Author: xpara

Compiled by: TechFlow

Summary of key points

The SEC is expected to approve a spot Ethereum ETF, which could bring in $5 billion in inflows within six months.

The approval of an Ethereum ETF could boost the returns of Ethena’s synthetic dollar, sUSDe, similar to what happened after the approval of a Bitcoin ETF.

Ethena’s products are subject to funding rate fluctuations, liquidity challenges, and potential risks in smart contracts and custody operations, but these issues have been transparently addressed.

Ethena plans to enhance the utility of its ENA Token and is preparing to launch the Ethena application chain.

2024 has been a unique year for the crypto industry. The approval of Bitcoin ETFs at the beginning of the year enabled traditional investors to gain exposure to Bitcoin price movements through regulated financial products, driving positive market sentiment and market capitalization growth.

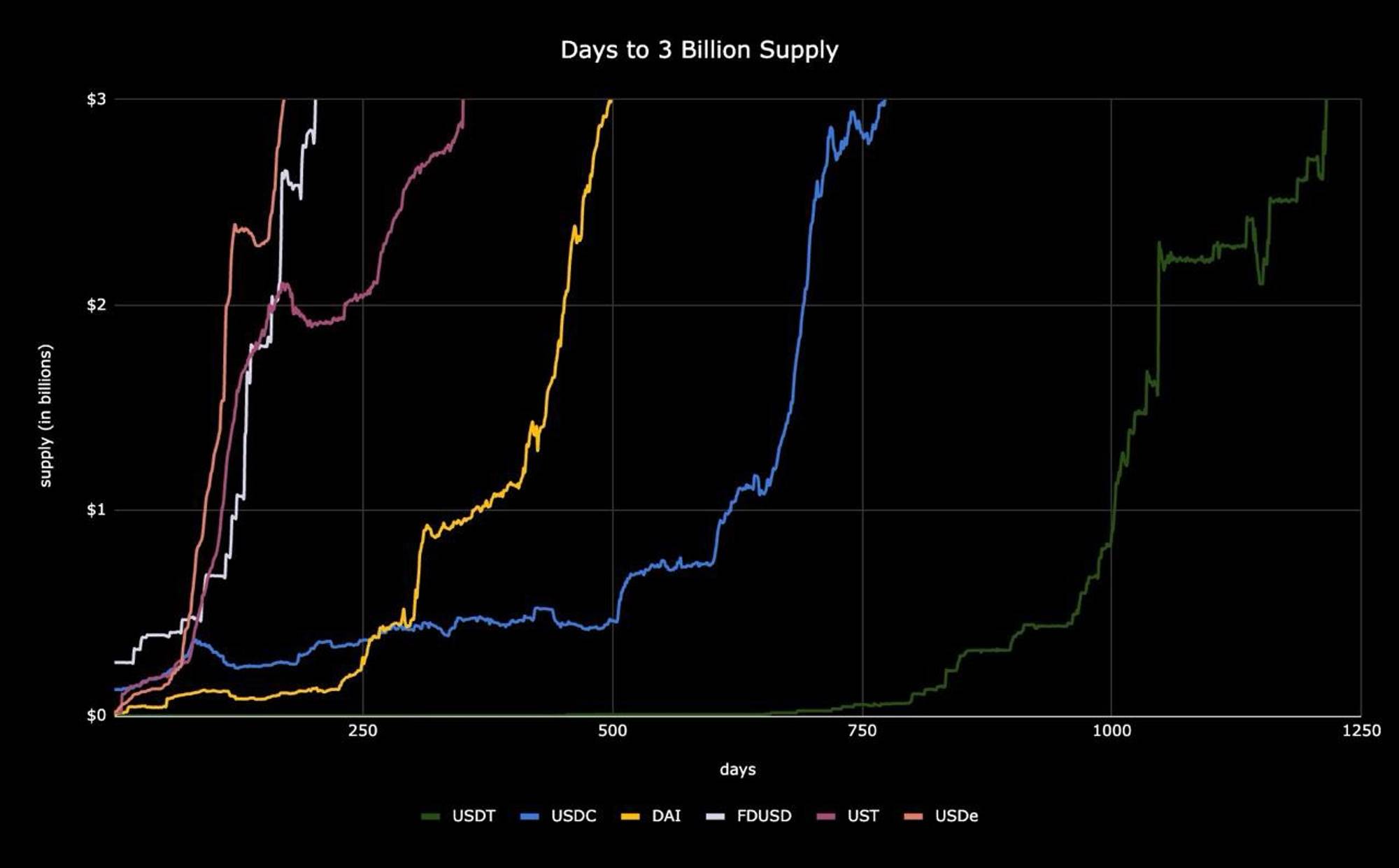

In terms of the crypto industry, the current trend is to launch your own rollups and memecoins. Compared to the previous bull market cycle, this phase has not seen many new fundamental innovations. But in the field of DeFi applications, Ethena stands out. Ethena's synthetic dollar USDe became the fastest crypto dollar to reach $3 billion , surpassing the records of DAI and USDC. Its success is attributed to its unforkable architecture, unique business model and sustainable income opportunities.

Currently, the biggest focus of the market is the expected approval of an Ethereum ETF, which is expected to be announced in July this year. This could bring new liquidity to the Ethereum ecosystem, which in turn will bring other opportunities and new development opportunities for Ethena's products - USDe, sUSDe and ENA. This article will explore the current sentiment towards Ethereum ETFs and the impact this has on Ethena.

