Bitcoin is once again experiencing a roller coaster ride. OKX market data shows that around 21:00 last night, BTC once again exceeded 70,000 USDT after more than a month, reaching a maximum of 70,050 USDT. (But it only lasts less than a minute)

However, just when the market was speculating on whether this would be a harbinger for BTC to reach new highs, BTC immediately suffered a rapid and significant correction. At around 10:00 today, BTC once fell below $66,000. The situation of ETH is slightly different. It may be affected by events such as the implementation of ETFs and grayscale outflows. ETH's rise before BTC broke through 70,000 USDT was not ideal, but perhaps the market is looking forward to a potential inflow/outflow inflection point. ETH's rise here The callback is not too obvious.

The trend of the Altcoin market is relatively noteworthy. Changed from the previous practice of " when BTC rises, the altcoins do not move, and when BTC falls, the altcoins collapse ". During this sharp correction of BTC, Altcoin generally did not experience a major correction. Most currencies The 24-hour declines were smaller than those of BTC, and some Altcoin such as PEPE, AAVE, and LDO even recorded positive values for the time being.

Alternative data shows that although today's Panic and Greed Index is still in a "greedy" state, the value has dropped from 74 to 67, and the decline will be significant.

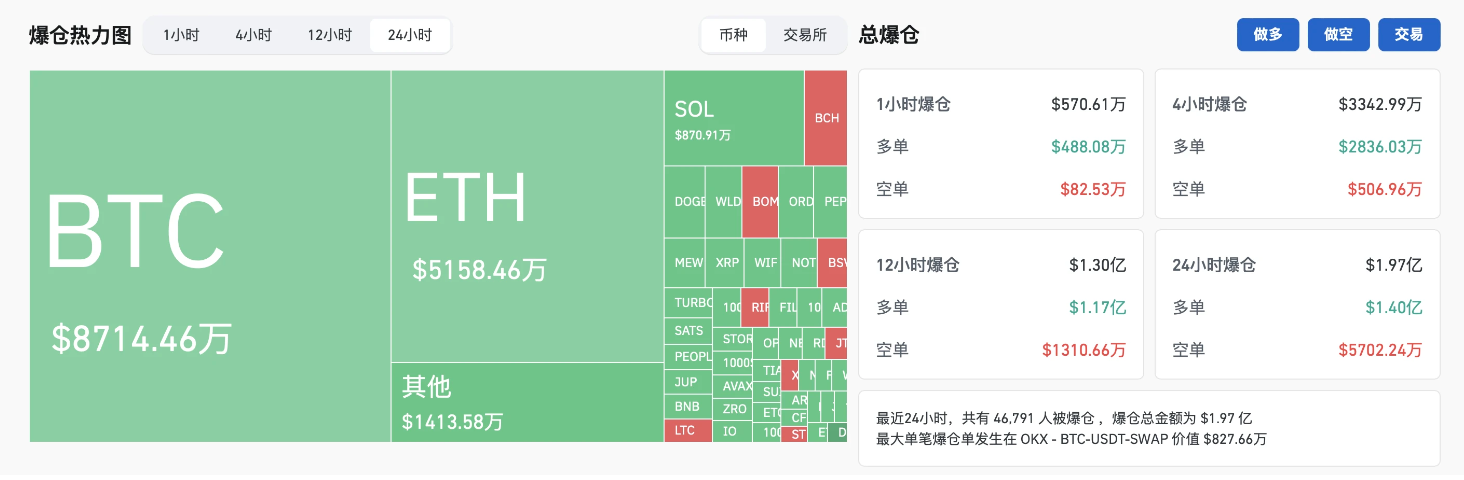

In terms of derivatives data, Coinglass data shows that in the past 24 hours, the entire network has liquidated positions of US$197 million, most of which were long orders, amounting to US$140 million. In terms of currency types, BTC liquidated positions at US$87.1446 million and ETH liquidated at US$51.5846 million.

