Table of contents

ToggleBlackRock IBIT’s single-day net inflow exceeds 500 million mg

According to data from Sosovalue, BlackRock's Bitcoin Spot ETF (IBIT) had an inflow of 7,759 Bitcoins on July 22, with a total value of approximately US$533 million, setting a record high since March. Yesterday's net inflows also brought BlackRock's total funds under management to 333,000 Bitcoins, equivalent to $22.7 billion at current prices.

Will Bitcoin become a U.S. strategic reserve asset?

Several analysts are optimistic about Bitcoin’s short- to medium-term prospects. According to Cointelegraph, Markus Thielen, founder of 10x Research, speculated that Republican candidate Donald Trump may announce at the Bitcoin 2024 conference on July 25 that Bitcoin will be designated as a national strategic reserve asset (that is, in the event of a national emergency) assets used in this case) and trigger a “parabolic” rise in the price of Bitcoin in the coming weeks.

Bryan Courchesne, founder of cryptocurrency asset management company DAIM, also made the same prediction. He said that it is very likely that Trump will designate BTC as a strategic reserve asset at the meeting.

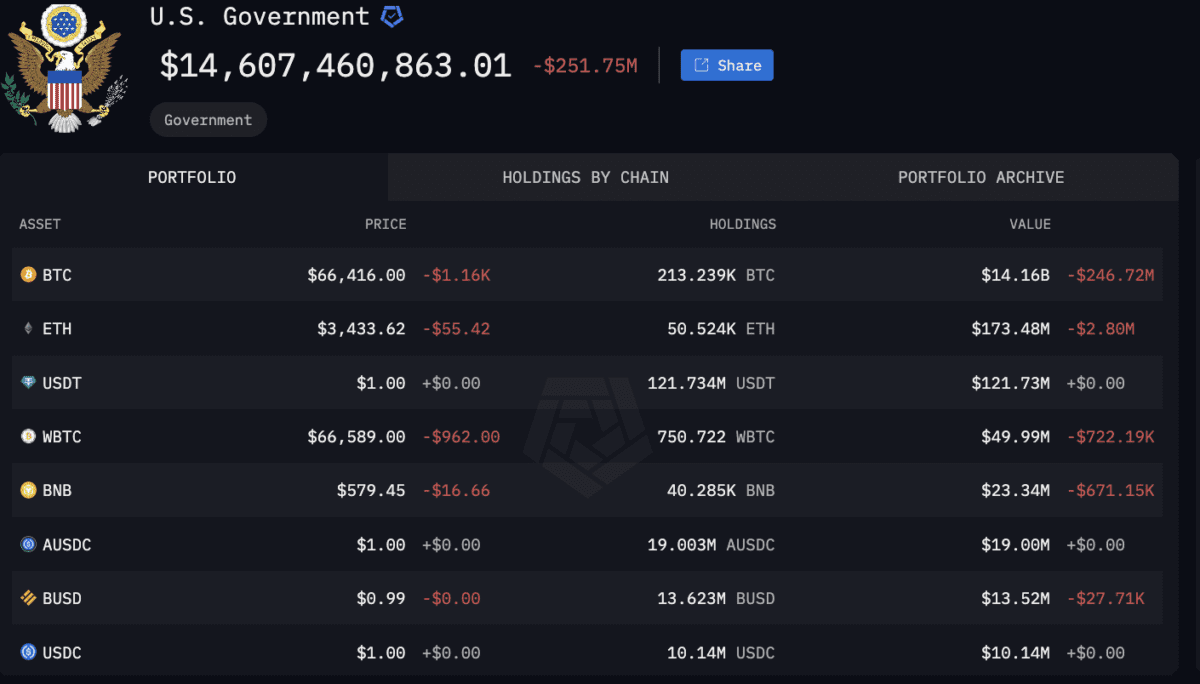

In fact, this policy is not difficult for the US government to implement. So far, the U.S. Department of Justice has seized 210,000 Bitcoins from Silk Road and other criminal cases, with a total value of more than 14 billion U.S. dollars, making the U.S. government the largest holder of Bitcoin, second only to Bitcoin’s anonymity Creator Satoshi Nakamoto. Therefore, the U.S. Department of Justice can implement the policy of using Bitcoin as a reserve asset by simply transferring these Bitcoins to the Treasury Department.

However, Ari Paul, Chief Information Officer of BlockTower Capital, believes that the probability of Bitcoin becoming a U.S. strategic reserve asset within the next four years is only 1 in 10. It stated that even if a future president announced that the United States would not sell the country’s Bitcoin holdings, Bitcoin would not be immediately included in the United States’ strategic reserve assets.