First, review the article of yesterday's master that pre- short in the range of 70000-70400, and the market rose to around 70081 at 9 pm. Then it fell to around 66300 in the early morning. The first target of the long order in the article, 69200, and the second target, 68700, were both accurately reached, and the pre-buried short order won 1300 points of profit.

Hot topics of Master Chat:

According to on-chain data, the US government's Silk Road wallet transferred 29,799 bitcoins to a new address, worth approximately $2.02 billion.

Many people interpreted this transfer as a sell-off, but in fact the U.S. Department of Justice transferred the Bitcoin to the Coinbase exchange for safekeeping.

In addition, the Ethereum spot ETF attracted $1.183 billion in inflows last week, but due to large-scale outflows from the Grayscale Fund, the overall net outflow was $338 million.

The decline in the market this time was mainly due to the news that the US government transferred out Bitcoin, which caused market panic.

But in fact, the United States did not sell Bitcoin. It was just that the U.S. Department of Justice transferred Bitcoin to the Coinbase exchange for safekeeping.

Judging from the spot ETF data of Bitcoin and Ethereum, funds are still continuing to flow in.

Master looks at the trend:

BTC 4 hours:

Bitcoin failed to hold its high after breaking through last night and subsequently experienced a sharp correction.

At present, a big negative line has formed on the 4-hour chart. Since it failed to gain a foothold after breaking through the high point, the price has returned to the box range again, so the possibility of further rebound has decreased.

So it is necessary to pay attention to trading volume when the price is rebounding, and maintain the view of sideways consolidation after a decline.

Resistance level reference:

First resistance level : 67150

Second resistance level : 68200

In the current downward trend, we need to determine whether it is an adjustment stage. The price needs to rebound to the first resistance level at the current price.

If there is no trading volume during the rebound, then there may be another pullback near the first resistance level. In the short term, I expect a slow rebound.

Support level reference:

First support level : 65700

Second support level : 64000

A short-term rebound near the first support level is also a favorable ultra-short-term buying position. If the current selling pressure cannot be overcome, the possibility of further decline will increase. You can also consider entering a position below the 120-day moving average and the rising channel.

If the price threatens 66k, I think it may fall further to 65k, and a smaller stop loss should be set when it rebounds.

Today's trading suggestions:

In today's trading suggestion, as the bearish trend strengthens, bulls need to wait for prices to stop falling in the short term before entering positions.

The chart is still in the rising channel, so the rebound view can still be maintained. However, the RSI indicator shows that it may further enter the oversold zone, so it is a better strategy to wait for the price to fall before looking for a favorable buying price.

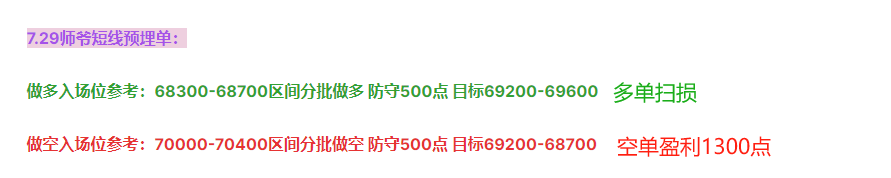

7.30 Master's short-term pre-buried order:

Long entry reference: 64000-64400 range, long in batches, 500 points of defense, 65700-67000

Reference for short entry: 68200-68600 range short, 500 points of defense target 67150-66000

The content of this article is exclusively planned and released by Master Chen (public account: Master Chen, the God of Coins). If you need to know more about real-time investment strategies, unwinding, spot contract trading methods, operating skills, and K-line knowledge, you can add Master Chen to learn and communicate. I hope it can help you find what you want in the crypto. Focusing on BTC, ETH and Altcoin spot contracts for many years, there is no 100% method, only 100% going with the trend; daily updates of macro analysis articles, technical indicator analysis of mainstream coins and Altcoin, and spot mid- and long-term review price forecast videos.

Warm reminder: Only the column public account (pictured above) in this article is written by Master Chen. The other advertisements at the end of the article and in the comment area have nothing to do with the author himself! ! Please carefully distinguish the true from the false. Thank you for reading.