BTC: The pullback is expected, institutions and miners are still optimistic

Let’s first look at the market of BTC. Benefiting from the positive sentiment at the Nashville Bitcoin Conference, and especially the fact that a number of politicians represented by Trump have successively released unexpectedly friendly information, BTC has maintained a stable performance last week (especially in the second half of the week). A relatively strong performance.

Based on this background, with the conclusion of the conference, the market also has certain expectations for the potential correction of BTC.

Extended reading: Trump shouted: Fire SEC Chairman Gary Gensler on the day he wins the election! All Bitcoin supporters stood up and applauded

Bitfinex Alpha released a report yesterday stating that the implied volatility of the Bitcoin options market surged simultaneously during the Nashville conference, but the implied volatility has declined recently, which means that there may be a slight consolidation in the short term.

However, around 7:30 this morning, the Mt.Gox address once again made a small test transfer (0.02 BTC). Considering that Mt.Gox would conduct substantial large-amount transfers every time after performing similar operations. This also aggravated the panic in the market, causing the pullback to further amplify - the low of today's pullback appeared at around 8:15, shortly after this news appeared.

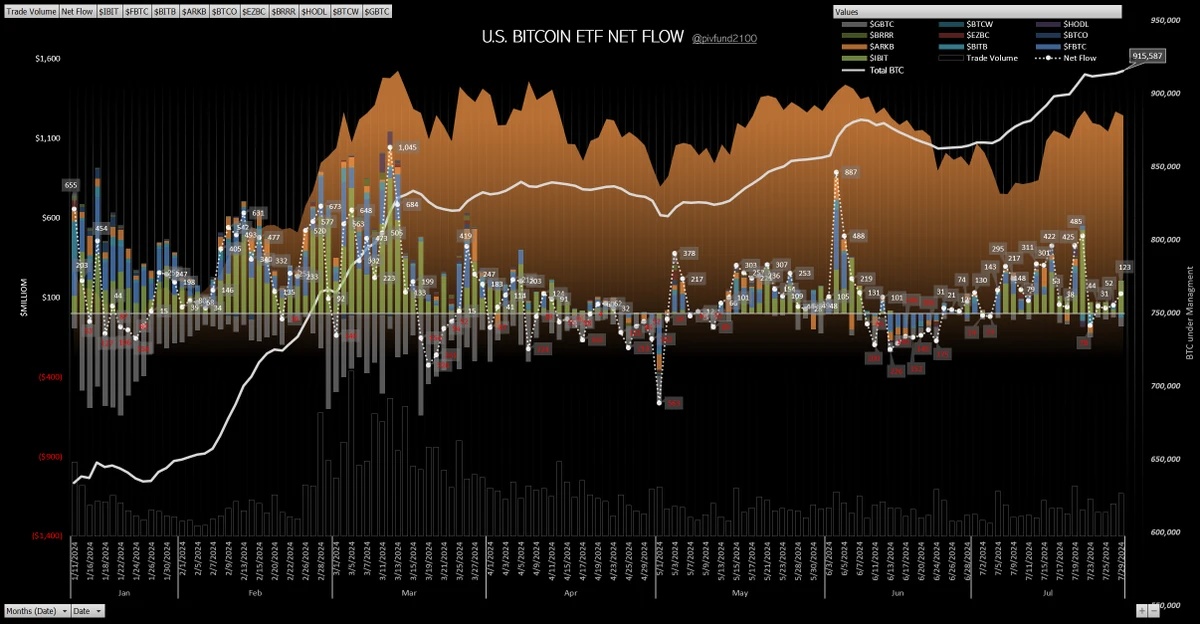

However, judging from the outflow/flow situation of ETFs, institutions still maintain a relatively optimistic sentiment towards BTC for the time being. Trader T monitoring shows that the net inflow of U.S. Bitcoin spot ETFs yesterday was US$123.1 million, which means that in the past half month (only counting trading days), there was only one day of net outflows in the ETF market, and there were more than ten other trading days. All maintain positive inflow.

