Author: Cerus Markets CEO Michael Brescia, CoinTelegraph; Translated by: Deng Tong, Jinse Finance

The crypto world is delighted by former President Donald Trump’s about-face on cryptocurrencies. Despite his 2019 comments that cryptocurrencies are “not money” and are “created out of thin air” and “can facilitate illegal activities, including drug trafficking,” and his 2021 statement that Bitcoin “looks like a scam” and that he doesn’t like it “because it’s another currency that competes with the dollar,” Trump is now unabashedly supporting cryptocurrencies with all his might.

Trump made a splash at a Bitcoin conference in Nashville on July 27, promising the crowd everything from the immediate removal of SEC Chairman Gary Gensler to the appointment of a Bitcoin and Cryptocurrency Advisory Committee and the creation of a strategic Bitcoin reserve at the Federal Reserve—if he were re-elected. In fact, Trump seemed almost ready to make promises to this low-key group of voters.

That’s the rallying cry for an industry that has come under intense pressure from U.S. lawmakers and regulators in recent years. However, Trump’s belief in cryptocurrencies could be similar to his stance on electric vehicles: flexible and driven entirely by donations.

Some might argue this by pointing to Trump’s vested interest in cryptocurrencies, which is, of course, undeniable. In fact , he began changing his tune on the asset class shortly after a financial filing revealed that his non-fungible token (NFT) collection had netted around $500,000 on Ethereum. Additionally, Trump’s running mate, JD Vance, also holds a small portion of his $5 million fortune, valued between $100,000 and $250,000.

Of course, being in on the action is always a powerful motivator. Yet Trump and Vance’s crypto collective pales in comparison to BlackRock, which is led by billionaire and registered Democrat Larry Fink, who now manages the world’s largest BTC spot ETF, which has been valued at $22 billion since its approval in January. Or JPMorgan, whose CEO Jamie Dimon (another Democrat) has softened his anti-Bitcoin stance as the bank’s BTC holdings have continued to grow.

If history tells us anything, what’s good for BlackRock and JPMorgan is usually good for the Democrats. In fact, whether you like Gensler or hate him, the BTC ETF was approved under his and President Joe Biden’s watch, not under Trump — who had plenty of opportunities during his tenure. In contrast, the Trump administration oversaw a rule proposal from the Financial Crimes Enforcement Network (FinCEN) that would have required cryptocurrency companies to do human searches on DeFi users.

Donald Trump likes to talk, but his actions speak louder than words. So far, Trump’s actions as a businessman and political leader run counter to the mission of Bitcoin — an asset created in 2009 to protest rampant money printing, a phenomenon of which he himself is a big fan. As he told CNN in 2016, his response to rising government debt is to print more money (the U.S. will never default on its debt because of “printing money”). He started the printing presses long before the coronavirus pandemic devastated the economy, and later claimed that he had driven the stock market higher.

Overall, Trump’s administration has seen the third-largest increase in government debt, behind only George W. Bush and Abraham Lincoln, both of whom were financing wars. If Trump’s comments on Jerome Powell’s conservative interest rate policy are anything to go by, we’d see much the same if he’s elected.

None of this is to say that Biden is a fan of cryptocurrency — and certainly neither are Senators Elizabeth Warren or Gary Gensler. However, Vice President Kamala Harris’s position is less clear. We know she’s a Silicon Valley supporter. She’s a frequent visitor to Meta and Google’s offices, she stresses the importance of finding a balance between regulation and innovation, and she’s already got a big endorsement from Sheryl Sandberg.

