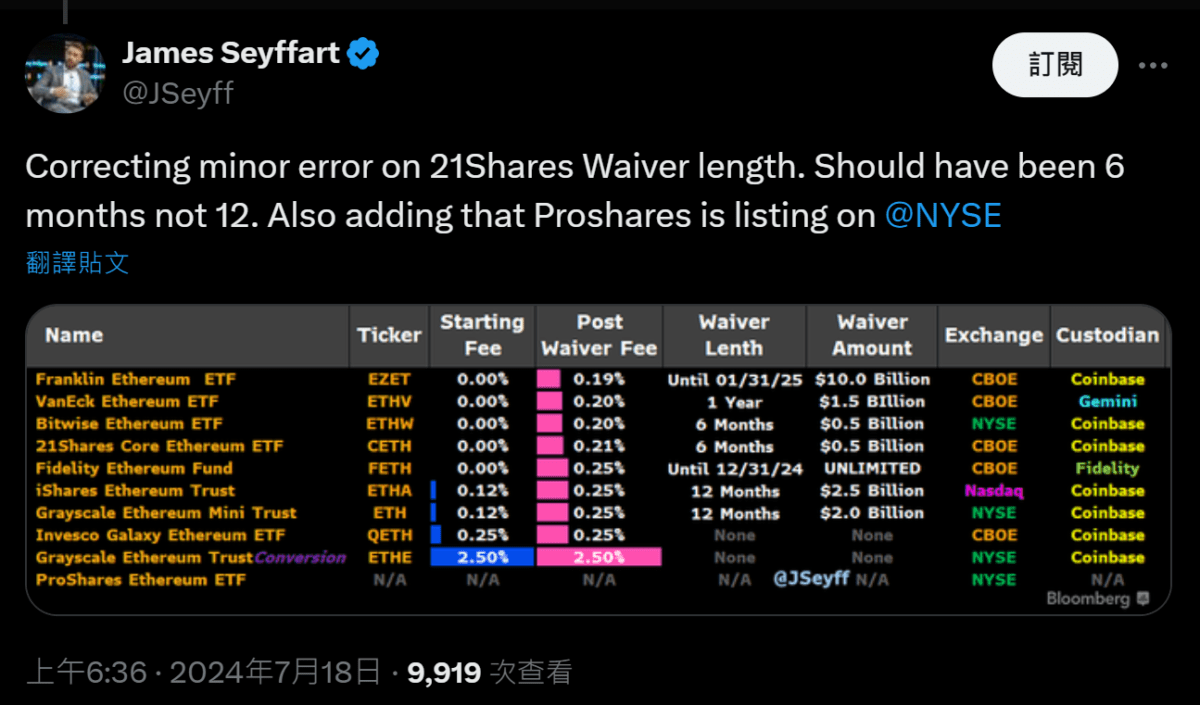

Asset management giant BlackRock has set the fee for its Ethereum ETF at 0.25% and may waive the fee "in whole or in part" for certain periods, up to one year after listing, according to a filing on Wednesday. and fell to 0.12% during the period for the first $2.5 billion in assets.

Other publishers also announced their own fees and fee waivers on Wednesday. According to the revised filing, 21Shares set rates at 0.21%, Bitwise at 0.20%, VanEck at 0.20%, Franklin Templeton at 0.19%, Fidelity at 0.25%, Invesco and Galaxy's co-filed Ethereum ETF has a fee of 0.25%.

Grayscale will maintain the management fee rate at 2.5% after its Grayscale Ethereum Trust Fund (ETHE) converts to a spot ETF, and plans to maintain the management fee rate at 2.5% in the first 12 months after the conversion or until the fund asset management scale ( 0.12% initial fee before AUM) reaches $2 billion. Grayscale will also launch another fund based on Ethereum spot "Grayscale Ethereum Mini Trust". Once launched, it will use 10% of ETHE assets as seed capital, which is equivalent to providing more than 1 billion for the Ethereum Mini Trust. USD liquidity.

People familiar with the matter revealed this week that after the Ethereum spot ETF takes effect next Monday, trading may begin on Tuesday (July 23).

Is it still possible for Ethereum ETFs to include a staking mechanism?

The SEC has not approved Ethereum spot ETFs to participate in staking, and the agency has always had issues with this service. However, Republican SEC Commissioner Hester Peirce revealed in an interview released on Wednesday that she believes the inclusion of staking functions in Ethereum spot ETFs can be reconsidered.

Bloomberg senior ETF analyst Eric Balchunas said that if the presidential administration changes, staking and in-kind creation are possible. He wrote on the X platform:

“Hester Peirce spoke our mind and it’s great to hear this directly: both staking and physical subscription/redemption of Ethereum and Bitcoin ETFs are “open to reconsideration” (apparently if there is a change in the US President ). "