Written by: WOO

Summary of key points

1. Hot market events

Wintermute: Stablecoin market capitalization rises to $164 billion for the first time in 22 years. -7.25

JD.com: Will issue a stablecoin based on a public blockchain in Hong Kong and pegged to the Hong Kong dollar at a 1:1 ratio. -7.24

Mt. Gox official documents stated that more than 17,000 creditors have been repaid through BTC and BCH. - 7.24

Mt. Gox creditors have received their BTC, BCH and ETH assets in their Bitstamp accounts. -7.25

Kraken CEO: Kraken has returned Bitcoin and BCH to Mt. Gox creditors. -7.24

On the tenth anniversary of Ethereum ICO, the US SEC approved the official listing and trading of spot Ethereum ETF. -7.23

Binance Labs invests in Catizen.AI distribution platform PLUTO Studio. -7.23

Biden announced his withdrawal from the 2024 US presidential election, Harris announced her candidacy for vice president, and may be nominated as the Democratic presidential candidate on August 19. -7.22

2. Introduction to popular tracks (stable currency track)

Importance: The current total market value of stablecoins exceeds US$164 billion, returning to the bull market level in 2022; stablecoins are the cornerstone of DeFi and an important carrier for connecting Web2 and Web3 payments; yield-generating stablecoins have become an important narrative in the stablecoin track in 2024; in March, USDT and USDC issued a total of US$10 billion in stablecoins; the recent trend of stablecoins is relatively optimistic, and the inflow of stablecoins has increased.

Key points: stablecoin definition, stablecoin-related narratives, overall data performance of the track, decentralized stablecoin types, key projects and analysis of the track

Potential projects in the track: Ethena, BitU, Midas, SPOT

1. Hot market events

1. Wintermute: Stablecoin market value rises to $164 billion for the first time in 22 years. -7.25

2. JD.com: Will issue a stablecoin based on a public blockchain in Hong Kong and pegged to the Hong Kong dollar at a 1:1 ratio. -7.24

[1, 2 Analysis and Comments]

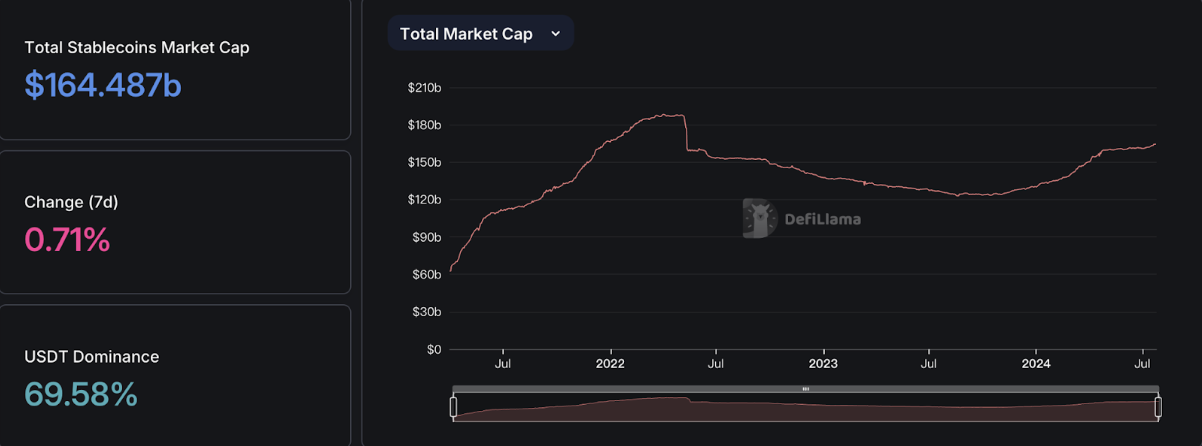

Stablecoin indicators are an important indicator for predicting the future. According to DefiLlama data, the current total market value of stablecoins exceeds 164 billion US dollars, of which the total market value of USDT is 114.3 billion US dollars, accounting for more than 69.71%. From December 2021 to May 2022, before Luna's explosion, the market value of stablecoins in the bull market steadily increased to more than 180 billion US dollars, and has now returned to the level of the previous bull market.

From December to early January this year, Tether issued an additional $7 billion in USDT. In March, Tether and Circle issued an additional $10 billion in stablecoins within 30 days. However, the inflow of stablecoins slowed down after the BTC halving. The recent market trend is relatively optimistic, and the inflow of stablecoins has also increased.

Decentralized stablecoins are considered to be the most crypto-native and orthodox. This year, they have shown signs of restarting after the collapse of UST. Ethena's USDe has flourished under the support of American capital such as Arthur Hayes, with the APR once reaching more than 30%. Usual's USD0 has also entered the market to try to get a piece of the pie.

Since Hong Kong began to pay attention to Web3 in 2022, it has been clarifying the regulatory direction of stablecoins. In December last year, the Hong Kong Monetary Authority once again issued a consultation document on the proposed regulatory system for stablecoin issuers. On July 18 this year, the Hong Kong Monetary Authority announced the list of participants in the stablecoin issuer sandbox, and JD CoinChain Technology (Hong Kong) Co., Ltd. was listed.

On July 24, JD.com announced that it would issue a Hong Kong dollar stablecoin. JD.com's entry into Web3 once caused heated discussions. In the past few years, due to domestic regulatory reasons, large companies quickly retreated after entering the encryption field in the early years. Most of them focused on industrial blockchains and alliance chains, but alliance chains have been proven to be unfeasible. Since 2022, Hong Kong's Web3 policy has been relaxed, but traditional large companies are still cautious. Metaverse XR business and Metaverse PICO laid off employees last year and turned to the AI track. But with the arrival of the bull market trend in the second half of last year, traditional large companies also began to re-enter Web3. For example, Alibaba Cloud and Aptos cooperated to establish the Asia-Pacific developer community Alcove, Alibaba's Ant Chain released a new Web3 brand ZAN, former Ant employees made a parallelized EVM public chain Artela, Tencent invested in Wintermute, Immutable X, Chainbase, etc.

But only JD.com chose stablecoins and targeted the payment track. Because stablecoins with payment attributes are the simplest business line, but also extremely profitable. Once compliant, they will be open to more ordinary users. In fact, Hong Kong's Web3 policy is extremely strict. Many exchanges were rejected for applying for Hong Kong compliance licenses in the middle of the year. Even compliant exchanges did not perform well. The compliance costs of stablecoin issuers are extremely high. It can be seen that JD.com has invested heavily and tried to overtake in the Web3 competition of traditional large companies.