1. Current Status of Ethereum ETF and Estimated Inflows

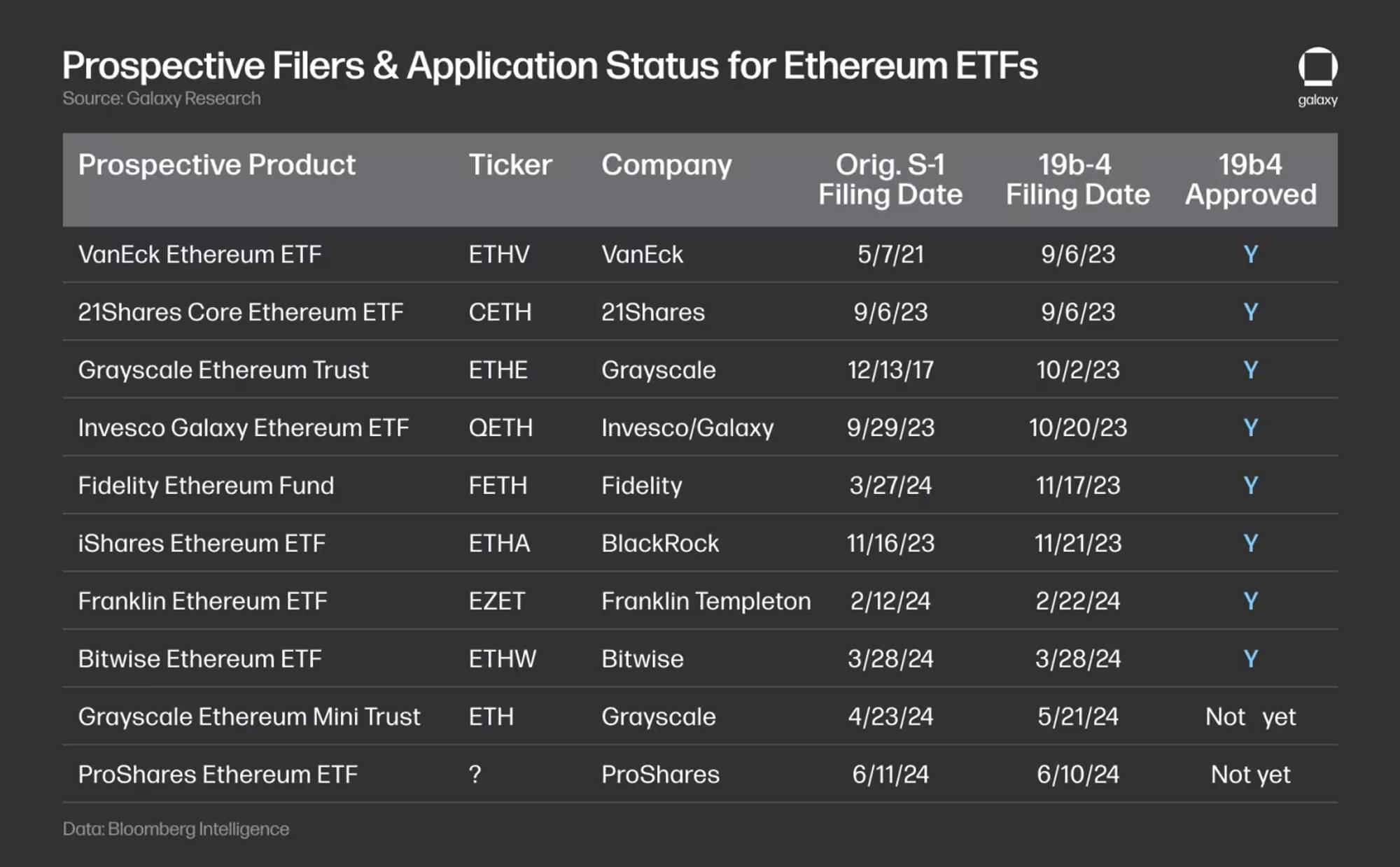

Prior to May 2024, the sentiment surrounding Ethereum ETFs was dominated by skepticism and uncertainty. This uncertainty stemmed from the SEC’s historical reluctance to approve cryptocurrency ETFs, especially those related to Altcoins like Ethereum. As of July 2024, the U.S. Securities and Exchange Commission (SEC) has taken steps to approve a spot Ethereum ETF. After approving a Bitcoin spot ETF at the beginning of the year, the SEC granted a rule change in May 2024 to allow exchanges to list spot Ethereum ETFs. Several asset managers, including BlackRock, Bitwise, and Fidelity, have already submitted applications for these products . As of July 16, the spot ETF could begin trading on July 23 .

Source: Galaxy "Sizing the Market for the Ethereum ETF"

1.1 Estimated capital inflow after approval

Source: Galaxy Digital, CoinDesk, Crypto Adventure, CryptoSlate, CoinDesk, Cointelegraph, The Block, Investing.com

It is difficult to estimate Ethereum inflows as Ethereum ETF market dynamics are influenced by different factors than Bitcoin, such as the large amount of ETH locked in staking, bridges, and smart contracts, which may amplify ETH price sensitivity. As the asset becomes more accessible to retail investors, this demand is expected to drive early inflows, and institutional interest will increase as wealth management platforms increase accessibility. However, the lack of staking rewards may reduce some of the appeal.

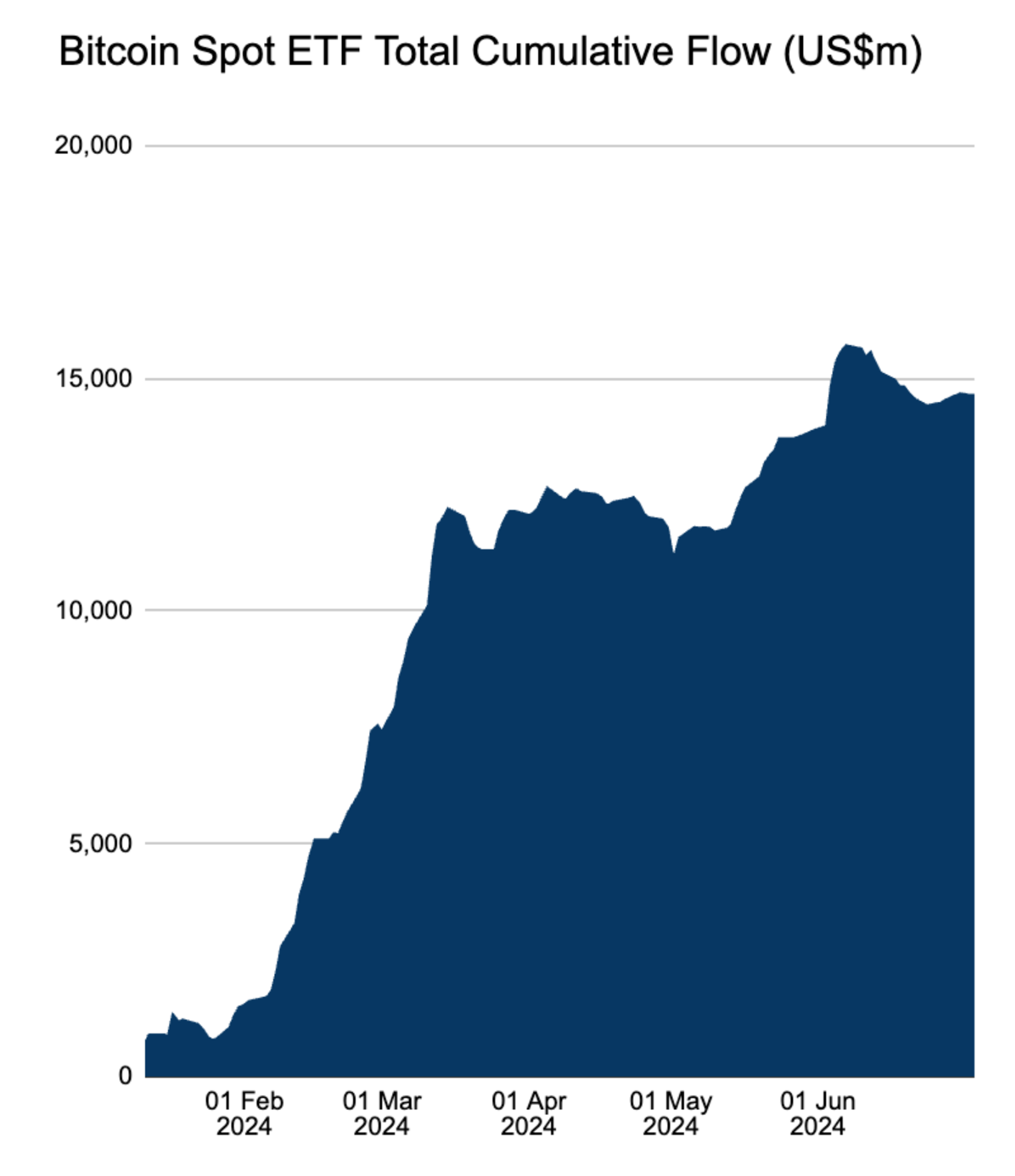

Cryptocurrency exchange Gemini predicts that the spot Ethereum ETF could see up to $5 billion in net inflows within the first six months of trading. On the other hand, analysts at JPMorgan Chase are more conservative, predicting net inflows of $3 billion in 2024. Many analysts use the performance of Bitcoin ETFs as a benchmark, with estimates ranging from 15% to 50% of Bitcoin ETF inflows. The Bitcoin ETF attracted $15.1 billion in net inflows in its first five months of trading.

There is still debate over whether the Ethereum ETF approval will have a similarly significant impact on ETH prices as the Bitcoin ETF did on BTC. Some analysts believe that the effect may be more modest due to current market conditions and investor saturation. Ilan Solot , co-head of digital assets at Marex Solutions, said, "General pessimism is a strong basis for outperformance. For sell-on-the-news strategies, many will try to repeat the BTC ETF situation. However, I am concerned that many inflow forecasts may be over-benchmarked to the BTC ETF numbers."

2. sUSDe opportunities that may be brought by Ethereum ETF approval

The approval of a spot Ethereum ETF could make sUSDe an attractive option for investors, similar to what happened after the approval of a Bitcoin ETF. Additionally, the approval could also bring more institutional money to the Ethereum ecosystem, increasing demand for USD-denominated yield-generating assets like sUSDe. As a high-yield synthetic dollar, sUSDe could appeal to investors who want to maintain USD exposure while benefiting from Ethereum market growth.

As a complementary investment strategy to Ethereum ETF exposure, sUSDe is a good choice. Let’s first review the situation when the Bitcoin ETF was approved and examine how sUSDe’s returns work and its potential influencing factors.

