Author: George Kaloudis Source: coindesk Translation: Shan Ouba, Jinse Finance

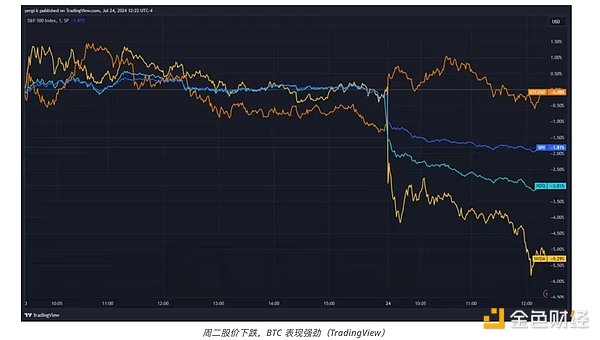

Since yesterday’s open, the S&P 500 is down 1.8%, the tech-heavy Nasdaq 100 is down 3.0%, and tech darling Nvidia (NVDA) is down 5.3%. Typically, Bitcoin’s daily moves follow those of stocks (especially tech), but this time around, Bitcoin (BTC) is up 0.5% as of this writing. What’s going on?

Granted, this was only a short period of time, but in a week where we saw both Mt. Gox-related selling pressure and disappointing spot Ether ETF inflows, Bitcoin’s performance today was surprising, especially given its usual trajectory.

Market commentators have long pointed out that Bitcoin is just a tech stock, given its strong correlation with tech stocks. Bitcoin optimists, myself included, have been preaching about the coming decoupling, when Bitcoin will break free of all asset correlations and become an uncorrelated macro asset that belongs in every balanced portfolio. But this has not always been the case.

Narratives drive day-to-day market movements, so what narratives does Bitcoin have that the stock market currently lacks?

Donald Trump won’t be speaking at the biggest stock market conference this week; mainstream investors aren’t eagerly awaiting what the former U.S. president has to say about Nvidia; and there are no rumors that a Nasdaq 100 strategic reserve will be announced.

But Trump is set to speak at a Bitcoin conference this week ; Bitcoin supporters are eagerly awaiting what the former US president will say in his speech on Saturday; there are rumors that he will announce a strategic Bitcoin reserve.

It looks like Trump, in the absence of other strong arguments, is shielding Bitcoin from the price action of tech stocks. Trump may be running for President of the United States, so perhaps he deserves a new title: Bitcoin’s Chief Decoupler.

Whatever happens on Saturday, Trump’s speech has the potential to be a “selling event,” as some market analysts predict. Trump may talk or claim many things about Bitcoin in his speech; who knows what they will be. What is certain, though, is that his remarks will have broad implications for the cryptocurrency market.