Affected by the positive impact of the Bitcoin Consensus Conference and the rebound of US stocks, the crypto market also began to stabilize and rebound. Bitcoin returned to $68,000 and Ethereum returned to $3,250.

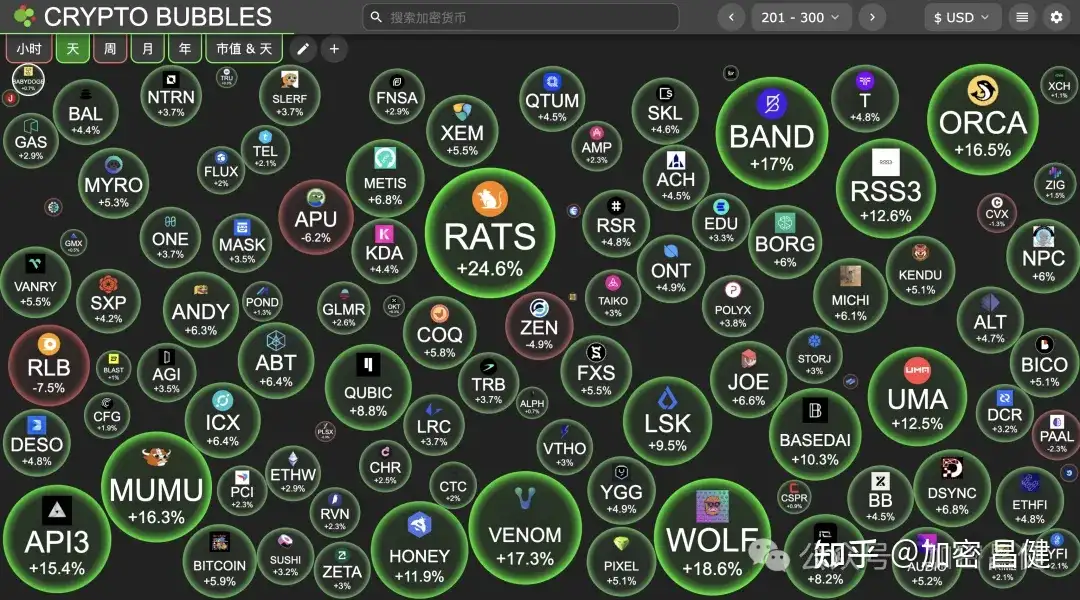

Altcoin as a whole also saw a wave of general gains, with the general increase being more than 5%. The strongest performance was in the Bitcoin ecosystem, with CFX and RATS both rising by more than 20%.

The news worth noting is:

1. US presidential candidate Kennedy said, I understand that President Trump may announce his plan tomorrow to authorize the US government to purchase one million bitcoins as a strategic reserve asset, and I appreciate this statement.

At the same time, he also said, "Most of my wealth is invested in Bitcoin. I will devote myself to it."

Because the assets of American politicians must be made public, this is most likely true.

The current market narrative is the Bitcoin Consensus Conference. Everyone is anticipating Trump’s speech when he takes office, and whether he will really use Bitcoin as a strategic reserve asset.

2. The mayor of Jersey City, USA, said: The municipal pension fund is investing in Bitcoin ETF as an inflation hedging tool.

In addition to Bitcoin, he also personally holds Ethereum.

The Jersey City Pension Fund in the United States also plans to invest in a Bitcoin ETF, which is expected to be similar to the 2% allocation of the Wisconsin Pension Fund.

The Wisconsin Investment Board disclosed that they hold nearly $100 million in the BlackRock Bitcoin Spot ETF.

3. The U.S. state of Michigan has also included Bitcoin ETF in its pension fund and disclosed the purchase of $6.6 million in Bitcoin ETF.

This shows that major pension funds in the United States are continuing to buy Bitcoin, and more new funds will enter the market in the future.

4. The annual rate of the U.S. core PCE price index in June was 2.6%, higher than expected.

The market now generally expects the Federal Reserve to keep interest rates unchanged in July and start cutting interest rates in September.

eToro analysts also said: The PCE data released yesterday will lay the foundation for Powell's expected interest rate cut in September.

