Including XMR, FLOW, XRP, ADA, AXS, DYDX, WLD, BCH.

- Author: ardizor , encryption researcher

- Compiled by: Felix, PANews

Before purchasing any token, a wise investor should at least analyze the following key factors:

- Market capitalization (MC)

- FDV

- Future unlocking situation

- Token demand

- narrative

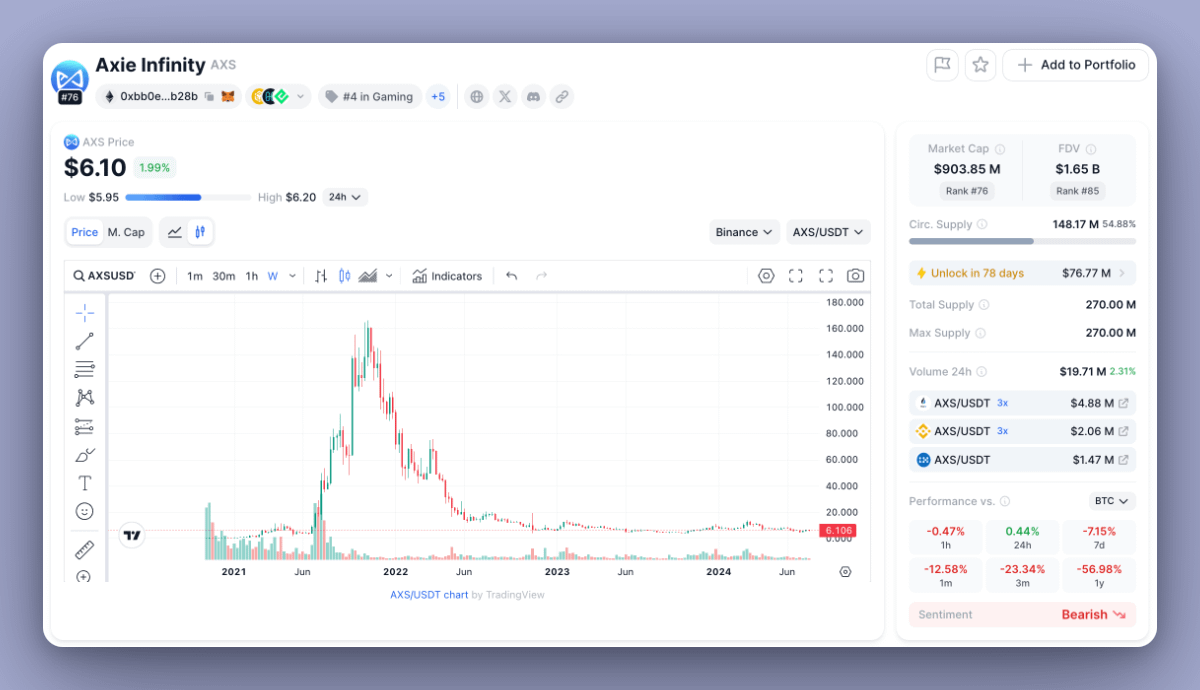

This type of analysis will help determine whether a coin is worth holding and has upside potential. But 98% of Altcoin are destined to fail because they simply don’t have any potential. For example, if you invested $10,000 in AXS in November 2021, you would only have $382.5 left today.

