Coinbase Exchange CEO Brian Armstrong commented on the launch of the Ethereum spot ETF. He sees this as evidence for Ethereum from the security label imposed by the U.S. Securities and Exchange Commission (SEC).

Monday's groundbreaking development makes Ethereum as accessible to institutions as Bitcoin (BTC) was in January.

Coinbase CEO says Ethereum is not a security

Armstrong reiterated what cryptocurrency advocates have been saying for years: Ethereum is not a security. He says the regulator's decision formalizes this position, with the country's largest trading platform now offering custody services for eight of the nine newly approved financial products.

“This is another big step toward regulatory clarity: Ethereum is not a security! We've been saying this for years, and today the SEC finally made it official. Coinbase is proud to be a trusted partner and custodian supporting eight of the nine newly approved Ethereum ETFs,” Armstrong noted .

Read more: Ethereum ETF explained: What it is and how it works

Last May, the U.S. Securities and Exchange Commission ( SEC) proposed that Ethereum could be classified as a security . At the time, the potential approval of a spot Ethereum ETF was threatened as regulators sought public input on Ethereum's classification. In April, blockchain software company Consensys laid out four reasons why Ethereum should not be considered a security .

Ethereum ETF issuers that use Coinbase's services include Blackrock, Franklin Templeton, Grayscale, Bitwise, 21 Shares, Invesco, and Grayscale. Coinbase also offers custody services for several issuers of physical Bitcoin ETFs . Coinbase Custody Service is very important to investors as it ensures safe storage of their tokens.

Through this, Coinbase operates a significant portion of the US-based Bitcoin and Ethereum spot trading platform. Coinbase, the largest cryptocurrency trading platform in the US, handles a significant portion of US-based and US dollar-denominated BBTC and ETH trading. As the Bitcoin spot ETF campaign became more active, collaboration with the Chicago Board Options Exchange (Cboe) began on June 21, 2023.

