Yesterday, in the article of Master, a long long in the range of 66200-66600, and the market fell to the lowest level near 66544 in the early morning. Then it rose to the highest level near 68235. The first target of the long position in the article, 67450, and the second target, 68300, were both accurately reached, and the pre-buried long position won a profit of 1700 points.

Hot topics of Master Chat:

Although the approval of the Ethereum spot ETF is good news, the market reaction was not as expected.

After the announcement, the price of Ethereum fell slightly. This may be because the market has already digested the news in advance.

Coupled with redemptions from early Ethereum investors, who will switch to other ETF products with lower fees, there may be a small wave of selling in the short term.

In addition, the U.S. second quarter GDP data will be released on Thursday, and the U.S. PCE inflation data will be released on Friday, which is also the Federal Reserve’s core inflation indicator.

Master looks at the trend:

BTC 1 hour:

According to market analysis, Bitcoin currently has a lot of positive news that puts the market in an overheated state, so the current position can be regarded as an important support area.

Judging from the on-chain data analysis such as miner costs and external factors, this rebound may be a temporary phenomenon and does not represent a long-term bull market trend, so the current position is very important.

When the market is overheated, many people will be bullish, but it is necessary to pay attention to the selling actions of institutions or large investors.

Resistance level reference:

First resistance level : 68200

Second resistance level : 69000

If the price of the currency breaks through the first resistance level, we need to observe whether it can stabilize at 68,000, and then we can expect another test of 69,000.

Although the price of the currency temporarily broke away from the rising channel yesterday, it has returned to the channel again. Therefore, we can expect to break through the resistance in the short term, and we also need to wait and see in the callback area to find a favorable entry point.

Support level reference:

First support level : 67350

Second support level : 66600

The first support level is the low point area formed after the rebound, and it is also the area that needs to be defended in the short-term rise. Since the buying and selling orders are small, it is more likely to break away in the short term.

Today's trading suggestions:

In today's trading, since the K-line has re-entered the rising channel, we can maintain a bullish view and conduct short-term trading in the short term.

If the first support level is maintained in the short term, we can expect an increase in the channel. If the price falls below the lower edge of the channel, it may adjust to 66.6k, which is a favorable buying point.

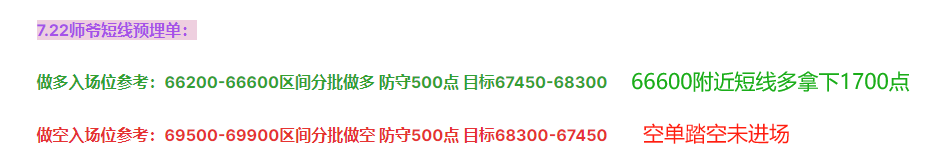

7.23 Master's short-term pre-buried order:

Long entry reference: 66200-66600 range, long in batches, 500 points of defense, 67350-68200

Reference for short entry: 69000-69400 range short in batches 500 points defense target 68200-67350

The content of this article is exclusively planned and published by Master Chen (public account: Master Chen, the God of Coins). If you need to know more about real-time investment strategies, unwinding, spot contract trading methods, operating skills, and K-line knowledge, you can add Master Chen to learn and communicate. I hope it can help you find what you want in the crypto. Focusing on BTC, ETH and Altcoin spot contracts for many years, there is no 100% method, only 100% going with the trend; daily updates of macro analysis articles, technical indicator analysis of mainstream coins and Altcoin, and spot mid- and long-term review price forecast videos.

Warm reminder: Only the column public account (pictured above) in this article is written by Master Chen. The other advertisements at the end of the article and in the comment area have nothing to do with the author himself! ! Please carefully distinguish the true from the false. Thank you for reading.