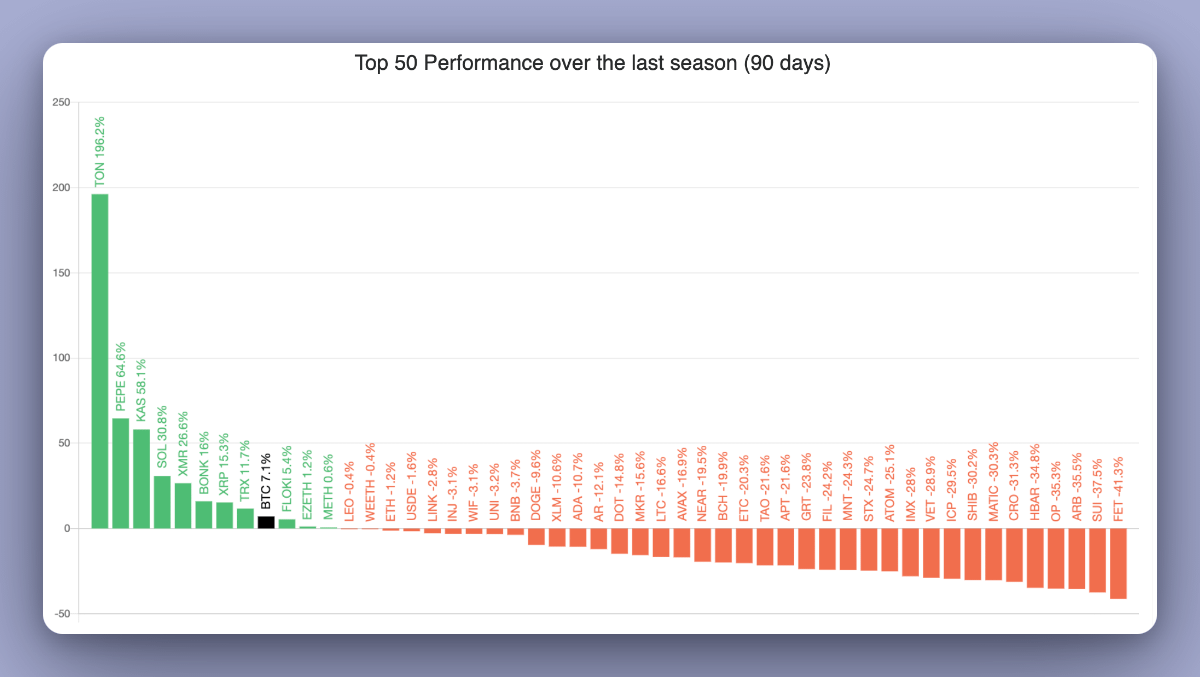

Furthermore, as can be seen from the chart below, only TON, SOL, Memes, and BTC showed significant growth within 90 days. All other so-called “tech”Altcoin fell.

If you don’t want to see your money disappear over time, here are three types of Altcoin you should avoid holding.

1. Outdated and overrated projects

These types of projects are usually devoid of technology because they are made up. Over time, they will gradually lose value compared to ETH, as is seen now.

2. Projects related to past narratives

Typical characteristics are high FDV, low market capitalization and sustained selling pressure. These tokens have lost narrative relevance and are gradually declining.

3. Tokens with inflated prices

The supply of such tokens is tightly controlled by the team or VCs, leading to manipulated valuations.

Based on the above three types, encryption researcher ardizor took stock of 8 tokens that are destined to "fail".

PANews Note: This article is intended to provide market information and does not constitute investment advice, DYOR.

