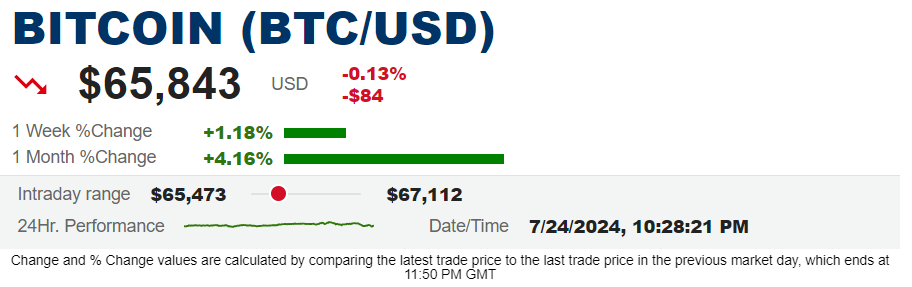

As Donald Trump addresses an estimated 20,000 Bitcoin enthusiasts in Nashville, Tennessee, later this week, pro-crypto Republican Sen. Cynthia Lummis of Wyoming is looking to make some big news, announcing that she is working on new legislation that could fundamentally change the burgeoning cryptocurrency business by firmly establishing Bitcoin as a mainstream financial asset, FOX Business has learned.

Loomis has been quietly preparing to announce legislation at the annual Bitcoin conference that would require the Federal Reserve to hold some Bitcoin as a strategic reserve asset, according to three cryptocurrency executives with knowledge of the bill. As of press time, Loomis' plans remain undetermined and the announcement could be delayed. But people who have had direct contact with some of Loomis' staff say she hopes to announce her intentions at the conference on Saturday, just before Trump's scheduled speech; her staff hopes Trump will support the bill and the ideas behind it.

Senator Cynthia Lummis speaks at a Bitcoin conference in Miami, Florida, on June 4, 2021. (Eva Marie Uzcategui/Bloomberg via/Getty Images)

She also could choose to announce the bill during a fireside chat Friday afternoon hosted by former Democratic Rep. Tulsi Gabbard, who now supports Trump’s attempt to retake the White House, these people said.

News of the bill has not been publicly reported, but Lummis has been teasing a big announcement on her X account this week, writing: "Big things are coming this week. Stay tuned!"

While the specifics of the bill are unclear, according to a person who has seen an early draft, the bill is intended to direct the Fed to buy Bitcoin and hold it as a reserve asset, just as the U.S. central bank holds gold and foreign currencies, to help manage the U.S. monetary system and keep the value of the dollar stable.

Lummis has been quietly pitching the bill to some of his colleagues on the Senate Banking Committee to sign on as co-sponsors, the person said.

“The Federal Reserve holding Bitcoin as a strategic reserve asset would be a significant move that would bring stability to the dollar and our capital markets,” said Alex Chizhik, chief commercial officer at HarrisX. “It also sends a loud signal that our central bank is embracing innovation, and as an independent institution, it is a natural, nonpartisan home for Bitcoin.”

Trump raises money at Bitcoin conference, demands $844,600 per seat

Implementing Bitcoin as a reserve asset would require presidential and congressional support, but that is no easy feat given political and economic skepticism about the validity of digital currencies as financial assets. The $2 trillion cryptocurrency industry has been plagued by fraud; many mainstream economists are skeptical of its use as a store of value.

Still, even the introduction of legislation (and Trump’s likely support) to classify Bitcoin as a reserve asset would be a high-level recognition by government that Bitcoin is a legitimate financial asset, something the cryptocurrency industry has been seeking in its quest for mainstream acceptance.

Sam Lyman, director of public policy at bitcoin mining company Riot Platforms, said: "Classifying the world's largest cryptocurrency as a strategic reserve asset will be the trigger for a 'bitcoin space race.' If the United States - the world's richest country and the seat of global capital - begins accumulating bitcoin on its balance sheet, other countries will have a strong incentive to do the same."