3. Mt. Gox official documents stated that more than 17,000 creditors have been paid through BTC and BCH.

4. Mt. Gox creditors have received the returned BTC, BCH and ETH assets in their Bitstamp accounts.

5. Kraken CEO: Kraken has returned Bitcoin and BCH to Mt. Gox creditors.

[3, 4, 5 Analysis and Comments]

Mentougou was founded in 2010 and was the world's largest Bitcoin trading platform at the time. In 2014, Mentougou was hacked and 850,000 BTC were stolen, which was worth about 480 million US dollars at the time. Mentougou then filed for bankruptcy liquidation. In 2023, Mentougou opened a repayment window and announced a "repayment plan" in May this year, but said it would not sell Bitcoin immediately.

At present, Mentougou has recovered 140,000 BTC (about 9 billion US dollars), and the potential selling pressure has caused a certain degree of panic in the market. On June 24, the Mentougou trustee announced that it would start the repayment of BTC and BCH in July this year, involving crypto assets worth up to 9 billion US dollars. Affected by this, the crypto market staged a "diving" market, and Bitcoin once fell below the 60,000 US dollar mark.

It is reported that Mentougou has a total of 127,000 creditors (Japanese users account for less than 1%), and it needs to repay 142,000 BTC (currently worth about US$8.58 billion) and 143,000 BCH (worth about US$53.311 million) to its creditors.

However, the impact of the Mentougou sell-off may be exaggerated, and it is not a one-time compensation for all assets. Its repayment plan includes basic repayment and proportional repayment. The basic repayment part allows the first 200,000 yen claimed by each creditor to be paid in yen, and the proportional repayment provides creditors with two flexible options, namely "early lump-sum repayment" or "mid-term repayment and final repayment". Among them, the early lump-sum repayment method can only allow creditors to obtain partial compensation, and the part exceeding 200,000 yen allows creditors to choose a mixture of BTC, BCH and yen or pay the full amount in legal currency. And Mentougou set the deadline for basic repayment, early lump-sum repayment and mid-term repayment as October 31, 2024, but if creditors want to obtain a higher proportion of compensation, they may have to wait five to nine years. At the end of 2023, many Mt.Gox creditors have stated that they have received the first compensation denominated in yen. The upcoming compensation plan is the first time that Mt.Gox will repay in the form of BTC and BCH.

At the same time, the time for each exchange to pay creditors is also different. BitGo takes up to 20 days to pay, and Kraken and Bitstamp's payment procedures may take 90 days. In addition, it is also questionable whether individual creditors who bought BTC early will sell BTC. In general, the Mt. Gox sell-off may not be as expected and will not put too much pressure on the market.

6. On the tenth anniversary of Ethereum ICO, the US SEC approved the official listing and trading of spot Ethereum ETF. -7.23

VanEck first disclosed its plan to apply for a US spot Ethereum ETF in 2021, but later withdrew it. Successive applications for spot Ethereum ETFs began in the second half of 2023, including Grayscale, Invesco and Galaxy, BlackRock, Fidelity, Hashdex, VanEcK, ARK 21Shares, etc. Perhaps because the US SEC was busy approving Bitcoin ETF-related matters, it repeatedly postponed its decision on the Ethereum spot ETF until March.

From March to April this year, the US SEC solicited public opinions on the spot Ethereum ETFs of various issuers. Grayscale and Coinbase also consulted with the SEC to discuss the rule changes for launching spot Ethereum ETFs. Starting in May, issuers such as ARK Invest, 21Shares, Fidelity, Grayscale, and Franklin Templeton deleted the "Ethereum pledge" service in the ETF application documents, while CoinShares and Valkyrie stated that they would not apply for Ethereum spot ETFs, mainly because there was no pledge. Since then, the Ethereum ETF has been approved and is on the right track. Therefore, all Ethereum ETFs do not provide pledges.

The Block data shows that the cumulative trading volume of 9 Ethereum spot ETFs on the first day of listing on US exchanges exceeded US$1.019 billion. Among them, Grayscale Ethereum Trust (ETHE) led with a trading volume of US$456 million, accounting for nearly half of the total trading volume; the net inflow on the first day was US$106.6 million, but there was a net outflow in the next two days, with a net outflow of US$133 million on the 24th and a net outflow of US$152 million on the 25th.

At present, the traditional market consensus on Ethereum is not as good as Bitcoin. Since there is no staking income, Ethereum ETF has no demand for insiders, so the buying is weaker than Bitcoin. However, due to the difference of more than 10 times in management fees of Grayscale Ethereum Trust, there is still room for arbitrage, but since Grayscale has split out a low-fee mini trust, the selling may decrease.

7. Binance Labs invests in Catizen.AI distribution platform PLUTO Studio. -7.23

There is a rumor that VCs are looking at the TON ecosystem but cannot make a move. That is because the TON project cycle is usually only 2 months. If the VC round is locked for 2 years, then naturally they cannot make a move. Therefore, it can be found that Binance chose the game development company behind Catizen. The Pluto team comes from Web2 and has more than 10 years of experience in Web2 applets.

I think Catizen is TON mini-game 2.0, which goes beyond the boring "click and click" and is a real game. This game is now No. 1 on TON. On July 24, Telegram CEO Pavel Durov said that Catizen has more than 26 million players and has earned $16 million through in-app purchases. This number of users and revenue capacity are rare in the current Web3 world.

8. Biden announced his withdrawal from the 2024 US presidential election, Harris announced his candidacy for vice president, and may be nominated as the Democratic presidential candidate on August 19. -7.22

During the competition between Biden and Trump, Trump, who was shot in the ear and shouted "Fight" under the American flag,

He won important public opinion in the United States, and even Elon Musk expressed his support for him on Twitter. Trump also received praise from crypto practitioners for his participation in Crypto (issuing NFTs), crypto-friendly remarks, and crypto-friendly policies. Messari CEO Ryan Selkis even resigned for making radical remarks in support of Trump.

However, after Biden announced his withdrawal from the presidential election, Harris also received extremely high support as she may become the first black female president of the United States. Polls show that Harris's support rate is higher than Trump's. However, Harris refused to attend the Bitcoin 2024 conference hosted by Bitcoin Magazine, so Trump's support rate is still far ahead on the prediction market Polymarket. It is worth noting that driven by the US election, Polymarket's transaction volume in July exceeded US$275 million, a record high.

In addition, the US election played an important role in promoting political meme coins on Solana.

2. Introduction to popular tracks (stable currency track)

2. Basic introduction of the track

2.1 What is a stablecoin?

Stablecoins are a special type of cryptocurrency whose value remains constant over time, rather than being volatile like other cryptocurrencies. Stablecoins are usually stabilized by pegging their value to another more stable asset, or they can be uncollateralized, purely algorithmic stablecoins.