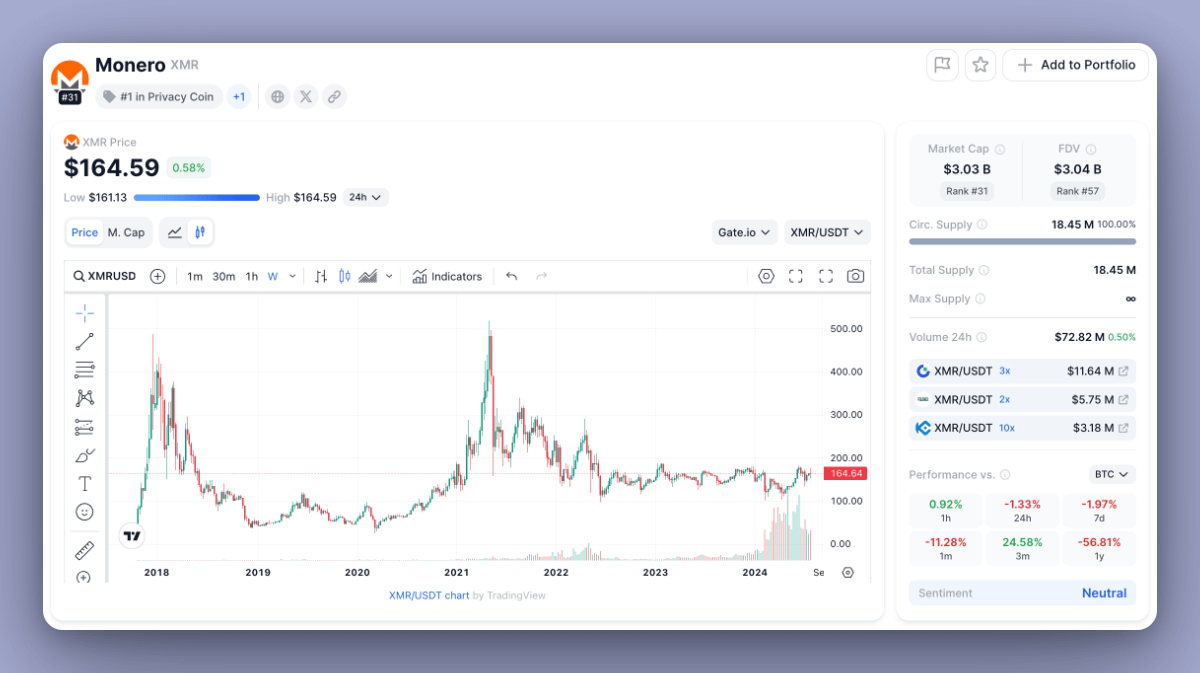

XMR

You all probably know about Monero’s anonymity and privacy of transactions.

XMR is one of the oldest crypto tokens. However, the price of XMR has not changed much since 2022, and it may be banned in the future like Tornado Cash.

Most importantly, Binance delisted it this year, which may be “the straw that broke the camel’s back.”

Overvalued in the short term, with bleak prospects and high risks.

