Speaking of yesterday's article "Mt.Gox has distributed more than 40,000 BTC, how much impact will it have on the price of the currency?" , the echo of the selling pressure is still there. BTC plunged overnight, falling more than 3% during the day, and once pierced 64k. The crypto market was bloody.

At the same time, the US stock market also experienced a bloodbath. The three major stock indexes, the Dow Jones Industrial Average, the S&P 500 and the Nasdaq Composite Index, all plummeted, and many analysts believed that this was the first shot in the bursting of the US stock bubble.

Yesterday [ 7.24 Teaching Chain Insider "Exploding, JD.com actually issued stablecoins in Hong Kong!" ] said, "In 2024, the inflow of funds into BlackRock's spot BTC ETF - IBIT has exceeded the inflow of funds into the "Seven Flowers of US Stocks" (Microsoft, Apple, Tesla, Amazon, Meta, Alphabet and Nvidia) stocks."

The internal reference of Jiaolian cannot be read separately, but should be read together. Interested friends may still remember that Jiaolian mentioned in the internal reference "BSV was removed from coinbase!" on February 3 this year , "Bubble master Grantham, JPMorgan Chase quantitative strategy analysts, Bank of America, etc., all believe that the US stock market is currently seriously overvalued, there are structural risks, economic recession is coming, AI is over-hyped, and the US stock market is mainly driven by 7 technology stocks, which makes the market more and more extreme, and its dominance is more and more similar to the Internet bubble, which greatly increases the risk of selling."

Look, isn't it rolled up?

Although this round of the dollar cycle has sucked a lot of liquidity back to the US financial market from the world, it is still not enough. So the "Seven Flowers" began to suck blood from small and medium-sized stocks, causing a serious imbalance in the allocation of US stock capital. At the beginning of this year, Cheng Yaojin came out of nowhere and the spot BTC ETF was listed on the US stock market. BlackRock was so powerful, so it began to absorb liquidity from the US stock market more vigorously.

Capital is ruthless and heartless. Capital always pursues the safest and fastest-growing assets. Finally, after BTC ETF sucked blood for half a year, ETH ETF came up again, and the "Seven Flowers" are finally going to be defeated. Sure enough, the only thing that can defeat magic is stronger magic.

The purpose of a company is to create surplus value. The purpose of stocks is to be a tool for distributing surplus value. The role of the stock market is to distribute surplus value in a market-based way. Now that BTC ETF has entered this market, it has also entered the game of distributing surplus value.

However, the article of Jiaolian wrote that BTC itself is extremely pure and does not produce surplus value. Therefore, it comes to this market to suck blood - absorbing the surplus value brought into this market by other stocks and created by the companies behind these stocks.

From this perspective, BTC is a black hole of surplus value with extremely strong gravitational pull. According to the hypothesis proposed by Jiaolian, BTC will eventually drain all the surplus value created by all companies, and then distribute it to all holders according to the number of BTC they hold.

BTC is the highest level of financial assets. Marx envisioned the end point of capital mergers, where all the surplus value created by all mankind converges to one point. The singularity of capital.

The most amazing thing is that BTC is the most suitable carrier of this singularity because it is the most decentralized. Such a heavy burden is definitely not something that any centralized entity can bear.

When it comes to the issue of decentralization, the first thing to consider is the decentralization of bookkeeping. The key to decentralizing bookkeeping is the decentralization of bookkeeping rights. The key to decentralizing bookkeeping rights is the decentralization of computing power, because the mechanism of BTC is that computing power determines bookkeeping rights.

At the beginning, Satoshi Nakamoto, the inventor of BTC I hope everyone can use the computing power of their computers to “mine” — that is, to fight for the right to keep accounts.

However, technology soon advanced to GPU computing, which is the computing technology used in graphics cards sold by Nvidia today.

The era of GPU mining was fleeting. Soon, the profit mechanism drove people to use the most advanced computing technology - customized dedicated chips, namely ASIC mining.

ASIC dedicated chip mining machines, coupled with joint mining in mining pools, have rapidly evolved BTC mining into a highly specialized industry today.

But this also brought about the problem and controversy of computing power concentration. This problem was once criticized by netizens in the overseas BTC community. Why?

Before "519" in 2021, China once accounted for more than 80% of the world's BTC computing power and produced most of the world's best BTC mining machines.