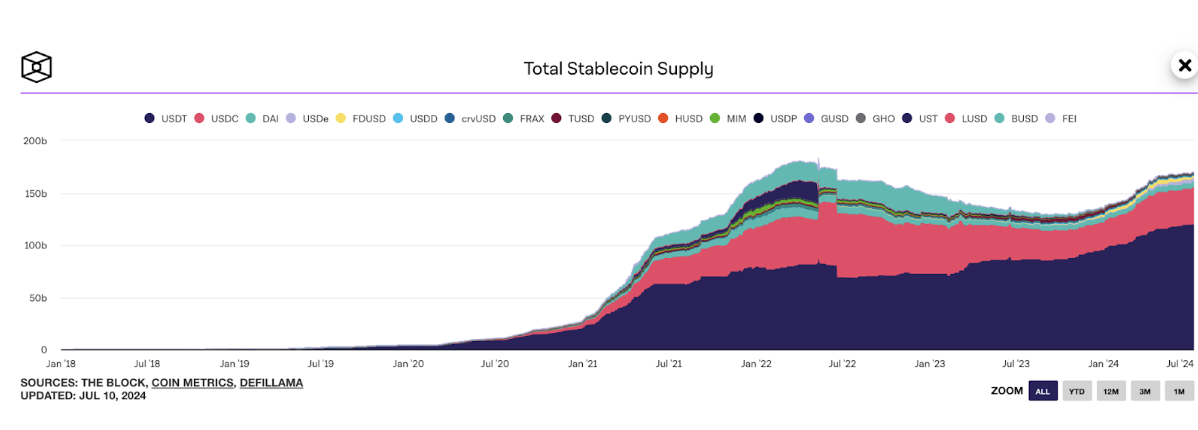

Stablecoins are divided into centralized and decentralized stablecoins, both of which first appeared in 2014. The earliest centralized stablecoin was Tether, a centralized entity established by the core members of Bitfinex in the Cayman Islands, and issued USDT. Currently, USDT is the most widely used stablecoin with the highest market value. Currently, there are nearly 50 centralized stablecoins in the industry, including USDT, USDC (Circle), FDUSD (First Digital), PYUSD (PayPal), TUSD (TrueUSD), USDY (Ondo), BUSD (Binance), GUSD (Gemini), etc.

Decentralized stablecoins refer to stablecoins that are issued and governed in a decentralized manner, pegged to the US dollar at a 1:1 ratio, and do not require the intervention of centralized institutions/entities. Decentralized stablecoins are regarded as the "holy grail" of financial technology. The earliest decentralized stablecoin appeared in 2014, which was BitUSD issued by BitShares. However, four years after its issuance, BitUSD also decoupled from the US dollar and has never recovered since then. Terra/Luna's UST was the most famous decentralized stablecoin in the last bull market, but it caused great damage to the industry because it fell into a death spiral.

The performance of stablecoins varies widely, depending on the type of collateral backed.

2.2 Narrative

In the Crypto world, stablecoins are the cornerstone of DeFi. They provide a stable medium of exchange, and users can buy and sell without having to convert them back to fiat currency.

The narrative of stablecoins is mainly focused on their characteristics, namely "stability" + "coin". Usually, stablecoins are much less volatile than other cryptocurrencies such as BTC and ETH. As a cryptocurrency, they have the characteristics of "peer-to-peer electronic payment" envisioned by Satoshi Nakamoto. Decentralized stablecoins also have the anti-censorship advantages of cryptography. For algorithmic stablecoins, they are more in line with the spirit of encryption and the ideal of decentralization.

In the past two years, stablecoins have been regarded as a bridge connecting Web2 and Web3. Compared with traditional cross-border payment methods such as SWIFT, stablecoins have higher costs and clearing and settlement efficiency. In Africa, USDT and Binance P2P are very popular. The African continent is vast and fragmented, with close ties with overseas countries. Cross-border payments are extremely popular, and stablecoins are its important payment and settlement currencies. For example, the TRON version of USDT has a strong dominant position in emerging markets. In South America, Africa, Turkey and other regions, the TRON version of USDT once had a market share of more than 70%, or even 80%. Payment giant PayPal has more than 430 million users and occupies 40% of the payment market. Its stablecoin PYUSD has a huge influence in Web2. JD.com is targeting the Hong Kong dollar stablecoin, and is also targeting the blue ocean market of compliant stablecoins combined with payments and cross-border payments.

In addition, in these developing countries, inflation and currency depreciation problems in various regions are extremely serious due to the flood of US dollars and the Federal Reserve's interest rate hikes. Stablecoins are a very good carrier for hedging against inflation and currency depreciation, which is very consistent with Satoshi Nakamoto's ideal of fighting against central banks when he first designed Bitcoin.

In the narrative of decentralized stablecoins, MakerDAO's DAI is the first to bear the brunt. DAI was named because the founder knew Chinese, which means "loan". Another alternative currency name is "JIAO", which was the world's earliest "official" paper currency issued during the Northern Song Dynasty. At the same time, DAI is also to pay tribute to Dai Wei, the founder of digital currency and B-money.

But so-called stablecoins are usually not stable, whether they are centralized stablecoins or decentralized stablecoins. In March 2023, Silicon Valley Bank filed for bankruptcy, resulting in the freezing of some of Circle's cash reserves in the bank, which led to a decline in market trust in USDC, a large-scale run and sell-off, and the price of USDC once fell to $0.878. The decoupling of USDC has also led to a certain degree of decoupling of decentralized stablecoins such as DAI, FRAX, and MIM.

LUNA crashed, and the market took two years to digest it. This year, the overall market trend is good, and stablecoins have also ushered in a wave of innovation. Decentralized stablecoins are on the stage again. This year, with the iteration and upgrade of asset income models, the narrative of interest-bearing stablecoins has become the mainstream paradigm of the market. The more famous ones include Ethena's USDe, Blast's USDB, Ondo's USDY, Mountain Protocol's USDM, Lybra's eUSD, etc. The sources of income for these stablecoins are more diversified, including U.S. Treasury bonds, Ethereum staking income, structured strategy income, etc.

But in any case, the performance of stablecoins is an important indicator of the bull market. It means the movement of off-market funds and their attitude and sentiment towards the crypto market.

