Bloomberg ETF analyst James Seyffart compared the performance of the Ethereum spot ETF and the Bitcoin spot ETF on the first day, and believed that "compared to the first day of the Bitcoin ETF, the trading volume of the Ethereum ETF was about 24%, and the flow was 16.5 %. It was a very solid day!”

Table of contents

ToggleEthereum spot ETF first day performance

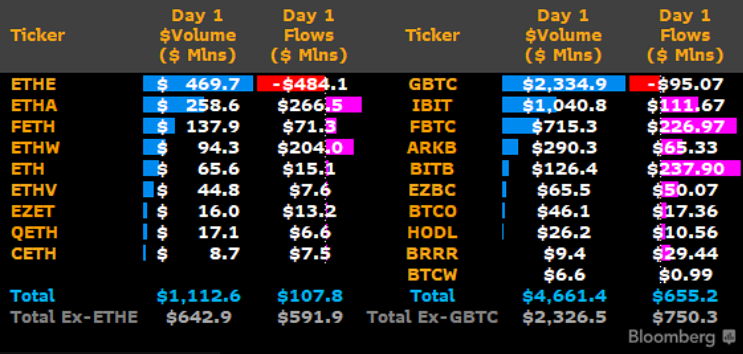

The Ethereum spot ETF was officially launched on July 23. The total trading volume on the first day reached US$1.112 billion, with an overall net inflow of US$107.8 million.

EHTE's total trading volume, excluding grayscale, reached US$642.9 million, with an overall net inflow of US$591.9 million.

ETH vs BTC ETF

Bloomberg ETF analyst James Seyffart also compared the performance of the Ethereum spot ETF and the Bitcoin spot ETF on the first day (the following data is the relative performance of ETH divided by BTC).

Transaction volume: 23.9%

Transaction volume (excluding grayscale, but including grayscale mini): 27.6%

Net inflow: 16.5%

Net inflow (excluding grayscale, but including grayscale mini): 78.9%

James Seyffart says:

Compared to the Bitcoin ETF on its first day, the Ethereum ETF had approximately 24% trading volume and 16.5% flow. I thought it was a very solid day!

The difference lies in the outflow of grayscale

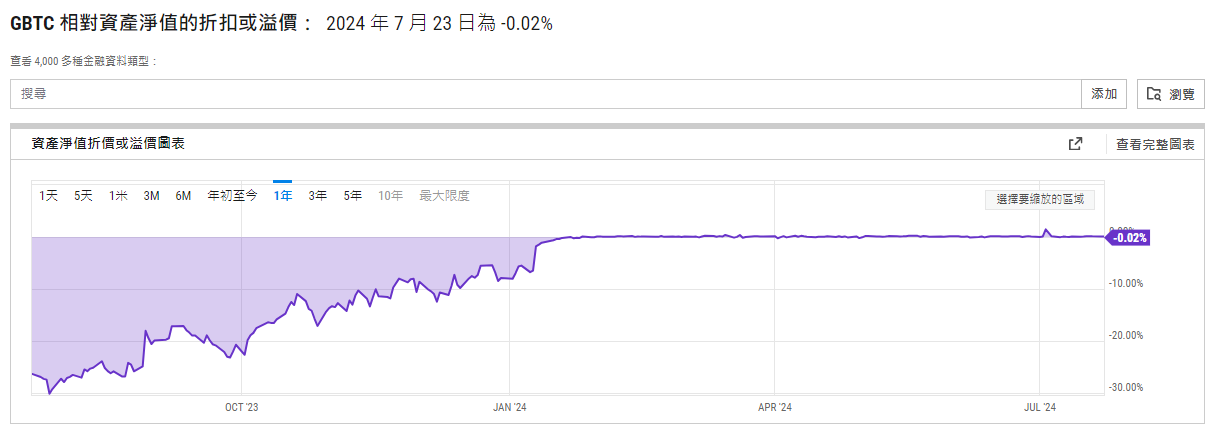

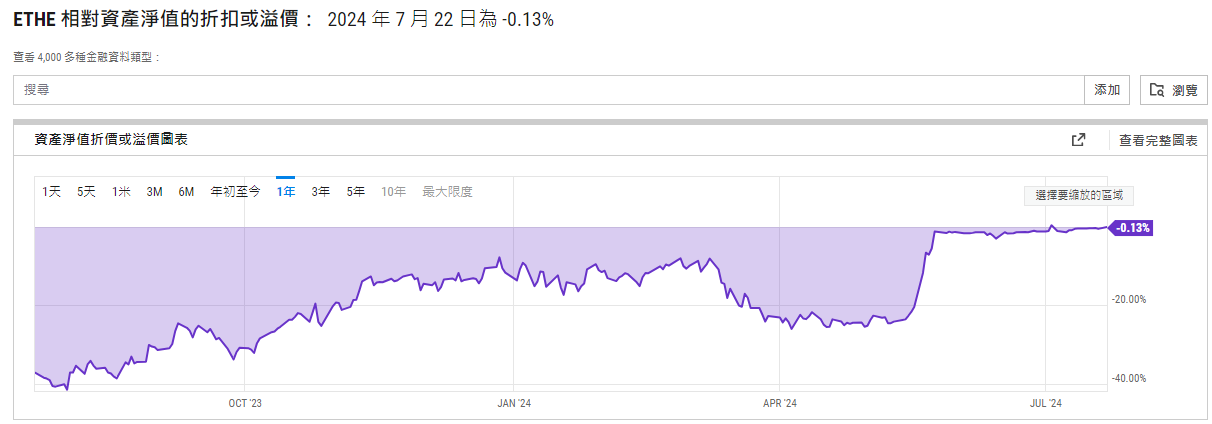

Seyffart also pointed out that the main difference between the two comparisons is the relatively large outflow of ETHE, as GBTC was still at a meaningful discount when launched.

According to YCharts data, GBTC slowly recovered from -6.53% on 1/9 before its launch to -0.11% on 1/22.

However, ETHE has risen sharply and approached 0 as early as 5/24, that is, after the approval of Form 19-4b of the Ethereum spot ETF.

Demand for ETH exceeds expectations on day one

Juan Leon, senior analyst at Bitwise, also said:

This is a marathon, not a sprint, but demand for ETH exceeded expectations on day one. Prepared for the road ahead.

OKX Global Business Chief Lennix Lai said that the approval and launch of the ETH ETF shows that the SEC does not define ETH as a security.

The launch of the ETH ETF means more funds flowing into the ETH ecosystem, especially from institutional investors.

Alice Liu, head of research at CoinMarketCap, also said:

Based on the European market where the ETH ETF already trades, we expect institutional demand to increase in the next 3-5 months. Strong first-day demand for the ETH ETF significantly exceeded market expectations and signals a promising long-term outlook.