Author: Tanay Ved & Matías Andrade Source: Coin Metrics Translation: Shan Ouba, Jinse Finance

Key Takeaways:

Ethereum’s staking ecosystem has come a long way, evolving from the initial PoW to PoS with The Merge, with the emergence of key innovations such as liquidity staking, re-staking, and spot ETH ETFs shaping its journey.

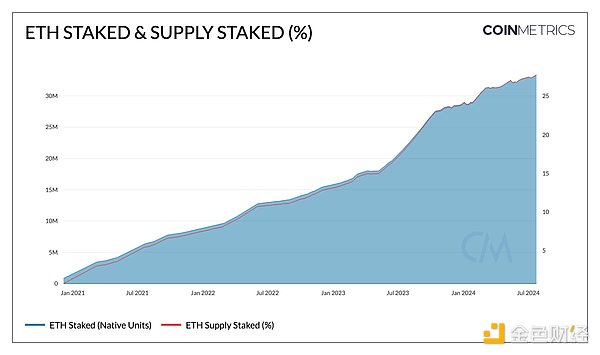

Approximately 33.5 million ETH, worth approximately $115 billion, is staked on the Ethereum consensus layer, accounting for 27.8% of the total ETH supply.

There are currently 1.05 million active validators participating in the network, which will increase by 15% in 2024 year-to-date.

A brief background on Ethereum staking

Staking is at the heart of proof-of-stake (PoS) blockchains like Ethereum. As Ethereum transitions from a proof-of-work (PoW) network to proof-of-stake (PoS) in 2022, participants will now need to commit to “staking” by depositing at least 32 ETH as collateral in order to become active validators on the network — the system’s core economic participants.

Staking is the basis for network consensus, which is the process by which network participants (validators) propose, verify and prove new blocks on the blockchain. The value of the staked assets contributes to the economic security of the network. The validator's stake can serve as an economic incentive to encourage participants to act in the best interests of the network. On the one hand, if the validator performs his duties honestly, he will be rewarded with Ether, otherwise he will face the risk of being punished or having his stake cut for malicious behavior.

introduce

With the upcoming launch of a spot ETH ETF on July 23 and the regulatory clouds surrounding staking, we believe it is important to understand the fundamental role staking plays in the Ethereum network. In this report, we reveal Ethereum’s staking journey so far, and understand how the $115 billion staking ecosystem emerged, developed, and where it is headed.

From the transition to PoS through The Merge, to withdrawals through Shapella, to the emergence of liquid staking and re-staking, and the recent launch of a spot ETH ETF - staking is undoubtedly one of the core pillars of the Ethereum roadmap and is critical to the entire ecosystem.

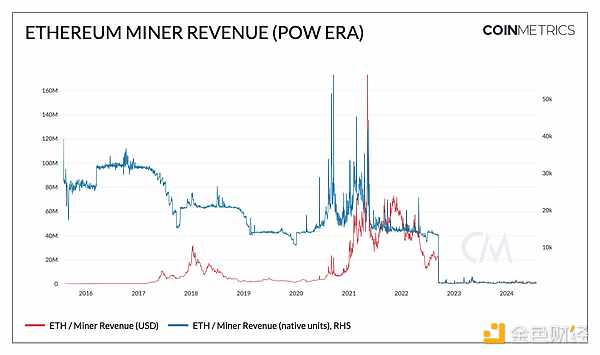

The End of PoW (2015-2022)

Ethereum's Genesis Block was recorded on July 30, 2015. For more than seven years since then , the chain has been secured by a Proof of Work (PoW) consensus mechanism. Similar to how the Bitcoin blockchain operates today, this requires large clusters of hardware, including general-purpose processing units (GPUs) and eventually application-specific integrated circuits (ASICs), which consume computing resources to find the hash of the nonce . Miners who find a valid nonce broadcast the new block to the chain and are rewarded in the form of a block reward (issued ETH) and transaction fees included in the block.

However, as the network difficulty (the amount of computational work required to find random numbers) increases, the energy resources consumed by miners are becoming larger and larger. As early as 2016, Vitalik Buterin advocated that Ethereum switch to Proof of Stake (PoS) to solve bottlenecks such as energy consumption, scalability, and network sustainability, and prepare for Ethereum's future growth. This marks the end of the era when Ethereum miners gave way to validators .

Introduction to the Beacon Chain (2020)

In October 2020, the staking deposit contract was deployed to the Ethereum execution layer. This is the gateway for participants to stake ETH, whether through self-custodial infrastructure (staking individually), through staking-as-a-service providers such as Figment, pool staking platforms such as Lido and RocketPool, or the eventual emergence of centralized exchange staking programs.

