Highlights of this issue :

1. ETHE sell-off is decreasing

2. If BTC becomes a reserve asset

01

X Viewpoint

1. Phyrex (@phyrex_NI): ETHE sell-off is decreasing

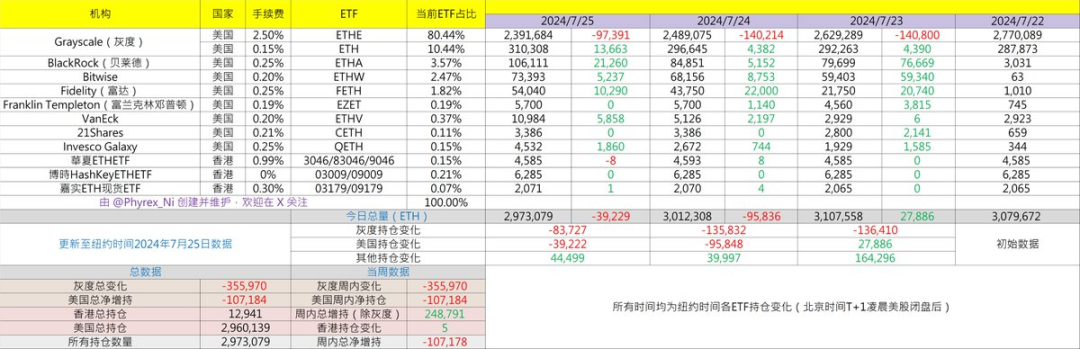

I roughly estimated the data of #ETH spot ETF on the previous trading day. Since most official websites are updated in the afternoon or evening Beijing time, I used part of the fund data and replaced it after the update in the evening.

Judging from the current data, the ETH spot ETF had a net outflow of 39,229 ETH, which was lower than the net outflow of 95,836 ETH on the previous trading day. The main reason was the increase in net purchasing power and the reduction in selling of $ETHE.

In addition, Grayscale's $ETH has seen a large-scale increase in holdings, which can be seen as a transfer from ETHE users to ETH users. Currently, Grayscale's ETHE has reduced its total holdings by 378,405 ETH, accounting for 14.67% of the total ETHE.

2.Bitwu.eth (@BTW0205): The big players are making money quietly, but the retail investors want to sell?

Some people say that this is the darkest moment for Ethereum and the Ethereum ecosystem. I find that there is indeed some meaning in it. The market is full of bearish voices, one after another! Even cursing Ethereum has become politically correct?

I couldn’t stand it, so I decided that during the period when Ethereum was falling and the ETF was constantly being sold through Grayscale, I would be the tough guy who was determined to be bullish on Ethereum and buy it when it fell.

You can think of me as someone whose head is determined by my butt, but this is also my true opinion; in fact, my Bitcoin position was adjusted to be larger than Ethereum in the last cycle. I am a Bitcoin maximalist, but the position of Ethereum in my heart is absolutely unshakable. It is not comparable to other alternative public chains, because its path is unreplicable. Ethereum must be great!

I found a problem, that is, whenever Ethereum falls, its shortcomings, such as high GAS fees and congestion, will be magnified by everyone, as if this is the original sin of Ethereum; but when Ethereum rises, no one mentions it, and it even seems that everyone can accept this fucked-up fee rate;

Of course, Ethereum’s GAS and security are bound to remain in the Blockchain Trilemma. There is no panacea to completely solve all of them in the short term. I have seen a very interesting prediction of Ethereum’s path written by Professor Wang Chuan:

The following passage is from Wang Chuan’s Treasure Book:

Before Ethereum 2.0 is successfully deployed, a possible development path is:

The spontaneous emergence of a certain second-layer rollup solution has reduced the transaction fees of a certain local link, attracted more traffic into Ethereum, and promoted the complexity of the ecosystem.

——Because of the influx of new traffic, an application on Ethereum becomes a new bottleneck, network fees soar again, and traffic overflows to other centralized backup public chains.

