In the past week, the market fell back after a vigorous rise due to the influence of the US stock market. Has this round of rebound come to an end? Recently, although the voices of interest rate cuts in the United States have gradually increased, the US stock market seems to reflect faster. The former chairman of the New York Federal Reserve said that he had changed his hawkish attitude and said that interest rates should be cut immediately. The Ethereum spot ETF has landed, but the inflow failed to reverse the selling pressure of Grayscale. The Ethereum price briefly experienced a stampede effect, and some Altcoin began to be under pressure. However, supported by the positive news of the Bitcoin Conference, Bitcoin continued to rise. In the short term, the market outlook should continue to fluctuate in a weak position.

Macro environment

1) US technology is weak, and indicators show concerns

Google and Tesla's earnings yesterday fell short of Wall Street's high expectations. Investors may also doubt their views on artificial intelligence and whether large-scale investments will pay off as they imagine. The market is also worried about whether the United States will enter an irreversible deep recession if interest rates are not cut.

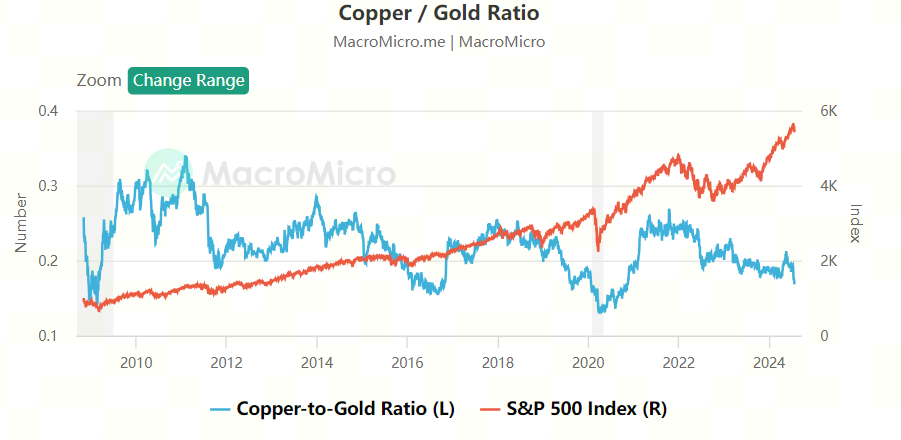

Figure 1: Gold to Copper Ratio

Source: MacroMicro

This month, the "copper-gold ratio" (blue line in the figure) fell by more than 8%, which is considered by the market as a warning signal for risky assets. The current relative decline in copper prices has made the market worry about whether risky assets can continue to strengthen.

2 ) Market status and future trends

Recently, the market has begun to weaken due to the impact of the US stock market and the launch of the Ethereum ETF. The price trend of Bitcoin (BTC) has begun to weaken, and the altcoin market has also declined. The short-term market sentiment is still high, and the trend in the next week is not optimistic.

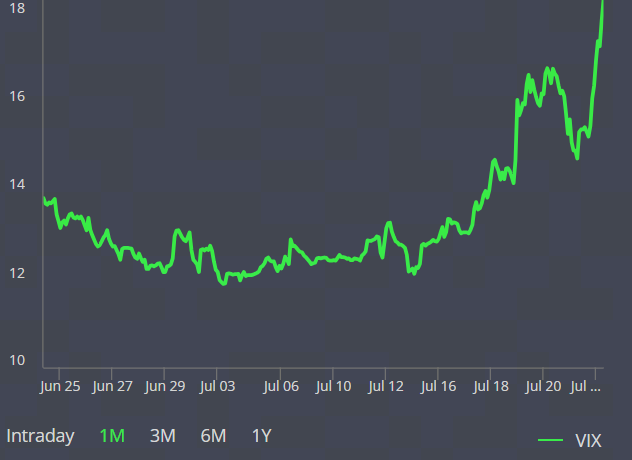

Figure 2: Fear and Greed Index

Source: Coinglass

After the positive impact of the Ethereum ETF was realized, Bitcoin's recent trend showed signs of peaking. After the Ethereum ETF was approved, Grayscale also brought short-term and huge selling pressure. This selling combined with short-term profit chips formed a large selling pressure. In addition, after a round of strong rise in technology stocks, the market began to worry about the contribution of AI to profits, which may force US stocks to go bearish. At present, the VIX index continues to weaken, and the market needs to pay close attention to the deterioration of sentiment.

Figure 3: Volatility Index

Source: CBOE official website

High-quality track

1) TON Ecosystem

Strong fundamentals

In the crypto market where the narrative of the primary track is dull, TON is one of the few public chains that has kept people playing for months. It is labeled as a social platform with 900 million users, a GameFi with tens of millions of users, a dozens-fold increase in Notcoin, a huge number of users to be developed, and the most friendly migration platform for mini-programs. The chain games on TON are simple and easy to play, the economic system is direct and effective, and the communication efficiency is high. Recently, Binance Labs announced its investment in Pluto Studio, the publishing platform of Catizen, and continued attention to TON ecological mini-games.

