Author: hyphin, Onchaintimes; Translation: Jinse Finance xiaozou

The seeds sown last year in a climate of uncertainty are finally beginning to bear fruit. Retail investors have shown their cards to everyone, but it’s still unclear what cards private equity has. What outcomes are they betting on? Since the last time Bitcoin was trading at prices like it is now and private equity got burned by excessive enthusiasm, they have been playing it safe. Will the strategy be different this time?

1 Introduction

Regardless of market conditions, funding will never completely stop, as the crypto industry’s creativity engine is efficient enough to reward those who fund it. However, positivity is largely dependent on forecasts. Promising conditions have always been able to attract early capital because the potential rewards far outweigh the associated risks. To many onlookers, the increasing number of these for-profit entities is either a sign that the party has already begun or is about to begin. It is clear that we have been immersed in a bull market for quite some time and the fort is within reach. Given this, we can predict that cumulative funding will exceed or at least approach the norm of the previous cycle.

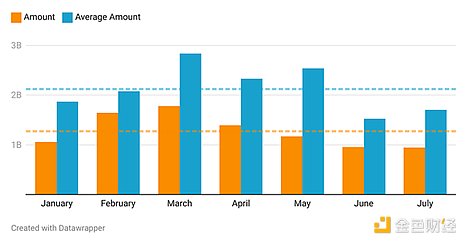

The following chart shows the financing situation in 2024: the monthly cumulative financing amount in 2024 compared with the four-year average.

It’s safe to say that these optimistic expectations have been met with a reality check, as this year’s monthly indicators are significantly below the four-year average. Compared to 2018, 2021, and 2022, these numbers are just a drop in the ocean of zero-interest, cheap money. While the reported financials aren’t worth a close look, they do suggest that as we transition to the new normal, the opportunities to secure big initial startup funding have clearly diminished, as activity seems to have evaporated. However, the number of funding rounds for invested projects is actually above average.

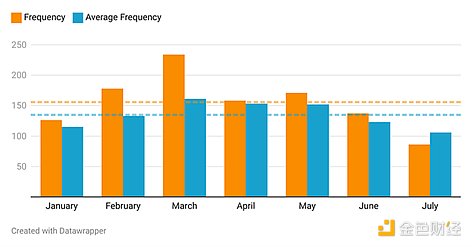

The following chart shows financing frequency in 2024: the monthly number of financing rounds in 2024 compared to the four-year average.

Before the bitcoin price rose to new all-time highs, the distribution of funding announcements accelerated significantly, indicating active involvement in startup operations behind the scenes. This surge was largely due to marginalized players rushing in to participate in more rounds than usual. However, activity has slowly tapered off, and Summer has traditionally been quite quiet.

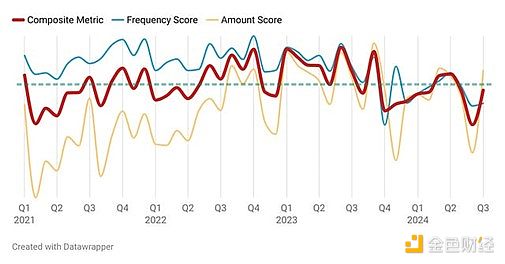

The following chart shows funding participation (2021-2024): Create interactive, responsive, and beautiful charts — no code required.

Granted, the average check to founders is certainly not as big as it once was, which requires developers to be more calculating and manage their burn rate wisely to successfully bring the products they are building to the finish line.

2. Emotion / positioning

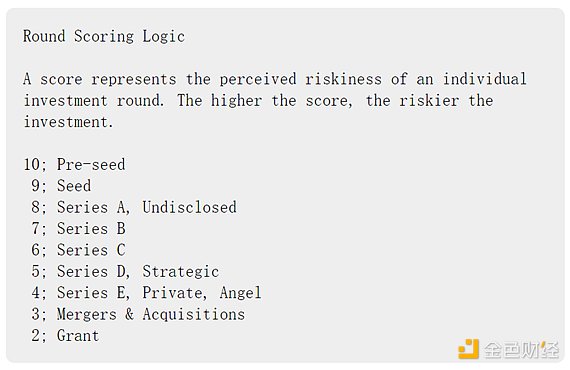

By looking at the current financing situation, we can confidently judge that venture capital will have some upside in the unforeseeable future. Although the size of the financing may not convey much confidence, the risk appetite may. Financing can be targeted at different stages of a company's development, each with its own considerations and industry-standard amount ranges.

By categorizing investment types by their individual characteristics, we can assign them a rough risk score. This allows us to broadly measure the overall risk tolerance of all given parties, and thus determine confidence that a trend will continue or turn by quantifying their collective propensity to engage in speculative activity.

The sentiment shown in our graph will be represented by a composite metric calculated by adding the frequency-based and amount-based weighted scores using the values we determined previously.

Lower values of the composite index indicate a defensive orientation, while higher values indicate an offensive orientation. Changes between these positions can be determined by whether the composite index value exceeds the average (the green dashed line in the figure).

The chart below shows funding sentiment (2021-2024): The chart shows risk capital sentiment, based on participation trends in riskier funding rounds, using normalized values (lower = defensive; higher = offensive). The funding score is determined by the perceived risk factor of the funding type, which is then used to calculate the frequency and amount scores. The composite metric is the sum of these two weighted values.