——The big guys get rich quietly, the small investors complain loudly, public opinion becomes pessimistic again, the market value of the backup public chain rises (similar to the increase in suburban housing prices exceeding the increase in city center housing prices at a certain period of time), and they package themselves as Ethereum killers to attract traffic.

——New second-layer solutions have emerged on the Ethereum network, Ethereum fees have fallen, and traffic has returned to Ethereum, further complicating its ecology, and the difference in actual ecological complexity with the backup public chain continues to widen.

We can learn from history to understand changes in everything. Ethereum actually developed in a spiral. The backup public chain has its value, and their greatest value is to promote the spiral development of Ethereum.

Compared with other alternative public chains, the fees on the Ethereum network will remain high for a long time. Just like the housing prices in the center of Shanghai are always higher than those in the suburbs such as Jiading or Fengxian. And in the world, there are always faint whispers, spreading the legend that "housing prices are too high and no one lives there."

In other words, if you are Wall Street and a banker, would you rather hype Ethereum or something else? Don’t forget that in addition to its technological innovation and stable development, Ethereum has one thing that other alternative public chains cannot match: Ethereum is a high-quality bond!

So, brothers, don’t believe those stupid remarks, those remarks will only make you miss out on wealth. Ethereum big players are making money quietly, but they just don’t tell you, just like the big guys living in Silicon Valley are making money, but you laugh at them for being stupid and not knowing how to rent a house in the suburbs to enjoy life.

3.qinbafrank (@qinbafrank): The future of copycat season may be limited to the leaders of the main narrative logic sector

Regarding the iteration and evolution of views on Altcoin:

Old people who have experienced more than two cycles of the cryptocurrency market probably miss the scene of thousands of coins soaring and everyone prospering in the past big cycle. In fact, many people are broken in this cycle. Small coins rise slowly and fall quickly, and they are back to the pre-liberation era. From March to now, my own understanding of small coins has also gradually evolved. Today I just sorted out my previous tweets.

1. In March, I thought that this cycle of altcoin season might be very mild. The mildness lies in the large amplitude of the trend. Three steps forward and one step back or three steps forward and two steps back is the norm. Unexpectedly, my words came true. Since April, many Altcoin have been cut in half, and it is common to see a drop of 60% to 70%. It is really a three-fold increase and a two-fold drop, or even a larger amplitude.

The core reasons are:

The funds coming from the BTC ETF only embrace BTC;

The scale is too large. I should be the first one to look at the future trend from the perspective of market value. This cycle started with tens of billions of US dollars, and hundreds of billions of US dollars are a lot. The larger the scale, the more compressed the space will be.

2. In April, we proposed a new normal for the cryptocurrency market based on the current differentiated state of the U.S. stock market.

The conclusion is: the more mature the market, the stronger the effectiveness. The manifestation of effectiveness is that the most growth (narrative) and certain targets must attract the most attention and funds. It should be noted that the Matthew effect in the capital market is very obvious, and this aspect will be reflected very thoroughly in the future currency market, so the differentiation will become more and more serious.

The average market value of the bottom 3,000 of the 5,000 companies in the U.S. stock market is 800 million U.S. dollars, and the daily trading volume is less than 2 million U.S. dollars. This is a very painful fact. The differentiation of the U.S. stock market is not formed this year, but has lasted for many years. The new normal of the currency market will also be the same in the future

3. If we use the US stock market as an analogy, the future structure of the cryptocurrency market will be very clear.

The US stock market is now very stratified: the leading Big3 and Mag7, nearly 100 second-tier market value stocks in the middle, and thousands of small and medium-sized market value stocks. If we have to make an analogy, the strong mainstream such as BTC, Ethereum, BNB, and Sol are more like the second-tier market value stocks in the US stock market. They have performed very well in the past year and have risen a lot, and the retracement range is also acceptable. They were able to keep up with the Big3 and Mag7 before.