2.3 Overall data performance

According to data from DefiLlama and Wintermute, the total market value of the stablecoin industry (including hundreds of tokens) has jumped to more than $164 billion for the first time since the Terra crash in May 2022, returning to the level of the previous bull market. Wintermute said this "indicates growing investor optimism, supporting the bullish outlook. The increase in stablecoin supply shows that funds are being deposited into the on-chain ecosystem to generate economic activity, either through direct on-chain purchases that can catalyze price appreciation or through yield-generating strategies that can improve market liquidity. This activity ultimately promotes positive on-chain growth."

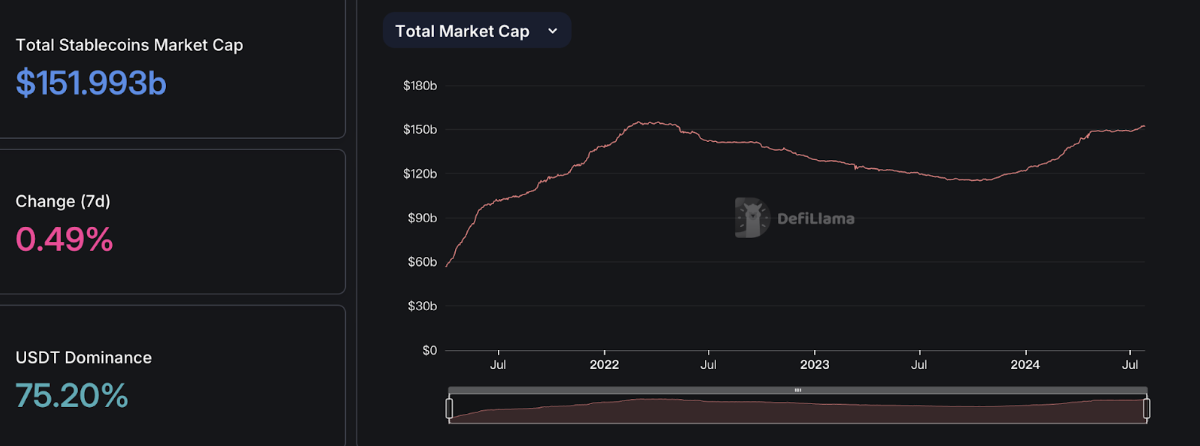

Centralized Stablecoins

Currently, the market value of stablecoins backed by fiat currencies is US$151.99 billion (accounting for 92.4% of the market share in the entire stablecoin market), which has returned to the level of the previous bull market.

Affected by the bankruptcy of Silicon Valley Bank, the market value of USDC has shrunk, while USDT accounts for 75.2%.