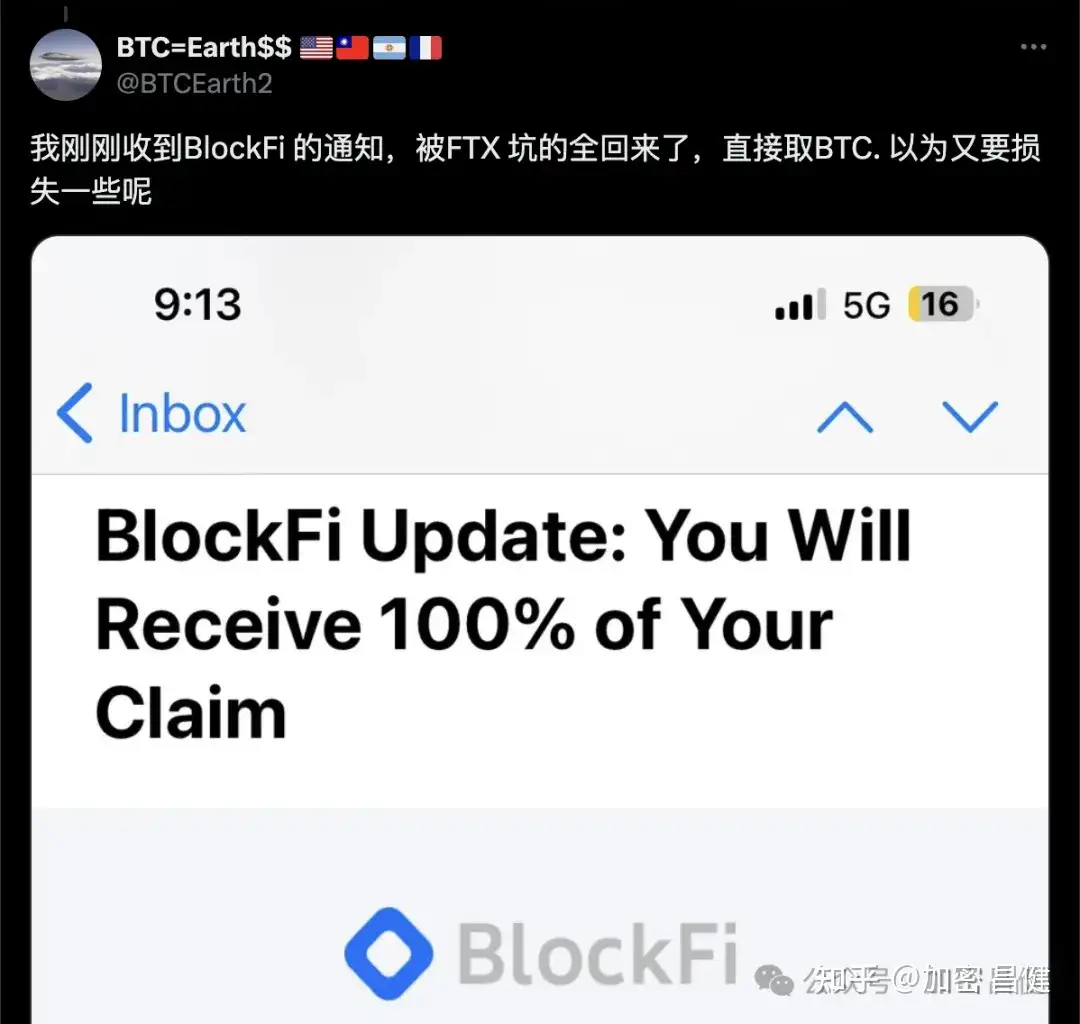

5. BlockFi obtained approval from a US court to repay 100% of customer funds.

Some FTX creditors stated that they have received compensation assets, which are based on assets at the end of 2022.

6. According to the Ethereum spot ETF data, there was a net outflow of US$163 million yesterday.

Grayscale’s ETHE has seen $1.16 billion in net outflows over the past three days of trading, and at this rate, its assets under management could be depleted within a few weeks.

Overall, the purchasing power of American investors is increasing, and Grayscale's selling is also on a downward trend.

7. According to the data of Bitcoin spot ETF, there was a net inflow of 700 BTC into the United States in the past 24 hours.

Among them, only BlackRock had a net inflow of 1,093 BTC, Invesco had an inflow of 18 BTC, and Grayscale had an outflow of 411 BTC.

8. According to data from the prediction market Polymarket, Harris's probability of becoming the Democratic presidential candidate has risen to 97%, a new high.

In addition, Harris's probability of becoming the winner of the 2024 presidential election rose to 38%, while Trump's probability dropped to 60%.

9. In the past 24 hours, the total network contract liquidation was US$156 million, of which long positions were liquidated for US$76.7063 million and short positions were liquidated for US$79.4015 million.

It is another bull-bear market explosion. Those who play contracts must be careful.

10. Uber and Ferrari have recently announced support for crypto payments, which is a long-term positive for the crypto market.

In general, the market is currently in a trend of stabilizing and rebounding. The focus of the market now is Trump's speech at the Bitcoin Conference. His speech corresponds to 3 am on the 28th Beijing time.

By then, the market is expected to fluctuate greatly, so be careful of the ups and downs of the long and short markets.

We will have a live broadcast on Tencent Conference at 8 o'clock tonight. If you have any questions, you can come to the live broadcast room for interactive Q&A.

For more useful information, please add assistant changjian018 to join the group