2.1 Review of the situation when Bitcoin ETF was approved

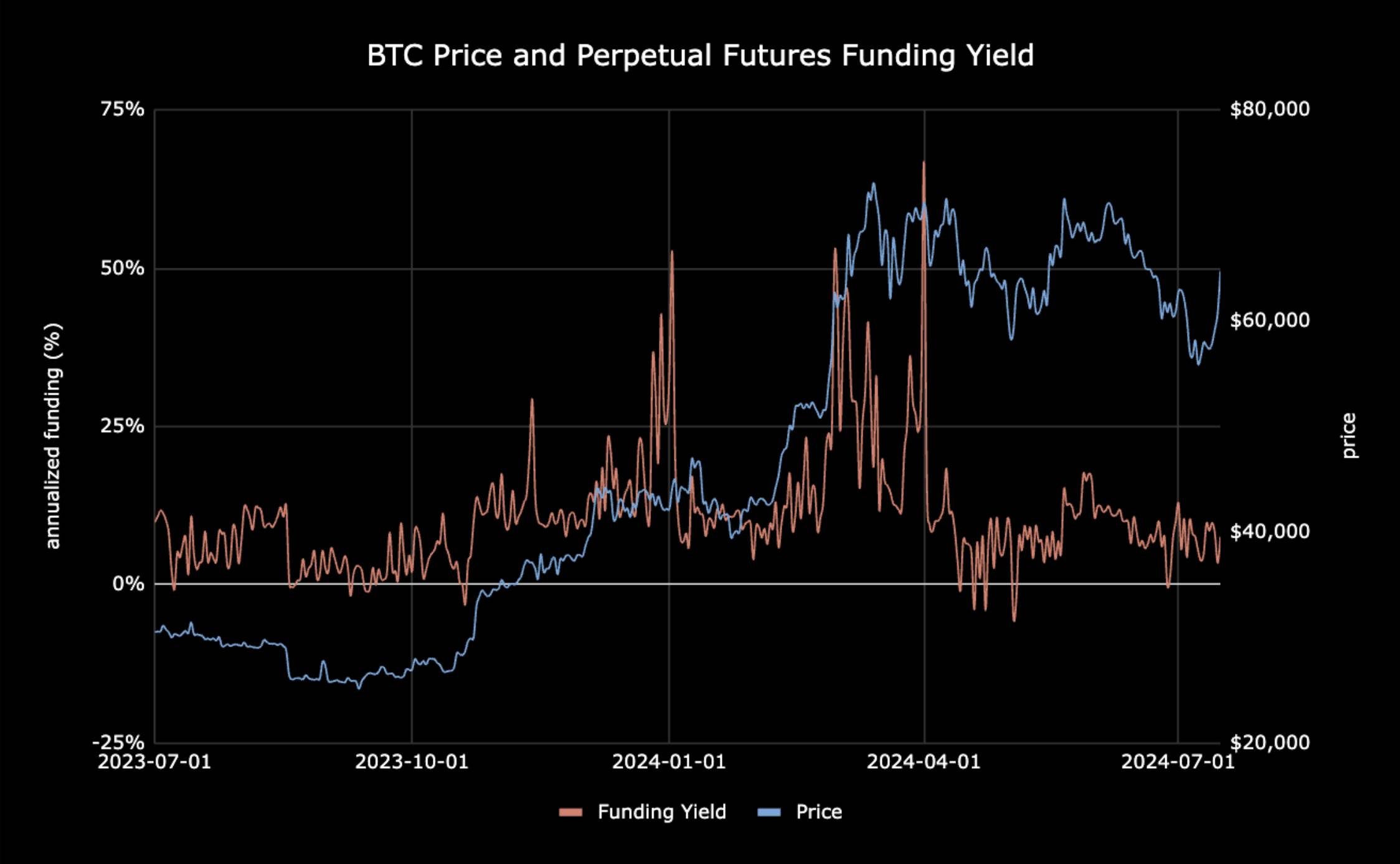

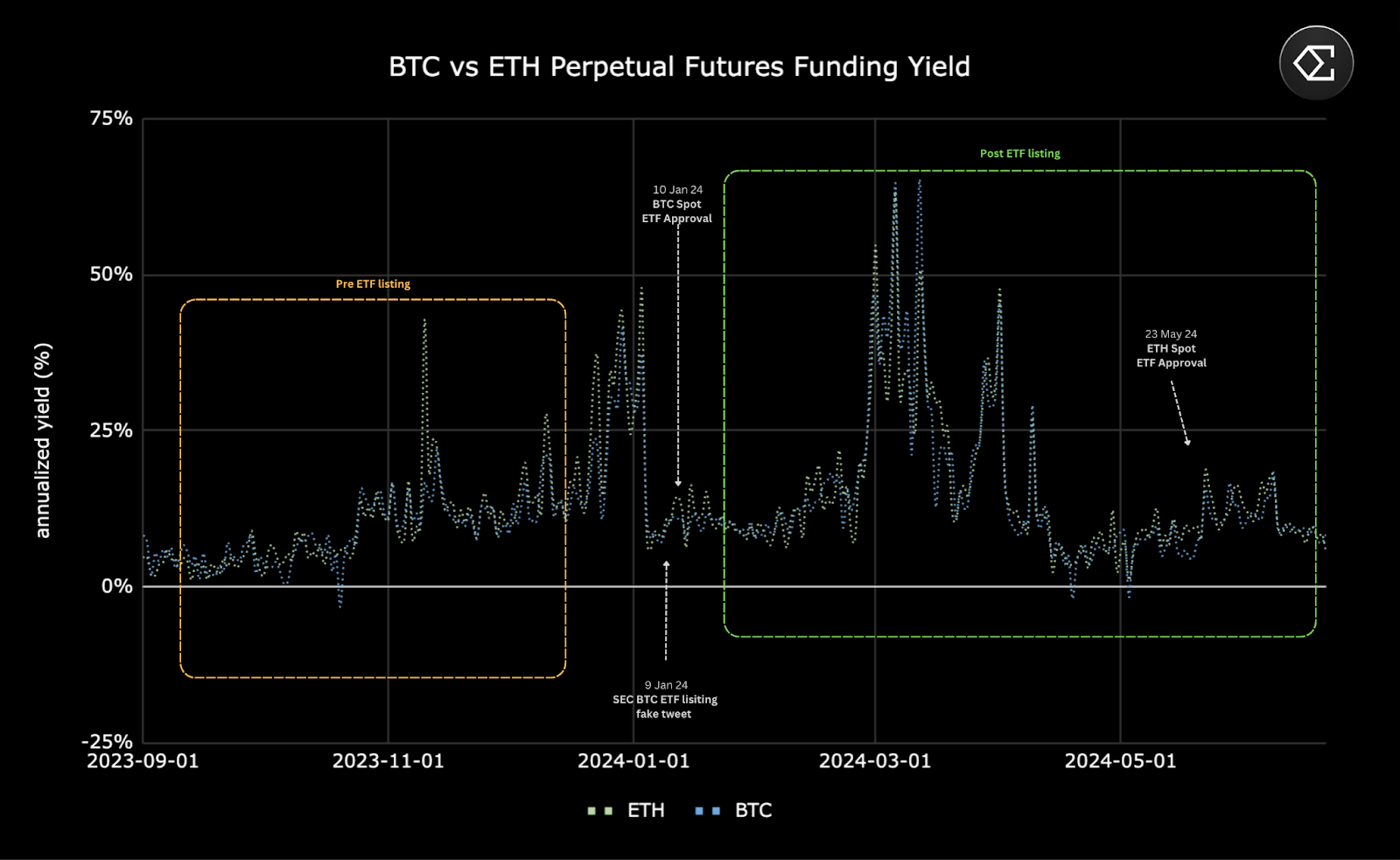

The approval of a Bitcoin ETF has had a profound impact on the market, pushing up prices and funding rates. Funding rates are regular payments between long and short positions in the futures market, and these rates increase significantly as more traders take long positions in anticipation of rising prices. These rates are affected by the supply and demand dynamics of the underlying asset.

Prior to the ETF approval, funding rates were relatively stable, hovering around 10%. However, after approval, these rates rose dramatically, reaching an annualized rate of up to 50%. Similarly, the approval of the Ethereum ETF could drive up funding rates for ETH perpetual futures, benefiting sUSDe holders, as the token’s earnings are partially derived from these funding rates.