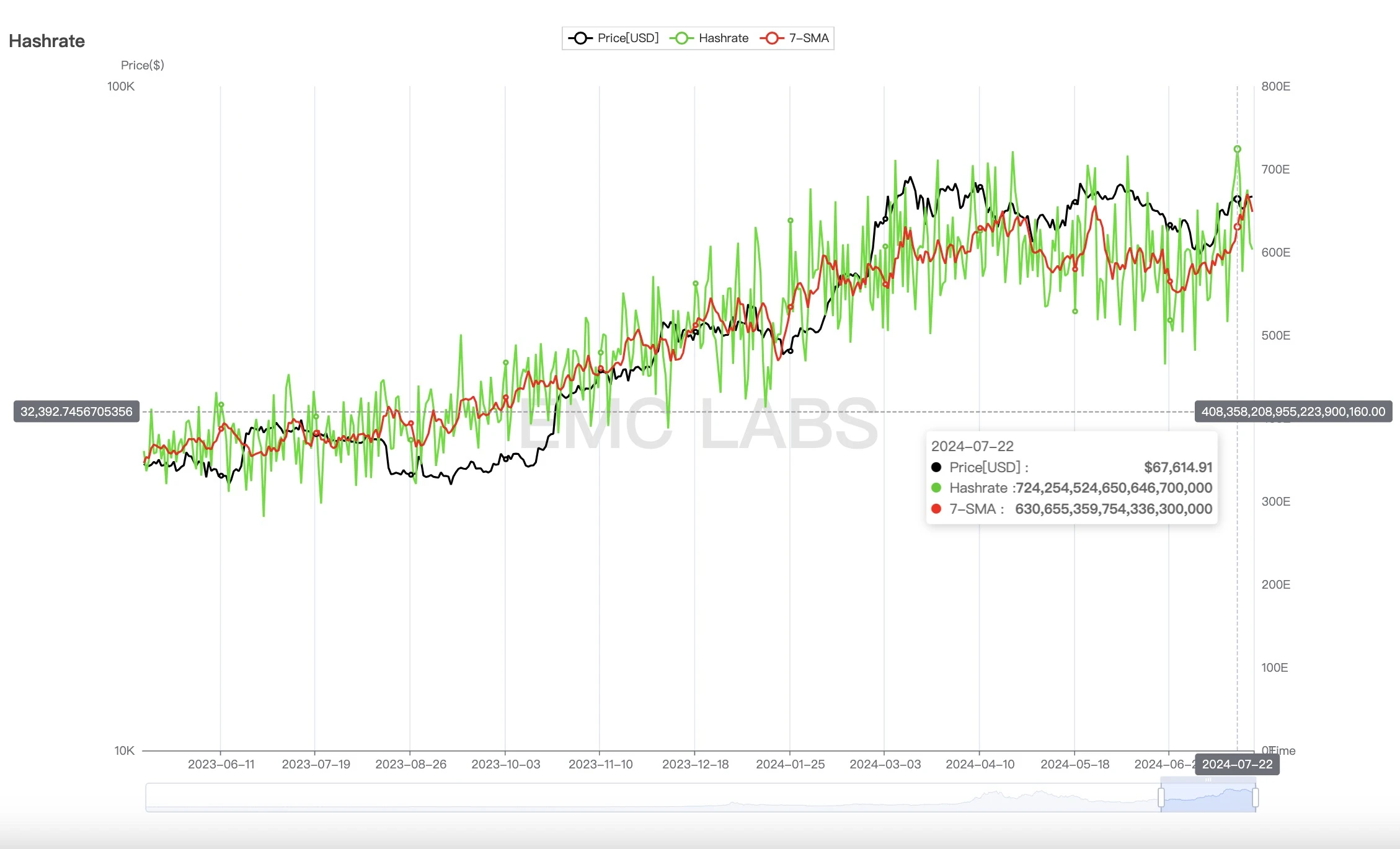

In addition, investment research institution EMC Labs also mentioned that the recovery in computing power market data shows the optimism of the miners. On July 20, the computing power of BitNet reached a record high of 724 EH/s, and the 7-day average computing power was also close to the historical high. The recovery of computing power indicates that miners, an important community member, are firmly optimistic about the market outlook, and has also become an effective support for BTC to reach a record high in the market outlook.

