Table of contents

ToggleTechnology stocks tumble

As the second quarter financial reports of Google parent company Alphabet and Tesla were not as expected, they fell 5% and 12% respectively, which also dragged down other technology stocks, including Huida and Facebook parent company Meta, which fell 6.8% and 5.6% respectively. , while Microsoft fell 3.6%. The Nasdaq index, which is dominated by technology stocks, suffered its largest one-day decline since 2022. Major U.S. indexes closed generally lower yesterday:

- The Nasdaq fell 3.64%.

- The Dow Jones Industrial Average fell 1.25%.

- The S&P 500 fell 2.31%.

Cryptocurrency linkage, Ethereum ETF net outflow

The cryptocurrency market, which has always been linked to technology stocks, cannot escape the fate of decline. Both Bitcoin and Ethereum fell rapidly last night.

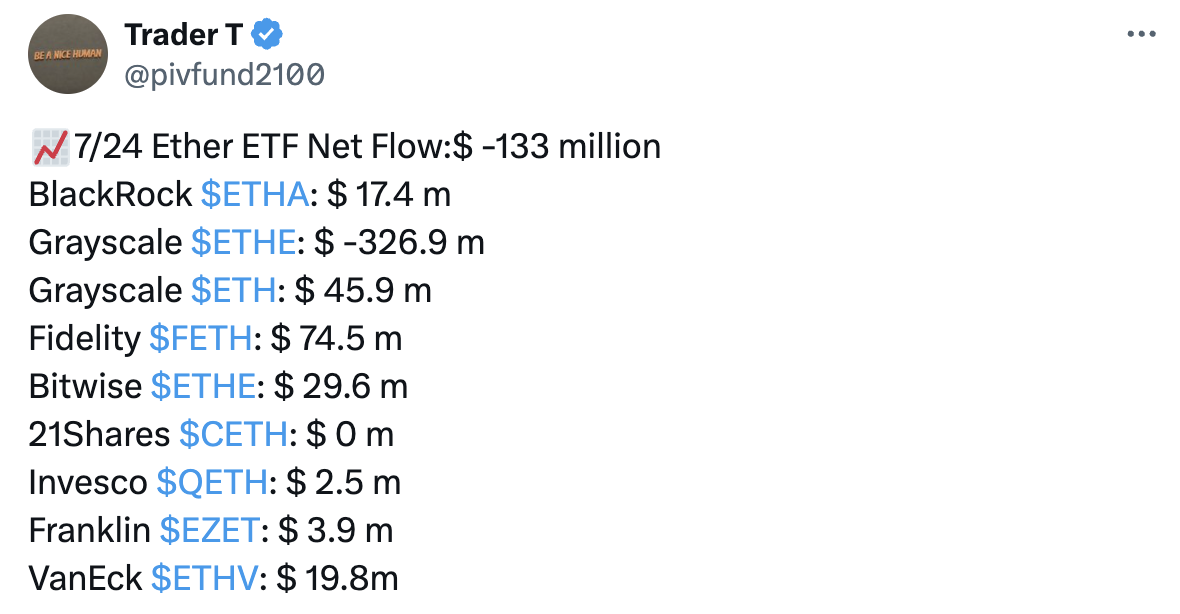

Among them, although the Ethereum ETF had a net inflow of about US$100 million on the first day of trading, its performance on the second day was quite miserable. Grayscale's ETHE net outflow was still quite high, about US$300 million, but the net inflows of other ETFs could not keep up with Grayscale's. The rapid outflow rate caused the overall net outflow of the Ethereum ETF to reach US$130 million on the second day after its listing, spitting back all the capital inflows on the first day.