1. Notcoin (NOT):

Notcoin was originally an experimental project on Telegram, attracting users with a gamified way of interactive mining of virtual coins, with the goal of creating an introductory experience for novices in cryptocurrency. It was internally tested in November 2023 and received more than 650,000 followers. It was officially released on January 1, 2024, with more than 5 million players joining in the first week.

2. Catizen (CATI):

Catizen is a popular Telegram game where players become mayors of a virtual cat city and develop the city through construction. It combines city construction with cryptoeconomics and adopts a “play and earn” model. Players can earn tokens by developing and completing tasks. Daily tasks and rewards add to the fun, and players can choose different cat characters to provide a unique experience.

3. Hamster Kombat (HMSTR):

Hamster Kombat is a new popular game on Telegram, in which players play the role of hamster CEO of a fictional crypto exchage. By investing in markets, licenses, talent, and new products, the goal is to push the startup to the top of the industry. The game is both fun and strategic.

2 ) Solana Circuit

Hot Spot: SOL Spot ETF

After the launch of the Ethereum ETF, the market generally began to bet on the next approved ETF asset. Currently, the biggest hope in the market is Solana. At the same time, the tokens of the Solana ecosystem have been relatively active recently.

In the past 30 days, the trading volume of the decentralized exchange (DEX) on the Solana chain has surpassed the Ethereum mainnet for the first time, and it has now become the most frequently used chain by this standard. Under the premise of increased on-chain activity, Solana's DeFi infrastructure sector has ushered in a valuation repair, and the market has generally begun to increase its valuation of this sector.

Specific currency list:

1. PYTH (Pyth Network): PYTH is a real-time blockchain market data protocol, similar to Chainlink on Ethereum. Its goal is to provide high-quality real-time price data for DeFi and other applications. PYTH continues to expand its boundaries in the short term and is now available on the Starknet mainnet.

2. JUP (Jupiter): JUP is a liquidity aggregator. It helps users find the best liquidity pool on Solana, thereby improving transaction efficiency. JUP has performed well recently and has set a new historical high.

User attention

1) Popular Tokens on Twitter

$KAMALA

On the afternoon of July 21, US President Biden issued a statement on social media X, announcing that he would give up running for re-election in the autumn presidential election and decided to withdraw from the election. In addition, Biden also said in another post on X: "I fully support and recommend Kamala as the party's candidate for this year's election." He further called: "Democrats, now is the time to unite and defeat Trump." Kamala Harris received his support about half an hour after Biden announced his withdrawal, and Kamala Harris has begun sending campaign fundraising emails. Kamala Harris said she intends to "win" the nomination and "do everything I can...to unite our country and defeat Trump (Donald Trump)."

$Solend

Solana ecosystem lending protocol Solend announced that it will be renamed Save (Solana's permissionless savings account). In addition to the rebranding, Solend also announced three new products: decentralized stablecoin SUSD, SOL's liquid staking token saveSOL, and meme token short platform dumpy.fun.

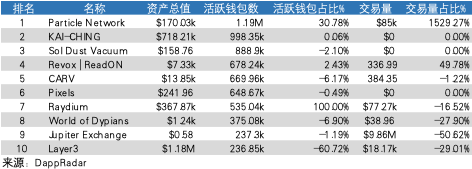

2) Popular DApps

Figure 4: Top 10 popular DApps

Sol Dust Vacuum

Sol Dust Vacuum is an independent project developed by Alexandre Neto, a full-stack blockchain developer. He encountered a similar problem in the Solana ecosystem, that is, buying many tokens that are no longer valuable, resulting in a lot of "dust" accumulated in the account. These "dust" tokens are worthless, but still need to pay account rent. Therefore, Alexandre created Sol Dust Vacuum to help other users close these accounts and return the rent.

Summarize

In the past week, the market retreated after a strong rise due to weakness in US stocks, and it is unclear whether the rebound has ended. The Ethereum spot ETF was launched, and the inflow failed to reverse the selling pressure of Grayscale, resulting in a short-term stampede in prices and pressure on some Altcoin. The US technology stock earnings report did not meet expectations, raising market doubts about the return on AI investment and concerns that the United States may enter a deep recession. The copper-gold ratio fell sharply, which is seen as a warning signal for risky assets.

At present, the short-term market sentiment is still high, and the trend in the next week is not optimistic. TON and Solana ecosystems have performed outstandingly and are worthy of attention, but we need to pay close attention to changes in market sentiment and the trend of the volatility index.