The People's Bank of China ( PBOC ) cut its short-term policy and benchmark lending rates on Monday. This move was very unexpected and caught the entire market by surprise. More importantly, the central bank's move has far-reaching implications, including in the field of cryptocurrency. Some industry professionals and traders generally believe that China's interest rate cut is a prelude, and Bitcoin is expected to hit a record high within two months, that is, before September . After all, this is a major move by the world's second largest economy .

The price hits $68,000. Will China's unexpected interest rate cut become a catalyst for Bitcoin's rise?

The Bitcoin market has not been very good in recent times.

In particular, Bitcoin prices briefly fell last Sunday after U.S. President Joe Biden announced that he would not seek re-election. According to relevant data, the decline in Bitcoin led to the liquidation of futures contracts worth $ 159 million.

Of course, this wave of pain is at most labor pains. By early Monday morning, the price of Bitcoin had reached $ 68,000 . Some people believe that this may be related to Biden's withdrawal from the 2024 election and the return of some investment to Bitcoin. It can be said that "the success and failure are all due to Xiao He".

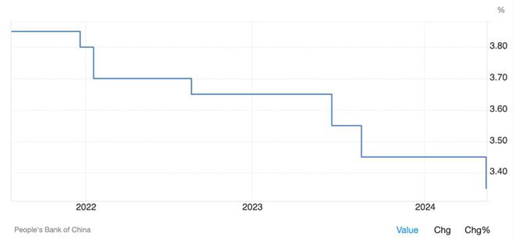

Speaking of the central bank's interest rate cut this time, the 7- day reverse repurchase rate was reduced from 1.8% to 1.7% ; the one-year loan market benchmark rate (LPR) was reduced from 3.45% to 3.35% ; and the five-year loan market benchmark rate (LPR) was reduced from 3.95% to 3.85% .

The rate cut came after second-quarter gross domestic product (GDP) growth fell short of expectations at 4.7%, in response to weak consumer demand and deflationary pressures, particularly in the real estate sector, which is still struggling and many developers are facing huge financial difficulties.

The global interest rate decline has always attracted much attention, especially the impact of interest rate reduction in China, the world's second largest economy. For this reason, the sudden announcement of the People's Bank of China to cut interest rates was regarded by some industry insiders as a major boost to the continued rise of Bitcoin in the future.

The United States did not follow suit in cutting interest rates, so the future direction of Bitcoin remains to be seen.

However, compared with China, cryptocurrency investors around the world are more looking forward to the Federal Reserve's response to interest rate cuts.

We know that lower interest rates are a key factor in the performance of risky assets, including cryptocurrencies. Since cryptocurrencies are basically pegged to the US dollar, people are more concerned about the Fed's decision. According to the plan, the Fed is expected to hold the next Federal Open Market Committee meeting on July 31. There is no doubt that the majority of investors are looking forward to the Fed's final decision.

Bitcoin tends to view U.S. rate cuts as bullish because it makes investments like Treasury bonds less attractive. This tends to cause traders to allocate a larger portion of their assets to riskier categories like stocks and cryptocurrencies.

According to the CME FedWatch tool, the market is currently almost unanimous (about 95% of investors) that the Fed will keep interest rates unchanged this time. Among them, nearly 90% of people believe that the Federal Open Market Committee will choose to cut interest rates after the September 18 meeting.

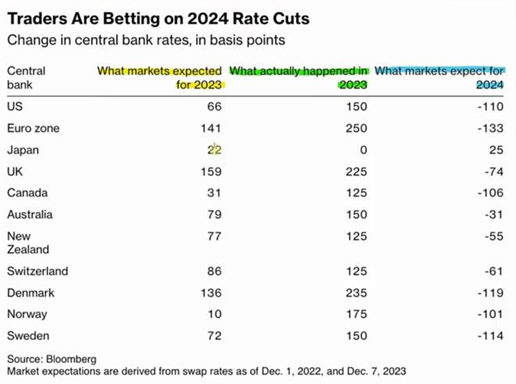

2024 seems to be a critical node. Since entering 2024, many traders have bet that the market has entered a rare, large-scale coordinated global easing cycle , which will reverse half or more of the tightening policies. But now, July is about to end, which means that more than half of 2024 has passed, and substantial benefits have not yet appeared.

Bitcoin is still on the rise, is it promising in the future or will it be weak in the later period?

Of course, although the road is tortuous, we must believe that the future is still bright.

In 2024, there will be many events that can affect the crypto, such as the halving of Bitcoin and increased mining difficulty, but what will really cause turbulence and change in the crypto is the change in the Federal Reserve’s interest rate.

We know that the Federal Reserve interest rate refers to the policy tool used by the Federal Reserve System to adjust interest rates. These interest rates mainly include the federal funds rate, the discount rate, and the reserve rate. By adjusting these interest rates, the Federal Reserve can achieve the purpose of monetary policy.

If the Federal Reserve announces a rate cut in September or even at the end of July as everyone predicts , it means that it has lowered borrowing costs, thereby stimulating investors to increase investment in high-risk assets, of which Bitcoin is one of the important choices.

When the Fed cuts interest rates, the value of the U.S. dollar will decline, which may push up the value of digital currencies such as Bitcoin. Since digital currencies such as Bitcoin usually appreciate relative to the U.S. dollar, the more the U.S. dollar depreciates, the more Bitcoin has the motivation to rise . In addition, interest rate cuts will also increase inflation expectations, further pushing up the value of digital currencies such as Bitcoin. Digital currencies represented by Bitcoin are often seen as one of the effective means to combat inflation, so rising inflation expectations may boost the price of Bitcoin.

In addition to the Fed's decision, another factor is worth paying attention to: Ethereum. The U.S. Ethereum spot exchange-traded fund will begin trading on the morning of July 23rd, Eastern Time. This is the first appearance of the Ethereum spot fund, and it is also likely to enhance Bitcoin's positive moment and bring it to a monthly high. BRN analyst Valentin Fournier said that if this trend continues, the price of Bitcoin will continue to rise and even break through the $70,000 mark.

Of course, as things stand, Bitcoin will not see the parabolic acceleration and gains it has seen previously, but positive ETF inflows are bound to sustain the rally for longer than previously expected.

After talking about the Fed’s interest rate cut, let’s take a look at the central bank’s interest rate cut. Can it have an impact on the cryptocurrency market and what kind of impact will it have?

As early as June last year, China's central bank chose to cut its policy interest rate to increase market liquidity and pledged to take measures to stimulate household consumption.

The price of Bitcoin is very sensitive to monetary liquidity shocks, so China's decision to shift to a more expansionary economic policy will have a positive impact on it. In addition to expansionary monetary policy, the new crypto regulations enacted by Hong Kong have also become a huge positive, allowing the Chinese financial market to have a profound impact on cryptocurrencies, especially Bitcoin.

In fact, China is not the only country that has made the decision to cut interest rates. When it comes to cutting interest rates, the entire world is a huge closed loop.

In early June 2024 , the Bank of Canada fired the first shot in cutting interest rates, becoming the first G7 country to start cutting interest rates; on June 6, the European Central Bank announced interest rate cut measures. It should be noted that in the past five years, the European Central Bank has maintained a high interest rate level and has never implemented a policy of cutting interest rates.

Because of this, the pressure is on the United States. Can the Federal Reserve cut interest rates? When will it cut interest rates? How much will it cut interest rates? We can only wait and see.