Source: Coin Metrics Network Data Pro

Currently, there are 33.5 million ETH (worth about $115 billion) staked on the Ethereum consensus layer, with 1.05 million active validators participating in the network. This represents 27.8% of the total ETH supply, also known as the “staking rate.” Staking rates can vary widely due to implementation differences between PoS blockchains.

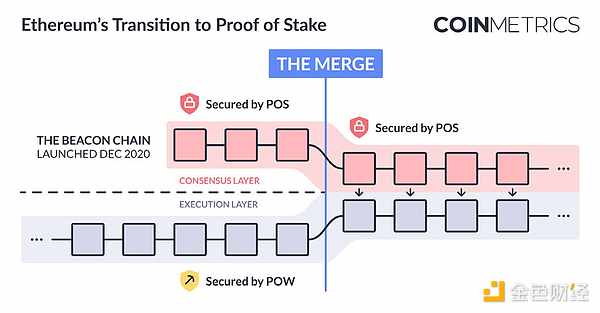

In December 2020, the Beacon Chain (also known as the consensus layer) was launched as a parallel blockchain to the Ethereum mainnet, implemented through EIP-3675. It marks the first step in the transition from Proof of Work (PoW) to Proof of Stake (PoS). The chain is specifically designed to handle the PoS process, managing validator balances, responsibilities (certifying and proposing new blocks), and incentives (rewards and penalties) to reach consensus. This lays the foundation for an eventual merger with the mainnet, which hosts a large number of smart contracts and dApps powered by the Ethereum Virtual Machine (EVM).

Merger: Transition to PoS (2022-Present)

The integration of Ethereum’s two distinct systems, the “execution layer” (also known as the mainnet) and the “consensus layer” (also known as the beacon chain), is now widely referred to as the “merge.” This represents Ethereum’s official shift to using the beacon chain as the engine of block production.

Source: Mapping Out The Merge

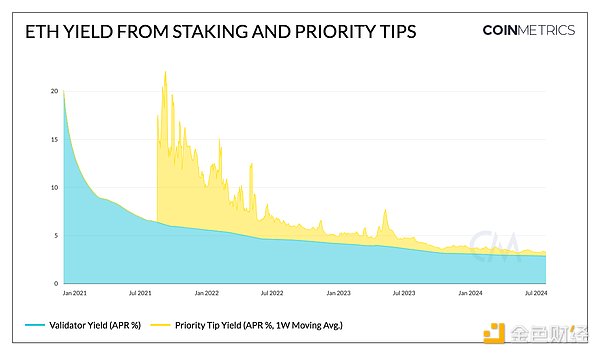

Miners are no longer the means of producing valid blocks. Instead, in proof of stake, validators have assumed this role and are now responsible for proposing blocks and processing the validity of all transactions. In return for these duties, they are rewarded through newly issued ETH, transaction fees voluntarily paid by users (as "priority tips"), and maximum extractable value (MEV).

As we described in our report Planning the Merge, the move to PoS brings significant changes to Ethereum’s validator and coin economics. Under PoW, Ethereum’s daily issuance was around 13.5K ETH, with an annual inflation rate of over 4%. However, with the changes implemented in EIP-1559, which introduced a base fee burn mechanism and priority fees (which will be distributed to validators), ETH’s daily issuance is closer to 0, with an annual inflation rate of 0.67% currently.

The rise of liquidity-collateralized derivatives

At the time, Ethereum’s PoS system had certain bottlenecks, which led to the rise of stake pool providers and Liquidity Stake Tokens (LST). Some of these issues included:

Unable to withdraw pledge : Staking is a one-way operation for several months. The pledged ETH can only flow from the execution layer (where the pledge deposit contract is located) to the consensus layer and cannot be redeemed.

Insufficient liquidity of staked ETH: The inability to withdraw means that the staked ETH is effectively illiquid, hindering any further usage.

Capital and operating requirements: The minimum capital requirement of 32 ETH, combined with the need to run and maintain Ethereum node software (including execution and consensus layer clients), creates a barrier to entry for many potential stakeholders, limiting widespread participation in the network’s validation process.