The U.S. is already the largest national holder of Bitcoin, so it has a strong first-mover advantage. Thanks to the Justice Department’s massive seizures from illegal actors over the years, the U.S. currently holds about 210,000 Bitcoins, worth just over $66,000 each.

“This will send nation-state game theory into overdrive as countries compete to accumulate the scarcest monetary asset on the planet,” Lehmann added.

A spokesman for Loomis declined to comment; a spokesman for the Trump campaign did not respond to a request for comment.

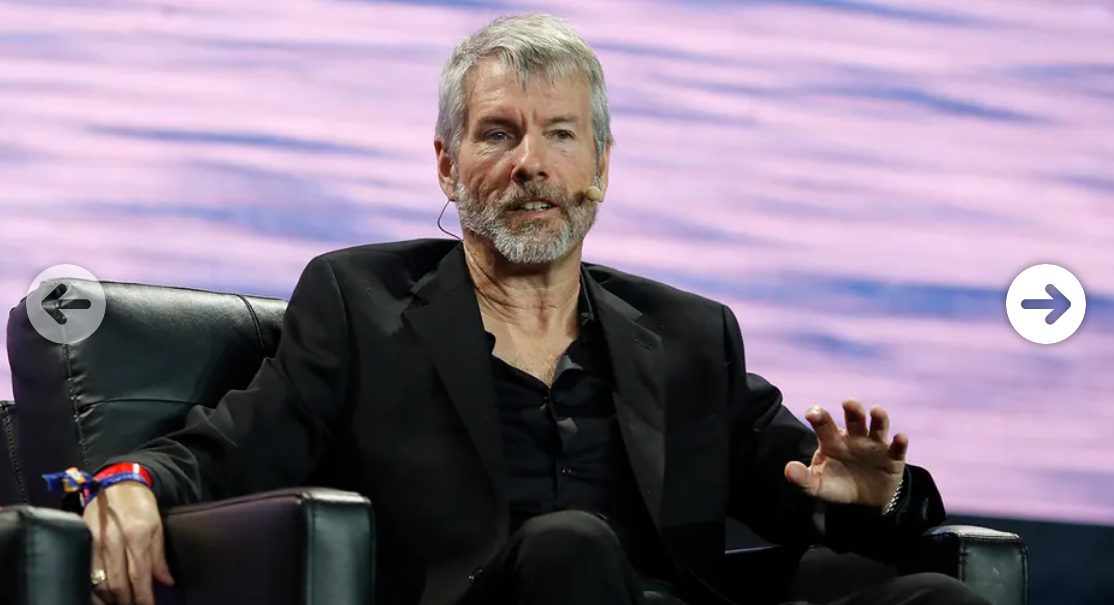

The conference is expected to feature other notables such as MicroStrategy’s Michael Saylor, Ark Invest’s Cathie Wood, former presidential candidate Vivek Ramaswamy and independent candidate Robert F. Kennedy Jr. The conference comes at a time of political turmoil across the country, with both parties tapping voters who own cryptocurrencies and the November presidential election looking set to be a close race.

Image 1 / 4 MicroStrategy CEO Michael Saylor speaks at a Bitcoin conference in Miami on April 7, 2022. | Getty Images

Vice President Kamala Harris emerged as the Democratic nominee after President Biden dropped out of the race. While Harris has a lot on her plate — including picking her running mate — pro-crypto Democrats like tech billionaire Mark Cuban have been advising her campaign to soften its relationship with the cryptocurrency industry, which has been under intense scrutiny under a Biden administration’s regulatory regime.

Harris declined to attend the bitcoin conference after negotiations with conference organizers, according to people familiar with the matter.

But Democratic insiders say she appears willing to court cryptocurrency holders because they represent about 50 million potential voters, many of whom have no interest in politics other than protecting their investments.

A press representative for Harris Corporation was not immediately available for comment.

The Republican Party has taken a strong position in the cryptocurrency industry; former Republican presidential candidate and current Trump aide Ramaswamy has been courting the industry for months. Trump has done the same, and in a scheduled appearance on Saturday, he plans to promote promises made in the Republican platform, including promoting Bitcoin mining, self-custody of digital assets, and abandoning the creation of a central bank digital currency (CBDC).