The rest of the cryptocurrency alts are actually more like the Russell 2000 Index (a representative index of small-cap stocks in the U.S. stock market). They rose a little from the bottom but quickly deflated and are still quite far from their previous highs (however, the Russell 2000 has soared slightly recently due to expectations of interest rate cuts, while the cryptocurrency alts are still lying flat).

4. How did the current plight of copycats come about?

The popularity of the previous cycle has greatly boosted the size of crypto VCs. The larger the size of VCs, the more difficult it is to invest in small projects. In addition, I also have a group of founders with very good backgrounds entering the market, and jointly pushing up the valuation of the primary market. This year, I found that the market liquidity is not sufficient and the secondary market cannot handle such a high market value.

Another problem is that the application is nowhere near being implemented, and the market is fed up with reinventing the wheel without creating value.

5. How to invest in the new normal

In the past, the focus of cryptocurrency investment was on timing (at the bottom of a big cycle or the start of a big market, when the BTC led the way and small coins all soared), but in the future, both timing and coin selection will be equally important (target screening is far more important than before)

It should also be made clear that the copycat season that everyone previously imagined would bring prosperity to everyone is actually likely to be limited to the leaders of the main narrative logic sectors, and most of the small coins will likely be a one-wave flow that comes and goes quickly.

6. If we combine this with the baseline scenario of limited easing in the next one or two years

Differentiated and structured markets may still appear, and the market breadth will also be partially expanded from extreme concentration to a small number of targets that have both certainty and growth.

Betting everything on the stock may not be a good choice. Lowering expectations and concentrating positions on a few stocks with strong consensus and high liquidity may be the safest option.

02

On-chain data

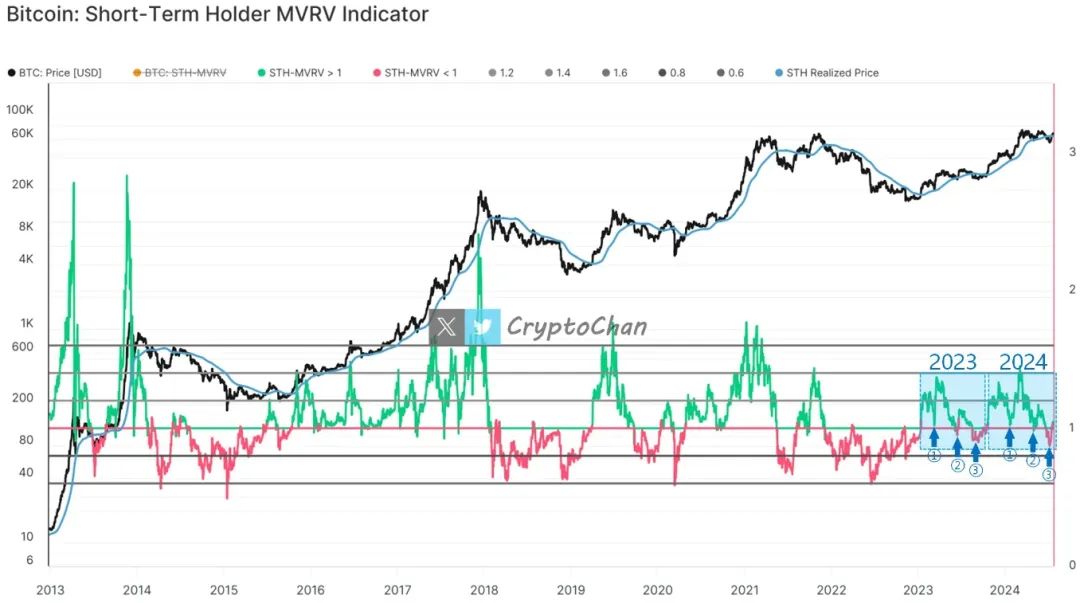

CryptoChan: After three waves of callbacks, the price of the currency has risen to a new level

This year is very similar to last year. The same three waves of large-scale pullbacks; the same three waves of pullbacks are more severe each time; the same three waves of pullbacks are completed and the price of the currency rises to a higher level?