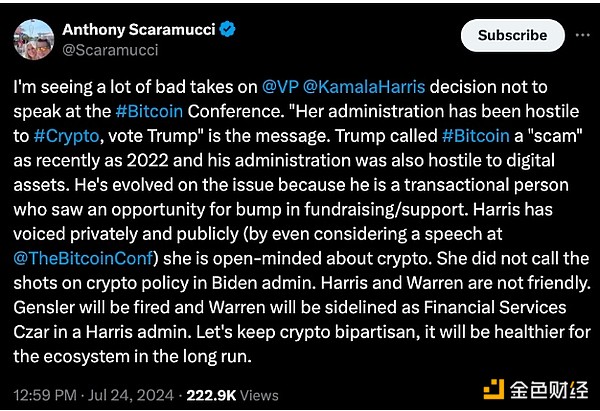

Anthony Scaramucci, who served as communications director in the Trump White House for 11 days, claimed that Harris told him she was "open to cryptocurrency." Source: X

We also know that Harris’ campaign is focused on empowering the young middle class — a group that dominates the cryptocurrency space — so it makes sense to leverage cryptocurrency’s ability to create wealth for this key voter group. Although Harris didn’t attend the Nashville conference, she still seemed eager to learn more, and billionaire cryptocurrency supporter Mark Cuban revealed that her camp had reached out to her. Former White House communications director Anthony Scarumch also claimed that Harris told him that she was “open to cryptocurrency.” He also seemed to believe that if she were elected, she would fire Gensler and marginalize Warren — although this is only speculation.

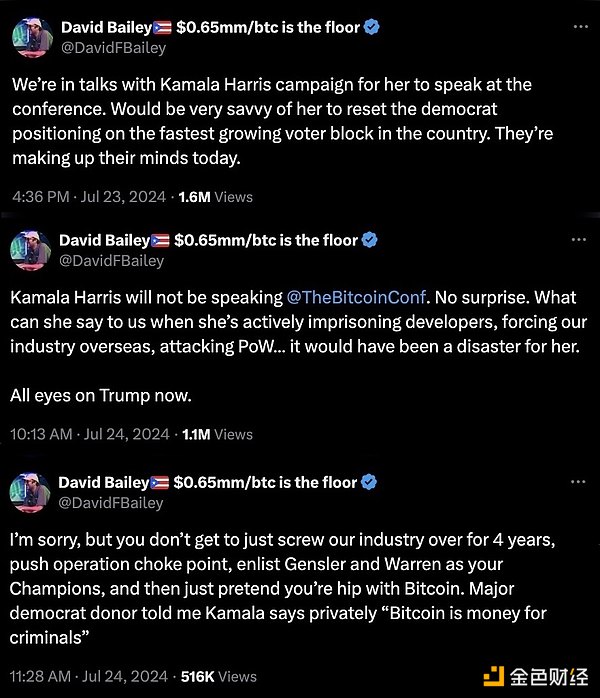

Harris did not speak at the conference. Although organizer David Bailey blasted Harris on social media, 48 hours is not enough time to prepare for the vice president’s appearance in a state where anyone over 18 can carry a handgun and just weeks after the Secret Service director resigned over a Trump assassination attempt. Harris certainly did not attend.

David Bailey said he invited Kamala Harris to his Bitcoin conference in Nashville — but reportedly blasted her on social media after she declined to attend.

In short, despite Trump’s rhetoric in Nashville, anyone counting on him to save crypto should take a closer look at the receipts and remember that he is under no obligation to keep any promises to the Winklevoss twins, Michael Saylor, or Cathie Wood.

Just as Trump is unlikely to get his pro-EV agenda through fossil fuel-loving Republican senators, he is unlikely to pass any bills that threaten banks or the dollar’s hegemony. Moreover, he may find it tricky to support an industry where so many “hard-working Americans” have lost billions of dollars through FTX and Celsius. Conversely, if the crypto industry helps him return to the White House, Trump will almost certainly refocus on his populist agenda of lowering taxes and — maybe — building that wall.

What we need now is not heated rhetoric, but meaningful engagement from both Republicans and Democrats on key regulatory issues. The cryptocurrency industry needs clear, well-defined guidelines that are not as stringent as securities regulations, but protect retail investors. The best way to achieve this is to get both sides involved, and I look forward to seeing some forward-looking and innovative policies from experienced experts and lawmakers.