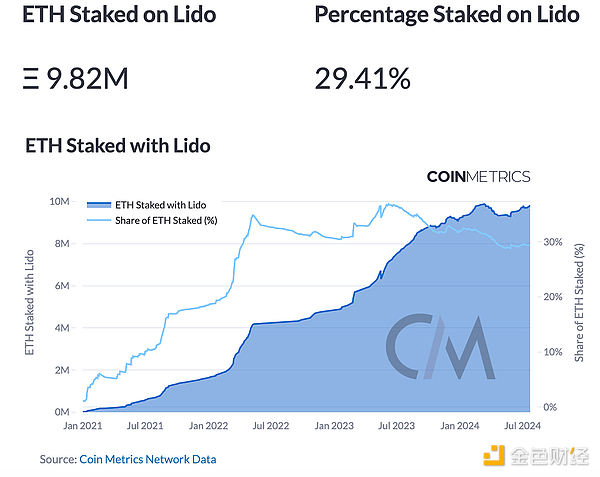

As a result, multiple pool solutions such as Lido, Coinbase, and RocketPool emerged to take advantage of this lucrative opportunity. They allow users to participate with any denomination of ETH, managing node operations by accumulating deposits between users to create validators on the beacon chain. Users receive liquid receipt tokens (called liquid staking tokens) representing the underlying staked assets, which do not need to be "locked" to receive staking rewards. Ultimately, this lowers the barrier to entry for staking, driving growth in the industry and allowing a larger group of participants to protect the Ethereum network.

Source: Coin Metrics Staking Dashboard

Currently, 9.8 million ETH (worth ~$32 billion) is staked through Lido. This represents a 29% market share of all staked ETH, also known as “Lido dominance”. Surpassing a high threshold (33%) of ETH staked by a single entity can introduce centralization risks. This has prompted the need to manage a decentralized set of validators and node operators through innovations such as DAO governance or DVT.

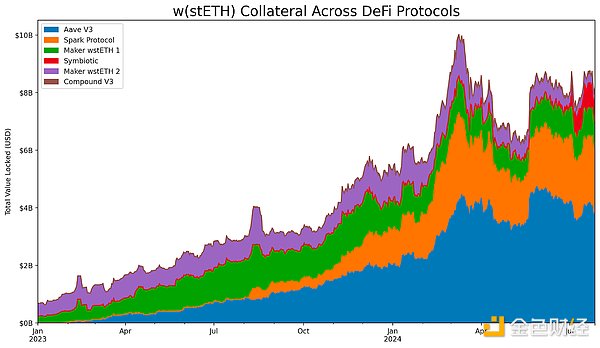

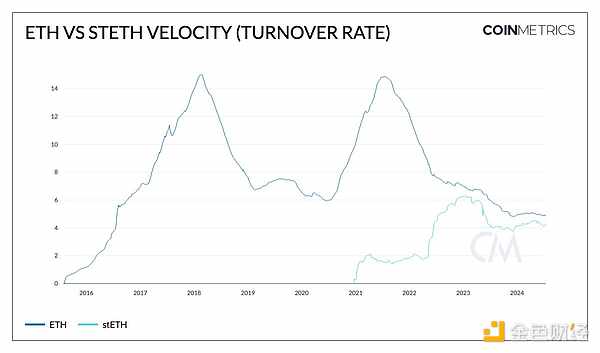

In addition to making it easier to participate, staking pools also drive the utility of Liquidity Staking Tokens (LST) in the broader on-chain ecosystem. Lido-issued LSTs, such as stETH and wstETH (wrapped staked ether), have generated significant network effects and are widely used in decentralized finance (DeFi) applications, whether as collateral in the largest lending protocols or as liquidity in decentralized exchanges (DEX).

Source: Coin Metrics ATLAS

Currently, over 2 million ETH (worth ~$10 billion) is used as collateral to back loans on DeFi lending protocols like Aave v3 and Spark. LST is also a popular form of liquidity reserve for DEXs, layer 2, and economic security for re-collateralization protocols.

Shapella: Withdrawals Enabled (2023)

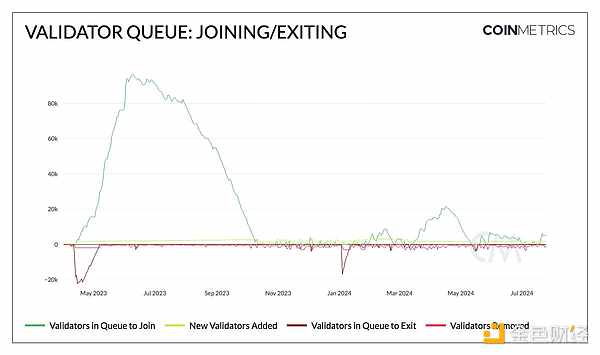

On April 12, 2023 , the arrival of Shanghai and the Capella upgrade (called Shapella) closed the loop on staked ETH, eventually enabling redemption from the beacon chain. Validators are now able to enter and exit the PoS system, subject to validator queues and churn limits (the maximum number of validators that can be activated per epoch, currently set to 8 via EIP-7514 in Dencun ).