Decentralized Stablecoins

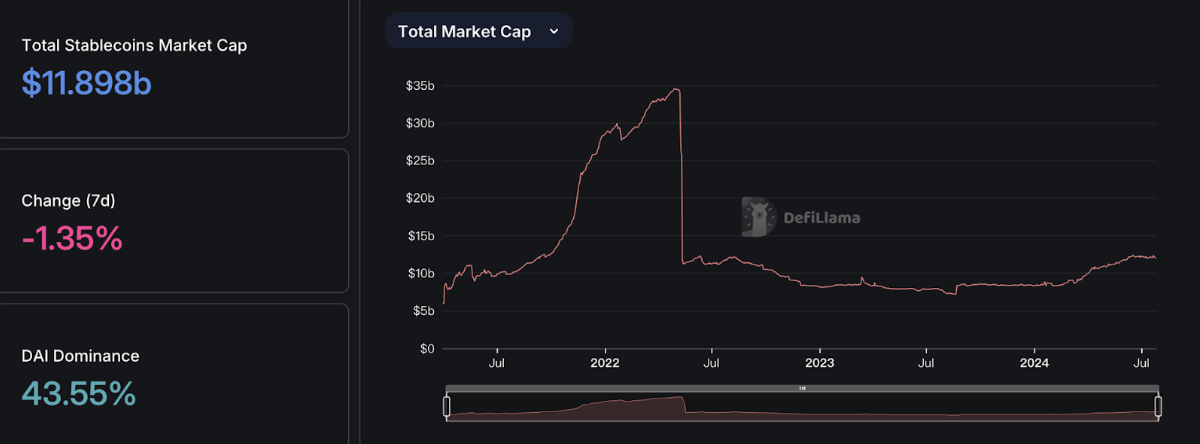

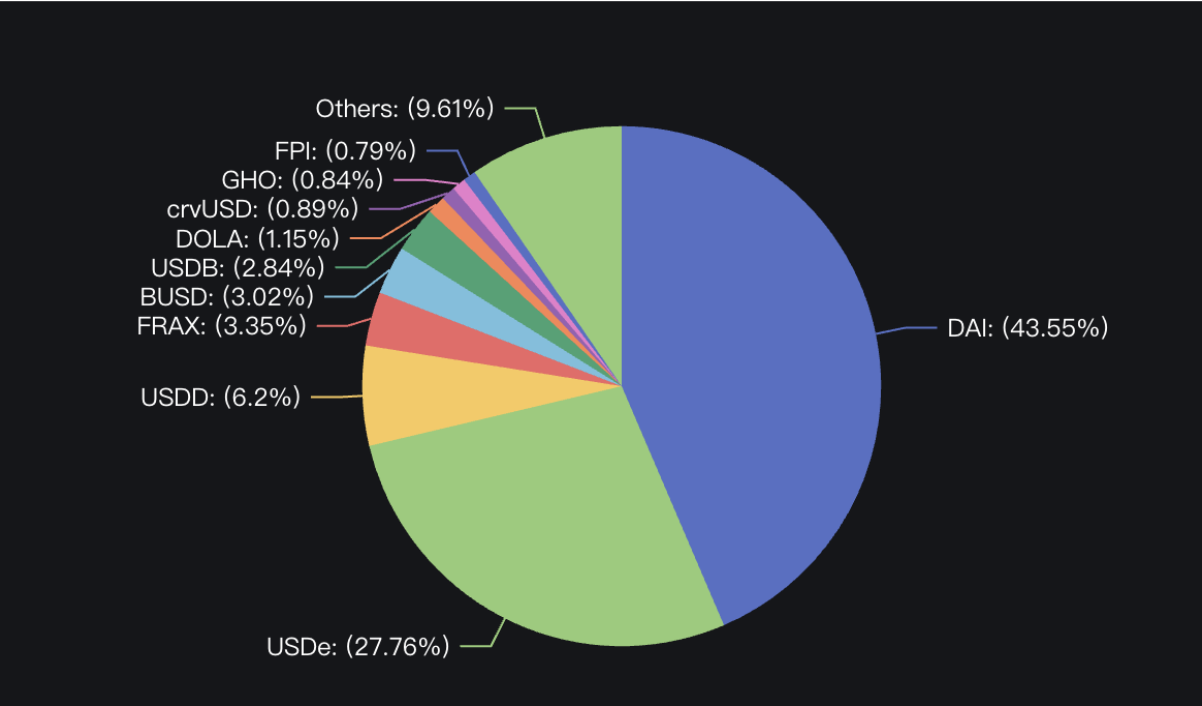

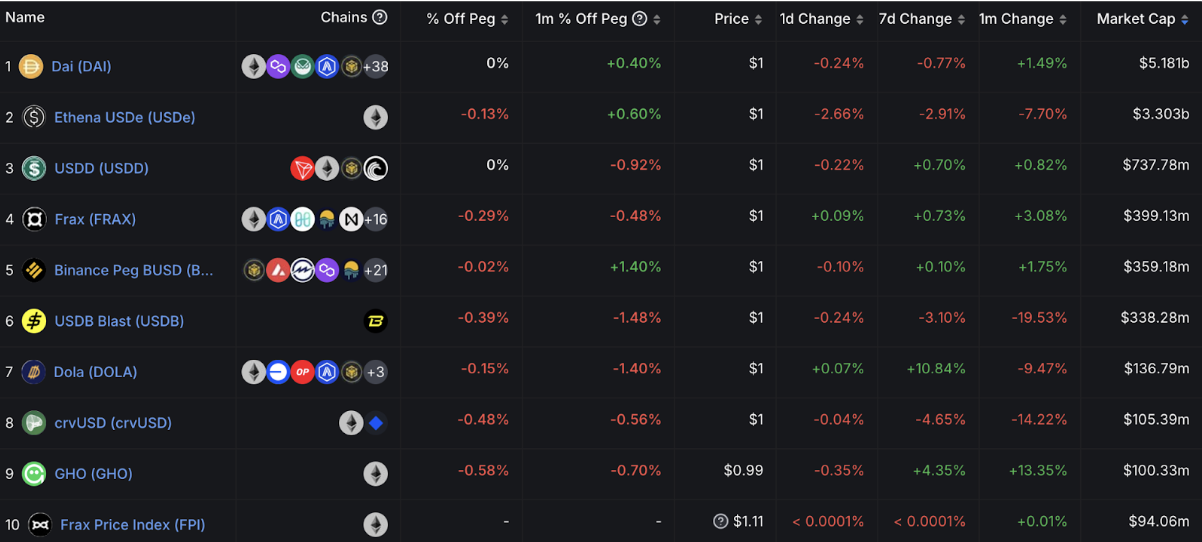

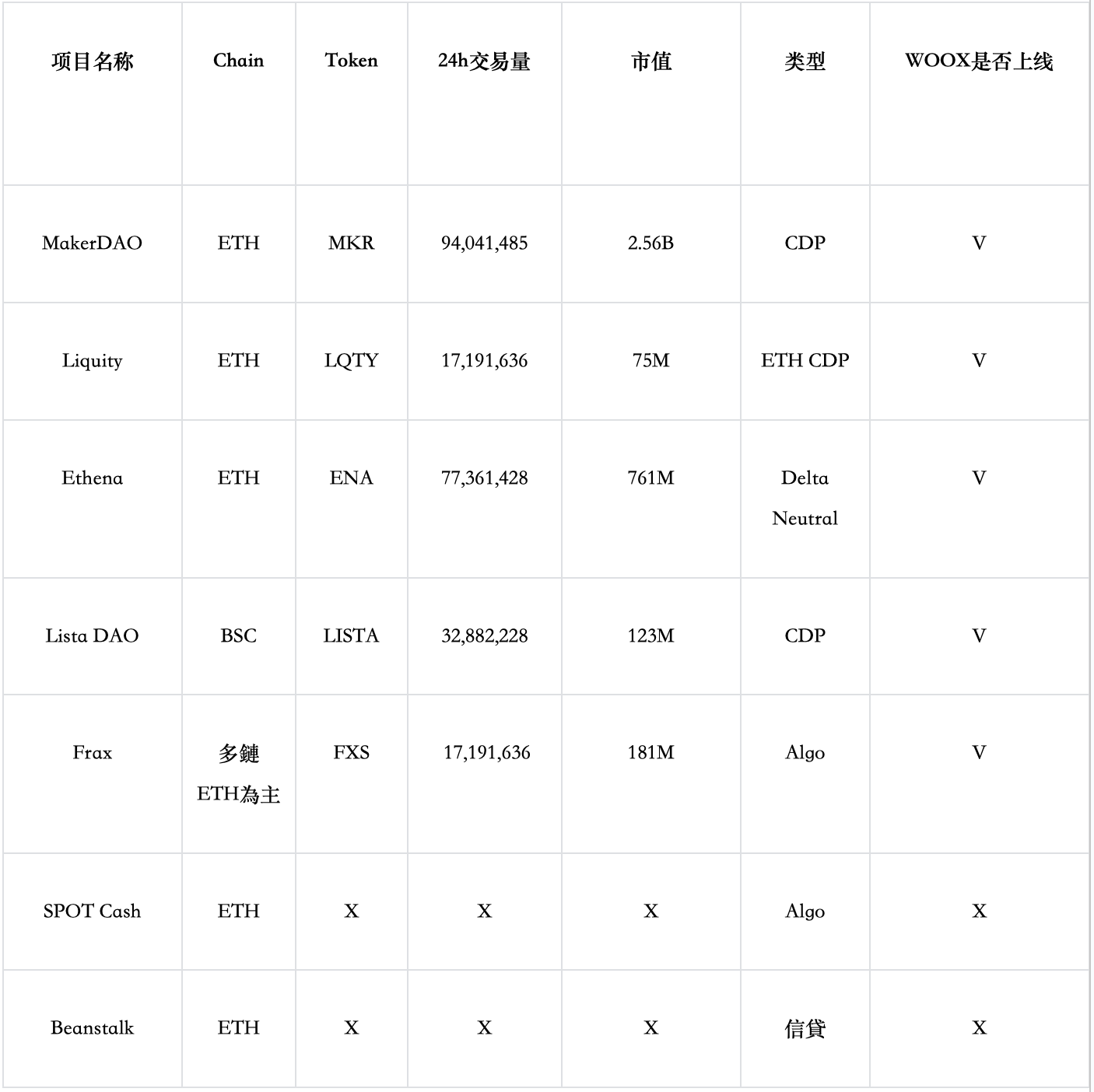

There are currently more than 100 decentralized stablecoins on the market, with a total market value of $11.89 billion, which has not yet returned to the $30 billion level of the previous bull market. Among them, MakerDAO's DAI dominates with 43.55% and a market value of $5.181 billion.