The black line in the figure is the BTC price; the blue line is the average purchase cost of chips by short-term holders on the chain (holding the currency for <155 days); the oscillation indicator is: currency price/average purchase cost of chips by short-term holders. When the ratio is <1, it means that short-term holders are generally in a loss.

03

Sector Interpretation

According to Coinmarketcap data, the top five currencies in terms of 24-hour popularity are BTC, SOLYMPICS, ETH, MEW, and SOL. According to Coingecko data, in the crypto market, the top five sectors with the highest growth are Events, Fenbushi Capital Portfolio, Ferrum Network, TRON Ecosystem, and Yearn Partnerships.

Focus: 10x Research: How will ETH prices develop in the post-ETF era?

On May 20, the SEC unexpectedly asked exchanges to update their 19 b-4 filing materials, which means that the filing progress of the Ethereum spot ETF has made substantial progress. The market has also directly increased the approval probability of the ETF from 25% to 75% based on this change. On May 23, the SEC officially approved the 19 b-4 filing of the Ethereum spot ETF, solving the biggest problem before the ETF was listed.

Although the price of ETH rose to $3,959 at the end of May, it fell below $3,000 in early July. This in itself shows that traders lack confidence in the continued rise in the price of ETH. Although ETH has rebounded to $3,500 before the approval of this ETF, we suspect that many people will choose to sell and take profits as soon as the ETF is launched - or even before it is launched.

In addition, the marketing efforts around the Ethereum spot ETF are relatively low, which may directly lead to low interest in the ETF from retail or institutional investors. BlackRock CEO Larry Fink recently gave a televised speech, but he only promoted Bitcoin instead of Ethereum. This shows that (at least in the early stages) BlackRock's customers have relatively limited interest in ETH.

When the Bitcoin spot ETF was released, the annualized funding rate in the futures market was close to 15%, and it once increased to 70% in February, which attracted the attention of many arbitrage funds - they would buy ETFs and hedge with futures to earn arbitrage profits. This buying action strengthened the bullish sentiment around BTC.

Currently, the annualized funding rate in the Ethereum futures market is only 7-9%, which is not very attractive to arbitrage institutions, especially considering the capital sitting cost of at least 5% (federal funds rate). Compared with the situation of Bitcoin spot ETF in February, the Ethereum spot ETF is expected to be less likely to attract too much arbitrage funds, thereby weakening the optimism about ETH. From a technical point of view, ETH's stochastic indicator has basically reached its peak, which means that it is a good short opportunity now - we will use the recent high of 3560 as the stop loss.

Judging from the market discussion heat, the discussion about Solana in this cycle is also significantly higher than that of Ethereum. The Solana ecosystem gave birth to the craze of meme tokens, while Ethereum missed this opportunity due to high gas fees. We can cite various data to prove that Solana is more popular than Ethereum. For example, Solana currently has 14.2 million active addresses, while Ethereum only has 7.5 million.

Ethereum's market dominance has dropped to 17.0% after reaching a high of 18.4% a month ago. The lack of market interest is also reflected in the gas price, which has never been able to rebound. The Dencun upgrade in March 2024 significantly reduced network fees, but the number of network transactions has stagnated, the number of active addresses is similar to three years ago, and the Ethereum network has hardly grown.

In a trade finance environment with zero interest rates, Ethereum’s staking yield advantage was a key reason for the ecosystem to breed DeFi Summer in 2020 and 2021. Today, Ethereum’s staking yield is only 3.12%, and Coinbase’s Ethereum staking yield is only 2.91%. Although ETFs themselves do not involve staking, from a yield perspective, opportunity cost is a key reason for the low demand for ETH in this cycle.

