Bitcoin mining difficulty has plummeted to its lowest level since 2021. Photo: DL News

Bitcoin mining difficulty has plummeted to its lowest level since 2021. Photo: DL News

Bitcoin's mining difficulty decreased by 11.16% over the weekend, falling to 125.86 trillion Hash, according to data from Mempool. This is the largest negative correction since China's widespread mining ban in July 2021, and the 10th sharpest drop in the network's history, according to Bitcoin developer Mononaut.

Statistics on the technical difficulty of mining Bitcoin. Source: Mempool (09/02/2026)

This move reflects the rapid shrinking of computing power across the network. Prior to the rebalancing at Block 935,424, the Medium Block creation time had stretched to approximately 11.4 minutes, far exceeding the protocol's 10-minute target, indicating a significant number of Mining Rig had left the system.

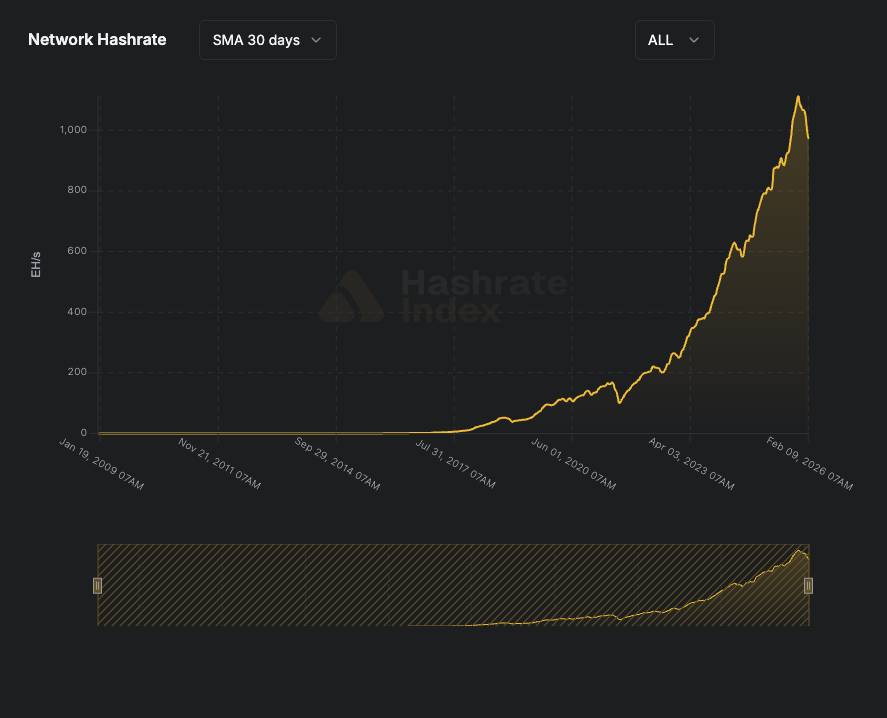

Bitcoin's hashrate has dropped by 20% in just one month. According to Luxor's Hashrate Index, mining power fell by another 11% last week, to around 863 EH/s, from its historical peak of over 1.1 ZH/s reached in October. Some Block Time tracking models suggest the actual rate of decline is even faster than estimated, raising the possibility that further difficulty adjustments are not yet over.

Bitcoin network hashrate statistics over time. Source: Hashrate Index (09/02/2026)

Bitcoin network hashrate statistics over time. Source: Hashrate Index (09/02/2026)