Since the beginning of this year, Ethena's USDe has performed the best, with a market value of over US$3.3 billion, becoming the second largest decentralized stablecoin. The market value of other decentralized stablecoins has not exceeded US$1 billion.

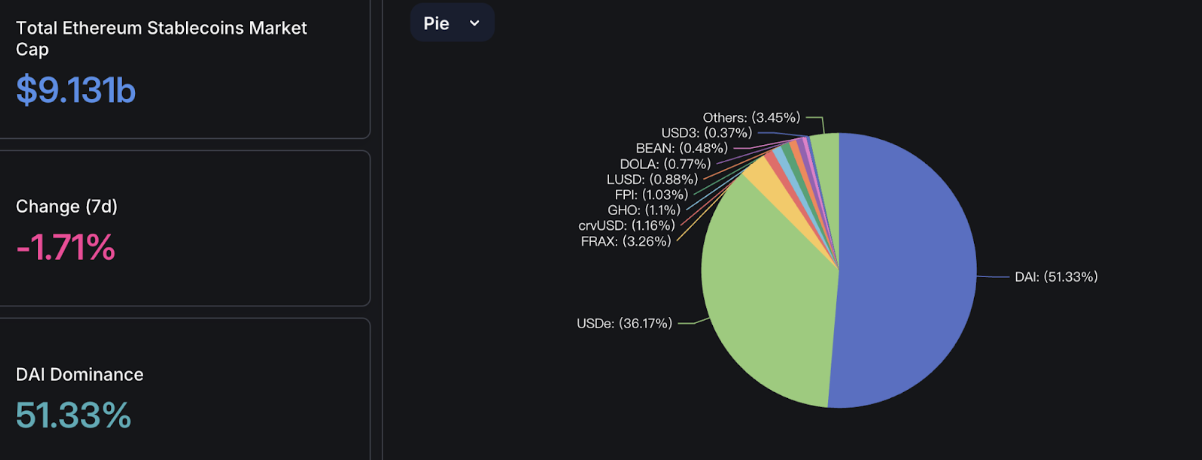

In the decentralized stablecoin market with a market value of US$11.89 billion, there are US$9.131 billion worth of stablecoins on the Ethereum mainnet, accounting for 76.79%, of which DAI accounts for 51.33%.

It is worth noting that among the top ten decentralized stablecoins by market value, the second-ranked USDDe has a market value of $3.3 billion, all on the Ethereum mainnet, while the sixth-ranked USDY has a market value of $338 million, all on Blast. Other head protocols are mainly multi-chain.

The market value of algorithmic stablecoins is $1.47 billion, accounting for 12.35% of the total market value of decentralized stablecoins. However, since the collapse of Luna, algorithmic stablecoins have been in a slump and are still on a downward trend. Currently, the more well-known projects include USDD (market value of $737 million) and FRAX launched by Justin Sun The market value of other algorithmic stablecoins does not exceed $100 million.

2.4 Decentralized Stablecoin Types

Decentralized stablecoins are mainly divided into crypto-asset collateralized stablecoins and uncollateralized pure algorithmic stablecoins. The performance difference of stablecoins is also mainly affected by the collateral. According to the collateral, decentralized stablecoins can be divided into over-collateralized stablecoins, algorithmic stablecoins, hybrid algorithmic stablecoins, and delta-neutral stablecoins.

Overcollateralized stablecoins

Overcollateralized stablecoins are a common type of decentralized stablecoins, and their assets usually come from cryptocurrencies such as BTC and ETH. The representative of this type is MakerDAO's DAI, which deposits ETH and other ERC20 tokens into smart contracts, and automatically issues DAI at a certain collateral rate by the smart contract, which is equivalent to a "decentralized central bank". The advantage of this type is that the investment is relatively stable, but too much collateral assets will also reduce capital efficiency, and when the collateral assets fluctuate greatly, it may trigger liquidation. At present, MakerDAO is also exploring the possibility of using RWA as collateral.

Algorithmic Stablecoins

Algorithmic stablecoins use market demand and supply to maintain their own fixed prices without the need for actual collateral support. They are anchored to the US dollar based on mathematical formulas and incentive mechanisms. These stablecoins use algorithms and smart contracts to automatically manage supply to keep prices stable. There are three types of algorithmic stablecoins: Rebase (elastic supply mechanism), Seigniorage (coinage tax) and Fractional Stablecoins. Ampleforth uses Rebase, which does not set a supply cap and automatically adjusts the supply according to market demand to balance the price. When the price is above $1, the supply increases, and when the price is below $1, the supply decreases.

The seigniorage mechanism adopts a dual-token model, usually consisting of a stablecoin and a governance token. Terra's UST and LUNA are designed in this way. UST is pegged to the US dollar at a 1:1 ratio, and users can destroy 1 US dollar of LUNA in the market to mint 1 UST, and vice versa. If UST exceeds the anchor price, 1 US dollar of LUNA can be exchanged for 1 UST worth more than 1 US dollar and sold at a profit. If UST is lower than the anchor price, 1 UST can be exchanged for 1 US dollar of LUNA. Under the seigniorage mechanism, the platform maintains the dynamic stability of stablecoin prices by encouraging users to actively arbitrage.

Fractional Stablecoins

The third type of stablecoin is Fractional Stablecoins, which is a hybrid algorithmic stablecoin. It uses a partial algorithm and a partial collateral method, and its collateral ratio is usually less than or equal to 100%. This method allows users to support with less total value of US dollars or cryptocurrencies, which improves capital efficiency. If the price of a stablecoin exceeds $1, the algorithmic system will automatically create more stablecoins until the price falls back to $1. If it falls below $1, the stablecoin will be considered over-collateralized and the algorithm will destroy the excess stablecoins. Frax is a representative of this type.

Delta Neutral Stablecoin

Delta neutral stablecoin is a portfolio risk management strategy that achieves Delta neutrality by long amounts of spot and short equal amounts of contracts, earning income from funding rates. Ethena is one of the representatives.