ETH: Waiting for the turning point

Unlike the situation with BTC, ETH's recent trends will be largely affected by the Ethereum spot ETF, which has just opened for trading.

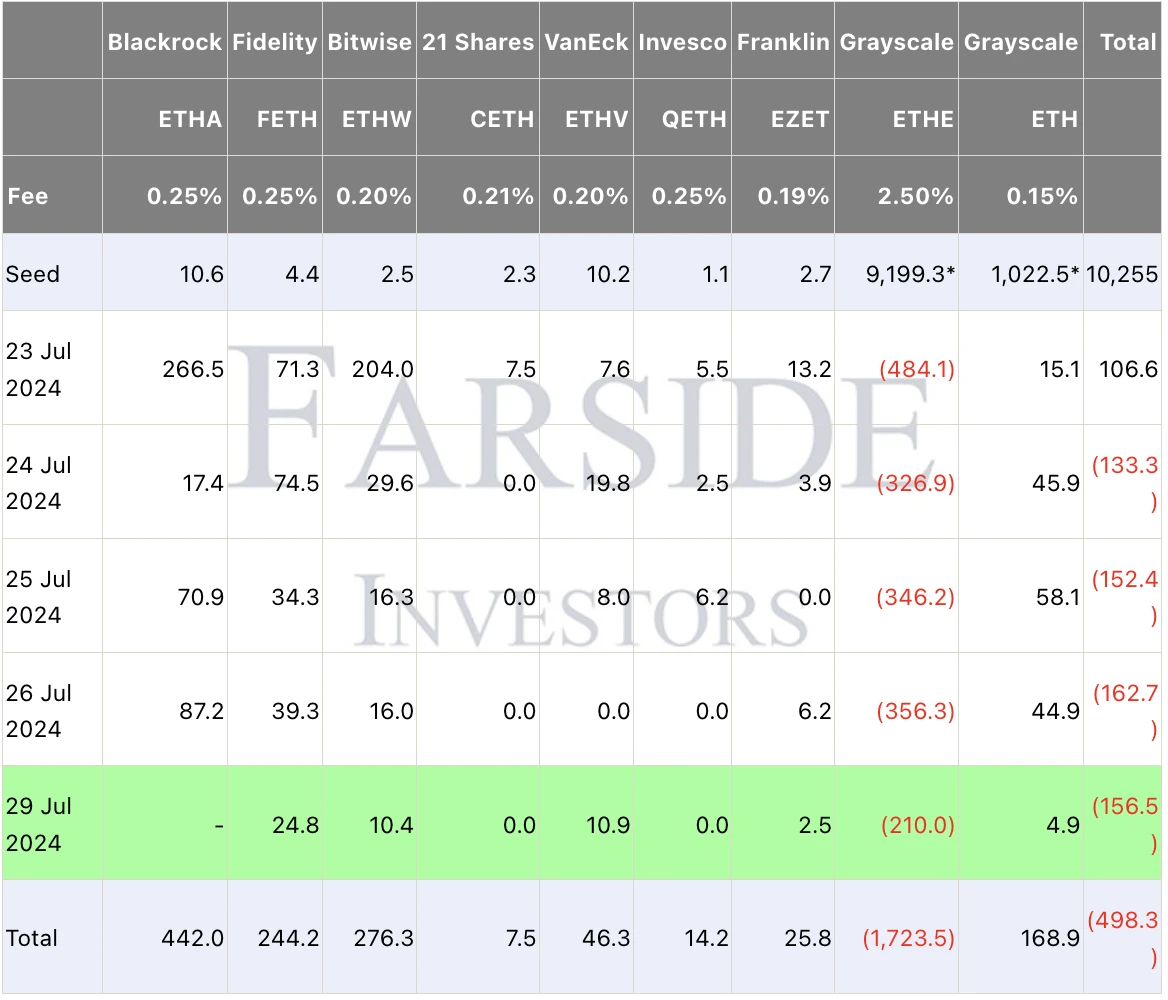

Although the eight major ETFs, including BlackRock ETHA, Fidelity FETH, Bitwise ETHW, Grayscale Mini ETH, etc., have always maintained positive net inflows, the liquidity situation has been reduced due to the sky-high outflow of Grayscale ETHE. It’s not as good as BTC’s ETH, which undertook hundreds of millions of dollars of net selling pressure in just a few days.