In addition, the price of Bitcoin has also increased since its approval. The chart shows the correlation between the price of Bitcoin and the annualized funding rate of perpetual futures contracts from July 2023 to July 2024. The data shows that both the price of Bitcoin and the funding rate increased significantly after the ETF was approved. The US SEC approved the Bitcoin ETF on January 10, 2024, causing the price of Bitcoin to surge from about $40,000 to nearly $80,000 in a few months.

Source: Ethena

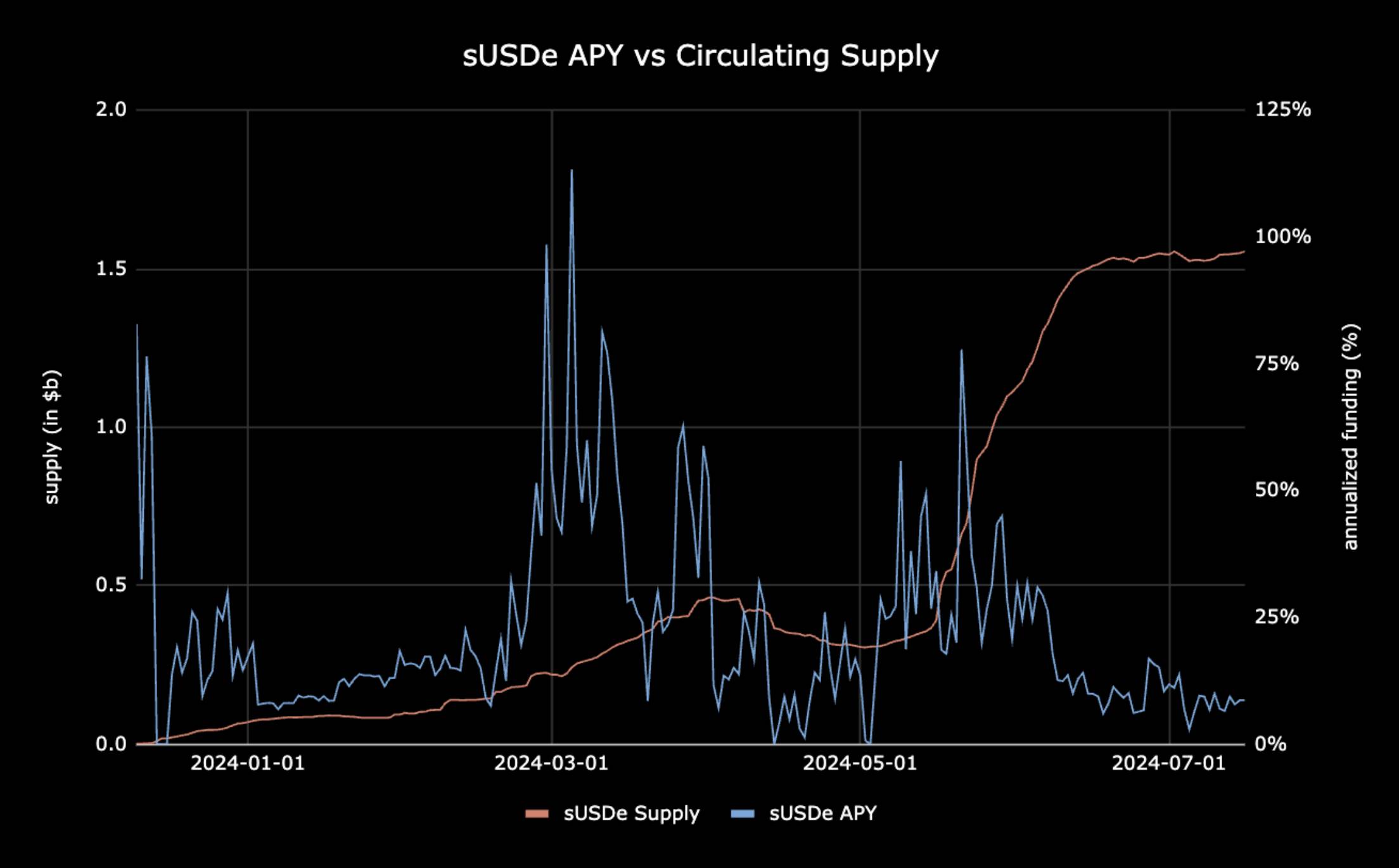

USD-denominated assets, such as Ethena USDe, have gained notable attention following the Bitcoin ETF approval. These assets offer stability and attractive yields, making them ideal collateral on DeFi platforms. For example, sUSDe’s yield surged to over 30% following ETF approval, highlighting its appeal among investors seeking stable and high-yielding assets. Let’s take a look at how this yield works and the potential factors that could influence it.

Source: Ethena

2.2 Potential impact on sUSDe revenue

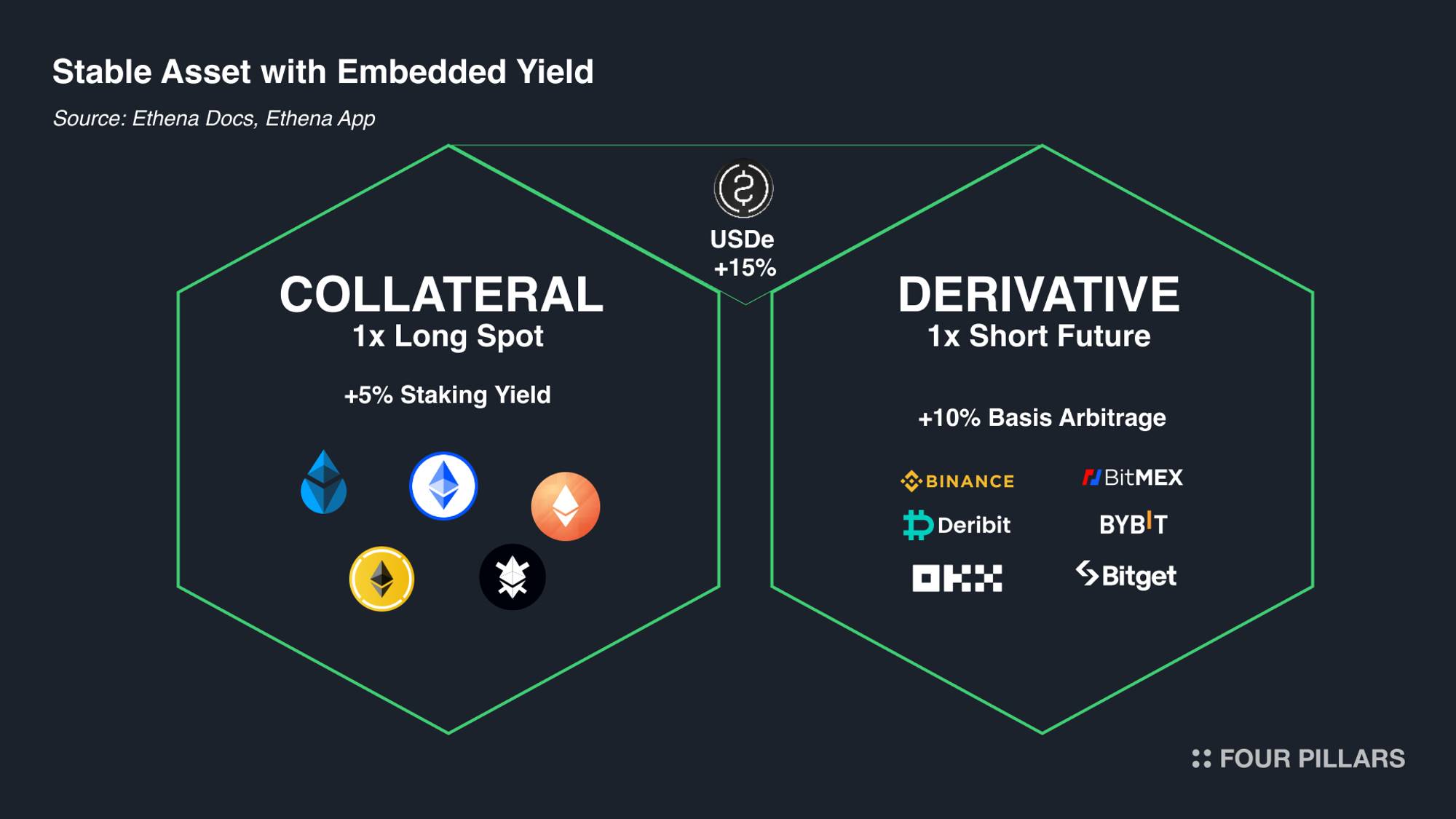

Ethena's USDe, a synthetic USD token, became a particularly attractive option after the approval of a Bitcoin ETF. By taking advantage of increased market activity and rising funding rates, USDe was able to generate returns of over 30% after the ETF was approved. This impressive return was achieved through a variety of strategies, including delta hedging of staked Ethereum collateral and exploiting the spread between spot and futures markets through basis arbitrage. Let's take a look at how it works and why an Ethereum ETF would impact this return.

