The previous Polymarket player made a staggering $106,000 in 61,793 trades in one year.

Written by: Mahe, Foresight News

Another miracle has occurred at Polymarket.

Through extensive surveillance and aggressive betting, a certain address made a net profit of $100,000 in just one year, based on minimal initial investment.

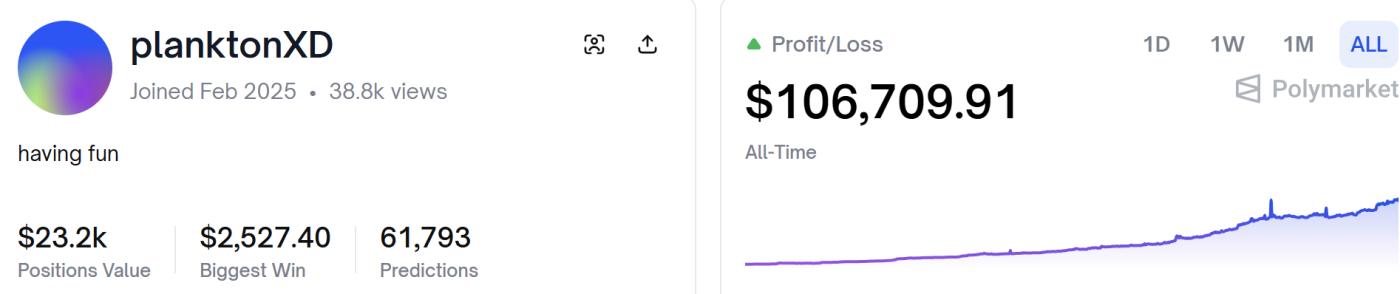

The address we're reviewing, planktonXD (0x4ffe49ba2a4cae123536a8af4fda48faeb609f71), is a quintessential high-frequency quantitative trader. Since joining in February 2025, in just one year, it has generated a net profit of $106,000 through over 61,000 predictions .

In the prediction market, most people are betting on "black swan" events or chasing big news, but planktonXD takes a completely different path: extreme certainty and terrifying execution frequency.

Looking at PlanktonXD's historical trading data, the most impressive thing is its 61,000 predictions. From February 2025 to February 2026, that's an average of about 170 trades per day.

This frequency far exceeds the limits of human manual operation, concluding that the player is using an automated trading script (Bot). It is not "predicting" the outcome, but rather "harvesting" the price difference.