Compared with BTC, ETH's beta coefficient is also weakening. ETH has not performed well since the beginning of this bull market. If we start from October 2022, ETH's performance will lag behind BTC by 40%. Considering the above factors and the fact that the issuer of the ETF has not yet carried out a large-scale marketing campaign; coupled with the fact that some traders will choose to close some long positions when the news comes out; in addition, we have to take into account the potential capital outflow from Grayscale... This can indeed be a reason to be bearish on ETH, at least in the early stages.

04

Macro Analysis

Kaori: What if Trump declares Bitcoin a strategic reserve asset?

Last weekend, a rumor that Trump would announce BTC as a strategic reserve asset for the United States at the Bitcoin 2024 conference spread widely. With Bitcoin quickly returning to $68,000, the market sentiment also rose a lot. Everyone is looking forward to the "crypto president" to go crazy again at the Bitcoin conference this weekend.

1. What are national strategic reserve assets?

National strategic reserve assets refer to assets held by a country to cope with economic uncertainty, external shocks or other emergencies. These assets usually include traditional safe-haven assets such as gold, foreign exchange reserves represented by the US dollar, euro, and yen, special drawing rights (SDRs) allocated by the International Monetary Fund (IMF), and government bonds, foreign currency-denominated deposits, and other highly liquid assets.

The composition and management of reserve assets play a vital role in a country's economic stability and its relationship with international financial institutions such as the IMF.

Dennis Porter, co-founder of Satoshi Action Fund, who is also a participant in the Bitcoin conference, posted on social media that the most likely direction for Bitcoin to become a strategic reserve asset of the United States is to become the US Treasury's Exchange Stabilization Fund (ESF).

The ESF is a special fund operated by the U.S. Treasury established under the Gold Reserve Act of 1934, with the primary goal of stabilizing the value of the U.S. dollar. The ESF provides the Treasury with tools to conduct currency and gold operations to influence exchange rates and promote stability in foreign exchange markets. Today, Bitcoin is generally considered a foreign currency in the United States.

Markus, a researcher at 10x Research, analyzed that the US government currently holds about 212,847 bitcoins, worth about $15 billion. In comparison, its total gold reserves are about 261.5 million troy ounces, worth about $600 billion. If the amount of Bitcoin held doubles ($15 billion), it is almost equivalent to the net inflow of funds into Bitcoin spot ETFs from the beginning of the year to date ($16 billion), which will undoubtedly be more influential in terms of signal effect.

On July 25, Republican Senator Cynthia Lummis of Wyoming, who supports cryptocurrency, is planning to announce Bitcoin Strategic Reserve legislation at the Bitcoin Conference. Although the specific content of the bill is still unclear, according to a person who has seen the first draft, the purpose of the bill is to instruct the Federal Reserve to purchase Bitcoin and hold it as a reserve asset, just as the U.S. central bank holds gold and foreign currencies, to help manage the U.S. monetary system and keep the value of the dollar stable.

Lummis hinted at a big announcement on her X account: "Big things are coming this week, stay tuned"

Asset manager Bryan Courchesne also recently appeared on CNBC to discuss the potential of Bitcoin to become a strategic reserve asset for the U.S. government under a future Trump administration. According to the asset manager, adopting Bitcoin as a reserve asset would be difficult, but not impossible. Courchesne noted that the U.S. Department of Justice holds 200,000 Bitcoins, which makes the U.S. government the largest holder of Bitcoin, second only to the anonymous creator Satoshi Nakamoto. The Department of Justice could simply transfer Bitcoin to the U.S. Treasury, paving the way for the Treasury to begin accumulating and holding this scarce asset for the long term.

If Trump really announces at the conference that Bitcoin will be used as a national strategic reserve asset in the future, what impact will it have on Bitcoin and even the crypto industry?