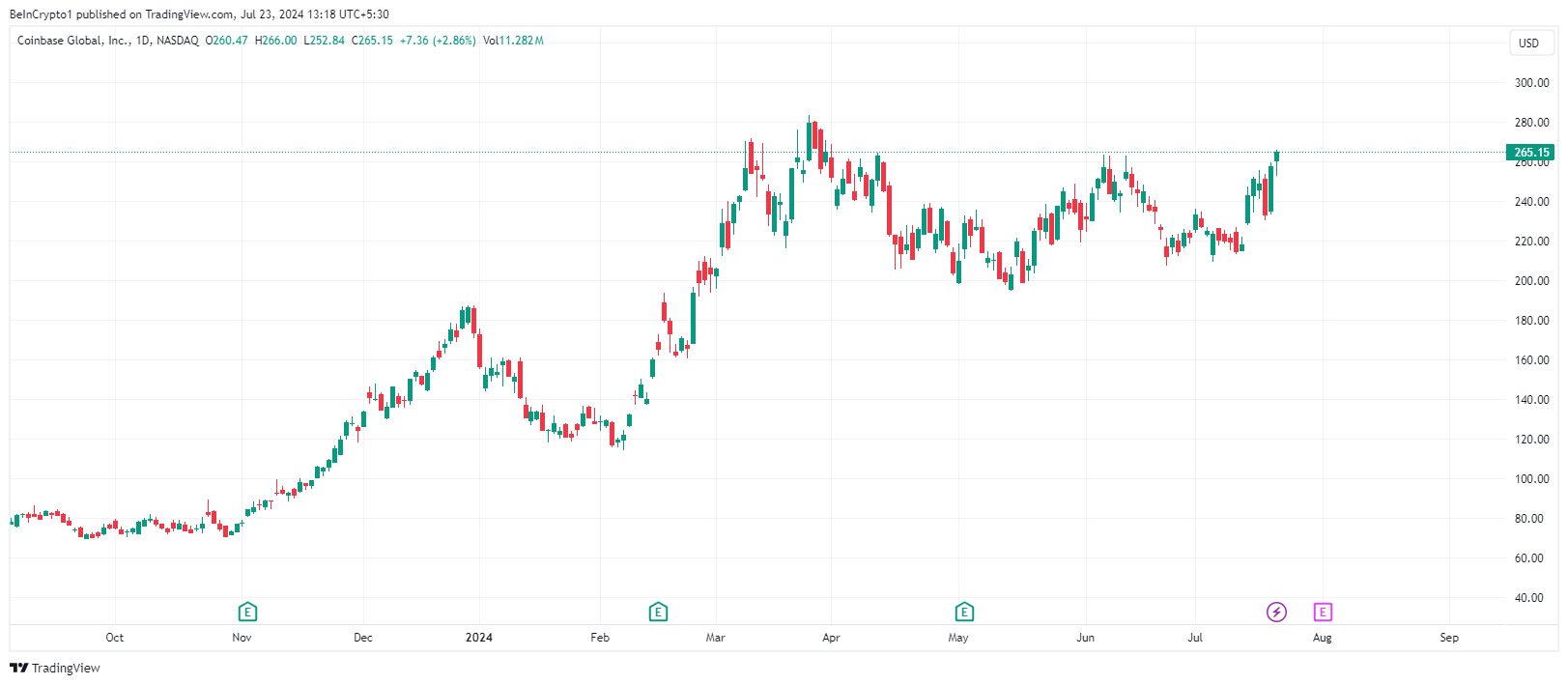

Following these developments, Coinbase stock COIN is up nearly 10%, trading at $265.15 at press time.

Blackrock and Bitwise comment on the launch of the Ethereum ETF

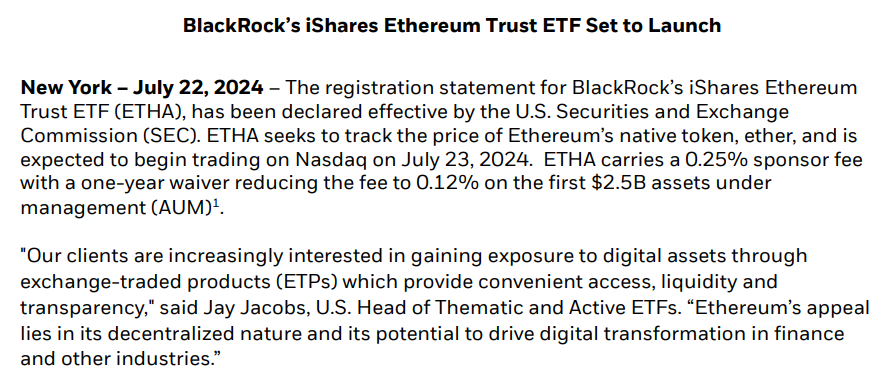

“The appeal of Ethereum lies in its decentralized nature and its potential to drive digital innovation in finance and other industries,” BlackRock, one of the issuers of the Ethereum ETF, said in a statement. “With this launch, institutional investors now have direct access to Ethereum.”

Meanwhile, Bitwise, another Ethereum ETF issuer, has pledged to donate 10% of the profits of the Bitwise Ethereum ETF (ETHW ) to the development of the Ethereum open source protocol.

“Bitwise plans to donate 10% of the profits of the Bitwise Ethereum ETF (ETHW) to develop the Ethereum open source protocol. Recipient organizations: – Protocol Guild and PBS Foundation. We cannot take Ethereum and its core protocol properties for granted. We are excited for ETHW to support the work of those working on the Ethereum protocol. These unsung heroes work tirelessly every day to improve the security, scalability, and usability of Ethereum. Donations will be made annually for at least the next 10 years. Recipient organizations are subject to change upon annual review.” This was announced with the launch of the Bitwise Ethereum ETF.

Bitwise has been vocal about its Ethereum ETF, including publishing a bold ad campaign in June mocking the limitations of trading finance. Recently, it was predicted that the price of Ethereum could exceed $5,000 after the launch of the Ethereum ETF .

Read more: How to invest in Ethereum ETF?

While the announcement did not spark a rise in the price of Ethereum , the approval conditions and subsequent launch show how the cryptocurrency asset can change over time. It also signals the maturing regulatory environment in the United States and demonstrates continued innovation in the cryptocurrency industry.