Approved Ethereum spot ETF applicants include well-known companies such as BlackRock, Fidelity and Grayscale, which are expected to bring billions of dollars of capital injection to the entire ecosystem.

Current share price: $3,461

The exchange-traded fund has successfully obtained final approval and will be officially traded on major US exchanges starting July 23.

On July 22, the U.S. Securities and Exchange Commission approved its final S-1 registration statement with Nasdaq, New York Stock Exchange and Chicago Board Options Exchange.

Other institutions that have successfully launched spot Ethereum ETFs include 21Shares, Bitwise, Franklin Templeton, VanEck and Invesco Galaxy.

Two months ago, on May 23, the SEC approved their 19b-4 application, a rule change that would allow spot Ethereum ETFs to be listed and traded on their respective exchanges.

BlackRock's iShares Ethereum Trust is about to be listed on the Nasdaq, while the Grayscale Ethereum Trust has chosen to be listed on the New York Stock Exchange.

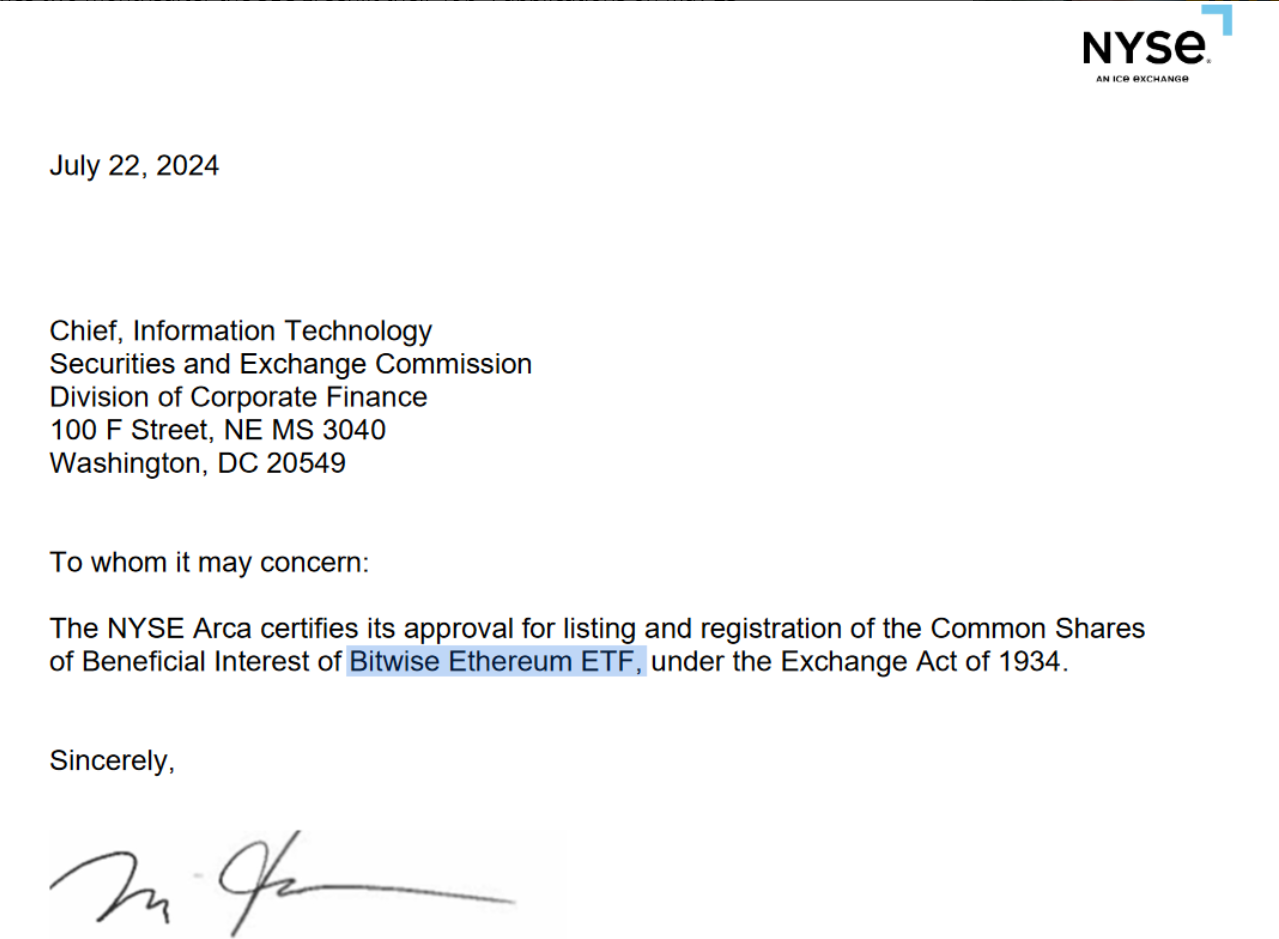

The New York Stock Exchange has officially approved the Bitwise Ethereum ETF for listing. Source: New York Stock Exchange Except for the Grayscale Ethereum Trust, the base rates of all other spot Ethereum ETFs range from 0.15% to 0.25%.

However, Fidelity, 21Shares, Bitwise, Franklin, and VanEck have pledged to waive fees on their spot Ethereum ETFs for a certain period of time or until their products’ net assets reach a certain amount.

The Grayscale Ethereum Mini Trust will also be fee-free for the first six months, or until its net assets reach $2 billion, whichever comes first.

Ethereum ETF could boost cryptocurrencies as Biden exits

The spot Ethereum ETF was approved a day after U.S. President Joe Biden announced his withdrawal from the 2024 presidential election, which could have a positive impact on the cryptocurrency market.

According to K33 Research, Ethereum is expected to outperform Bitcoin after the ETF is launched.

In a recent report provided to Cointelegraph, Josh Gilbert, a market analyst at eToro, said that Biden’s withdrawal from the race is seen as “a win for crypto assets”:

“We observe that the longer Trump’s lead in the election odds lasts, the higher the crypto asset price expectations for his victory.”

Industry analysts predict that a spot Ethereum ETF will likely attract 10% to 20% of the market traffic since the spot Bitcoin ETF launched six months ago.