2. If it comes true, its status will be comparable to real gold

The first thing that will be affected is the price. As one of the world's largest economies, the United States' policy changes have a huge impact on the global financial market. The news that Bitcoin has become a strategic reserve asset will trigger a strong reaction in the market, and investors' demand for Bitcoin will increase sharply, thereby pushing up its price.

This will also greatly enhance its mainstream recognition. Other countries and institutions may follow the footsteps of the United States and include Bitcoin in their reserve assets, thereby further consolidating Bitcoin's position in the global financial system. As more countries and institutions use Bitcoin as a reserve asset, its nature determines that its holders tend to hold it for a long time, and the volatility of the Bitcoin market may be reduced.

But before that, we need to realize that it is not up to one person to decide whether an asset can become a strategic reserve asset of a country. Even if Trump is really elected as the new president, he cannot make Bitcoin a strategic reserve asset by himself. This process will involve extensive deliberations by policymakers, economists and financial experts, and will also require approval from Congress and coordination with the Federal Reserve and the Treasury Department.

When all this is settled, the United States may formulate and implement clearer and stricter cryptocurrency regulatory policies in order to protect and manage its strategic reserve assets. These policies may have a profound impact on the entire cryptocurrency market, prompting other countries to strengthen their regulation of cryptocurrencies.

As Bitcoin grows in importance, the infrastructure and technology behind it will also develop further, including more secure storage solutions, more efficient transaction systems, and a more complete legal and regulatory framework.

Bitcoin’s role as a strategic reserve asset may change the structure of existing financial markets. The title of “digital gold” will challenge the status of traditional assets (such as gold and treasury bonds) in reserve assets, and portfolio diversification and risk management strategies will also change.

Regardless of the final outcome, there is no doubt that the crypto industry has entered a more mainstream social vision through politics.

05

Research Reports

Mary Liu: The weakness is only temporary

The crypto market and tech stocks failed to rebound after strong U.S. GDP data and cooling personal consumption expenditures (PCE) inflation data were released on Thursday.

Bitpush data shows that Bitcoin fell below the $65,500 support level in the early hours of Thursday. Ethereum fell nearly 5% in 24 hours, falling below $3,100 on the day. Since the listing of the spot Ethereum ETF, ETH has fallen 8.2% in the past week.

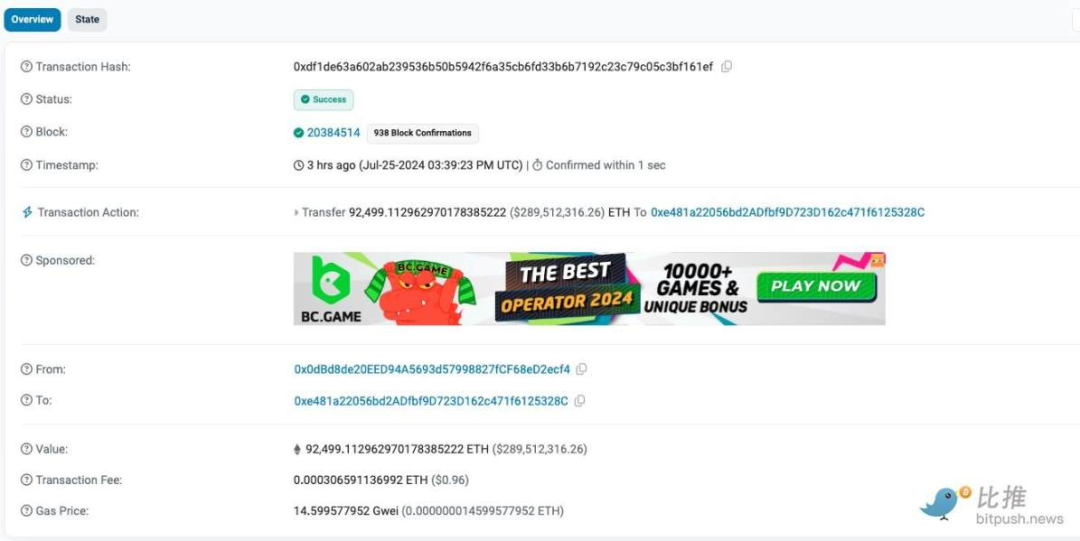

1. Dormant whale transfers 92,500 ETH, may it be related to the Ethereum Foundation?

Blockchain trackers including Whale Alert detected that at 03:39:23PM UTC on July 25, an address transferred more than 92,000 ETH, worth approximately $290 million, after being dormant for seven years. These tokens had been stored at the same address since 2017.