Source: Coin Metrics Network Data Pro

Currently, there are 4,000 validators in the staking entry queue, down from 96K in June 2023 and 21K in April of this year.

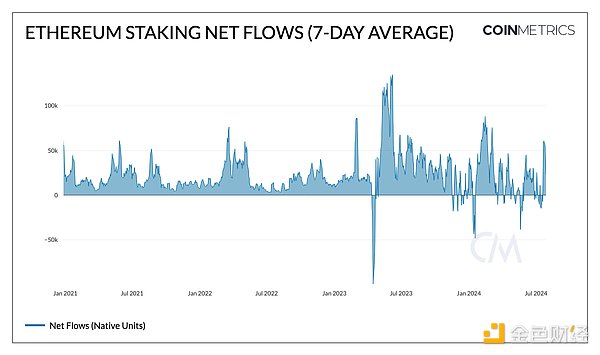

While the validator queue may have leveled off compared to last year, deposits of staked ETH still outstrip withdrawals. Since the Shapella upgrade, 30M ETH has been deposited into the consensus layer, while 17M ETH has been withdrawn. The discrepancy between the decrease in the number of validators in the queue and the increase in deposits can be partially attributed to the popularity of liquidity staking, which has led to an increasing amount of staked ETH without directly increasing the number of validators.

Source: Coin Metrics Network Data Pro

The emergence of re-pledge

With the launch of the EigenLayer mainnet in 2023, re-staking has quickly become one of the fastest growing verticals in the crypto ecosystem. While staking ETH secures the Ethereum network, re-staking allows the same staked assets to secure external services built on Ethereum, such as oracle networks, data availability layers, bridges, and other middleware, using native staked ETH or Liquid Staking Tokens (LST). This innovation helps emerging protocols bootstrap security without the high cost of finding their own validators.

Restaking improves the capital efficiency of staking ETH and expands Ethereum’s security model to the broader ecosystem. However, it also brings the risk of managing the liquidity representatives (LRTs) of staked and re-pledged assets, which come from different networks with different risk profiles. While the restaking space is still in its infancy, it has expanded from Ethereum to other blockchains, such as Solana, while new entrants such as Symbiotic and Jito have also demonstrated its growing importance.

The launch of the spot Ethereum ETF

This brings us closer to today - spot Ether ETFs began to roll out last week. While this is exciting news for the market, the current structure of Ether ETFs prevents issuers from participating in staking activities. This is an opportunity cost for investors, who will forgo an additional ~3% in staking rewards, a key component of staking.

Validators are incentivized to participate in the consensus process by receiving rewards in the form of ETH issuance, priority tips, and maximum extractable value (MEV), which come from the consensus layer (CL) and the execution layer (EL). The current ETH staking annual interest rate (APR%) (excluding MEV) is slightly above 3%. Although this may affect investor demand for ETFs, the impact on the Ethereum network is considerable, for example:

Expected annual interest rate returns for validators, stakers, and overall network inflation

Potential impact on stake participation and decentralization

Source: Coin Metrics Network Data Pro

Any decision to incorporate staking rewards will need to carefully consider these factors in order to balance network security and economic sustainability for the Ethereum ecosystem.

What are the future prospects?

Ethereum’s staking ecosystem has come a long way since the “merge,” and its future direction depends on a variety of converging factors.

With Ethereum’s staking rate exceeding 25% of the total supply and the number of validators exceeding one in a million, researchers and the community are considering changing Ethereum’s issuance curve and increasing the maximum effective balance of validators. These proposals stem from concerns about ETH’s growing staking rate and the trend of staking pool centralization, with incentives favoring liquid staking tokens over regular ETH. In addition, an increase in the maximum effective balance of validators from 32 ETH to 2048 ETH is being considered to control the exponential growth of the validator set, thereby reducing the overhead of the consensus layer.

Source: Coin Metrics Network Data Pro

The growth of liquid staking and re-staking, the emergence of spot ETH ETFs, regulatory developments around staking, and potential changes to validator and issuance dynamics present a complex and interconnected landscape that will guide Ethereum’s PoS system in the coming years.