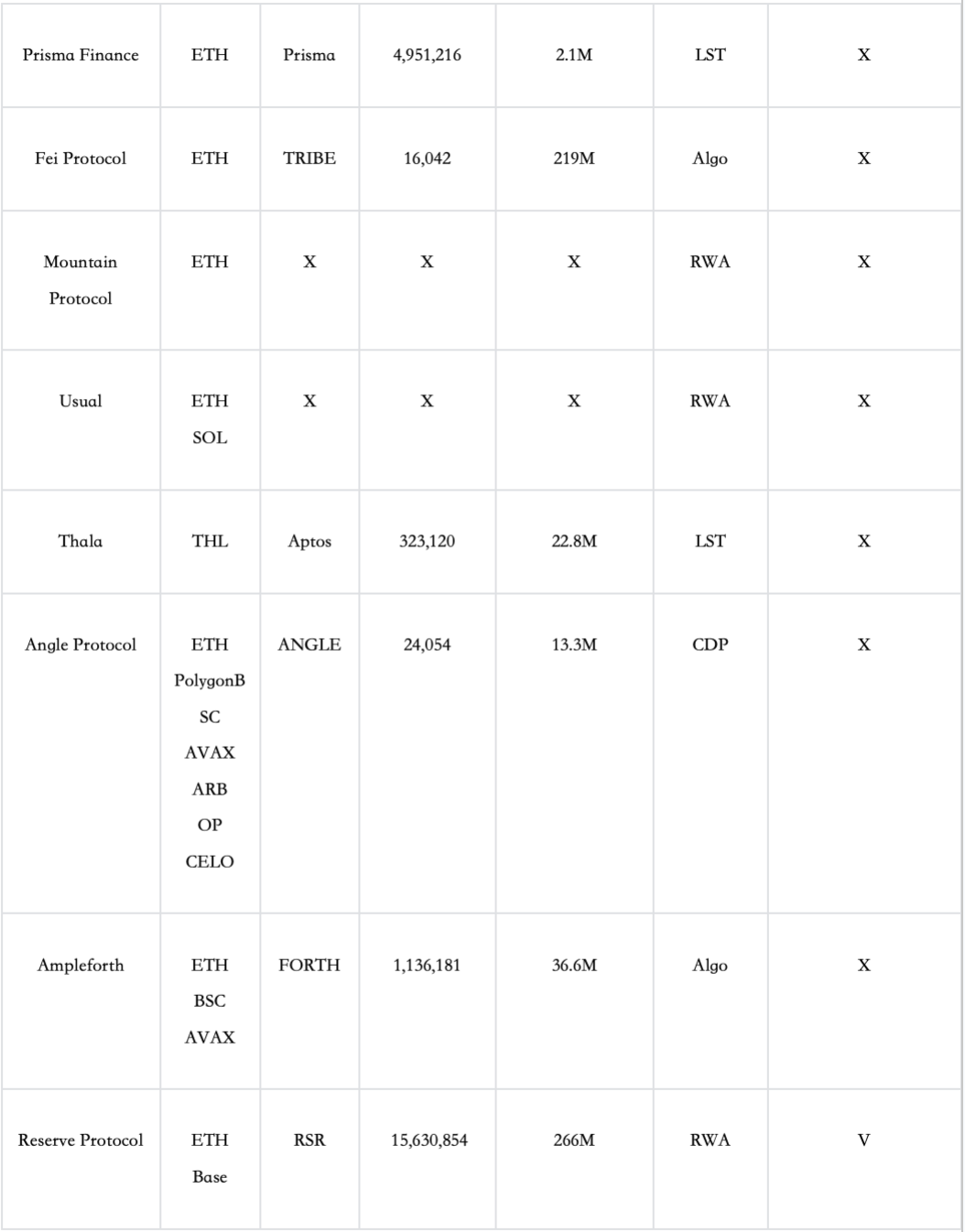

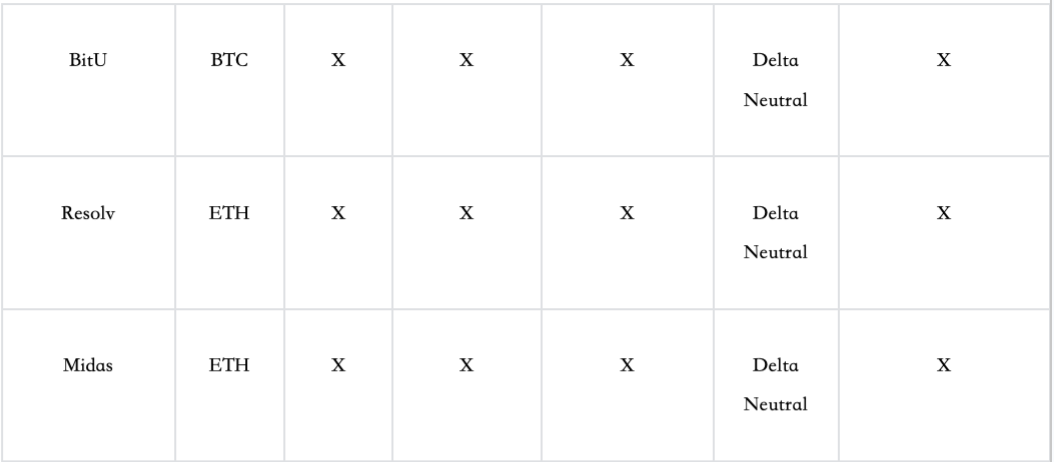

3. Track Ecology

4. Analysis of key projects

1) Project name: Ethena

Official website: https://ethena.fi/

Twitter: https://x.com/ethena_labs

Introduction: Ethena is a synthetic dollar stablecoin protocol built on Ethereum, which provides a "synthetic dollar" USDe through a Delta neutral strategy.

Ethena's synthetic USD stablecoin, USDe, provides a crypto-native, scalable currency solution by triangulating Ethereum and Bitcoin collateral. USDe is fully secured (there are still risks that may cause the guarantee to expire) and can be freely combined in decentralized finance (DeFi). Users can also choose to stake USDe, obtain sUSDe and obtain a share of the protocol revenue.

Features:

Staking income of collateral such as LST (1x long, Beta value is +1)

Open short futures and perpetual contracts to arbitrage basis and funding rate (1x short, Beta value is -1)

USDe's income changes mainly come from spot-futures arbitrage

Ethena launches insurance fund to subsidize yields during negative rates

Recent updates:

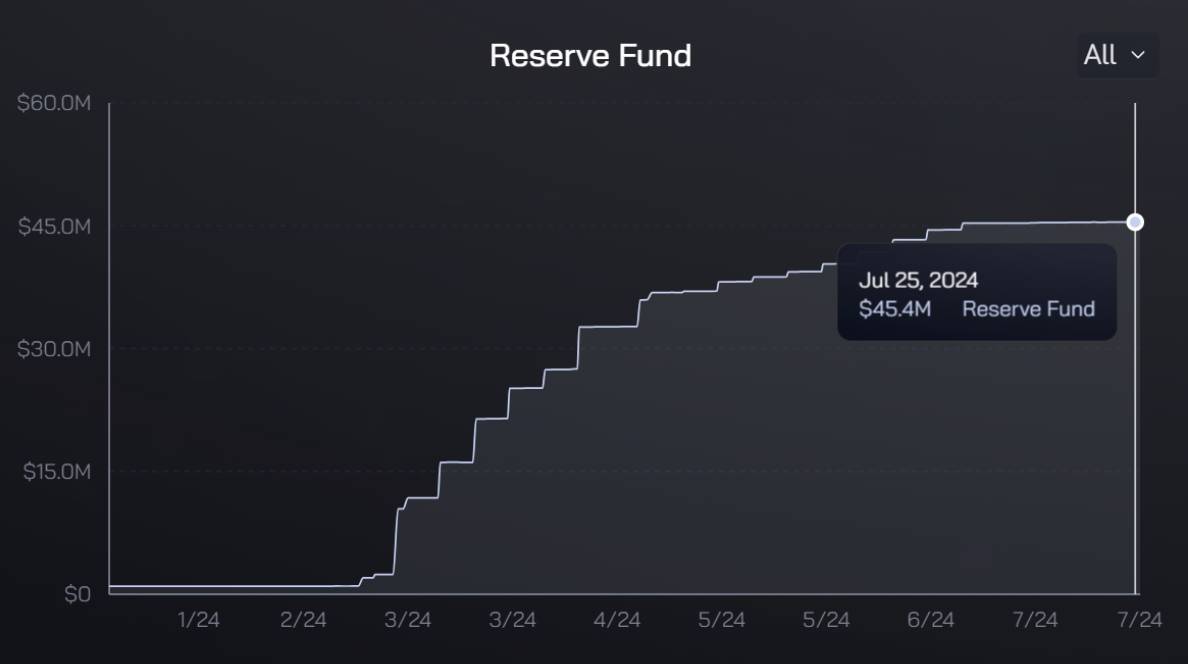

The Treasury is currently at ATH with total assets of $45 million

July 24: Announced plans to allocate part of its $235 million USDT stablecoin collateral and $45 million reserve fund to income-generating RWA products. BlackRock BUIDL issuers Securitize and Steakhouse Financial have applied to the Ethena Governance Committee for Ethena reserve fund allocations.

Securitize said BUIDL could enable Ethena’s reserve fund to invest in products backed by U.S. Treasuries, proposing an allocation of $34 million from a $45 million reserve.

July 23: Scroll announces integration with Ethena, bringing USDe to Scroll

July 9: Lyra, an options protocol, announced a partnership with Ethena Labs to launch the sUSDeBULL strategy, which earns sUSDe principal protection income through an automatic long call spread strategy. The upper limit of the fund pool is 10 million sUSDe.

3) Project name: BitU

Official website: https://www.bitu.io/

Twitter: https://x.com/bitu_protocol

Introduction: BitU is a crypto native collateral stablecoin protocol that uses off-chain liquidity and efficiency to provide higher returns (ALMM). Currently, only whitelisted users are allowed to pledge BTC to mint stablecoin $BITU, with a minimum collateral ratio of 200% and a liquidation ratio of 110%.

Features:

Ethena can be considered as the Bitcoin version

The source of income is lending + Delta neutral strategy. The protocol maps the user's mortgaged assets to centralized exchanges and lends funds to market makers and hedge funds. In the Delta neutral strategy, MirrorX, an over-the-counter settlement solution provided by Ceffu, is used to generate income.

Stake$BITU Get $sBITU and passively get rewards generated by ALMM. Rewards are generally distributed once a month.

Selected for the 7th Season MVB Program in Binance Labs

Recent updates:

July 1st announced the launch of Math Wallet dApp Store

On June 27, TVL was displayed on DefiLlama, and the current TVL is 21.35 million US dollars;

On June 14, it announced a partnership with CeffuGlobal to use their engine for over-the-counter settlement to enhance user security.

On April 9, it was announced that it had joined Binance Labs MVB Season 7; through ALMM, the protocol funds are managed, the pledged assets are mapped to the exchange, and the ALMM's yield module uses them to generate returns. Ultimately, the profits will be shared with users

3) Project name: Midas

Official website: https://midas.app/

Twitter: https://x.com/MidasRWA

Introduction: The RWA project is an asset tokenization platform that provides investment in institutional-grade assets on the chain. Through Midas, investors can access on-chain investment-grade securities while utilizing a full set of DeFi applications through permissionless ERC-20 tokens.

Features:

Use USDC to buy stablecoin mBASIS on the Midas platform. The stablecoin transferred to Midas is first placed in the custodian Fireblocks. The minimum amount for the first purchase is 120,000 USDC.

Use a Delta neutral strategy, take advantage of highly liquid currencies such as BTC or ETH, hold spot, and short in the contract market.

The capital allocation of mBASIS is more diversified. It is allocated to the top 20 Altcoin and US Treasury bonds. If the interest rate turns negative, the project will seamlessly convert the assets into mTBILL (US Treasury bonds). Therefore, the yield of mBASIS can always be higher than the TBILL interest rate.

The current APY is about 10%, and the management scale is 1M

Not for use by U.S. residents

Recent updates:

July 24 Partnering with MetaWealth to provide compliant, institutional-grade RWAs and structured products to a broad audience, starting with commercial real estate

mBASIS, newly launched on June 21, has made little progress

4) Project name: SPOT

Official website: https://www.spot.cash/

Twitter: https://x.com/SPOTprotocol

Introduction:

Ampleforth's decentralized algorithmic stablecoin is created by reorganizing the volatility of its collateral asset (AMPL) into two derivative assets.

The AMPL protocol can automatically adjust the number of AMPL tokens in all user wallets. When the market price of AMPL is higher than $1, the token balance in the wallet will automatically increase, which is equivalent to issuing more tokens to all wallets in proportion; when the market price of AMPL is lower than $1, the token balance in the wallet will decrease in proportion.

SPOT is a low-volatility derivative of AMPL as a stablecoin. stAMPL is a high-volatility derivative of AMPL

Features:

On July 8, Coinbase provided strategic financing of $1 million.

It is closely related to the Coinbase system, and its founder Brian Armstrong calls it the next generation of stablecoin.

Stablecoins in the non-traditional sense do not always maintain price stability, but have low volatility. Their purpose is to use mechanisms to completely decentralize inflation.

Recent updates:

July 20th: Announcement of opening of SPOT/USDC stablecoin pool at Aerodrome

Before obtaining financing from Coinbase, he rarely posted on Twitter. After obtaining financing, he announced the issuance on Base & the opening of a new pool mentioned in the first point.