2.2.1 sUSDe income generation mechanism

Source: Yield Explanation | Ethena Labs

In the Ethena protocol, the yield mechanism for sUSDe (staked USDe) operates through a reward-bearing " Token Vault" system similar to other staking tokens (such as Rocketpool's rETH). When users stake their USDe, they receive sUSDe tokens, which represent a partial stake in the total USDe held in the staking contract.

The protocol generates yield from two main sources: staking rewards for holding assets like stETH as collateral, and funding and basis yield earned through Delta hedging derivatives positions. These returns are distributed to sUSDe holders in a way that the value of sUSDe relative to USDe increases over time. Importantly, the protocol ensures that the value of sUSDe can only increase or remain stable, and any potential losses are covered by Ethena's insurance fund. (However, coverage by the insurance fund is currently only about 1%. ) Users do not need to take any additional action to earn returns; simply holding sUSDe can benefit from the returns generated by the protocol. To learn more about how it works, read the article " Ethena: Growing the Synthetic Dollar to Billions " by Steve from Four Pillars.

2.2.2 Benefits of Ethereum ETF and sUSDe

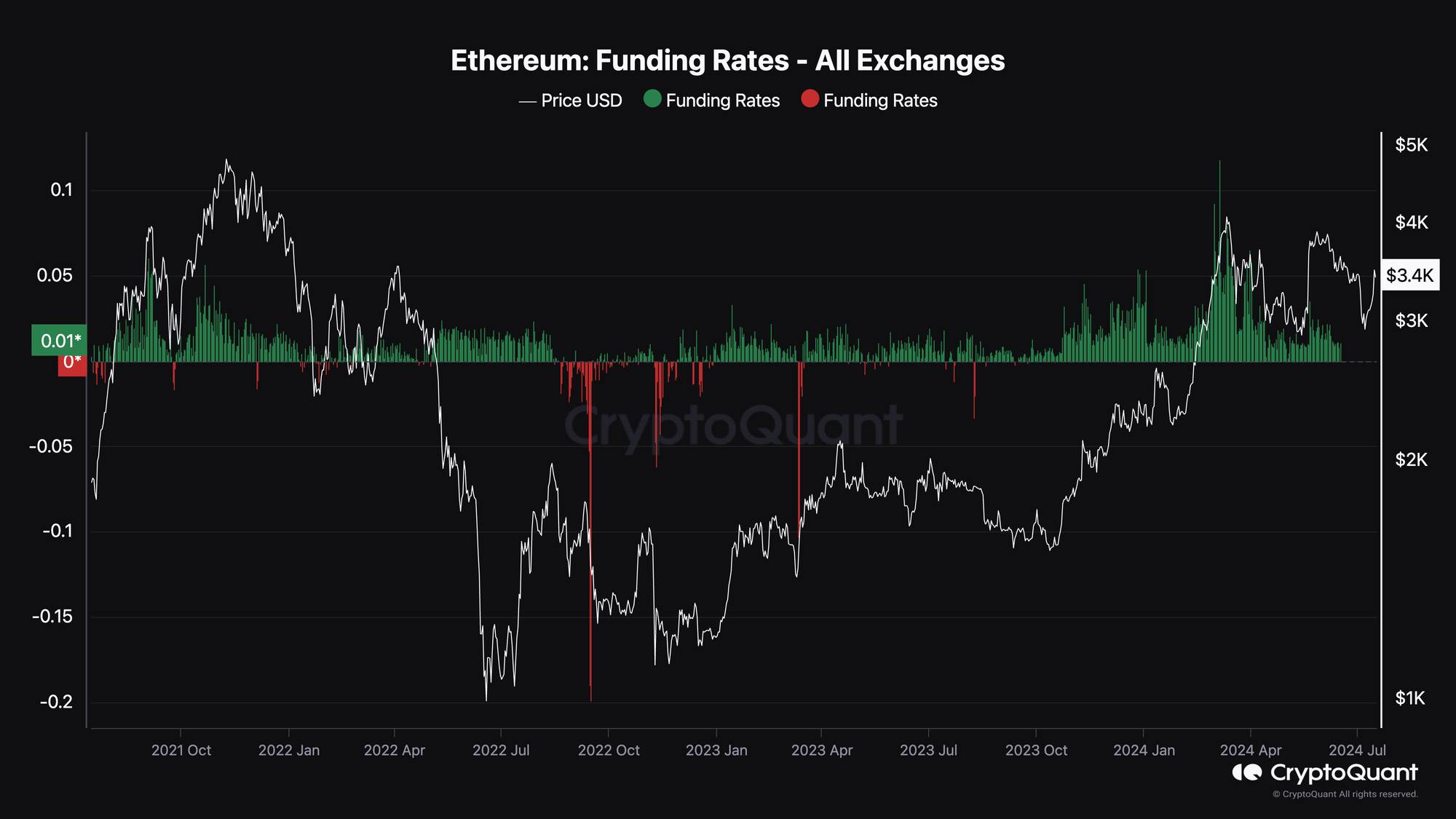

One of the key factors driving higher yields on sUSDe is the continued existence of basis and funding rates in the perpetual futures market. With the approval of the Ethereum ETF, demand for perpetual contracts is expected to improve as institutional investors may seek Ethereum exposure through various financial instruments. This increase in demand could lead to a sustained positive funding rate environment, benefiting sUSDe holders who can earn additional income from these funding payments.

Source: Ethena

As more spot volumes move to regulated ETFs, spot demand on offshore exchanges lags, potentially creating arbitrage opportunities. This could lead to a persistent basis between spot and futures prices, which traders could exploit, resulting in higher yields for sUSDe holders. Additionally, positive sentiment following ETF approval could push up funding rates, further enhancing sUSDe’s earnings potential. Historical data shows that funding rates tend to increase during periods of positive sentiment.

However, market dynamics are complex and difficult to predict, and actual results may vary depending on a number of factors.

Source: Ethereum: Funding Rates - All Exchanges | CryptoQuant

3. Risks of USDe and sUSDE

Ethena has grown rapidly in a short period of time, becoming the fastest crypto-dollar to reach $3 billion . This raises the question, is this growth sustainable? What are the risks? In this section, we explore some of the risks.

3.1 Funding interest rate and liquidity risk

Source: App | Ethena

Ethena faces risks related to funding rates and liquidity. If short positions outnumber long positions, the funding rate could turn negative, causing the protocol to lose money. If the funding rate turns negative, the protocol will need to pay large amounts to long positions, which could deplete the reserve fund (insurance fund). According to Ethena's research, the combined returns of stETH and short ETH funds are positive on 89% of days, but negative on 11% of days .

As the market value of USDe grows, management difficulty increases, and it becomes difficult to maintain its delta-neutral position and utilize the reserve fund. In addition, liquidity risk will arise if the underlying derivatives market is illiquid. This may affect the stability of USDe and the overall returns distributed to stakers. For example, if the liquidity of centralized exchanges decreases during a market downturn, Ethena may have difficulty rebalancing its positions.