Arkham Intelligence’s on-chain data shows that these funds may be related to the Ethereum Foundation, and the address is marked as a wallet suspected to be related to the Ethereum Foundation (0xe93232a). Other community members said that these funds may be related to early donors of the organization.

Data shows that the wallet initially received 96,474 ETH from the Ethereum Foundation at 12:21:51 UTC on September 1, 2015, worth $130,320.

Currently, these tokens are idle in the wallet "0xe481a22". Although it is not certain whether these tokens come from the Ethereum Foundation, as of press time, these funds have not been sold or transferred to exchanges. The transfer occurred during the decline in ETH prices and coincided with the launch of the spot Ethereum ETF.

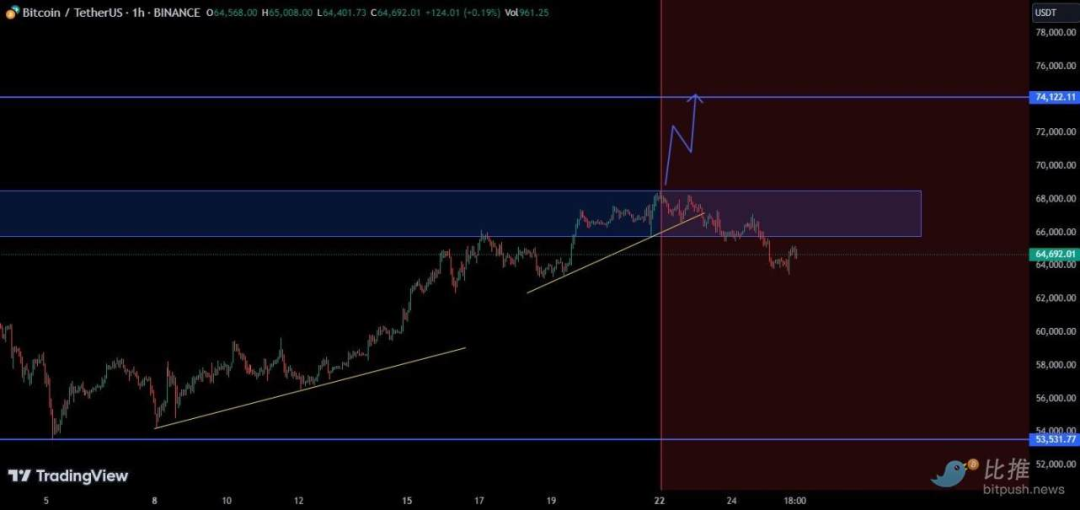

2. FUD will pass

Market analyst TradingShot said: "Bitcoin tested the 1D MA50 (blue trendline in the figure below) for the first time since July 19 today, which is the most important 'break and pullback' retest since October 11, 2023. This is the last time BTC retests the 1D MA50 as support after the recent breakout, following the 21-month upward channel bearish phase from April 14, 2023 to September 11, 2023, which began at the bottom of the previous bear market cycle in November 2022."

“Despite slightly breaking below that level on the retest, it has managed to sustain a candle close above it and kick-start a rally from October 2023 to March 2024,” he said. “Hence, if the same closing conditions hold, we expect a similar rally to begin, which technically would be a new bullish trend that could eventually reach the psychological benchmark of $100,000.”

“It must also be said that next week’s Fed rate decision or at least the hint from the September meeting will undoubtedly have a huge impact on it,” TradingShot said.

