Tuesday marked a significant milestone for cryptocurrency enthusiasts and investors with the launch of the US-based Ethereum spot exchange-traded fund (ETF).

Despite mixed results on investment flows, trading activity on the day was strong, with total volume exceeding $1 billion.

Grayscale Ethereum Trust records nearly $500 million in fund outflow

BlackRock's ETHA took the lead with the largest inflow of funds, securing $266.5 million. Bitwise’s ETHW recorded the second highest inflows at approximately $244 million.

In contrast, Grayscale Ethereum Trust (ETHE) recorded significant outflows of $484.1 million. Grayscale Ethereum Mini Trust (ETH) recorded inflows of $15.1 million despite large outflows of ETHE.

Meanwhile, Fidelity's FETH received $71.3 million in inflows, and Franklin Templeton's EZET received $13.2 million in inflows. Most smaller ETFs saw only single-digit inflows. Cumulative inflows total $106.6 million.

Read more: Ethereum ETF explained: What it is and how it works

| Blackrock | Fidelity | beat wise | 21 shares | VanEck | Invesco | Franklin | grayscale | gray scale | Sum | |

|---|---|---|---|---|---|---|---|---|---|---|

| ETHA | FETH | ETHW | CETH | ETHV | QETH | EZET | ETHE | ETH | ||

| July 23, 2024 | 0.25% | 0.25% | 0.20% | 0.21% | 0.20% | 0.25% | 0.19% | 2.50% | 0.15% | |

| Seed | 10.6 | 4.4 | 2.5 | 2.3 | 10.2 | 1.1 | 2.7 | 9,199.3* | 1,022.5* | 10,255 |

| July 23 | 266.5 | 71.3 | 204.0 | 7.5 | 7.6 | 5.5 | 13.2 | (484.1) | 15.1 | 106.6 |

The trading volume on this day was particularly impressive. ETHA topped the charts with daily trading volume of $247.8 million, followed closely by Fidelity's FETH. These numbers are incomparable compared to the more than 600 new ETFs launched over the past year, not including those based on Bitcoin.

“This is yet another example of how unusual this all is,” said Bloomberg ETF analyst Eric Balchunas.

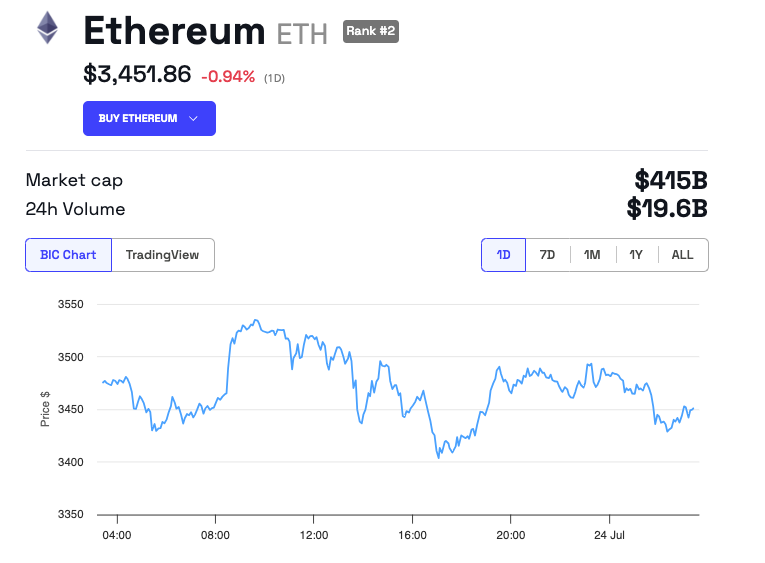

In contrast, the price of Ethereum showed little change. It was traded at $3,451, down about 1% from the previous day. Despite significant advancements in ETF products, the market prices of these major digital assets have remained relatively flat.

Blofin Research and options analyst Edward discussed Ethereum's market movements in a recent interview with BeInCrypto. He pointed out that Ethereum is bottoming out around $3,500 without showing a clear upward or downward trend.

“This behavior indicates that the significant negative gamma around $3,500 is one of the causes of price instability. At the same time, support around $3,300 and resistance around $3,600 make it difficult for the Ethereum price to break out in either direction,” Edwards told BeInCrypto.