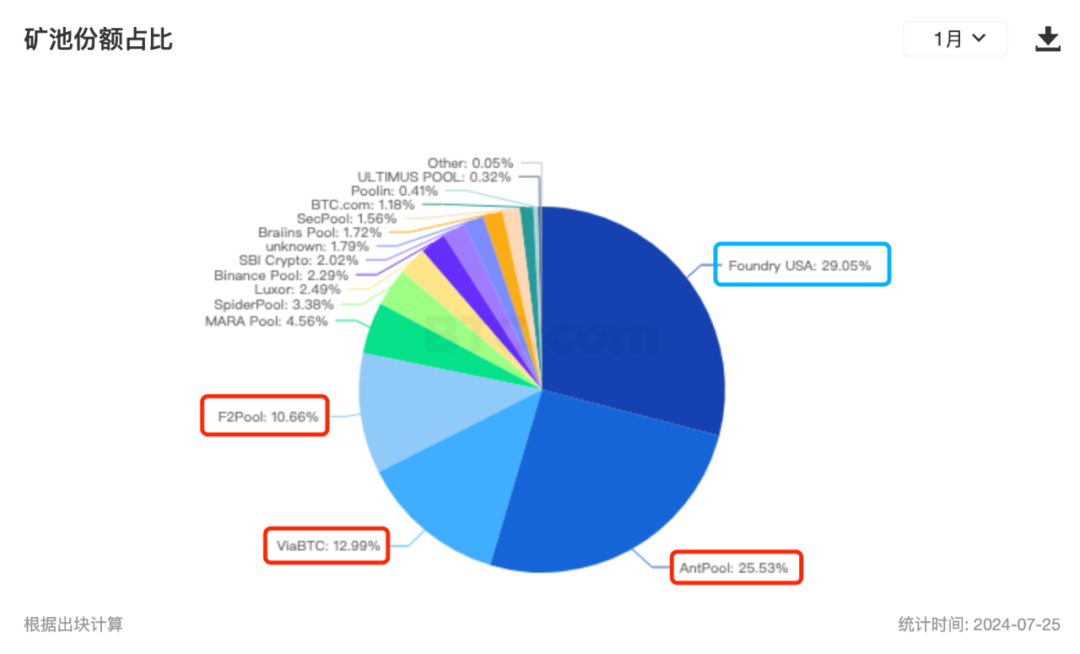

However, after 2021, after the external impact of national forces, BTC's computing power has finally become more decentralized and decentralized. The following figure is the current distribution of BTC mining pool computing power:

Foundry USA, which is framed in blue in the picture, is currently the world's largest mining pool, in the United States. This mining pool has risen rapidly with the help of the favorable conditions in 2021. It can be said that the right time, right place and right people are in place.

The red-framed F2Pool, ViaBTC, and AntPool are all from China. Chinese still occupy half of the market in this field.

Looking back, if the country had not intervened in 2021 to help BTC rectify its centralization problem, there might not have been a US BTC ETF listed in early 2024. Why? Americans must have concerns about the Chinese controlling the computing power base, so it would certainly be more difficult for them to promote the approval of the ETF.

From this we have a deeper understanding of Lao Tzu's philosophical thoughts, and better understand what "Misfortune is the foundation of good fortune, and good fortune is the root of misfortune."

Throughout the history of BTC development, many people have been obsessed with solving the problem of centralized computing power.

If you become obsessed with it, you will go astray.

A typical mistake is to try every possible way to limit hardware computing power at the code level and software level, resist the progress of productivity, reverse the course of history, and try to return to GPU mining or even CPU mining. Jiaolian believes that this is against the law of historical development and is futile. The concentration of computing power is an internal contradiction among the people, and the strength of computing power is a contradiction between the enemy and us to defend against the enemy. Don't you understand which is more important?

In fact, over the past decade, countless attempts to lock mining productivity at the CPU level have failed. I have never seen any successful projects in the teaching chain.

This logical error also directly affects investment judgment. Just as Jiaolian refuted in the article "Will BTC's security model collapse in the next 4-12 years?" on July 16, 2024, BTC miners use lower costs and higher computing power. This is obviously a good thing, so how can it become a bad thing and be used as an argument to prove that BTC will collapse? This is really deeply trapped in the logical error of thinking.

