According to data from Bloomberg, the trading volume of the newly launched Ethereum spot ETF exceeded $1 billion on its first trading day as expected. However, this data does not clearly indicate whether these transactions represent inflows or outflows of funds, nor can it be discerned whether the investors behind these transaction volumes are investing from a long-term investment perspective, or whether they are just for short-term gains such as through arbitrage trading. . Therefore, net fund inflow/outflow records are still a more important data indicator than transaction volume.

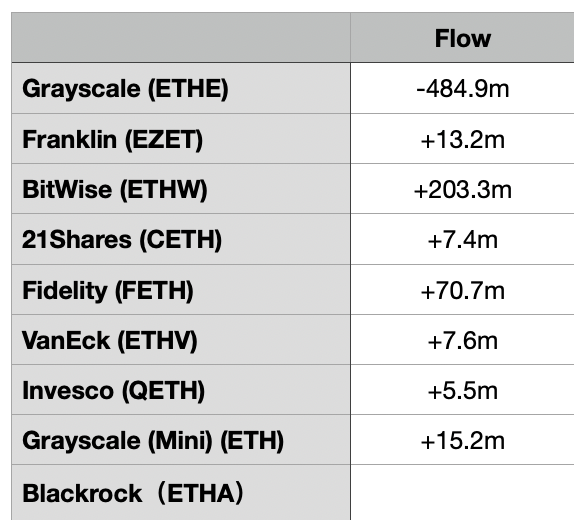

Except for BlackRock's ETHA, the net inflow/outflow data of other Ethereum spot ETFs have been released.

According to Bloomberg terminal data, Grayscale's ETHE net outflow was as high as US$489 million. The seven currently known ETFs still cannot fill this outflow. After adding up, the net outflow was still US$162 million. In other words, if the net inflow of ETHA is less than $162 million, the performance of the Ethereum spot ETF on the first day of trading will end with a net outflow.

By comparison, the spot Bitcoin ETF's trading volume on its first trading day was $4.5 billion, and all ETFs combined had net inflows of approximately $600 million.