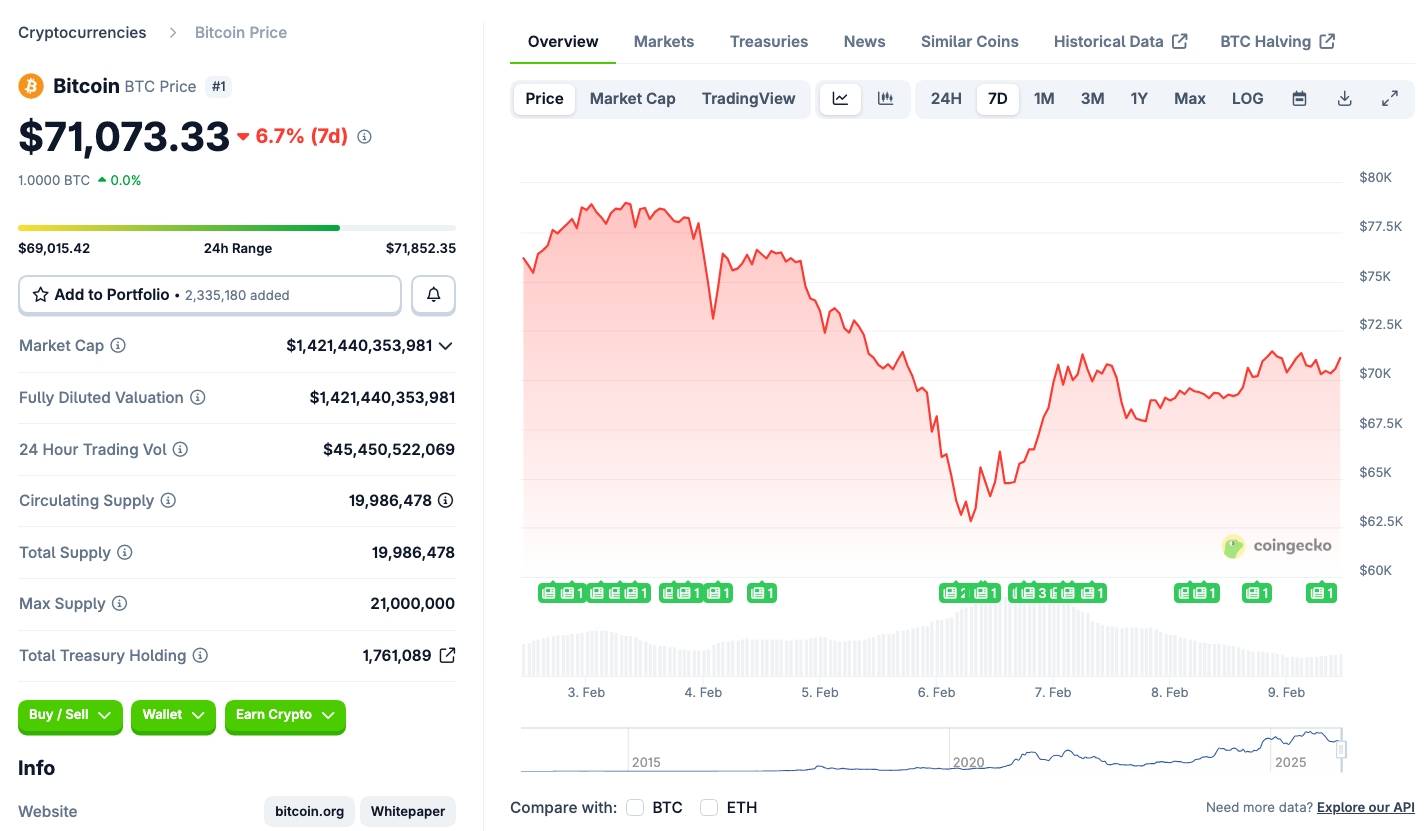

Two main factors are driving Miners off the network. First is the plunge in Bitcoin's price. The largest cryptocurrency by market capitalization has lost more than 45% from its all-time high of over $126,000 in October, at one point falling to nearly $60,000 in early February before recovering to around $70,000. This decline occurred amidst persistently high US Treasury yields, Capital outflows from Bitcoin spot ETFs , and a widespread "risk-off" trend in financial markets. According to data from SoSoValue, US Bitcoin spot ETFs have been net sellers since the beginning of 2026.

Bitcoin price fluctuations over the past 7 days, screenshot from CoinGecko at 11:10 AM on February 9, 2026.

Bitcoin price fluctuations over the past 7 days, screenshot from CoinGecko at 11:10 AM on February 9, 2026.

Simultaneously, non-market factors also contributed to exacerbating the shock. Winter storm Fern in late January forced many mining operations in the US to reduce or temporarily suspend operations to prioritize power for residential use. The Block estimated that approximately 200 EH/s were cut off from the grid during peak periods, with Foundry USA alone recording a hashrate drop of up to 60%. In addition to weather impacts, load balancing contracts with power providers also led many mining companies to proactively shut down operations for longer periods than expected to limit costs.

Revenue pressure has therefore reached extreme levels. Hashprice – an indicator reflecting expected earnings per unit of hashrate – has fallen to an all-time low of $33.31/PH/s/day on February 2nd, with a daily Medium of only $34.91/PH/s/day. Industry insiders consider the $40/PH/s/day threshold a critical point for survival, below which many mining operations are forced to choose between continuing to operate or shutting down to avoid losses.