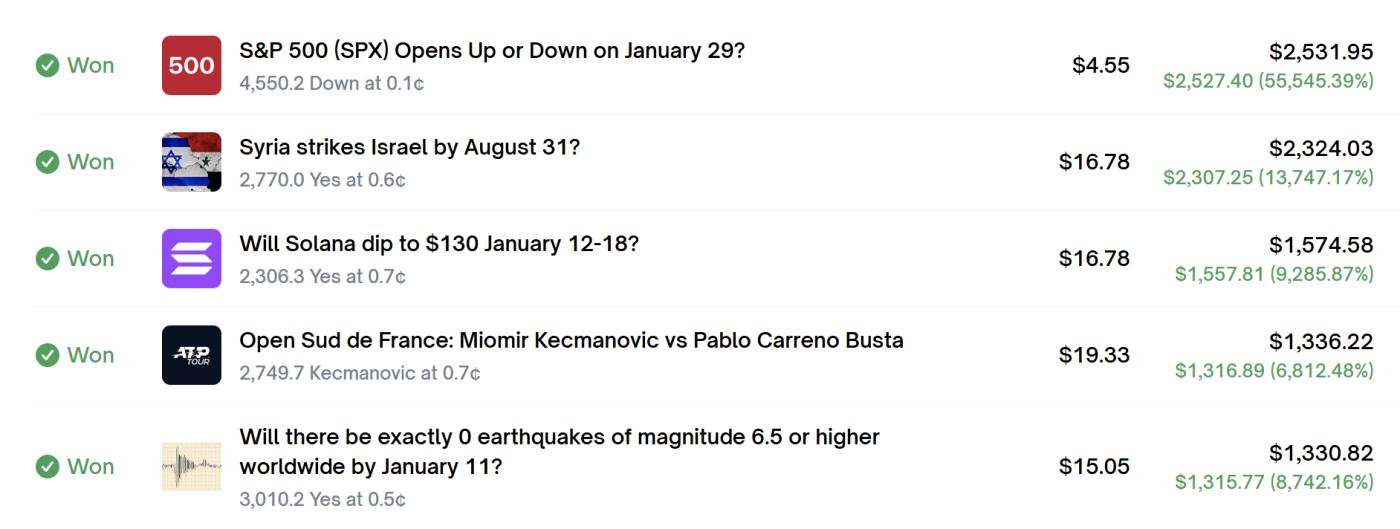

A very interesting phenomenon is that planktonXD's "Biggest Win" is only $2,527.4. Compared to its total profit of $100,000, this single largest win seems very "small" (only about 2% of the total profit).

Some retail investors always hope to make a big profit, and with overconfident judgment, they bet all their chips.

Winning is great, but losing makes it hard to get back to the poker table.

Even if you win every time you go all in, just one loss can lead to a huge loss.

Throughout its trading history, it never goes all-in on a single extreme event, nor does it gamble on high odds. Its profit curve exhibits a perfect 45-degree smooth ascent with almost no large drawdowns. This indicates that it employs a market-making strategy: placing orders on both sides of the order book to earn the bid-ask spread, or using price fluctuations between different markets for micro-arbitrage.

It doesn't always hold positions for the long term (buy and hold), but rather frequently enters and exits the market. This "light position, fast turnover" strategy greatly reduces single-point risk. Even if an unexpected event occurs in a prediction market (such as a sudden change in election results), the impact on its total capital pool is negligible.

Unlike previous quantitative trading bots that focused solely on vertical sectors like weather, this bot bets across multiple sectors, including sports, weather, cryptocurrency prices, and politics. It monitors thousands of prediction markets across the platform 24/7, searching for moments when pricing fails.

