Author: Tom Mitchelhill, CoinTelegraph; Translated by: Baishui, Jinse Finance

Heavy outflows from Grayscale’s recently converted Ethereum ETF — the Grayscale Ethereum Trust (ETHE) — should subside by the end of the week, leading to higher prices for ETH, according to one analyst.

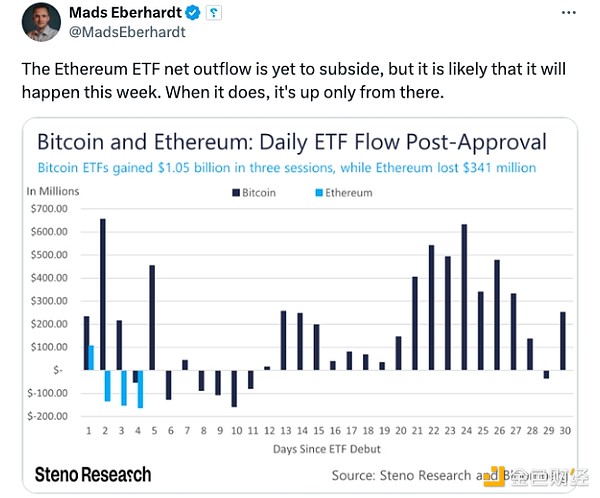

Mads Eberhardt, senior analyst at Steno Research, said in a post to X on July 30 that the massive outflows from Grayscale ETHE will “most likely” subside this week. His comments came as the Ethereum ETF saw outflows for the fourth consecutive day, reaching $98 million.

Source: Mads Eberhardt

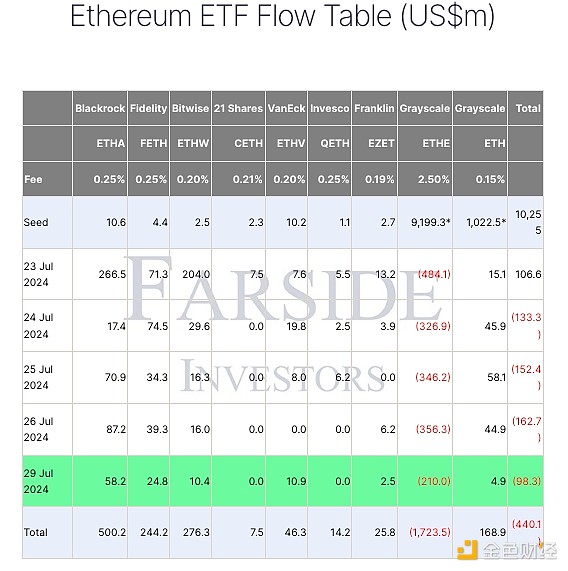

Since the conversion, ETHE has seen outflows of more than $1.7 billion. This figure represents nearly 18% of the $9 billion that ETHE originally contained before it converted to an ETF on July 24.

This figure resulted in the Ethereum ETF failing to achieve net inflows for four consecutive days, despite the other eight ETH ETFs continuing to see positive inflows.

BlackRock’s spot ETH fund had the largest cumulative inflows of $500 million, Bitwise’s fund had inflows of $276 million, and Fidelity ranked third with net inflows of $244 million.

Ethereum ETF has seen outflows for four consecutive days. Source: FarSide Investors

However, Eberhardt believes that the strong early outflows are a reason for short-term bullishness.

“After the 11th trading day, outflows from the Grayscale Bitcoin ETF dropped significantly,” he said.

“Since outflows from the Grayscale Ethereum ETF are so high relative to AUM, we think peak outflows will occur sometime this week.”

"So what happens once we get past the peak of these Grayscale outflows? Take a guess," Eberhardt wrote in a follow-up post on X.

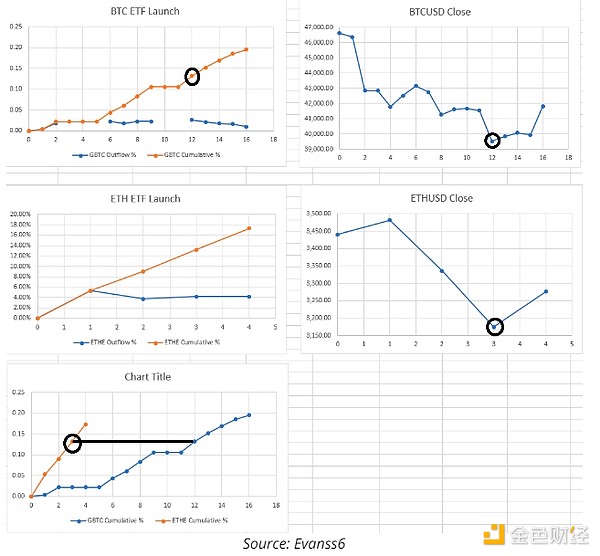

Anonymous trader Evanss6 echoed Eberhardt’s sentiments in a July 30 X post comparing the launch of a Bitcoin ETF and an Ethereum ETF side by side.

Evan wrote that Bitcoin ETF outflows bottomed out on the seventh trading day, and the bottom occurred when the Grayscale Bitcoin Trust (GBTC) cumulative outflows reached 13.2% of the original fund.

He added that after GBTC outflows bottomed out, Bitcoin went on to “plunge [approximately] 92% in 50 days.”

In contrast, he noted that Grayscale’s Ether ETF “sold out much faster than GBTC,” reaching 17.3% in just four days, when ETH price had a smaller overall correction relative to BTC.

Meanwhile, Samara Cohen, head of ETF and index investing at BlackRock, said that there is strong demand for ETH from institutional investors, adding that cryptocurrency-based ETFs will start to enter “model portfolios” by the end of the year.

“Investors really want to get exposure to ETH, especially if they’re going to use it in an overall portfolio in an ecosystem that they believe in,” she said.