Independent U.S. presidential candidate Robert F. Kennedy Jr. claimed in an interview on Wednesday that if elected, he would buy Bitcoin on a large scale, with the goal of making the U.S. government’s holdings the same as gold reserves. In other words, the United States currently needs to spend at least $615 billion to purchase nearly 9.4 million Bitcoins.

Table of contents

ToggleKennedy: Buying Bitcoin will buy you as much as the U.S. gold reserves

Kennedy, the nephew of former U.S. President John F. Kennedy, who is also a current supporter of Bitcoin and a candidate for this presidential election, revealed in an interview with YouTuber Scott Melker on Wednesday that he will push the U.S. government to purchase Bitcoin until it holds The amount is equal to the value of the gold reserve.

Seemingly to counter rumors that Trump would list Bitcoin as a U.S. reserve asset , Kennedy also continued to actively express support for Bitcoin:

Bitcoin is a currency based on proof of work. All transactions are on the ledger and it is decentralized. This is exactly what we call "democracy" we need.

This is consistent with his previous policy direction of " supporting the U.S. dollar and government debt through hard assets such as gold, silver and Bitcoin. " He also detailed the details:

New U.S. Treasury bonds can be backed by 1% of hard assets in the first year, 2% in the second year, and eventually 100%.

It added, “Bitcoin-USD transactions and derived capital gains taxes will also be exempted from tax to keep the Bitcoin industry in the United States.”

In addition, in April this year, he also proposed the idea of putting the government budget on the blockchain, calling for a blockchain-based transparency transformation of the federal budget.

Is Bitcoin Reserve Possible?

Kennedy Jr. said that large-scale purchases of Bitcoin will be carried out during his first four-year term:

I hope the federal government will start buying Bitcoin and eventually have a Bitcoin equivalent to the U.S. gold reserves during my term.

According to data from the World Gold Council, the U.S. government owns 8,133 tons of gold, worth approximately US$615 billion. In other words, the U.S. government will need to purchase approximately 9.4 million Bitcoins for this purpose, accounting for 45% of the total supply, which is quite difficult. .

( Can Bitcoin become a U.S. reserve asset? What are the potential implications? )

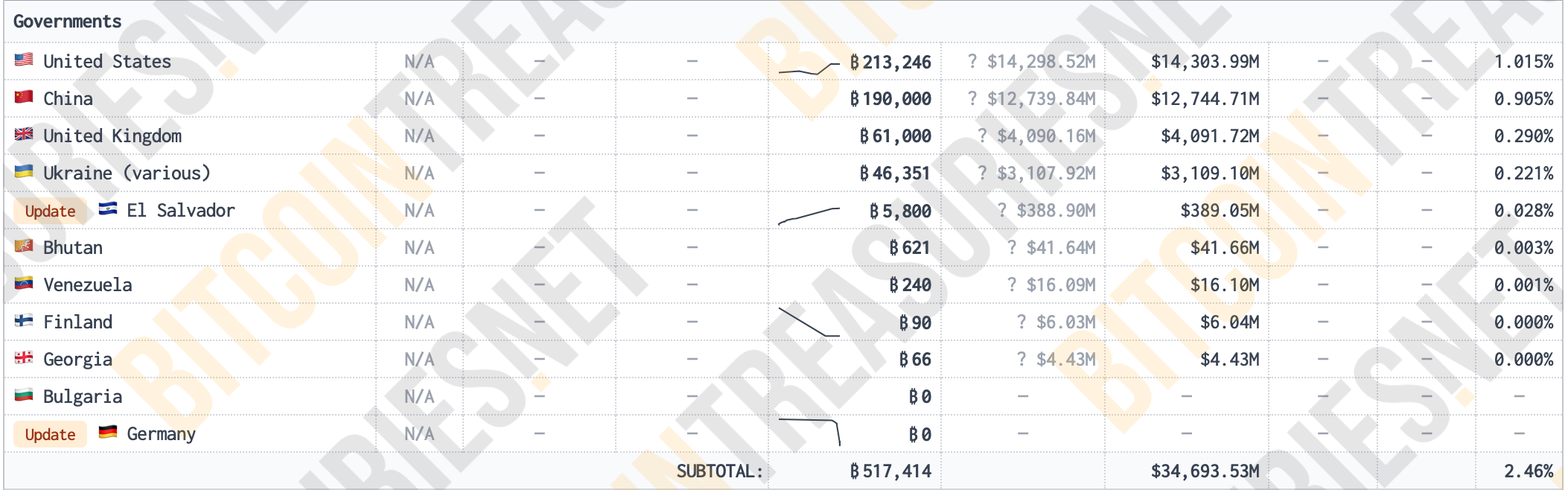

Bitcoin Treasures data points out that the U.S. government currently owns approximately 213,000 bitcoins, still leading the holdings of China and the United Kingdom.

In addition, public companies led the way with MicroStrategy ’s 226,000 Bitcoins, while ETF issuers led the way with BlackRock ’s 334,000 Bitcoins.

The implication is that if Kennedy Jr.’s Bitcoin reserve strategy is successfully implemented, the United States will become the world’s largest Bitcoin holder and at the same time bring huge wealth to Bitcoin investors during the period:

Decentralization is an important solution to saving democracy, and the decentralized nature of Bitcoin makes it the most honest currency.

(This article is not investment advice)