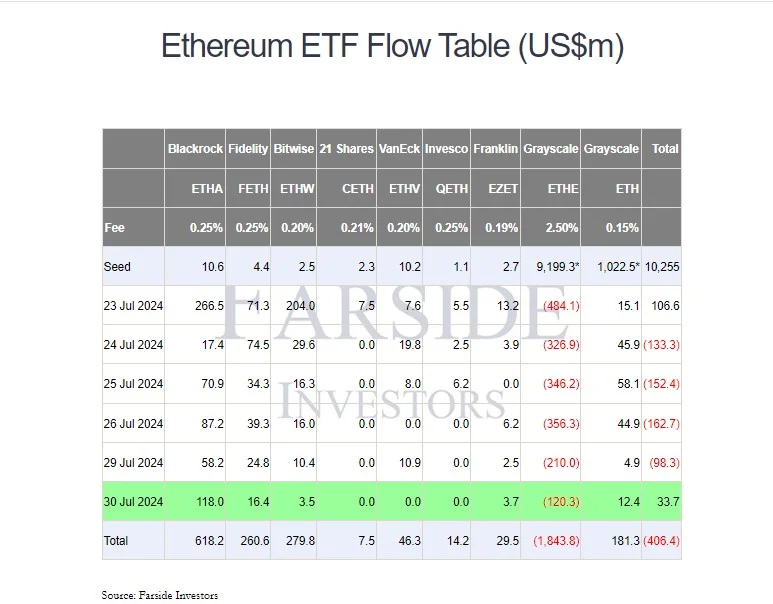

According to statistics from Farside Investors, after four consecutive days of net outflows, the net inflows of nine Ethereum spot ETFs finally turned positive yesterday, with a net inflow of US$33.7 million.

This is mainly due to the substantial increase in capital inflows from BlackRock's ETHA, which had a net inflow of approximately US$118 million yesterday. Nate Geraci, president of The ETF Store, posted on social media that ETHA has ranked in the top 15 of all new ETFs this year (a total of about 330 new ETFs this year) just one week after its launch.

At the same time, Grayscale ETHE's capital outflows are also gradually slowing down, with net outflows falling sharply from nearly $500 million on the first day to about $100 million, which makes BlackRock's ETHA's net inflows enough to offset Grayscale outflows. Analyst Mads Eberhardts predicts that the outflow of Ethereum ETF will slow down this weekend. Once the outflow stabilizes, a rise in price will follow. This trend is consistent with the launch of Bitcoin spot ETF in January this year. price fluctuations are similar.