- The recovery in Bitcoin prices is associated with a reduction in sell-side pressure from major stakeholders.

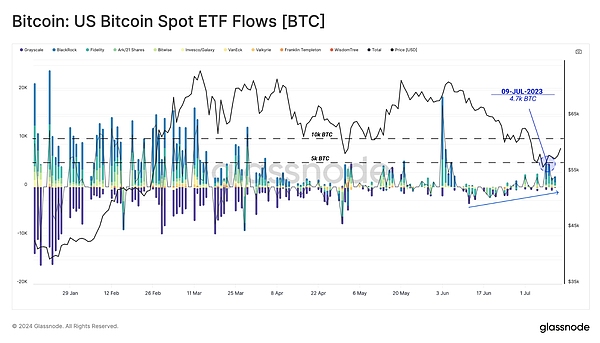

- Increased ETF inflows and institutional demand support Bitcoin’s current price stability.

After a period of significant downturn, Bitcoin [BTC] now appears to be making a significant rebound after reclaiming the $65,000 price mark earlier today.

If you want to know more about the crypto and get first-hand cutting-edge information, please visit Weibo Dolphin 1 for more good articles .

BTC is currently trading at $65,448, up 4.4% in the past 24 hours. Notably, the asset traded as high as $66,059 earlier today.

According to analysis from on-chain data provider Glassnode, the surge could be the result of “short-term seller relief,” suggesting a temporary easing of the selling pressure that has weighed heavily on Bitcoin’s price action in recent weeks.

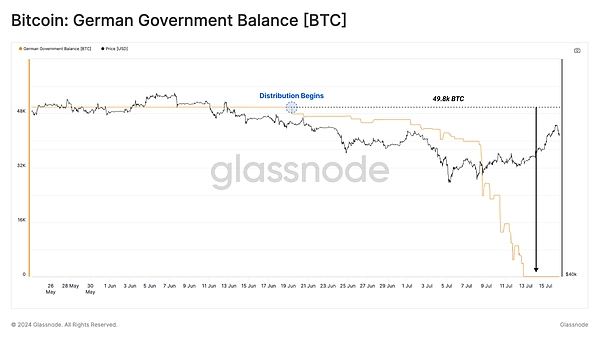

The easing of sell-side pressure appears to be primarily related to the cessation of large-scale selling by significant holders, including the German government, which had been exerting downward pressure on Bitcoin’s market value.

This development indicates a significant shift in the market and could pave the way for more stable or rising prices in the future.

Bitcoin: Analysis of recent market trends

Glassnode’s report highlighted that the recent drop in Bitcoin prices to around $53,000 was driven by the expected repayments from defunct Japanese cryptocurrency exchange Mt. Gox and the massive sale of Bitcoin by the German government.

These factors have led to an increase in the amount of Bitcoin flowing into the market, exacerbating sell-side pressure.

However, the bulk of the German government’s selling occurred in a short period between July 7 and July 10, during which 398,000 BTC flowed out of official wallets before stabilizing shortly thereafter.

This stabilization coincides with Bitcoin prices no longer falling further, suggesting that the market has absorbed the shock of these sell-offs.

Further supporting prices was a surge in funds into bitcoin spot ETFs, the first notable increase in interest since early June.

More than $1 billion flowed into these funds last week alone, coinciding with the recovery in Bitcoin prices and supporting the view that the market may have reached a point of seller exhaustion.

In addition to the reduction in sell-side pressure, institutional demand also rose significantly, which helped offset earlier outflows.

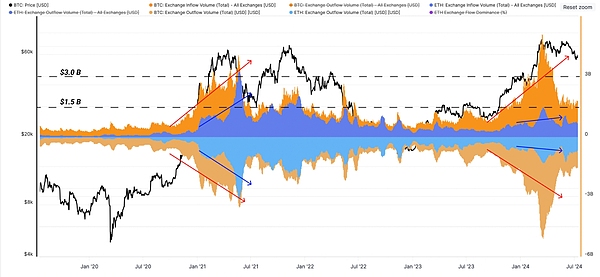

This demand is reflected in a significant drop in Bitcoin transaction flow, an important indicator of market liquidity and investor sentiment.

Foreign exchange flows have fallen sharply from their record highs in March and are now at a new baseline of around $1.5 billion per day.

A drop in trading volume typically indicates a reduction in selling pressure as fewer holders move their bitcoin to exchanges to sell. Combined with renewed interest from institutional investors, this points to a healthier market outlook.

Will the upward trend continue?

Although Glassnode revealed that the current rise in BTC price is due to complete exhaustion of sellers, it is worth studying BTC fundamentals to determine the sustainability of this upward trend.

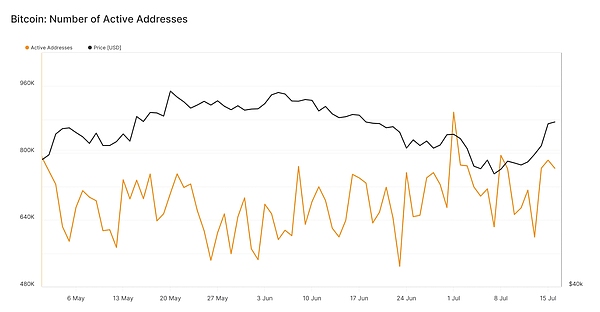

Data shows that the number of active Bitcoin addresses is recovering; it has risen to 12.84 million after falling from 17.35 million in March to 11 million at the end of June.

This rebound indicates growing retail interest, which could support a continued rise in Bitcoin prices.

Additionally, the creation of new Bitcoin addresses on Glassnode also highlights this positive sentiment. After falling below 600,000 at the end of June, the number of new addresses climbed to 897,000 on July 1, and then stabilized at 763,000.

Despite the minor pullback, the continued increase in active and new addresses could indicate growing market influence and could set the stage for further price stability or gains.

If Bitcoin remains above key thresholds, its ability to convert resistance levels into support levels could signal an impending stabilization or upward price trajectory.

The article ends here. Follow Weibo Dolphin Dolphin 1 for more good articles. If you want to know more about the relevant knowledge of the crypto and first-hand cutting-edge information, please consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!