According to data from Farside Investors, the total outflow of Ethereum spot ETFs yesterday was US$156.5 million, and the total outflow in the past five trading days was US$498.3 million - of which Grayscale had an outflow of US$1.723 billion, and a number of other ETFs had a combined inflow of US$1.225 billion.

However, something slightly more optimistic is that 19.7% of Grayscale ETHE has been outflowed in the past 5 days. If we assume that the final outflow share is 50%, it is expected to take 17 days to reach it. However, before that, with the decline in the scale of ETHE outflow, other ETF outflows should offset this.

Taken together, the outflow speed of ETHE is much faster than the outflow speed of GBTC that year. If ETH can replicate the "first fall and then rise" trend of BTC after the launch of the ETF, it is expected that the inflection point of ETH will appear earlier than that of BTC. .

Altcoin: Is the bull market back?

Prior to this, Odaily Odaily had released a number of analysis articles on market liquidity and Altcoin trends: "Data is confusing: ETFs are delaying the real bull market", "Times have changed, this cycle of altcoin season will be absent" ", "Can Altcoin still be saved? 》.

Taken together, except for a few sectors such as meme and AI, and a few projects such as SOL that are expected to take over from ETFs, the performance of most Altcoin in this market cycle can be described as "disaster." There are three main reasons why Altcoin have performed so poorly:

- The approval of ETF has led to changes in the market's liquidity transmission model. In the past, the entry path of incremental funds was generally "stablecoins - BTC, ETH - Altcoin", but now incremental funds come from traditional markets. They will be more inclined to directly invest in BTC through ETFs, which also results in the inability to continue transmitting funds, resulting in a lack of liquidity in the Altcoin market.

- The continuous unlocking of "VC tokens" has brought continuous selling pressure, resulting in a market pattern of "oversupply" - if you take a closer look at the circulation changes of some Altcoin, you will find that although some tokens Prices continue to fall, but the market value of circulation continues to hit new highs.

- New projects that opened at sky-high prices are constantly sucking up the remaining liquidity in the market. io.net, ZKsync, LayerZero, Blast... A lot of popular projects that have been building momentum for a long time have been launched one after another, and FDV is generally at the level of billions of dollars. This further exacerbates the lack of liquidity in the Altcoin market.

But even in this case, some top tycoons are optimistic about the market outlook of Altcoin.

Rich Rosenblum, co-chief executive and co-founder of cryptocurrency market maker GSR, posted on the X platform yesterday that Altcoin will make a comeback and will come back strongly. This is the most confident time for him.

Considering that the convention of "when BTC rises, copycats remain unchanged, and when BTC falls, copycats collapse" has been broken. Let us continue to pay attention to whether Rich's (that's such a good name...) prediction can be realized.

Potential variables: Super central bank week is coming

It should be noted that many of the overall economic releases this week may have a potential impact on the market outlook.

- At 11:00 am on Wednesday (July 31), Taipei time, the Bank of Japan will announce its interest rate decision and outlook report;

- At 2:00 a.m. on Thursday (August 1), the U.S. Federal Reserve will announce its interest rate decision. Half an hour later, Powell will hold a monetary policy press conference. At 19:00 that night, the Bank of England will announce its interest rate decision, meeting minutes and monetary policy. Policy Report.

Extended reading:"Central Bank Frenzy" in the UK, US and Japan determines the direction of the global currency market within 32 hours

Adam, a researcher at Greeks.live, also said that although market expectations are relatively consistent, any news that exceeds market expectations will be a bombshell.