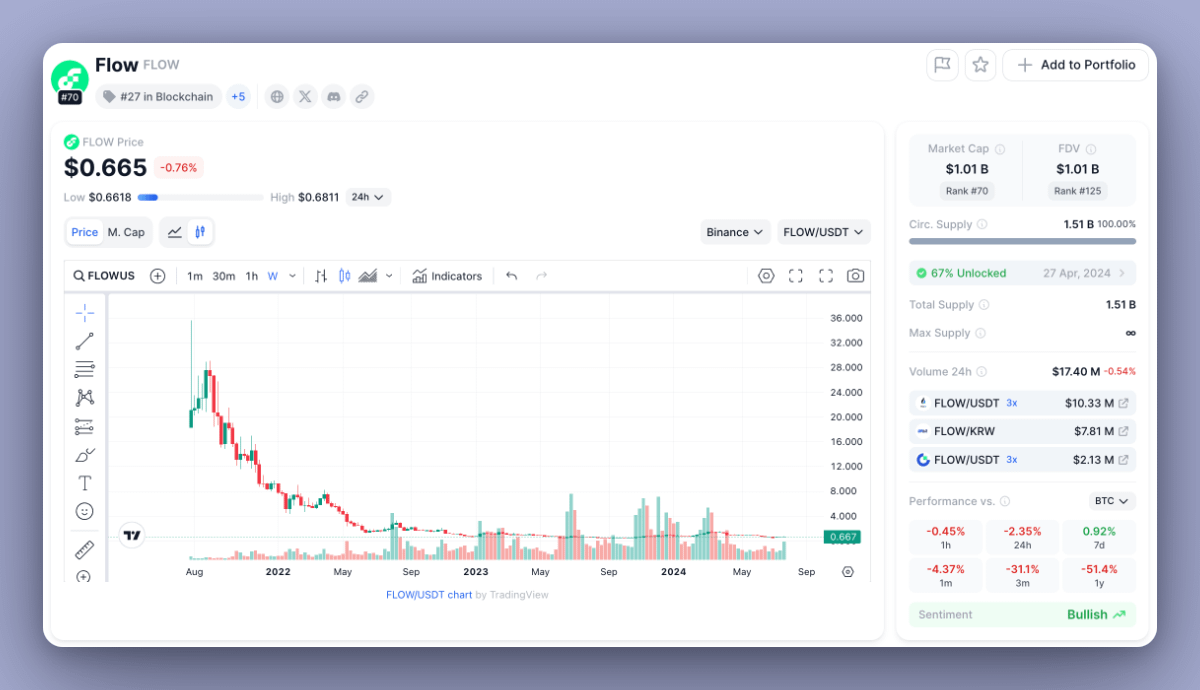

FLOW

Flow is a proof-of-stake blockchain designed to be the foundation for Web3 and the open metaverse, supporting consumer-scale decentralized applications, NFTs, DeFi, DAOs, PFP projects, and more.

Unfortunately, market interest in the project has faded, causing its value to decline.

This is due to continued selling pressure from VCs, as well as reduced hype surrounding NFTs.

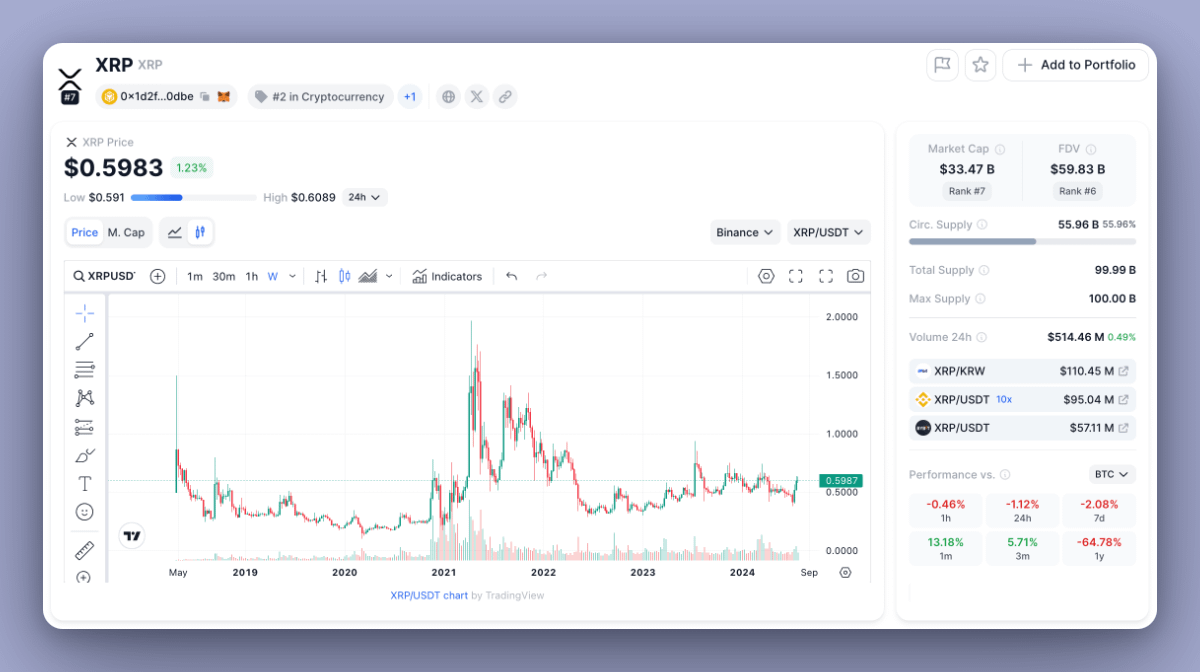

XRP

XRP is designed for fast and low-cost global transactions. However, this is an unnecessary fork of BTC and is overvalued.

It has a really cult following, but I haven't seen a really smart person get behind it.

XRP is not the worst coin, but ETH or BTC are better.

