The Ethereum spot ETF was officially listed for trading on the evening of the 23rd yesterday, and the trading volume reached US$320 million 90 minutes after the opening, which was approximately 50% of the 90-minute trading volume (US$610 million) of the Bitcoin spot ETF on the first day of trading.

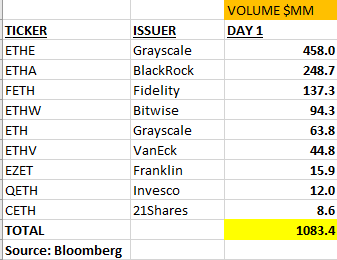

After the close, the total trading volume of the Ethereum spot ETF on the first day was US$1 billion, which was 23% of the first day trading volume of the Bitcoin spot ETF. Bloomberg ETF analysts said:

BlackRock’s Ethereum Spot ETF (ETHA) has 25% the trading volume of its Bitcoin Spot ETF (IBIT).

The gap between Grayscale’s ETHE and the nascent eight ETH ETF is a healthy $625 million (a sizable portion of which “should” convert into inflows).

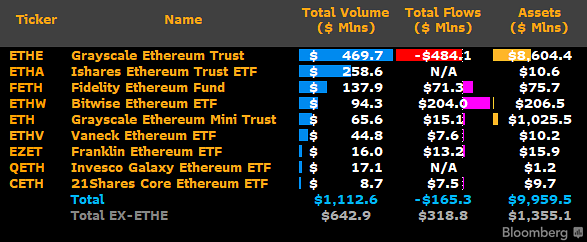

ETH spot ETF saw a net outflow of 165 million mg on the first day

In terms of capital flow, according to statistics from Bloomberg analyst James Seyffart, the following companies showed net inflows on the first day of launch:

- Bitwise ETHW: Inflows were $204 million;

- Fidelity FETH: Inflows of $71.3 million;

- Grayscale ETH Mini Trust: $15.1 million in inflows;

- Franklin EZET saw inflows of $13.2 million;

- VanEck ETHV saw $7.6 million in inflows

- 21 Shares CETH inflow was $7.5 million;

It should be noted that Grayscale's ETHE, due to profit-taking or conversion to low fees, has a total net outflow of up to US$484 million, close to 5% of its AUM. Eric Balchunas wrote in this regard:

Damn it. That’s a lot (ETHE net outflows)…not sure if the “top eight” newcomers can offset such large inflows. On the other hand, maybe it's better to end it quickly, like tearing off the OK jump.

Current statistics: The total outflow of ETH spot ETFs on the first day was US$165 million, but there is still a lack of data for BlackRock ETHA and Invesco/Galaxy QETH.

ETH falls below $3,400

There is no celebration in the price trend of Ethereum. U.S. stocks briefly rose by nearly US$3,500 after opening, and then continued to fall, falling below the 3,400 level near one o'clock, with the lowest price at US$3,389.

. It rebounded before the deadline, but not by much. It is now trading at $3,435, down 1.39% in the past 24 hours.

Betting on a 50% chance that ETH will not hit new highs this year

Perhaps due to the weak promotion of spot ETFs, the market currently does not seem to be optimistic about the price of Ethereum this year.

On the prediction market Polymarket, the largest market bets nearly $780,000. 51% of users believe that “ETH will not have ATH in 2024”; about 28% of users predict that ETH may break through the historical high in the fourth quarter. point.

Another smaller market forecast shows that there is only a 13% chance that ETH will break $10,000 this year.