3.2 Risks of Custody and Smart Contracts

Source: Solution: The Internet Bond | Ethena Labs

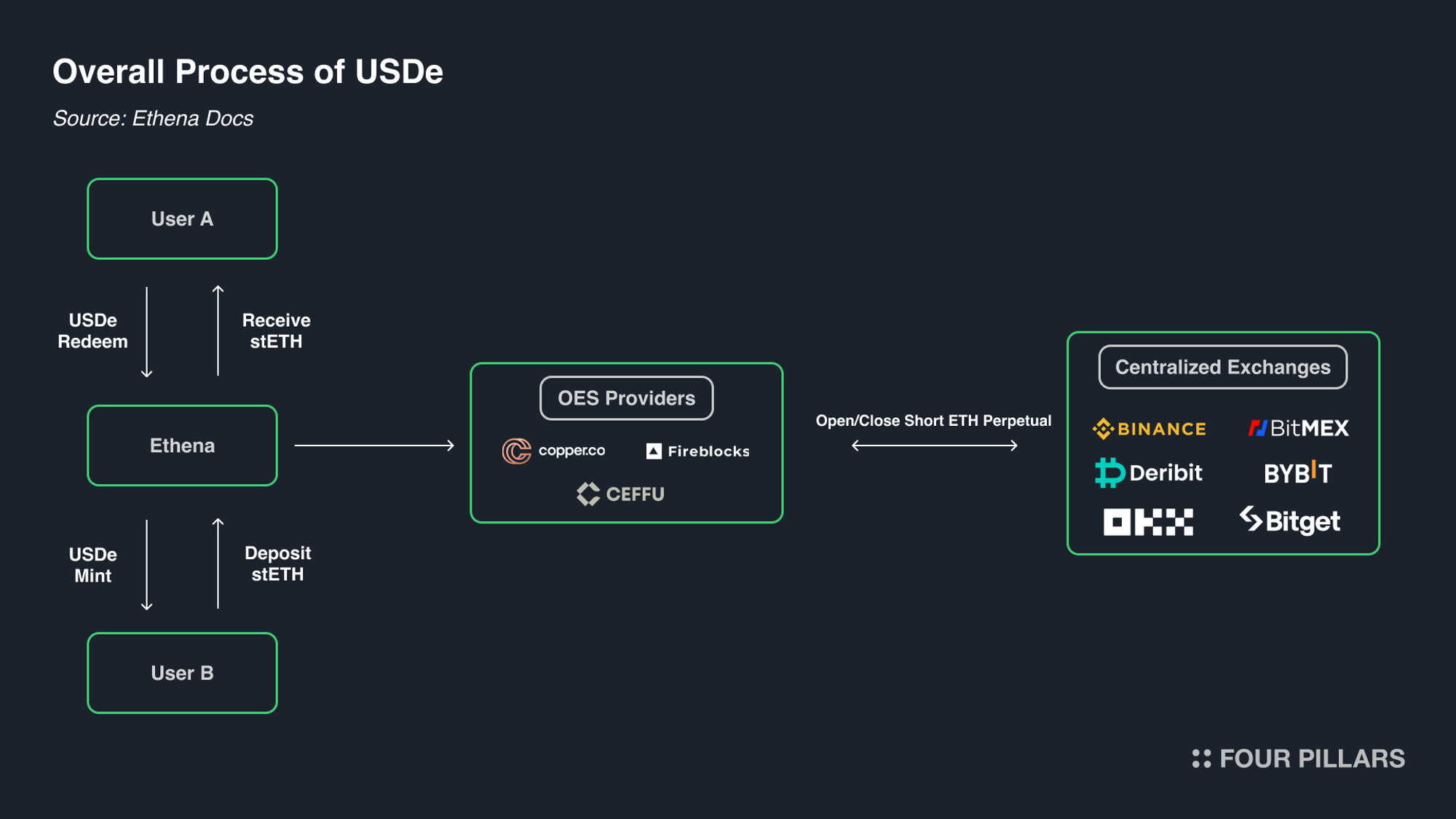

Ethena is also exposed to custody and smart contract risks. The protocol relies on external platforms such as centralized exchanges and offline settlement (OES) providers, which introduces potential operational or security vulnerability risks. If these platforms face bankruptcy or operational issues, it may affect Ethena's ability to execute trades and maintain its delta-neutral position. However, if a centralized exchange goes bankrupt, Ethena's perpetual position will be closed, but the collateral assets themselves should be safe because they never enter the exchange.

Additionally, vulnerabilities or bugs in smart contracts could lead to unintended consequences or be exploited. While Ethena has taken steps to mitigate these risks , such as using multiple providers and proactive monitoring, they remain a significant concern.

3.3 Risks of Ethena

As Ethena research director Conor Ryder said , Ethena has potential risks, but it is one of the few projects that publicly conducts research and builds a real-time dashboard to disclose the status of Ethena.

These dashboards , accessible on the Ethena website and platforms such as Dune Analytics and DefiLlama, provide real-time information on custodial wallet holdings, exchange subaccount positions, on-chain wallet assets, USDe supply, and key USDe and sUSDe metrics. The position dashboard displays details on collateral assets, derivative positions used for delta hedging, and USDe circulation. (Some information is not accessible on other platforms.)

Conor Ryder, head of research at Ethena, also said : “To be clear, USDe is not safer or better than other projects - we just provide a risk profile that is not correlated with other DeFi projects. There is no connection to the traditional banking system. Real returns do not come out of thin air. Bring CeFi cash flow into DeFi.”

4. The situation behind $ENA and USDe

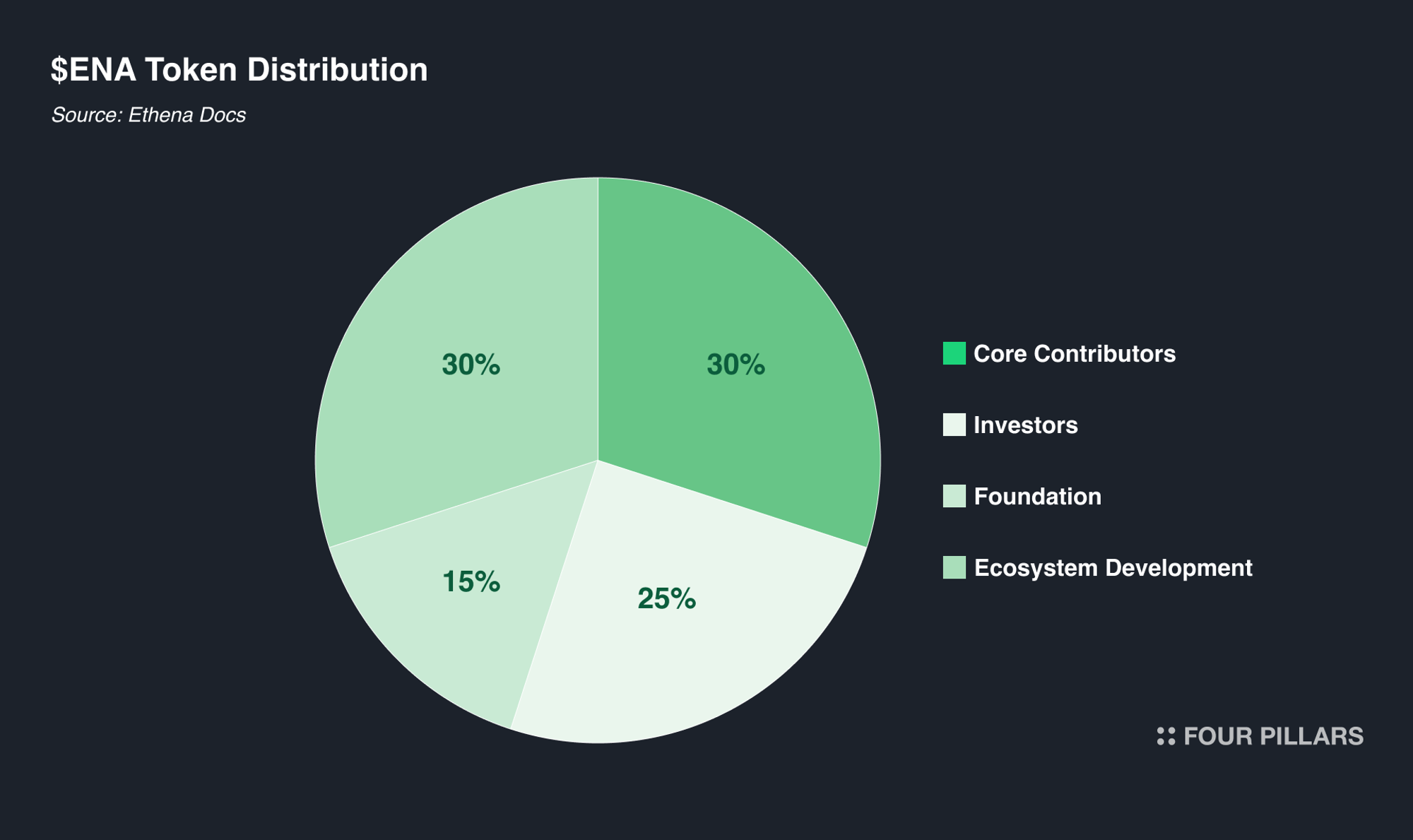

Ethena launched its governance token ENA on April 2, 2024 , marking an important step towards decentralization and community governance. As part of the launch, Ethena distributed 750 million ENA tokens, 5% of the total supply, to early ecosystem contributors and participants in its "Shard Campaign".