AXS

What is listed here applies not only to Axie Infinity, but also to other veteran P2E tokens such as SAND and MANA.

The excitement about it has faded and the FDV is quite high.

The hype surrounding these tokens has faded away and there is no hope of price recovery.

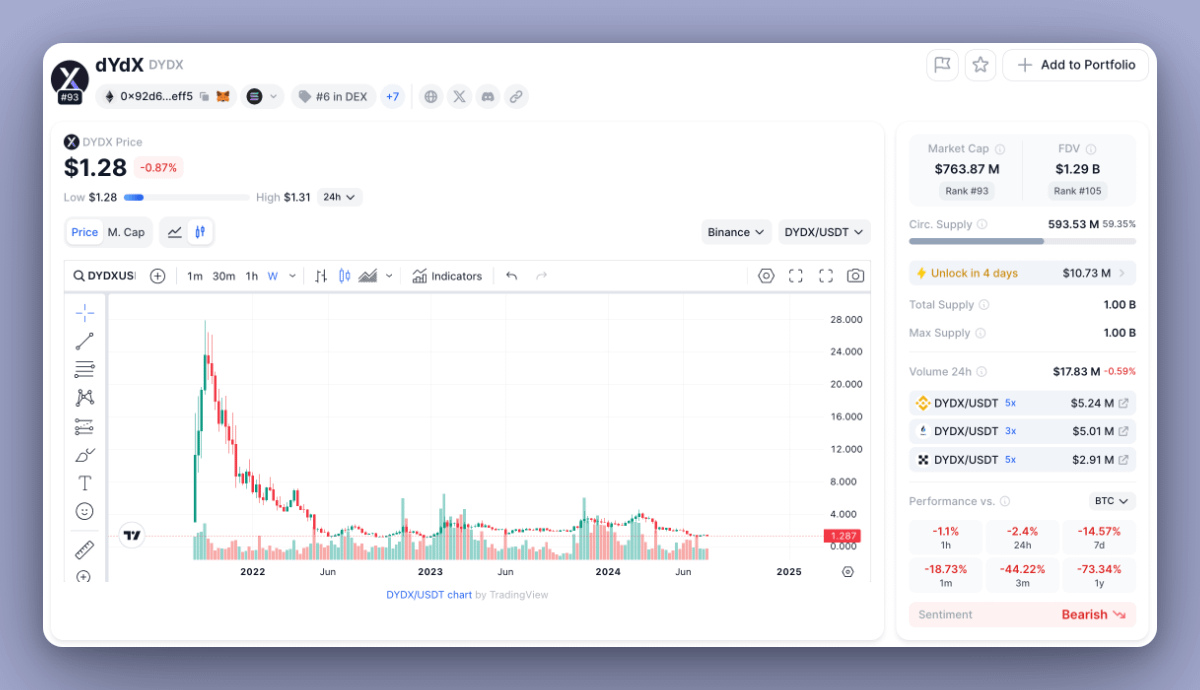

DYDX

The key challenge with DYDX is token unlocking.

These unlocking mechanisms were designed to stabilize selling pressure, but resulted in continued price declines.

Many projects face this problem, so it is crucial to review the unlocking schedule if the project wants to survive.

