Author: Ciaran Lyons, CoinTelegraph; Translated by: Tao Zhu, Jinse Finance

One Bitcoin analyst believes that a spot Ethereum exchange-traded fund (ETF) may be launched too early and could pose a risk to Bitcoin’s price if no new capital enters the market.

Charles Edwards, founder of Capriole Investments, pointed out: "It would be best if a BTC ETF was launched in 2024." He believes that a new Ethereum ETF will only distract the attention of investors who have already invested in Bitcoin.

“Current institutional BTC ETF holders may think they should diversify a little and buy into the ETF. If there is no new money flowing into the overall market, this will create selling pressure on Bitcoin,” Edwards argued.

According to Farside data, since the launch of spot Bitcoin ETFs on January 11, about $17.53 billion has flowed into these 11 products.

According to data from TradingView, Bitcoin’s dominance has remained fairly stable since the Ethereum ETF launched on July 23, rising 0.07% in the past 24 hours.

While the spot Bitcoin ETF recorded a net outflow of $78 million on July 23 (the first trading day of the spot Ethereum ETF), the next two days saw inflows of $44.5 million and $31.1 million, respectively.

Bitcoin dominance is at 56.56%, up 2.81% this week. Source: TradingView

However, Edwards believes that "launching an ETH ETF in a relatively weak market, or definitely not a strong market," means there is uncertainty in capital allocation.

He also foresees "no strong catalysts to drive significant price increases in the near term."

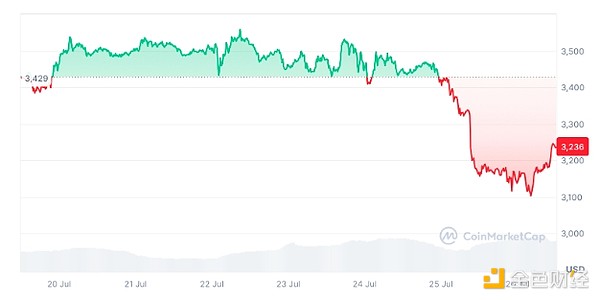

As of the time of publication, Ethereum’s price has fallen 9.2% since the launch of the spot Ethereum ETF on July 23, trading at $3,178, according to CoinMarketCap.

Ethereum’s value has fallen slightly more relative to Bitcoin, falling 10.4% over the past seven days.

Futures traders also don’t see a sudden recovery in sight, with $1.32 billion in short positions at risk if prices rebound to $3,500, according to CoinGlass.

Ethereum has fallen 5.56% over the past seven days. Source: CoinMarketCap

However, other cryptocurrency analysts agree with Edwards, arguing that “the situation may look very different in a few weeks.”

“As with Bitcoin, the start of spot ETH ETF trading appears to be a sell-off news event,” Julio Moreno, head of research at CryptoQuant, wrote in a July 25 X post. Similar to Bitcoin, analysts blamed the Grayscale Ethereum Trust for the price drop.

“Once this massive outflow stagnates or falls below $100 million, the market will reverse,” added Michael van de Pope, founder of MN Trading.

“Ethereum is moving exactly like Bitcoin after the ETF is approved,” crypto commentator Croissant told his 116,600 X followers.

“The hype seems to be priced in. One last sweep of range lows before moving into price discovery remains the game plan,” added cryptocurrency trader Kaleo.