Written by: Mary Liu, BitpushNews

Crypto markets got off to a hot start in early trading on Monday, with Bitcoin surging to $70,000 for the first time since mid-June.

U.S. presidential candidate Donald Trump spoke at a Bitcoin conference over the weekend and said he intends to use BTC as a strategic reserve asset if re-elected president, and independent presidential candidate Robert F. Kennedy Jr. made similar remarks.

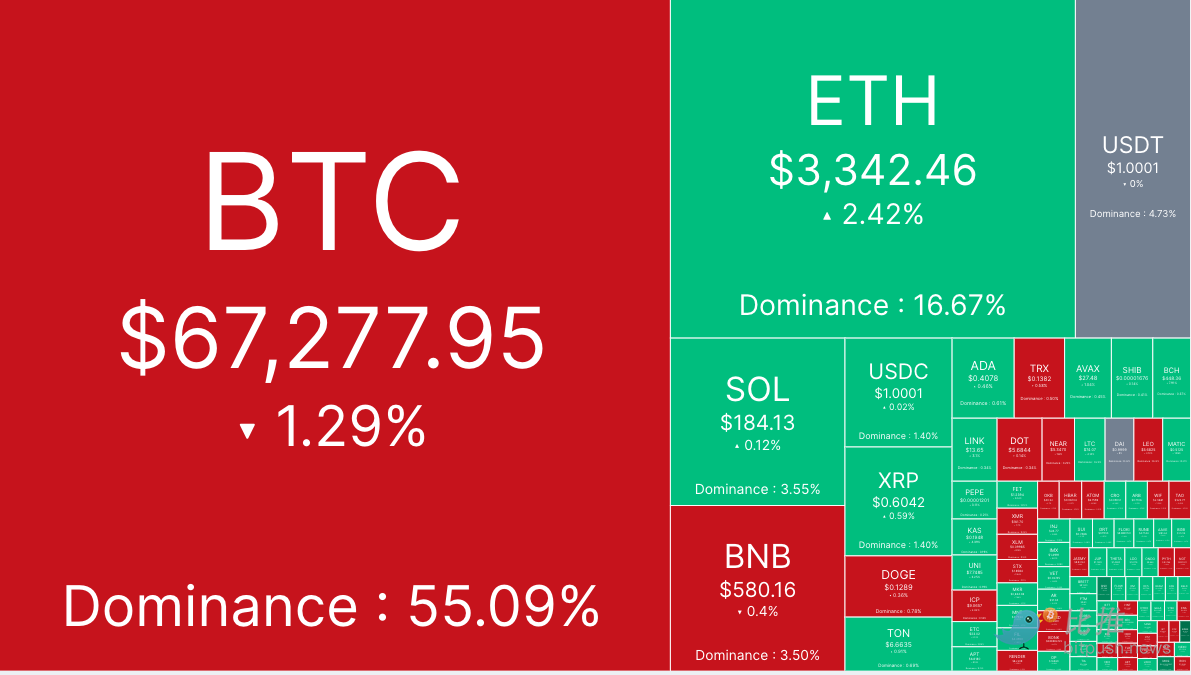

After Trump's speech, Bitcoin fell back to $66,650, but bullish forces revived in early trading on Monday, pushing BTC to the $70,000 resistance level, and market sentiment rose. However, BTC then fell back below the $67,000 support level and fell to an intraday low of $66,393 after midday. As of press time, Bitcoin is trading at $67,277, down 1.2% in 24 hours.

Altcoin trading was mixed, with the top 200 coins by market cap seeing mixed gains and losses.

Book of Meme (BOME) led the gains, up 13.4%, followed by Bitcoin SV (BSV) up 11.9% and Convex Finance (CVX) up 11.6%. Wormhole led the losses, down 6.3%, while SATS (1000SATS) fell 5.1% and Safe (SAFE) fell 4.9%.

The current overall market value of cryptocurrencies is $2.41 trillion, with Bitcoin accounting for 55.1% of the market share.

Ahead of the release of important news this week, such as the Federal Reserve's interest rate decision, the U.S. jobs report and the financial reports of large technology companies, U.S. stocks also fluctuated. At the close, the S&P 500 and Nasdaq 500 rose 0.08% and 0.07% respectively, while the Dow Jones fell 0.12%.

"This week's reports will be critical in determining whether tech stocks and crypto assets can rebound," said analysts at Secure Digital Markets. "Earnings to watch include PayPal, AMD and Microsoft on Tuesday; Meta on Wednesday; and Amazon, Apple and Coinbase on Thursday."

Although the Federal Reserve is expected to keep interest rates unchanged on Wednesday, many market observers believe that Fed Chairman Jerome Powell will lay the groundwork for a September rate cut in a subsequent speech. Wall Street currently puts the probability of a September rate cut at 100%.