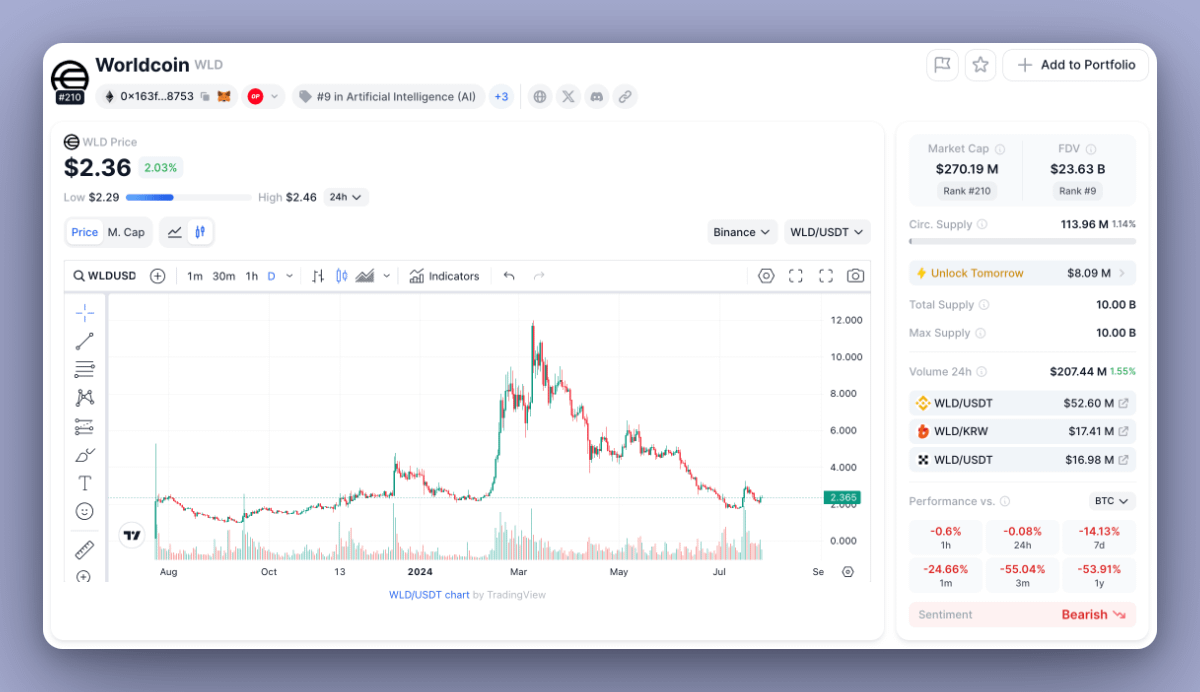

WLD

WLD is essentially a fictional token whose supply is tightly managed by major players and insiders who are always dumping tokens. The odds of winning are not on the side of retail investors.