In order to encourage more people to participate in the Ethena ecosystem, Ethena previously launched the Season 1 "Shards" Campaign in early April 2024. The Season 2 "Sats" Campaign is currently underway and will end on September 2, 2024. The campaign incentivizes participants to earn Sats through Pendle and Morpho's strategies, and the total token distribution is committed to 15-20% of all point activities.

ENA's token economics structure is designed to balance incentivizing contributors and maintaining an active ecosystem. Core contributors hold 30% of the tokens, investors hold 25%, the Ethena Foundation holds 15%, and the remaining 30% is used for ecosystem development, including airdrops and funding new projects.

Source: ENA Token Launch — Ethena Labs

Like many application tokens, $ENA serves as the governance token of the Ethena protocol, allowing holders to make decisions on a variety of matters, including determining USDe’s collateral assets (modification or addition), selecting a custodial entity (OES provider), cross-chain implementations, grants, which exchanges to use, and choosing a risk management framework.

However, ENA tokens currently have limited utility. Although Ethena’s TVL is growing rapidly and is one of the top projects generating a lot of revenue, these revenues are not currently shared with token holders.

This will change in the future development of Ethena. Ethena will not be just another DeFi project. It has a roadmap that will make $ENA more of an opportunity, two of which are potential revenue sharing and Ethena Appchain.

4.1 Potential Revenue Sharing

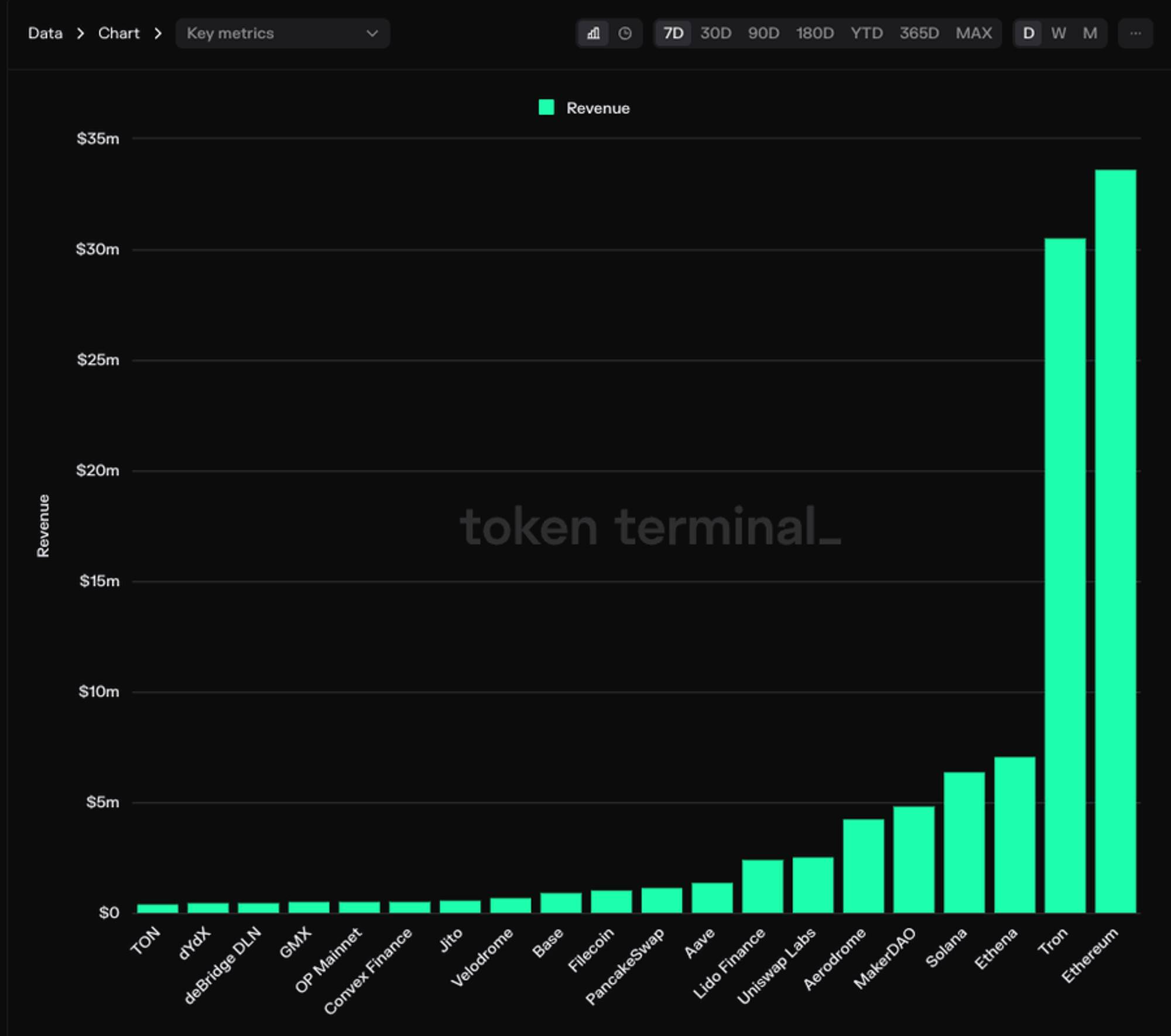

Source: Token Terminal [Date: Monday, May 27, 2024]

Ethena has experienced significant revenue growth, with its synthetic USDe becoming the fourth largest stablecoin by market cap. Here are some key points of Ethena’s revenue growth:

Revenue Leaders: In the last week of May, Ethena’s USDe generated $7 million in revenue , surpassing Solana’s $6.3 million. Only Tron and Ethereum’s DApp revenues exceeded it.

Market Cap: USDe’s market cap has surpassed $3 billion , making it the fastest growing crypto-USD asset in crypto history.

Revenue Forecast: According to Token Terminal , Ethena is expected to generate $222.5 million in revenue over the next 12 months.

As the governance token of the Ethena protocol, ENA token holders may have the opportunity to vote on proposals including revenue distribution mechanisms. This may allow ENA holders to influence the distribution decisions of protocol revenue, which may include returning a portion of the revenue generated by USDe staking or other protocol activities to token holders.

