- Consolidation around $165 in the coming hours could create ideal short squeeze conditions.

- Indicators are bullish, but one chart shows that the price could soon fall to $165.

SOL has been quite volatile over the past five days. The Altcoin rebounded from $167 to $185, achieving most of these gains in a single day on Sunday, July 21. It has since given back these gains on the charts.

If you want to know more about the crypto and get first-hand cutting-edge information, please visit Weibo Dolphin 1 for more good articles .

Its heightened volatility may be related to the approval and trading of the ETH spot ETF that began on July 23. Before the event, there was speculation that SOL would be the next ETF, which triggered positive sentiment and gains, although their collective impact did not last long.

Bulls are likely to defend range lows

The RSI is above the neutral 50 level, reflecting bullish sentiment. The OBV has been slowly climbing higher in July, and despite the recent pullback, the trend has not stopped. The CMF is above +0.05, indicating that buying pressure is stable and significant.

These are the signals that swing traders can expect if the range lows are to be defended.

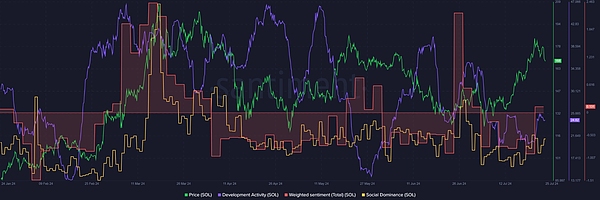

However, development activity has declined since June. The indicator’s value of 24.62 is lower than Ethereum’s 44.95 and Cardano [ADA]’s 77.83. Conversely, weighted sentiment jumped into positive territory.

Combined with the technical analysis results, indicators suggest that market sentiment has recovered. The increase in SOL's social dominance will further boost the bullish argument, but at present, it seems to be of little help.

The Possibility of a Solana Short Squeeze

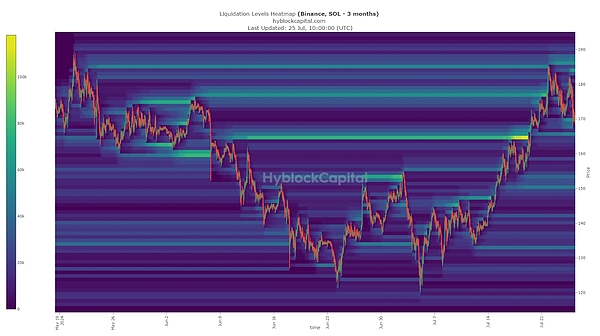

The 3-month lookback period of the Solana Liquidations Heatmap highlights $170 and $185 as the next areas of focus. The $165 and $150-155 levels are also potential locations where the downtrend could reverse.

They converge with technical support levels. Since breaking out of the $170 liquidity zone, range formation may persist, but indicators and sentiment are positive.

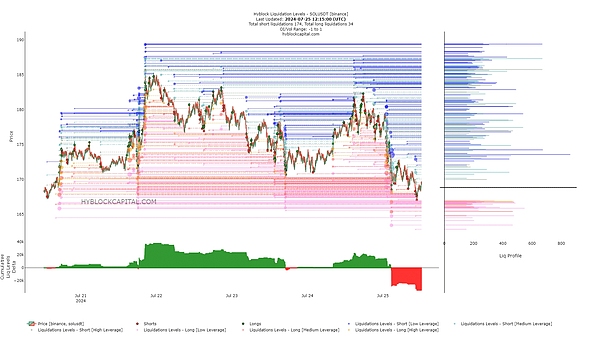

Liquidation levels suggest that the situation could be taking another turn. The cumulative liquidation levels are becoming increasingly negative, which suggests that short positions are becoming increasingly dominant.

If the price consolidates in the $165-167 range and attracts more short sellers, it will trigger more short liquidations. A short-term bullish reversal could squeeze these short positions, successfully defending the range low.

Traders can expect the price to rebound around $165 but should also be prepared for a range breakout, especially if BTC fails to hold $64,000.

End

Overall, the prevailing sentiment within the Solana community is one of confidence and excitement, with stakeholders eagerly anticipating the platform’s continued development and impact on the broader crypto ecosystem. While uncertainty remains, Solana’s innovative approach and robust infrastructure instill optimism for its future price trajectory and market dominance.

The article ends here. Follow Weibo Dolphin Dolphin 1 for more good articles. If you want to know more about the relevant knowledge of the crypto and first-hand cutting-edge information, please consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!