US government transfers $2 billion in Silk Road tokens

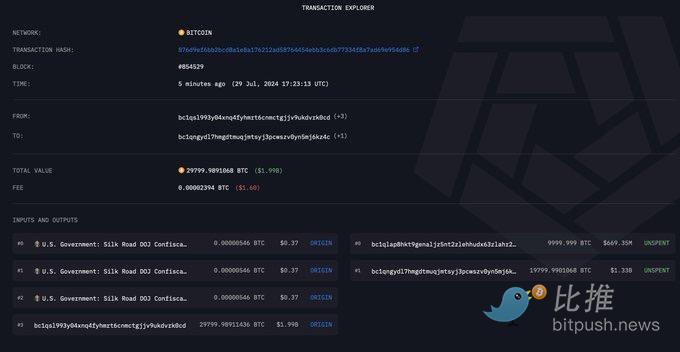

According to on-chain data shared by Arkham Intelligence, the U.S. government’s transfer of BTC may have been responsible for the brief market sell-off.

Arkham Intelligence’s blockchain data shows that a wallet marked as “US Government: Silk Road Justice Department” transferred 29,800 BTC to an unmarked address with no previous transaction history. Subsequently, the address forwarded 19,800 BTC and 10,000 BTC to two different addresses.

Arkham analysts predict that one of the 10,000 BTC transfers, valued at $670 million, was a deposit to an institutional custodian or service.

On-chain analyst @ai_9684xtpa posted on the X platform that the address transferred by the US government this time was used to store some of the tokens seized by Silk Road in November 2020 (a total of 69,369 tokens). The last operation was four months ago. This operation may be for selling, or it may just be a regular fund transfer, because there was also a wallet fund transfer operation on April 2. How the follow-up situation will be remains to be observed.

Trading sideways at key resistance levels

Bitfinex analysts said: "BTC encountered strong upward resistance in the $68,000-69,000 area and withstood a 7.24% intra-week correction. As the accumulation trend in the spot market continues, we expect the $68,000-69,000 level to continue to act as resistance. It is expected to fluctuate around these levels or fall slightly."

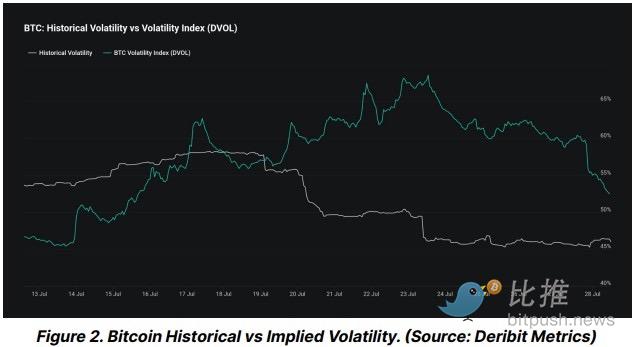

Bitfinex data shows that last week, the implied volatility of BTC options initially surged to a 4-month high of 68.6%, and then fell as most swing/position traders reduced risk before the Nashville conference. There was a brief spike in realized volatility over the weekend and during the Bitcoin conference, but implied volatility continued to fall sharply, which is consistent with typical behavior before option expiration, especially in the absence of major upcoming events or catalysts.

Bitfinex said: “We believe this activity in the options market is driven by some risk reduction in short-term call and put options as the market digests short-term catalysts such as the launch of the Ethereum ETF and the Nashville conference. Another key influencing factor is the monthly expiration date on August 2. Although the net open interest in this contract has a notional value of approximately $2.2 billion, its time value decreases as the expiration date approaches, thus generally leading to a decline in implied volatility.”

“Looking ahead, the market will adjust as the monthly contract expires this weekend. We expect that implied volatility could face further downward pressure. A decline in implied volatility could cause Bitcoin to stagnate or even pull back a bit from the $68,000-69,000 resistance zone,” the analyst predicted.

TradingView analyst TradingShot noted that the resistance zone highlighted by Bitfinex is consistent with Bitcoin’s “parabolic growth channel,” suggesting that Bitcoin will rise sharply once this resistance zone is overcome.

TradingShot said: “Bitcoin is about to end July with a strong test of its historic parabolic growth channel, an area that marks its cyclical bottom and is also the recommended buying area after the bear cycle. This marks the 5th consecutive month of sideways trading, as shown in this 1M chart. This is a behavioral pattern that usually occurs before BTC begins the most intense part of the bull cycle, the "parabolic rally."

“Before that, of course, there was an accumulation phase within the parabolic growth channel. We have been past this phase for a few months and according to the time period, the market has just entered the (green) zone and the parabolic rally could start at any time,” TradingShot concluded.