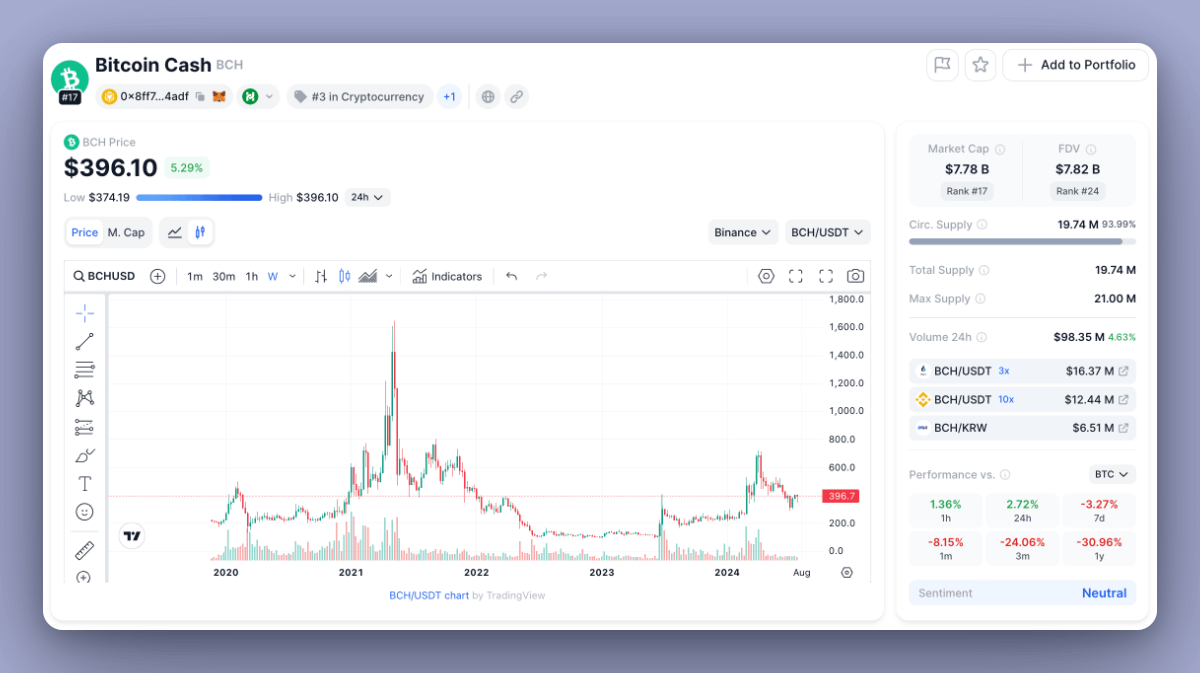

BCH

Bitcoin Cash (BCH) is a fork of BTC designed to increase block size and process more transactions simultaneously.

However, BCH is essentially similar to Bitcoin without major changes. Basically, it's just a fake Bitcoin. Why do you need fake Bitcoins?

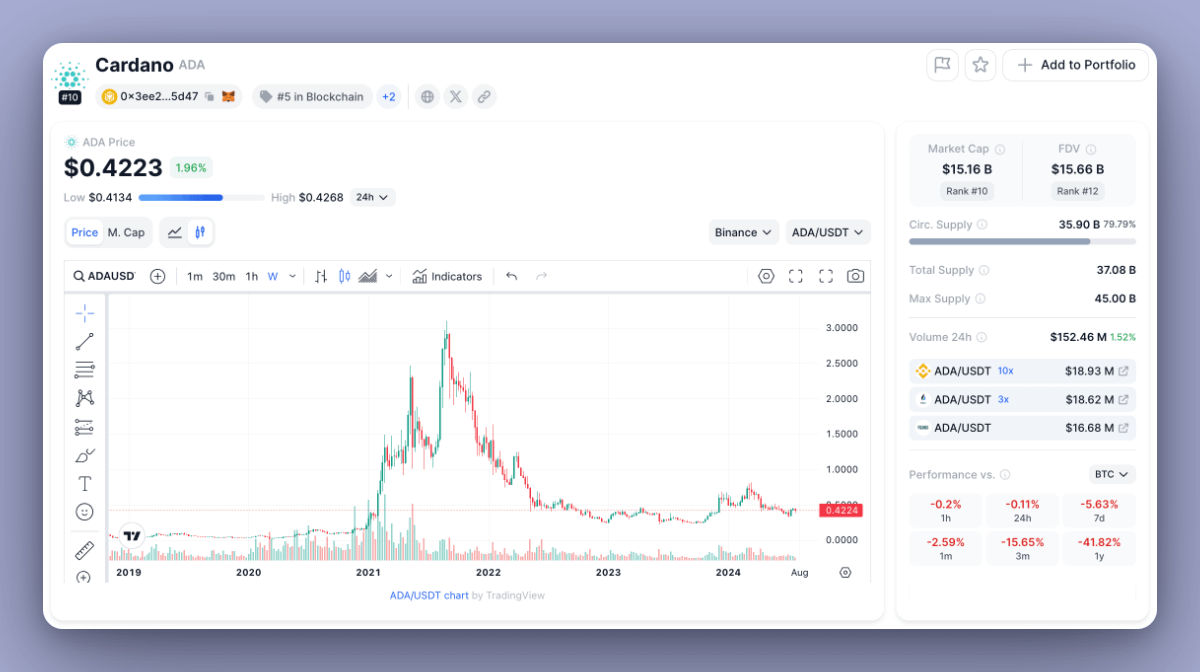

ADA

ADA is similar to XRP, but without any litigation issues.

ADA has a crazy community that will hold on to their token even if the price drops to $0.0000001.

The developer, Charles Hoskinson, is also very eccentric, and the author thinks he has "schizophrenia."

Related reading: Why did fundamental analysis of this market completely fail?