The U.S. Bitcoin spot exchange-traded fund (ETF) has seen cumulative net inflows of more than $17 billion, a new high, a milestone achievement.

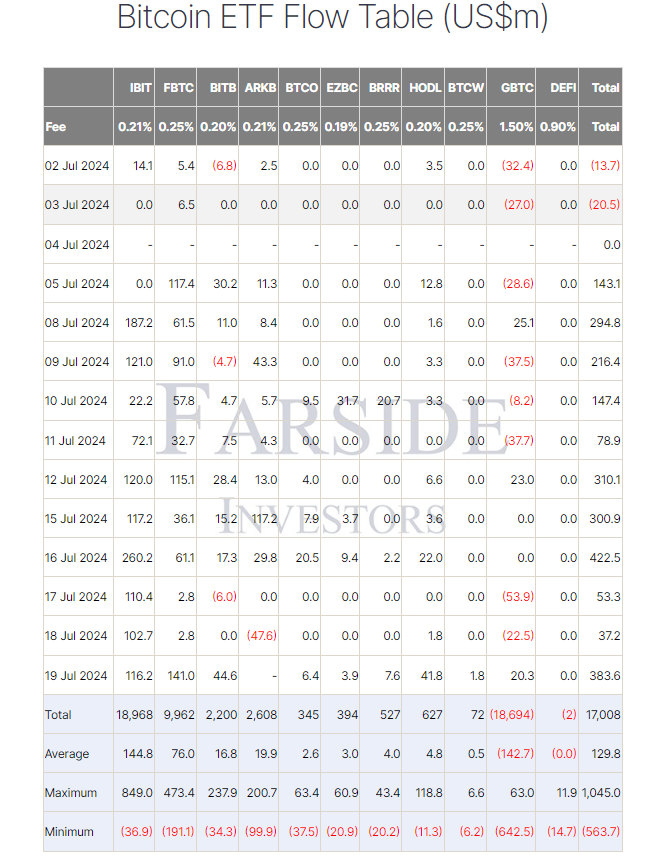

According to data monitored by Farside Investors, net inflows were mainly driven by IBIT under BlackRock, which alone received a total of $18.968 billion. FBTC under Fidelity also made a significant contribution, with a net inflow of $9.962 billion.

Record net inflows

However, this figure was significantly lower than the net inflow of $422 million on July 16. Despite this, BlackRock's IBIT continued to lead , recording the largest net inflow of $110.37 million on the day, with a trading volume of $1.21 billion.

Bitcoin spot ETFs have accumulated a net inflow of more than $17 billion. Source: Farside Investors

Fidelity's FBTC was the only fund to report net inflows on July 17, with $2.83 million. In contrast, Grayscale's GBTC and Bitwise's BITB saw net outflows of $53.86 million and $6 million, respectively. Seven other funds, including ARK Invest and 21Shares' ARKB, reported zero net inflows on the day.

On July 17, total trading volume for U.S. spot Bitcoin funds was $1.79 billion, a significant drop from a peak of more than $8 billion in daily trading in March. Prior to the current all-time high, these ETFs had accumulated net inflows of $16.59 billion since their launch in January, reflecting steady investor interest despite fluctuations in daily inflows.

BlackRock’s Bitcoin bet

The record inflows highlight the growing acceptance of Bitcoin and its inclusion in mainstream portfolios. BlackRock’s Bitcoin holdings have surged to more than $20 billion, thanks to the firm’s recent acquisition of an additional 4,004 Bitcoins and a 3% rise in Bitcoin prices since the market closed on Monday.

The fund’s assets under management topped $20 billion for the first time in late May, coinciding with bitcoin’s rapid rise to $70,000 , making it the world’s best-known bitcoin ETF.

Bitcoin is currently trading at $66,994, down 2.33% from $65,470 on July 17, after falling to a nearly five-month low of $53,600 on July 5.