Cryptocurrency firm FLOWDESK hires former New York Stock Exchange legal counsel as it seeks to build influence in the U.S.

Loomis is also a Bitcoin investor herself. She has been called the “Crypto Queen” of the Senate and has advocated the use of Bitcoin to strengthen the nation’s financial position.

In 2022, she floated the idea of using Bitcoin to diversify the Fed's $40 billion in foreign currency, emphasizing that the decentralized nature of the asset would make it more "ubiquitous" over time. Earlier this month, she floated the idea of a Bitcoin reserve in an interview with FOX Business' Larry Kudlow, saying it could help support a stronger dollar.

It is unclear how Trump, once skeptical of Bitcoin, views the concept of Bitcoin as a potential reserve asset, or whether he would support it. One person who reviewed a draft of Lummis' bill said a big selling point of the bill is that it would help strengthen the dollar, which is currently backed by the full faith and credit of the country's tax authorities rather than any hard asset.

Former President Trump waves to the crowd during halftime of the Palm Bowl game between Clemson University and the University of South Carolina at Williams-Brice Stadium in Columbia, S.C., Nov. 25, 2023. (Sean Rayford/Getty Images)

Still, the move could be controversial. Some say adding cryptocurrencies to the mix could undermine the value of gold, a mainstay of the U.S. economy. Crypto skeptics worry that Bitcoin’s volatility could make it difficult for the Fed to effectively use it as a hedge against economic headwinds.

Federal Reserve Vice Chairman Randy Quarles said the central bank needs to move toward holding U.S. Treasuries as the entirety of its balance sheet to avoid what he called a “slippery slope” of using the Fed’s balance sheet for political credit allocation.

Federal Reserve Vice Chairman Randall Quarles (Andrew Harrer/Bloomberg via/Getty Images)

As of June, the Fed's balance sheet was as high as $7.3 trillion, including assets such as Treasury bonds, foreign exchange reserves and gold.

“There is no safer investment than U.S. Treasuries, so I really don’t see why we need to hold Bitcoin as a strategic reserve,” economist and former Trump adviser Steve Moore said in a statement to FOX Business. “I guess one positive is that it would be a good way for the government to diversify its assets.”

Ramaswamy has floated a similar idea of backing the dollar with what he calls a “basket of commodities,” which could include Bitcoin, to combat the inflation that’s raging in the early days of the Biden administration. Kennedy, another Bitcoin supporter, has proposed a similar approach but has faced pushback from cryptocurrency industry skeptics who say it would represent an unrealistic return to the gold standard, which the U.S. abandoned in 1971.

While the idea of using Bitcoin as a potential strategic reserve asset is not new, the voices in favor of mainstreaming digital assets are growing louder. Bitcoin received a major boost from Wall Street when Larry Fink, CEO of BlackRock and the world’s largest fund manager, went from being an opponent to a staunch supporter. Fink, who once called Bitcoin a “money laundering index,” now calls it “digital gold” and a “long-term store of value” as the company launched a Bitcoin exchange-traded fund earlier this year. Since the fund’s launch, it has attracted nearly $19.5 billion in investor funds.

BlackRock CEO Larry Fink speaks at a World Economic Forum event in Davos, Switzerland, on January 17, 2023. (Hollie Adams/Bloomberg via Getty Images/Getty Images)

Trump has recently shifted that view.

“If we don’t do this, China will take over,” Trump said in an interview with Bloomberg last week about his recent embrace of digital assets. “I don’t want another country taking over this space.”

Meanwhile, cryptocurrency holders could see big returns if Lummis’ bill becomes law. Since the supply of revenue is fixed, any entity buying a large amount of Bitcoin could drive up the asset’s price in a relatively short period of time.

“Strategic bitcoin adoption does mean potentially significant upside from a price perspective because the interest in the market will be much stronger from a financial perspective,” Swarm Markets co-founder Philipp Pieper told FOX Business.

It is unclear how his congressional colleagues will react to Loomis' bill, which will largely depend on the makeup of the House and Senate and who will take office in the White House in November.