Another typical mistake is to think that the concentration of computing power is a problem of PoW (Proof-of-Work), so people want to use other so-called consensus mechanisms to replace BTC's PoW mining mechanism. For example, using PoS (Proof-of-Stake) for staking mining. The key problem of PoS is that capital can be quickly and in batches converted into virtual "computing power", thereby usurping the power of bookkeeping.

Obviously, the concentration of capital (tokens used for staking) is easier, cheaper, faster in flow, and less likely to be discovered and impacted by external threats than the concentration of hardware (mining machines with physical entities), making it passively decentralized.

What's more, the production speed, maintenance cost, depreciation and damage of hardware are all restricted by the laws of cosmic physics. Its concentration is limited, and the law of increasing entropy will exert a force to tear it apart all the time. Therefore, long separation will eventually lead to reunion, and long reunion will eventually lead to separation.

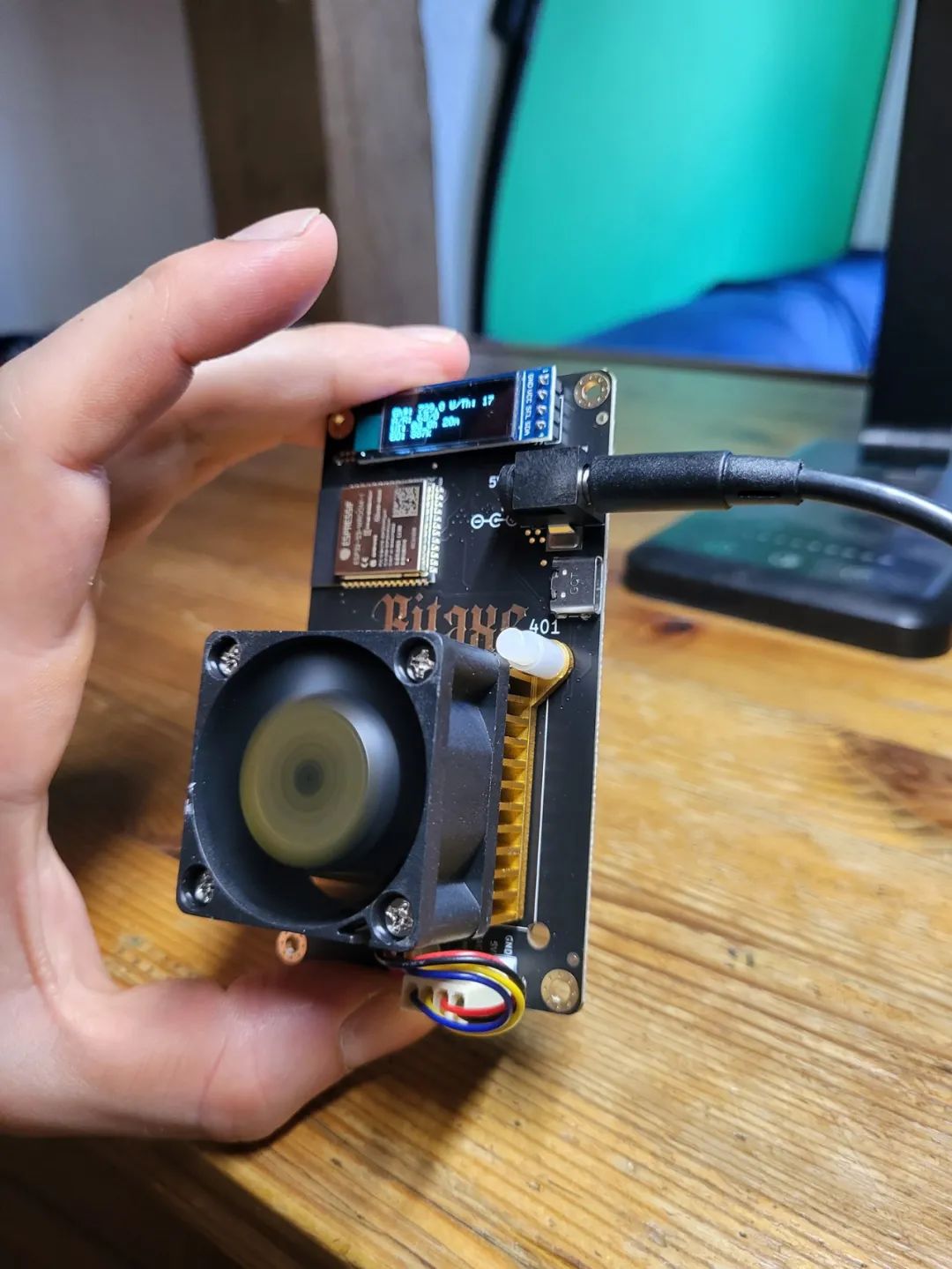

Well, some people have been promoting open source mining hardware for a long time. And many manufacturers have been manufacturing and selling such small desktop mining machines (see the picture below).

