Written by: TechFlow

Do memes have value? This question may have become a hot topic on the Nikkei.

But no matter whether the meme is good or bad, as long as it is popular, everyone will love it.

In the crypto where everything can be a meme, any joke or event can potentially be transformed into a wealth-making machine, which naturally attracts endless stream of dreamers to take a gamble on a little meme.

And a little-known fact you may not know is:

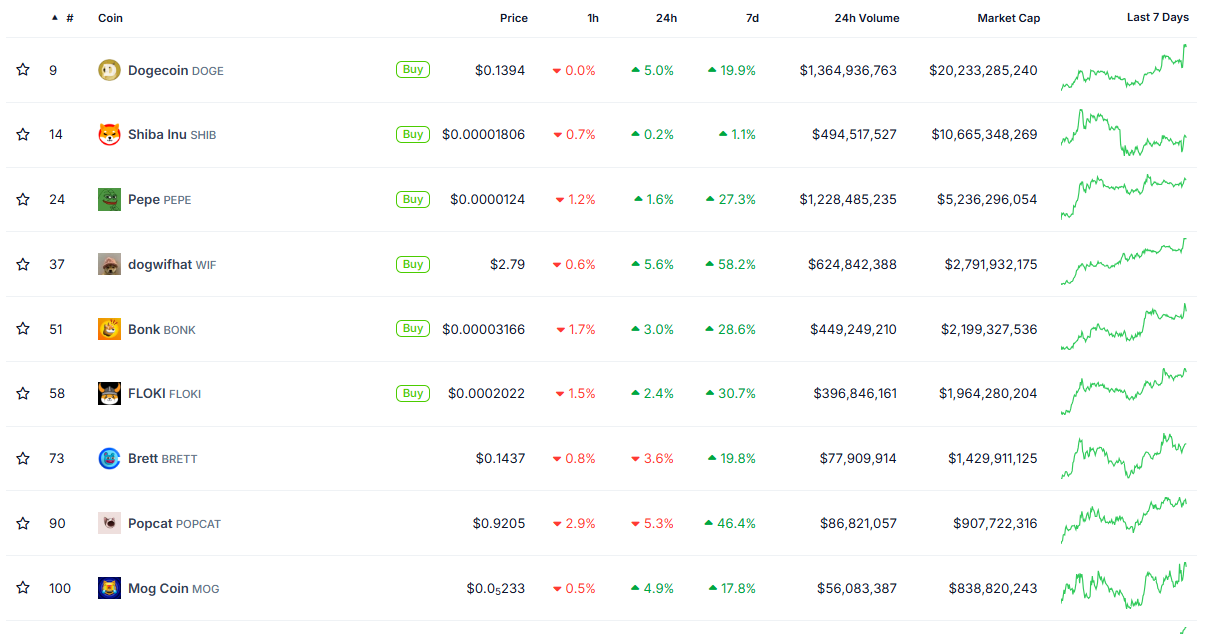

There are already 9 Meme coins in the current top 100 cryptocurrencies by market capitalization.

Big dog, second dog, hat dog, blue frog, green frog, open-mouthed cat... cats, dogs and frogs are gradually moving towards the big C position in the group portrait of cryptocurrency.

With the market rebound in the past few days, if you look at the list of the top 500 companies by market value, you will find that a number of memes are also among the ones that have seen the most growth.

Born in the grassroots, good at pulling up the market, skilled in communication, and trapped in risks .

Memes are a mixture of charming and dangerous qualities, like the 108 seats of the Liangshan heroes. As long as you sit on one, you are a hero. As for whether the hero was a mat weaver and shoe seller, or a murderer and robber, it does not matter under the logic of success or failure.

What is more important than arguing about "who is the valuable coin" is to embrace change.

Barbell strategy, both ends are attention investment

In this round of encryption cycle, a way of playing that is increasingly accepted by everyone is the "barbell strategy".

On one side of the barbell are BTC, SOL and other recognized large-cap and relatively stable tokens, while on the other side are various Meme coins that follow the hot spots.

On one side, stabilize the lower limit, and on the other side, bet on the upper limit; on one side, hold steadily, and on the other side, change hands quickly.

As for the VC coins and so-called value coins in the middle of the barbell, you should reduce your positions relatively or simply give up on them.

In the spirit of materialism that matter determines consciousness, you can think of this as the result of smart thinking by investors in the face of changes in the current market structure.

And in this barbell strategy, there is more and more consensus at both ends of the barbell.

Infrastructure has value, applications have value, narratives have value... but nothing is as valuable as attention.

The left side of the barbell represents lasting attention, while the right side represents short-lived attention. Crypto investment itself is an attention investment. Capturing the pulse of attention can create liquidity and provide a basis for price pumps (or dumps).

You think so, and smart institutions actually think so too.

Since December last year, Stratos, a hedge fund backed by a16z, has been operating a liquid fund holding WIF. At that time, the price of WIF was US$0.01, and Stratos once made a 300-fold profit .

Coincidentally, top VC Pantera also publicly stated that it holds Meme coins. Its partner Paul Veradittakit once wrote that Meme is a Trojan horse disguised as a toy, using allusions to prove that Meme will attract more people to get started in encryption.

While you are worrying about the high FDV and low circulation of VC coins and how they are making money, the VCs themselves are also playing with the meme on one side of the barbell.

Attention is value, which is a truth that every participant in the crypto world must respect.

The project is meme-ized, with infinite effects

Born in the grass and good at spreading, these two characteristics of Meme have also been noticed by project owners.

So you will see more and more projects gradually embracing Meme from launch to operation, trying to use more friendly expressions to narrow the distance with the crypto community.

For example, the next highly anticipated super-project, Monad, which is supported by parallel EVM narrative, has even made a "Meme Maker" on its official website based on its underlying infrastructure and hardcore technology, to facilitate the community to create Memes with Monad as the theme.

And you also see more and more, in the introduction posts and articles about Monad, there is always a sad frog image corresponding to Monad's purple logo.

Similarly, Berachain, the most meme-like in L1, positioned itself as a cute bear from the very beginning of its brand conception. The name of Bear Chain naturally spread.

In the more detailed product design later, you can also see the bear eating honey joke used in its token and liquidity design.

This actually reflects that in the current crypto market environment where attention is limited, Meme has the value of making people remember and spread better.

Looking closely at the attention marketing of crypto projects, nothing has changed:

In the early years, crypto projects preferred to promote themselves with hardcore geek terms, such as one million TPS, directed acyclic graphs, high concurrency, EVM compatibility... When investors and investors saw this, they would inevitably have a feeling of "although I don't understand anything, I think it's great."

As the crypto has developed to this day, market participants have gradually fallen into a kind of "NB fatigue". After hearing so many terms, they are no longer new to them.

On the contrary, the frog heads that are easy to spread are more interesting.

Be it a communication strategy or a trading strategy, embracing Meme has become an irreversible trend.

Don't get caught up in a discussion about whether memes are valuable or not. It's worthless to invest your precious time in metaphysical mental exhaustion.

Question the meme, understand the meme, and then embrace it or stay away from it, it's that simple.