Only the newest generation of machines, such as the Antminer S23, are maintaining relatively good profit margins. Older devices, including the Whatsminer M6 and Antminer S21, are approaching break Capital or operating below cost, according to data from Antpool. This increases the risk of industry restructuring, as units with high electricity costs and outdated equipment are gradually being phased out of the game.

This difficulty reduction far exceeds the largest adjustment since 2021 – approximately 7.5% in June 2025 due to summer heatwaves disrupting power supply to mining operations. The network also recorded a reduction at this time last year , demonstrating that hashrate volatility is becoming increasingly sensitive to both market factors and the post- halving environment .

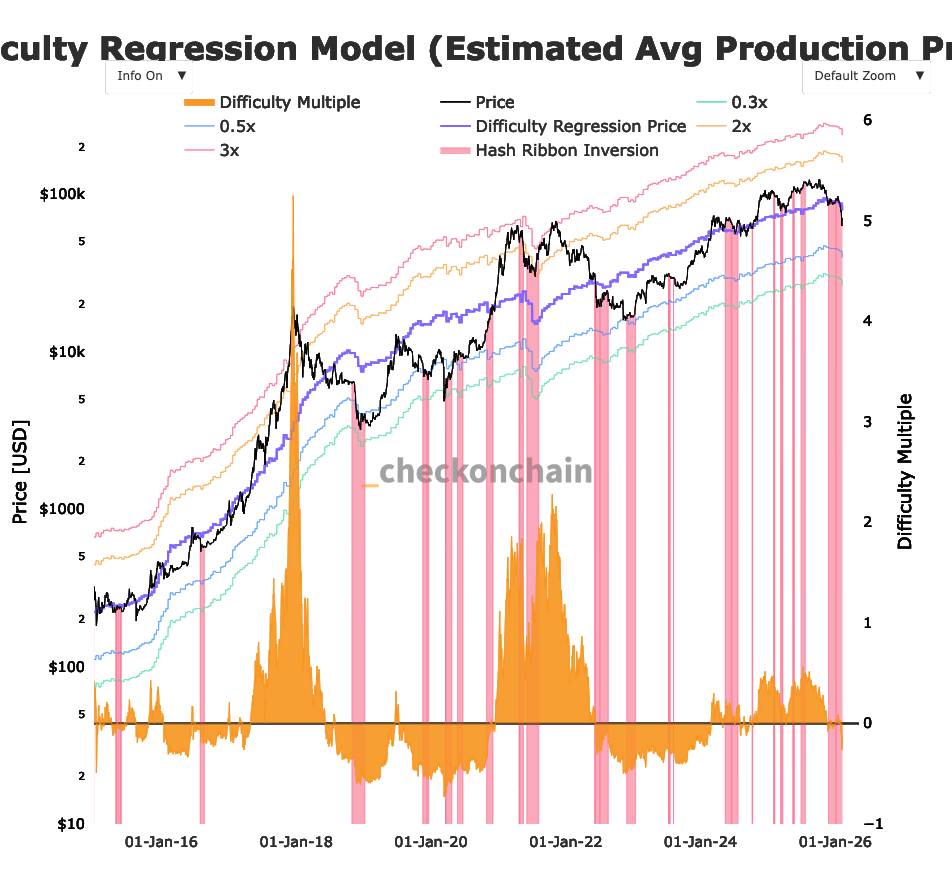

In the long term, the profitability outlook for the Mining industry remains bleak. The Medium cost to produce one Bitcoin is currently around $87,000, according to Checkonchain, while the spot price is only around $70,000, 20% lower than the cost. The Block 's "Mining Outlook 2026" report shows that the share of transaction fees in Miners ' total revenue has decreased from around 7% to nearly 1% after the on-chain activity frenzy of 2024 subsided, making the industry increasingly dependent on price volatility rather than network-based income.

Some analysts warn that the prolonged weakening of hashrate could reduce the theoretical cost of attacks on the network, although the actual risk is still considered low due to the scale and dispersed nature of the mining ecosystem.

However, the data also carries a contradictory implication. VanEck states that historically, Bitcoin has approximately a 65% probability of recording positive returns within 90 days following each period of hashrate decline. Bernstein analysts believe the current correction may be nearing its end, with the $60,000 region XEM as a potential Dip area before a reversal in the second half of the year. Several mining cost models also identify the $65,000-$70,000 range as a technical defense zone for the market.

On the positive side, the reduced difficulty gives remaining Miners a higher chance of winning block rewards. However, this advantage is only relative and unlikely to fully offset price and cost pressures.

Coin68 compilation