While a bit of a generalization, the chart provides an interesting perspective on how positioning and investment have evolved over time. In the previous cycle, low funding amounts and high funding frequency scores would have resulted in a relatively mild composite metric, with large amounts of money primarily flocking to high-valuation series financings. Many well-funded companies made significant bets on the industry by investing in infrastructure and institutional products. This sentiment began to shift near the end of the current rally, with riskier early-stage financings becoming more prominent as investors placed greater emphasis on incubating emerging projects while maintaining conservative commitments. A change in the pace of financing can be seen around the last quarter of 2022, when large individual financings occurred during the FTX debacle and the future of cryptocurrencies was questioned. After the catastrophic capitulation and market bottom formation, private capital took a gamble to significantly expand financial support for developing companies, which lasted until the fourth quarter of 2023. Subsequently, larger private sales and a series of strategic financings came into focus. This trend has continued for most of this year, resulting in a decline in frequency scores despite record activity. This indicates that investors are more cautious in their investment allocations, carefully screening, and preferring safer investments.

3. Financing analysis

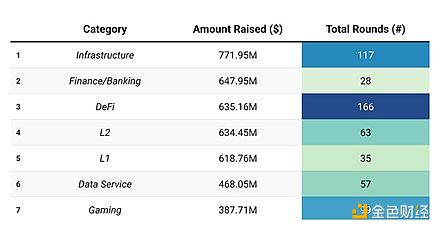

It’s been a tough year for most Altcoin, with only a few outperforming major assets. Even those receiving discounted Altcoin have not been immune, as the downside potential for more speculative investments has proven to be nearly bottomless. Picking the right niche is more important than ever. To get an overview of fund flows and filter out the most popular narratives, we can look at funding amounts by category. For consistency, all publicly traded Bitcoin mining companies have been excluded. It’s worth noting that not all fundings have concrete values, so the actual composition may be slightly different.

While investment interest has undeniably softened compared to last year, some traditional sectors that were previously overlooked have gained more traction alongside new sectors as financiers adopt a broader ecosystem and infrastructure approach. This further supports the view that risks are being carefully assessed and exposure to newly formed or re-emerging narratives is limited.

Focusing on the popular part, infrastructure as an industry pillar rightfully stands out, with projects like EigenLayer paving the way for new primitives and generating a lot of economic value and activity. Surprisingly, various trading venues and financial services aimed at expanding existing businesses and launching new products tailored for institutions and ordinary users have also received generous funding. The last time there was a keen interest in this corner of the market was in 2021, when efforts to bootstrap and simplify returns reached an all-time high. For the rest of the projects in the table, funding amounts either fell or remained relatively stable compared to last year, leaving only a few noteworthy observations.

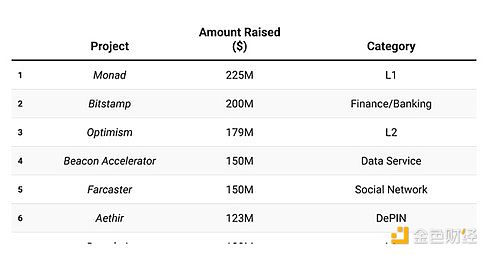

Largest Fundraises in 2024

Below is a chart of the largest financings in 2024: ranked by cumulative financing amount to date and their respective categories.

( 1 ) Recovery of L1 and L2

The blockchain investment space is back in the spotlight following some high-profile funding rounds. Despite a saturated L1 market, companies like Monad ($225M) and Berachain ($100M) have received significant liquidity injections, similar to what was seen in 2022. Total funding in the sector has nearly tripled compared to last year. Rollups have also shared in this success, with cumulative funding slightly higher than base chains, due to exciting new developments in the rollup space. While Ethereum L2 solutions, or those leveraging Ethereum’s underlying technology, have been in the spotlight, alternative virtual machines and chain deployments are showing signs of growing interest. Bitcoin and Solana are prime examples.

( 2 ) The rise of social networks

Although decentralized social platforms have been around for a while, they have struggled to gain a large user base and attract a lot of funding. The biggest challenge facing these platforms is how to convert Twitter users, which is still the real core of discussion in the cryptocurrency field. However, Farcaster, which was launched in late 2023, has been a huge success, raising $150 million in a $1 billion Series A led by Paradigm, after its daily active users reached nearly 40,000.

( 3 ) Ecological contribution

Ethereum and its more recent scaling solutions have been the main center of ecosystem investment, but their dominance is declining year by year, and emerging ecosystems offer a wealth of opportunities that are not often seen in mature, established environments.

Most of the capital flows are consolidated into Ethereum, Bitcoin, and Solana, and other chains are struggling to compete. Compared to the previous year, Solana has improved its position, with a large influx of active users with unique addresses, huge transaction volumes, and the popularity of its virtual machine. The same cannot be said for Bitcoin, which has failed to maintain its momentum and has been caught up by Solana, partly due to the shift in focus of mining operations. Nevertheless, the Bitcoin ecosystem is developing rapidly and is still in its infancy to some extent.

4 Conclusion

Despite Bitcoin’s favorable price action and strong institutional participation, cumulative funding is unexpectedly low, only a slight improvement from the year before. Activity spiked briefly but has since fallen back below average, reflecting seasonal patterns. So far, sentiment has been relatively negative, with risk capital remaining cautiously on the sidelines. With four months left in the Year of the Snake, Bitcoin still has plenty of time to establish a range and show a clear direction. A clear upside breakout, coupled with Altcoin finally being safe to buy again, should give the green light for riskier participation.