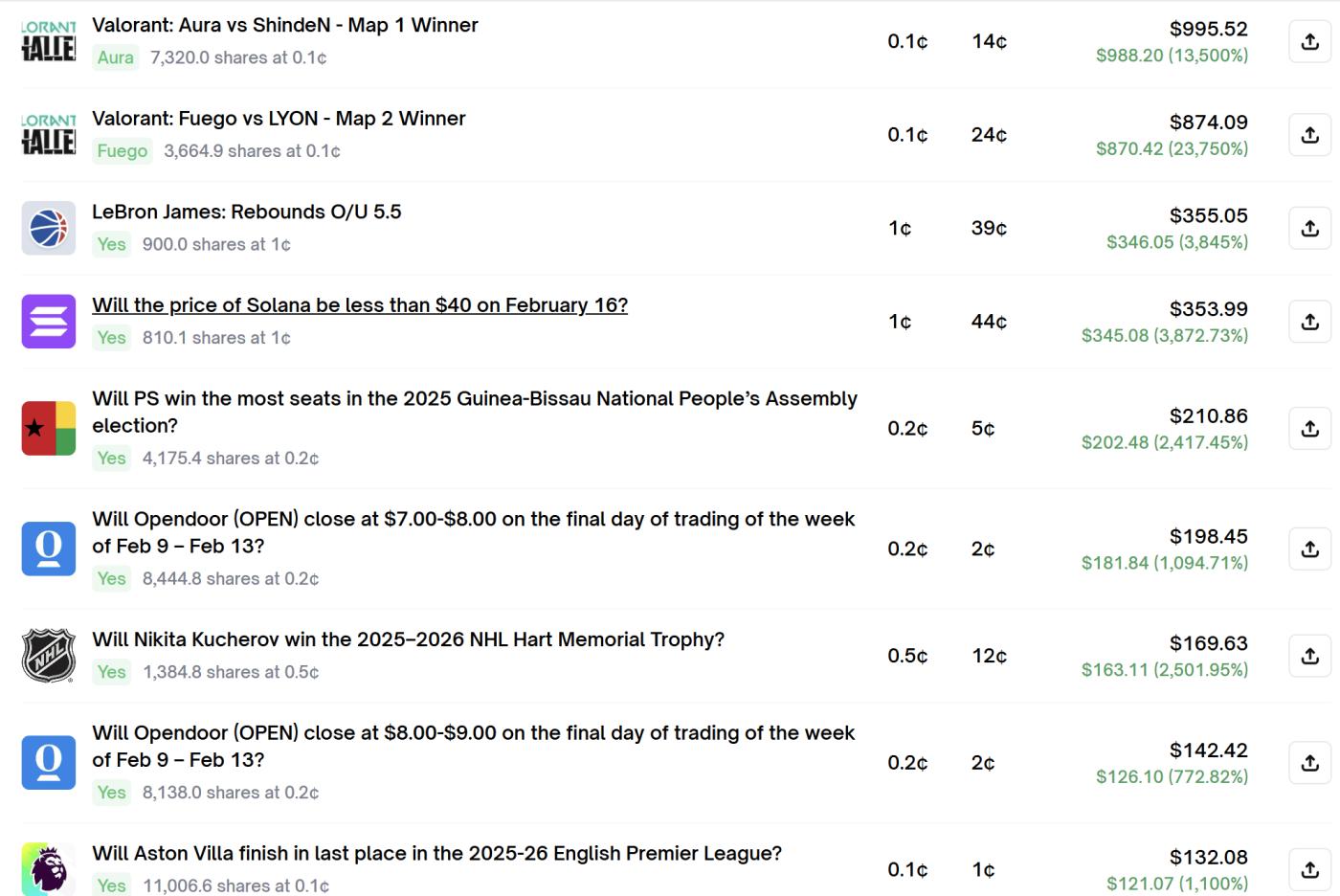

VALORANT Challengers is a classic real-world example of this trader's experience.

You can think of it as a "secondary league" or "regional league" in the esports world. Fuego and LYON are professional teams from Latin America. Because of the small audience and extremely high information asymmetry in these competitions, they have become a "paradise for arbitrage bots."

It won by buying 3,664.9 units of Fuego at a price of 0.1¢ per unit, and the final return on this trade was as high as $874.09, with a terrifying return rate of 23,750%!

This is a classic example of "small position, big odds." In long-tail markets with extremely poor liquidity or where the public is extremely pessimistic about a particular option (such as the results of a match in esports), it uses bots to monitor options that have been mispriced to near "zero." It doesn't need to predict who will win; it only needs to know that Fuego's probability of winning is definitely more than 0.1%. Essentially, this is harvesting the market's "extreme sentiment" and "lack of liquidity."

When it comes to emotions, the price of cryptocurrencies reflects them most vividly.

Will the price of SOL fall to $130 between January 12th and 18th?

It invested about $16 at a price of 0.7¢ (the market believes the winning probability is less than 1%) and eventually took away $1,574, with a return rate of an astonishing 9,285%.

Why did such an "almost impossible" prediction allow it to make a lot of money at the time?

During periods of extreme volatility in the cryptocurrency market, mainstream predictions tend to favor bullish or sideways movement. PlanktonXD continuously monitors "extremely bearish" options priced between 0.1¢ and 1¢. These options, seemingly worthless to the average person, are seen as extremely cheap insurance by quantitative analysts. A single sharp market dip or sudden negative news can cause these "worthless" options to surge a thousandfold. Furthermore, in specific price ranges (such as SOL < $40), the order book is often very thin due to the significant distance between the current price and the predicted price. PlanktonXD uses automated scripts to place orders in these "no man's land," absorbing cheap shares sold due to panic or misoperation—essentially acting as a probability manipulator.

PlanktonXD's SOL strategy demonstrates that in the Polymarket, buying the "impossible" doesn't mean it believes it will happen, but rather that the "probability of occurrence" is underestimated by the market. It buys out a one in ten thousand chance of market panic for just a few dollars—a classic example of "antifragile" trading.

The success of planktonXD offers three key insights for ordinary retail investors:

The power of compound interest should not be underestimated. Earning 0.5% daily through high-frequency trading yields far more stable returns after a year than betting on a single 10x coin. Technical skills are essential ; in the cryptocurrency era, quantitative tools and API access capabilities are standard equipment for top players. Finally, certainty outweighs odds . In prediction markets, seeking small profit opportunities with extremely high probabilities (e.g., over 90% certainty) is far more survivable than gambling on a 50/50 event.

After all, the most advanced way to play the market prediction game is not predicting the future, but managing probability and liquidity.