Author: Enda Curran, Charles Ayitey, Boomberg; Translated by: Baishui, Jinse Finance

After a booming 2023, the U.S. economy is returning to reality.

Companies are hiring less. Consumers are spending less. The highest interest rates in decades have all but paralyzed the housing market. Manufacturing is struggling, except for sectors that benefit from government incentives, such as semiconductors and electric vehicles. Even as inflation slows, businesses and households are complaining about the pain of high prices.

Unlike most slowdowns, however, this one is a classic soft landing — slowing the economy without triggering a recession, a rare and difficult feat. Inflation has cooled, unemployment hasn’t risen sharply, retail spending has cooled but hasn’t collapsed, and the economy continues to grow. Economists in the latest Bloomberg survey put the chance of a recession in the next 12 months at 30%, compared with 60% in a survey a year ago.

Data on Thursday is expected to show the economy grew 2% in the second quarter. That would be the slowest pace of consecutive quarterly growth since 2022, following a 1.4% expansion in the previous quarter.

The question now is how deep will the economic slowdown be and how long will it last?

“We’re still seeing a gradual slowdown at this point,” said Sarah House, senior economist at Wells Fargo & Co. “But there are still a lot of questions about, are things moving faster than expected?”

The change is evident on Main Street and on the factory floor. Suresh Krishna runs Northern Tool + Equipment, a family-owned business in Burnsville, Minnesota, that makes and sells products including compressors, pressure washers, pumps and a variety of equipment. He said business remains good. But he has also noticed that customers have become more discerning.

“Both trade professionals and consumers are watching their wallets,” Krishna said. This is especially true for big-ticket items that retail for more than $500. “They are being more cautious than they have been in the past.”

In New York, Avremy Scheinfeld, who runs Abe's Corner, a Brooklyn kosher restaurant and bar, has had to cut employee hours because high interest rates on his credit card debt are eating into his profits.

“It’s a tough economy right now, and everything is expensive," Scheinfeld said. "If I raise my prices, I’m going to lose customers. It’s hard.”

Such observations are consistent with the clear weakening trend shown in recent data.

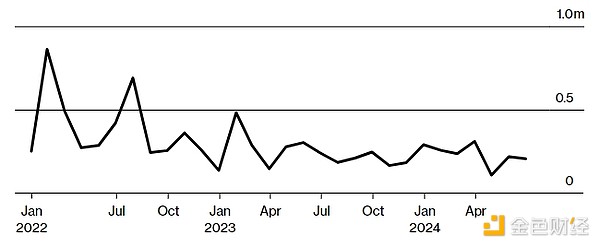

Hiring and wage growth slowed in June, while the unemployment rate rose to its highest level since late 2021 (though it remains historically low).“Looking at the unemployment rate, things have clearly cooled quite a bit,” said Anna Wong of Bloomberg Economics, who expects the jobless rate to rise to 4.5% by the end of the year from 4.1%.

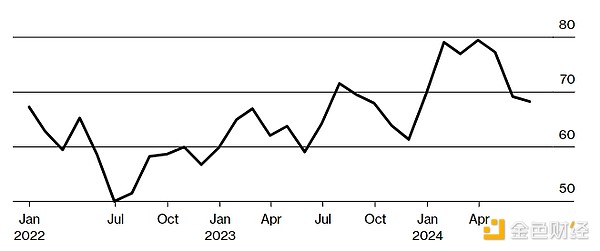

U.S. Consumer Confidence Index (University of Michigan Index)

Source: University of Michigan, compiled by Bloomberg

In addition, economic activity in the services sector shrank at the fastest pace in four years in June. Data released on July 12 showed that consumer confidence fell to its lowest level in eight months, and high prices continued to affect Americans' views on finances and the economy.

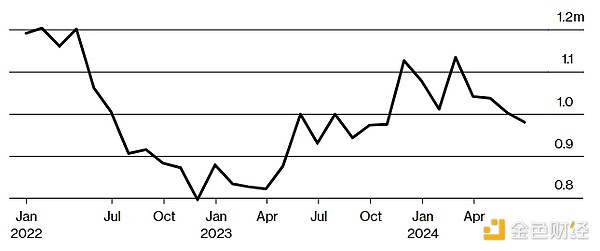

In the housing market, mortgage rates have hovered around 7%, more than double what they were three years ago, discouraging construction of single-family homes and keeping home prices high.

U.S. Single-Family Housing Starts Seasonally Adjusted

Data source: U.S. Census Bureau, compiled by Bloomberg

In the Fed’s latest Beige Book, a compilation of anecdotes and comments about business conditions, almost half of the 12 Fed districts said economic activity was flat or declining.

"This is an unusual slowdown," said Gregory Daco, chief economist at accounting and consulting firm EY. He said employers seem reluctant to lay off workers because worker shortages are still fresh in their minds. However, he believes that this may change quickly, especially if interest rates remain high. "Will this get worse? That is certainly a risk. We are navigating uncharted territory when it comes to the post-pandemic labor market."

US Nonfarm Payrolls Seasonally Adjusted Monthly Net Change

Data source: U.S. Bureau of Labor Statistics, compiled by Bloomberg

Federal Reserve Chairman Jerome Powell said on July 15 that second-quarter economic data made it more confident that inflation would return to the central bank's 2% target, which could pave the way for rate cuts, which also provided some clues about future trends.

“The U.S. economy is doing really well,” Powell said July 15 at an event at the Economic Club in Washington, D.C. Wall Street traders reacted to the weak data by increasing bets on three rate cuts this year, rather than the two they had previously expected.

Powell. Source: US Federal Reserve

There are red flags everywhere. Since the outbreak began, American households have added $3.4 trillion in debt, and some are struggling to make payments. “Credit card delinquencies are on the rise, and auto loan delinquencies are at a 13-year high,” Federal Reserve Governor Lisa Cook said in a speech in New York on June 25. “These rates are not yet worrisome for the overall economy, but they are worth watching.”

Jon Ferrando, founder and CEO of Florida-based Blue Compass RV, said expectations of multiple rate cuts this year had fueled hopes of a recovery in demand for recreational vehicles ahead of the spring and summer driving season. However, an unexpected burst of inflation in the first few months of the year led the Federal Reserve to keep interest rates unchanged.

“Right now we are in a slowdown. We have been in this for two years and I don’t think we will be out of this in 2024,” Ferrando said. “I don’t think the Fed will cut rates much, and if we have a divisive political election, that will affect consumer confidence.”

Some have likened the current situation to the mid-1990s, when the Fed managed a soft landing despite traditional recession warnings, such as a contraction in the money supply and persistent weakness in manufacturing orders. The economy continued to grow for five years until the dot-com bubble burst. In a research note titled “Breaking the Rules,” Morgan Stanley chief global economist Seth Carpenter questioned whether the signs of a slowdown were just that.

“I don’t know if we have another five years of expansion left,” he wrote. “But for now, we’ll need to see other indicators to change our minds.”