Benjamin Cowen, founder of Into The Cryptoverse, said that if supply continues to increase, it will "recover" to similar levels before Ethereum's merger in September 2022.

ETH issuance rate in Q2 is higher than destruction rate

In Q2 2024, 107,725 ETH were destroyed while 228,543 ETH were issued, causing inflation on the network over the past quarter. This resulted in a total increase of 120,818 ETH in Q2. There were only 7 days in Q2 when ETH destruction exceeded emission. In comparison, this number was 66 days in Q1. The largest contributor to ETH destruction was ETH transfers, which amounted to 6,838 ETH in Q2. The ETH destruction rate decreased by -66.7% month-on-month due to reduced network activity and lower gas fees. The decline in transaction volume was the main reason for this decline.

If the supply of Ethereum continues to increase at its current pace, the price of spot Ethereum exchange-traded funds (ETFs) could fall after the initial excitement about them dies down, one analyst said.

“If ETH supply continues to increase by ~60k per month as it has been since April, by December supply will be back to where it was at the time of the merger,” crypto trader and Into The Cryptoverse founder Benjamin Cowen wrote in a July 19 X post, referring to the much-anticipated merger that will transform Ethereum into Ethereum.

The upgrade to the current proof-of-stake consensus model will take place in September 2022.

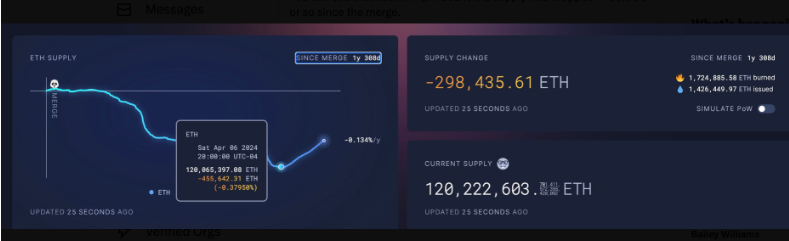

Ethereum, which fell into deflation after the merger , saw its supply drop by approximately 455,000 ETH by April 2024.

Over the past three months, the supply of ETH has increased by about 150,000 ETH. Source: Benjamin Cowen

However, the supply has increased by about 150,000 ETH since then. Cowen claims that if it continues to grow at this rate, it could return to the level it was before the merger two years ago.

“If ETH supply continues to grow at a rate of 60,000 ETH per month, then we will see supply return to the levels seen at the time of the merger,” Cowen said.

He added: “If the 2016 scenario holds, the final collapse of ETH/BTC would not begin until September 2024, which is long enough for the novelty of spot ETFs relative to BTC to wear off.”

Ethereum price could drop below current price in September

While he believes that the price of ether “will probably be higher” than it is now in 1.5 years, there is a “high probability” that the price of ether will drop in the next “3-6 months.” As of the time of publication, ether is trading at $3,507, according to CoinMarketCap.

Meanwhile, just a few days ago, on-chain analyst Leon Waidmann noted that Ethereum is facing a “supply crisis.”

“Exchange balances are down to 10.2%, while 39.3% of ETH is locked in smart contracts,” Waidmann said in a July 16 X post , claiming that most investors don’t realize “how tight” the ETH supply side is.

The Chicago Board Options Exchange (CBOE) announced on July 19 that “pending regulatory approval,” five Ethereum spot exchange-traded funds (ETFs) will begin trading on the CBOE on July 23.

Related: Ethereum may outperform Bitcoin after spot ETF launches — Kaiko

On May 23, the U.S. Securities and Exchange Commission (SEC) approved rule changes that would allow for the listing of several spot Ether (ETH) ETFs .

The five spot Ethereum ETFs that are about to start trading are the 21Shares Core Ethereum ETF, the Fidelity Ethereum Fund, the Invesco Galaxy Ethereum ETF, the VanEck Ethereum ETF and the Franklin Ethereum ETF.