Despite the initial excitement surrounding the launch of a newly launched U.S. spot Ethereum exchange-traded fund (ETF), analysts predict it will have minimal impact on Ethereum’s short-term price.

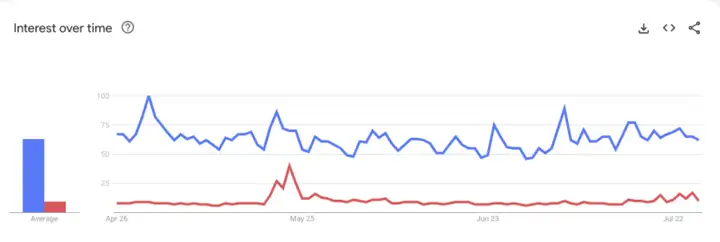

Since the SEC approved these investment products, Ethereum’s market behavior has been tepid, with its price and investor interest significantly down compared to Bitcoin and Solana.

Ethereum Struggles Despite ETF Approval

Since the ETF was launched, the price of Ethereum has fallen 8% to $3,260. Meanwhile, large net outflows from Ethereum-related financial products, especially Grayscale Ethereum Trust (ETHE), indicate a general waning of investor interest in Ethereum.

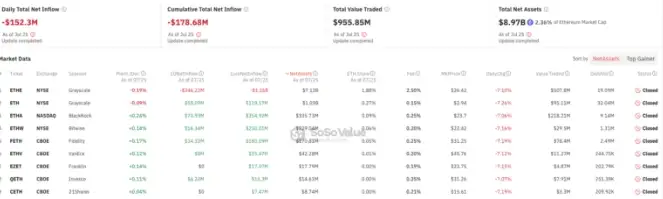

Data from SoSoValue shows that about $178.68 million has exited the market in three days, bringing the total withdrawal from ETHE to $1.16 billion since the ETF began trading.

ETHE’s outflows were mainly because investors were moving away from high-fee products. ETHE charges fees that are about 10 times higher than its competitors.

Market analysts had expected an Ethereum ETF to replicate the surge in enthusiasm and demand for a Bitcoin ETF. However, the Ethereum market’s response has been tepid.

ETH is in limbo. Ethereum failed to scale L1, while Solana rose rapidly. L2 scaling does not add value to Ethereum (low ETH consumption, fragmented liquidity, worse UX). Airdrop farming is no longer attractive (low returns). Even ETFs cannot ignite FOMO in ETH.

A major factor contributing to this apathy may be that ETFs are not eligible for staking. Direct Ethereum holders can typically earn 3%-5% staking returns. In contrast, ETF investors who cannot access this return due to regulatory restrictions face direct disadvantages.

This staking yield is critical to Ethereum’s value proposition and is the “risk-free” rate in crypto. The lack of this yield in the ETF model may deter potential investors who prefer more traditional direct holdings or alternative crypto assets that offer better returns or more favorable investment structures.

Furthermore, compared to Bitcoin, which is often referred to as “digital gold,” public understanding of Ethereum’s fundamentals remains relatively low. This knowledge gap has also dampened enthusiasm for Ethereum ETFs, as potential investors remain cautious and prefer more familiar investments.

Moreover, as the largest public blockchain, Ethereum has a relatively complex mining mechanism, and its development is affected by various forces within the ecosystem. Most importantly, as an investment target, its supply involves dynamic calculations, which are difficult for ordinary investors to understand intuitively.

In addition, an Ethereum ETF may not significantly change buying or selling pressure in the short term. While Bitcoin spot ETFs have huge daily net inflows that directly affect its market price, Ethereum's similar products currently lack such market-driving potential.

Why Ethereum ETFs Failed to Spark Market Enthusiasm The launch of Ethereum ETFs may still play a key role in the wider acceptance and integration of cryptocurrencies into mainstream financial markets. As the largest public blockchain platform, Ethereum's transition to regulated financial products may pave the way for similar moves for other digital assets.

simply put

The Ethereum ETF failed to boost market enthusiasm, resulting in a short-term price drop and a large outflow of funds.

The lack of staking returns and complex investment mechanisms of ETFs have discouraged potential Ethereum investors.

Although the impact is small, an Ethereum ETF could help cryptocurrencies gain wider acceptance in mainstream finance