Raoul Pal, CEO of Real Vision and renowned financial analyst, made significant changes to his investment strategy. Pal, famous for popularizing the term “Banana Zone,” has moved away from Bitcoin (BTC) and other altcoins and reallocated a whopping 90% of its float to Solana (SOL).

The move illustrates a broader trend of investors looking for assets with high growth potential and a good user experience.

Raoul Pal reveals his cryptocurrency portfolio

In a recent video speech, Pal explained his significant portfolio adjustments.

“Currently, 90% of my liquidity network is primarily allocated to Solana. I don't have a lot of Bitcoin right now. It’s not that I don’t like Bitcoin, it’s just that I think other cryptocurrencies will rise more,” Pal said .

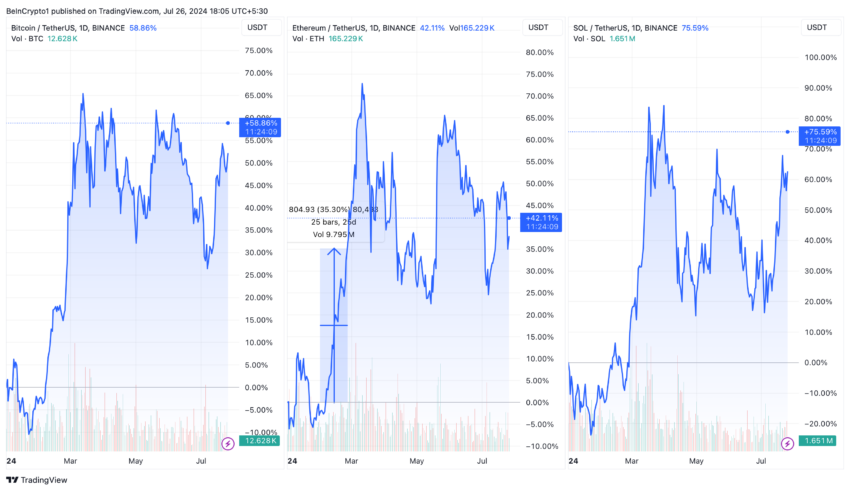

Solana's impressive market performance supports Pal's optimistic outlook. Solana has surged about 75% this year, outpacing Bitcoin and Ethereum (ETH), which have risen 58% and 42%, respectively.

Read more: How to Buy Solana (SOL) and Everything You Need to Know

Previously, Pal compared Solana's trajectory with Ethereum's historical charts from 2018, drawing similarities. He predicted that Solana has the potential to emulate the explosive growth of Ethereum, which has risen 47 times from its low.

Additionally, Pal compared Solana's user experience to Apple's ecosystem, noting its sophisticated design and efficient, closed system.

“It’s like comparing Android and Apple. Solana is a closed system like Apple, but it's very slick, great, and loyal. [But Ethereum is much broader and the different things you can build on top of it are much more open,” says Pal.

Pal’s strategic shift comes at a critical time when the cryptocurrency market is entering a new phase. He expects a parabolic cryptocurrency rally called ‘Banana Zone ’ to spark widespread enthusiasm.

In addition , interest in Solana is growing further as Franklin Templeton, a global asset management company that manages more than $1.64 trillion, recently endorsed Solana.

The company's interest in Solana has fueled speculation about a potential cash exchange-traded fund (ETF). These developments could impact the price of Solana, as ETFs provide a regulated path for institutional investors to gain exposure to cryptocurrencies.

Read more: Solana ETF Explained: What It Is and How It Works

However, various regulatory issues could hinder the Solana ETF. For example, there is no CME futures market for Solana, as is typically required by the U.S. Securities and Exchange Commission (SEC).