Market analyst SatochiTrader also believes that the current weakness is only temporary and believes that Bitcoin will start to move higher once the latest round of FUD is eliminated.

SatochiTrader said on the X platform that "BTC has a large number of DCA (dollar cost averaging) whale who will do everything they can to protect price trends. Our strategy is to hold BTC during active cycles. News about artificial intelligence, Trump, China, and miners may affect the market temporarily, but not permanently."

He added that the outlook for Bitcoin remains “positive and could rise to $74,000 over time.”

TradingView user The_ForexX_Mindset urged traders to remain calm despite the recent sell-off as technical data suggests Bitcoin will soon move higher.

He said: "Don't panic, he knows exactly what will happen next, many traders sold in a state of panic. Once this is over, the general rules will return to normal. Those who own ALTS, the price will go back up. Many people sold out of fear. Greed will come back."

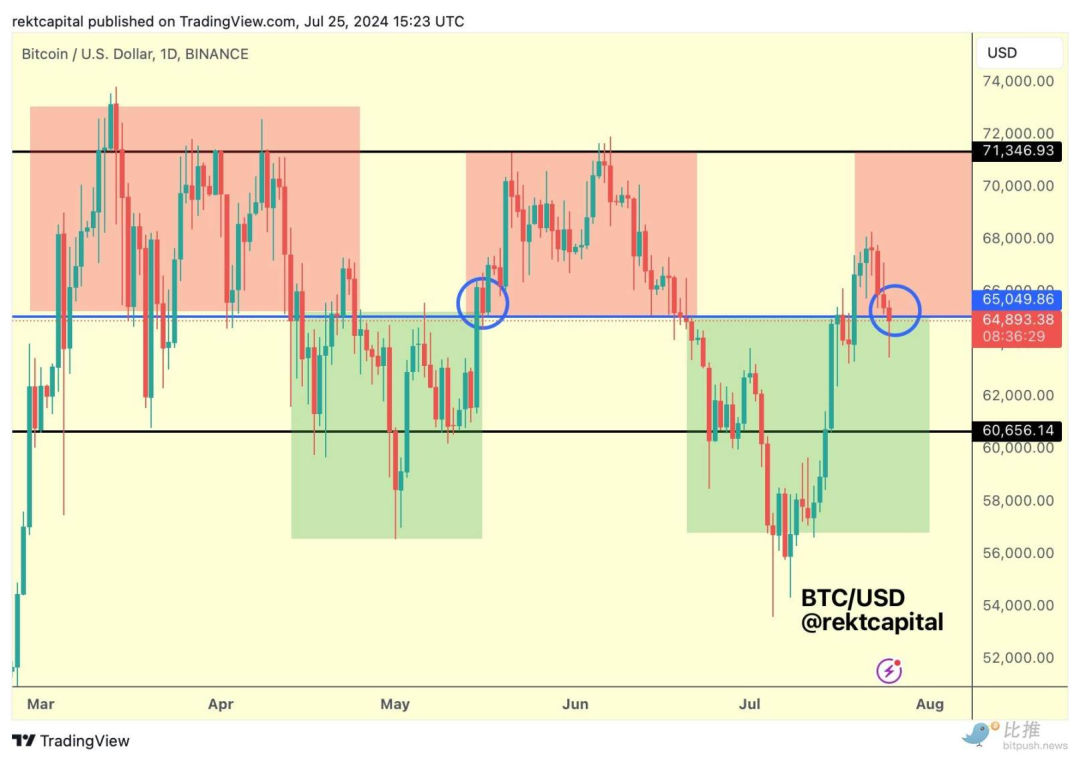

Market analyst Rekt Capital said that Bitcoin is now in the process of retesting the $65,000 level in a volatile manner.

“A daily close above $65,000 (blue) is now needed to make the retest successful and keep prices within the $65,000-71,500 region (red),” he said.