Matthew Sigel of VanEck said in an interview that Bitcoin benefits from huge economic imbalances, growing distrust of institutions, fiscal recklessness and growing debt burdens.

Bitcoin white paper (Jonathan Borba/Unsplash, modified by CoinDesk)

- Asset management firm VanEck said in a report that by 2050, Bitcoin could settle 10% of international trade and 5% of local trade proceeds, and central banks will hold Bitcoin as a reserve asset. The company said Bitcoin's Layer 2 network will play a key role in overcoming expansion issues and allowing BTC to be used as a medium of exchange. The report said there are risks to Bitcoin's growth, including rising electricity demand, a coordinated crackdown by governments, and competition with other digital assets.

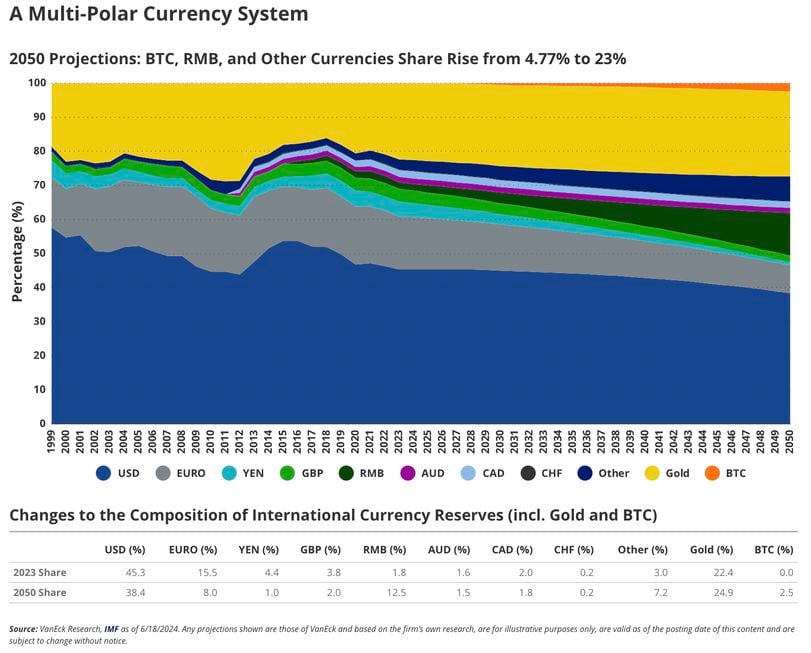

Asset management firm VanEck, issuer of spot Bitcoin (BTC) and Ethereum (ETH) ETFs, says BTC could reach $2.9 million by 2050 — assuming some pretty high hurdles are cleared. According to VanEck’s assumptions in a report Wednesday, Bitcoin will become a vital component of the international monetary system in the coming decades as rising geopolitical tensions and ballooning debt servicing costs erode the existing system. “Looking at the world today, we see huge economic imbalances, growing distrust of existing institutions and continued deglobalization,” Matthew Sigel, head of digital asset research at Van Eck and one of the report’s authors, told CNBC on Wednesday. “We believe that much of these distortions stem from… massive capital misallocations since the global financial crisis, as G7 governments abused the printing presses to achieve impossible goals with borrowed money,” Sigel explained. “Bitcoin… is the ultimate hedge against this growing fiscal recklessness,” Sigel said. In the report’s base case, BTC will become the dominant medium of exchange for local and global trade, accounting for 10% of international trade settlements and 5% of GDP. At the same time, the Chinese yuan will also rise in status as a global reserve asset, while the four largest foreign exchange reserve currencies — the dollar, euro, pound sterling and yen — will account for 2.5% of international foreign exchange reserves.

Bitcoin Can Become a Reserve Currency (VanEck)

If all goes according to VanEck's predictions, Bitcoin's price will rise 44 times, up 16% per year from its current price of just under $65,000. Its market capitalization will soar to $61 trillion. The report says the popularity of second-layer networks will play a key role in overcoming the bottlenecks and scaling issues of the Bitcoin blockchain that have prevented BTC from becoming a useful medium of exchange. By 2050, the industry could be worth a total of $7.6 trillion, using the same valuation framework as Ethereum's second layer. VanEck also warned of possible future risks that could hinder Bitcoin's expansion. The increasing demand for energy from miners requires innovation, while revenue from processing transactions must also grow significantly to replace the decreasing mining rewards (which are halved every four years) to incentivize miners to maintain the network. A concerted effort by governments around the world to restrict or outlaw Bitcoin is also a threat. Further risks highlighted in the report include competition from other cryptocurrencies and too much control exerted by large financial institutions.