I checked and found that a company in Hong Kong is selling it. It costs only about $100 or $200 per unit, and the computing power of a single unit is about 500 or 600GH/s. It is very light, only about 100 or 200 grams; the power consumption is very low, and it can be powered by a USB port.

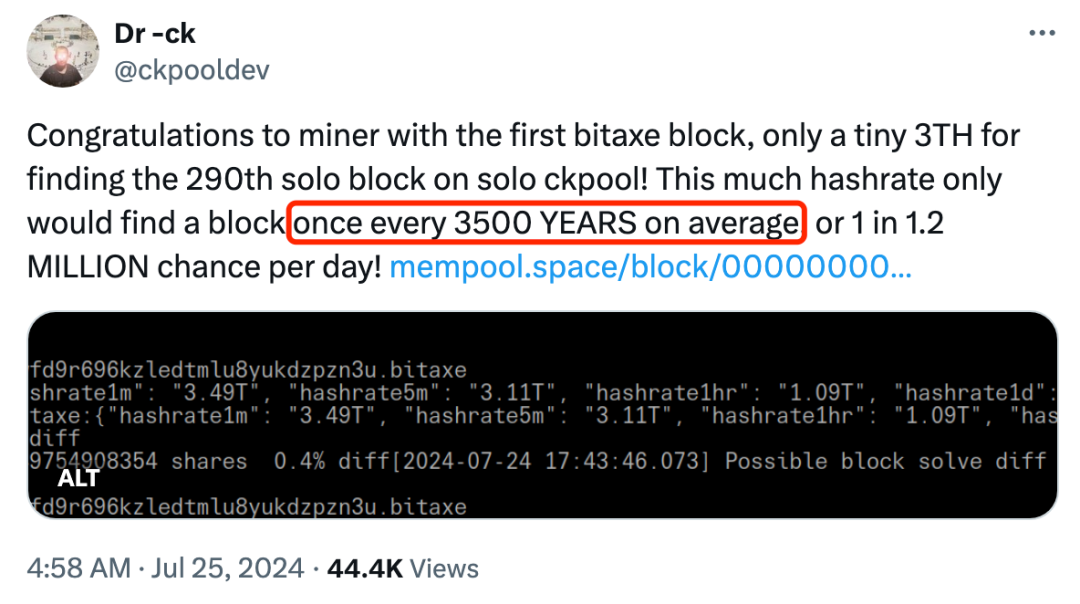

Just this morning, someone mined a BTC block with this little thing and earned 3.192 BTC! According to calculations, based on the 3TH/s computing power he used and the current total computing power of the entire network of about 648EH/s, a block can be mined (that is, a correct block is mined) approximately once every 3,500 years, or there is a 1 in 1.2 million chance of mining a block every day. Did this guy save the Milky Way in his previous life, and he was able to mine a block in his lifetime?

This truly is a legend that has been awaited for a thousand years, and it is actually happening in the real world!

Imagine that this kind of mini mining machine will be widely used in the future. A single chip of 500GH/s may not seem large, but if a spark can set off a prairie fire, and the people's war can become a vast ocean, only 1/8 of the world's population, that is, 1 billion people, will need one machine, and the total computing power can reach 500G x 1 billion = 500E! It is comparable to the BTC network computing power currently provided by these miners.

What if each person has two? That would be as high as 1000 EH/s, or 1 ZH/s!

Even if you have power, it is difficult to collect and centralize 2 billion microcontrollers from 1 billion people, right? Even if you have money, it is difficult to build and deploy mining machines with a computing power of up to 1 ZH/s in a short period of time, right?

When capital and power are difficult to quickly transform into computing power and bookkeeping rights, fully decentralized bookkeeping rights become a natural iron wall to protect the security of BTC.