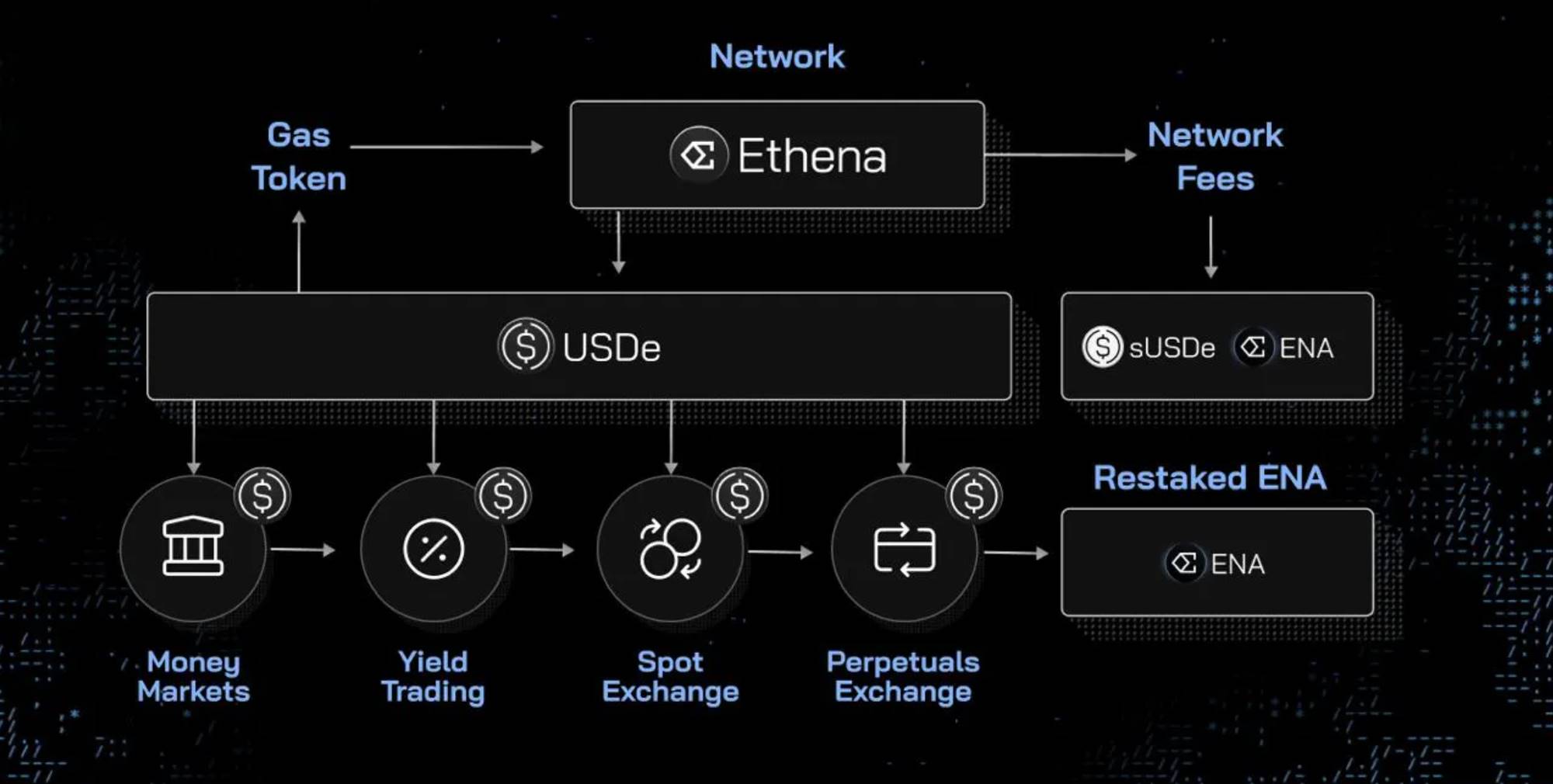

4.2 ENA Appchain and re-staking

Recently, Ethena updated the roadmap of ENA Token and introduced new token economics initiatives. Ethena launched the staking function of ENA, provided security for cross-chain transfers, and integrated ENA into its financial infrastructure, including the upcoming Ethena Appchain. In addition, users need to lock at least 50% of the available tokens to incentivize ENA holders to hold them for a long time. This move is part of the strategy to ensure the stability and growth of the ecosystem.

Source: Update to $ENA Tokenomics — Ethena Labs

The protocol introduces universal restaking of ENA, with potential rewards for ENA restaking pools within Symbiotic. These pools will provide economic security for cross-chain transfers of USDe, leveraging the LayerZero DVN messaging system. This initiative is part of the Ethena Appchain development, which aims to build financial applications and infrastructure using USDe as the primary asset. ENA staked in these pools will receive a variety of rewards, including high multipliers, Symbiotic points, and potential future allocations from LayerZero.

Going forward, ENA’s utility will expand significantly. The Ethena roadmap plans to integrate ENA into a variety of financial applications and infrastructure solutions on the Ethena Appchain, including spot DEXs, perpetual decentralized exchanges, yield trading platforms, money markets, and uncollateralized loan protocols. In addition, ENA can also be used for on-chain prime brokerage services, options, and structured products. These wide-ranging applications will not only enhance ENA’s utility, but also drive its demand as the ecosystem grows.

5. Looking to the future

Source: X (@leptokurtic_)

The approval of the Ethereum ETF marks a critical moment in the cryptocurrency market, similar to the impact of the Bitcoin ETF at the beginning of the year. This development is expected to bring a lot of liquidity and institutional interest to Ethereum, which may affect prices and markets. Ethena, with its synthetic USDe and yield token sUSDe, is in a good position to benefit from these changes. Increased demand for ETH-related financial instruments may drive positive funding rates and create arbitrage opportunities, resulting in higher returns for sUSDe holders. This situation also occurred after the approval of the Bitcoin ETF.

However, it is important to recognize the inherent risks that come with this rapid growth and market changes. Ethena must address challenges related to funding rate volatility, liquidity management, and custody and smart contract vulnerabilities. Despite these risks, the platform's transparent approach to risk management and proactive measures, such as real-time dashboards and the use of a diverse set of providers, increase confidence in it.

Since its inception, USDe has achieved exponential growth, making it the fastest crypto dollar to reach a $3 billion market cap. With the approval of an Ethereum ETF, Ethena is expected to grow further. Additionally, expanding ENA’s utility through initiatives such as revenue sharing and the Ethena Appchain may provide additional value and stability. Therefore, it is important to keep an eye on this opportunity.

Appendix A: Key Time Points for Ethereum ETF

A.1 January 2024: Paving the way for Bitcoin ETF

The approval of a spot Bitcoin ETF in January 2024 marked a major milestone and paved the way for Altcoin ETFs, with Ethereum becoming the next likely candidate. The success of Bitcoin ETFs has led to unprecedented net inflows, solidifying BTC’s position as a legitimate investment asset. The launch of these Bitcoin tracking funds became one of the largest debuts in ETF history . According to Morningstar Direct, this translated into $8 billion in net inflows. As of the end of June, the nine newly launched products had accumulated $38 billion in assets, demonstrating strong investor demand to gain exposure to cryptocurrencies through traditional financial instruments.

Source: Bitcoin ETF Flow – Farside Investors

A.2 May 2024: Ethereum ETF gains momentum

In May 2024, the U.S. Securities and Exchange Commission (SEC) made an important rule change by approving applications for major exchanges to list spot Ethereum ETFs. This decision allowed Nasdaq, the New York Stock Exchange, and the Cboe Exchange to list eight Ethereum ETFs. The SEC's approval came after the applicants revised their documents to comply with regulatory preferences, specifically removing Ethereum staking from ETF fund operations , which was seen as a potential obstacle to approval.

The rule change requires ETF issuers to update their Form 19b-4, which is used to propose new rules or change existing rules for self-regulatory organizations such as stock exchanges. While the SEC approved the forms for the eight spot Ethereum ETFs, including those from Bitwise, BlackRock and VanEck, the issuers still need to get their separate S-1 registration statements approved before they can officially begin trading.

A.3 June 2024: Expectations and delays

Expectations for Ethereum ETF approval continued to grow in June 2024. SEC Chairman Gary Gensler said the approval process was going smoothly , with some analysts predicting a launch as early as July 4. However, the SEC delayed the launch of the spot Ethereum ETF , pushing the timeline to mid-July or later.

A.4 July 2024: Delays and uncertainties

Delays in Ethereum ETF approval until July 2024 have led to uncertainty among investors. Although some analysts predict a launch within the next two weeks, the market remains cautious.Bitwise filed an amended S-1 form indicating that the products are almost ready to launch, but comments from the SEC pushed the timeline back further. Market sentiment is mixed, with some analysts predicting that ETH's price could fall if the ETF fails to generate significant inflows.

A.5 Mid-July 2024: Confirmation is coming

There are reports that a spot Ethereum ETF could begin trading as early as next week. According to sources familiar with the matter, the U.S. SEC has notified Ethereum exchange-traded fund issuers that their funds can begin trading on July 23, 2024. The SEC reportedly had no further comments on the recently filed S-1 form and requested a final version be submitted by Wednesday, July 17. The market reaction reflects optimism about the potential impact of these new financial products on the broader cryptocurrency ecosystem.