Author: 10x Research; Translated by: 0xjs@ Jinse Finance

A new research paper, “What Drives Cryptoasset Prices?”, authored by Austin Adams, Markus Ibert, and Gordon Liao, uses a structural vector auto-regressive (VAR) model to explore the factors that influence cryptocurrency returns.

This paper significantly validates the core tenets of 10x Research’s approach to analyzing crypto markets. Our emphasis on market structure, including various forms of risk premia, monetary policy, and liquidity, aligns with the key drivers of crypto asset prices identified. This solid foundation, coupled with historical quantitative analysis and our interpretation of forward-looking events and outcomes, forms the cornerstone of 10x Research’s methodology.

The key findings and lessons learned are as follows:

Key findings:

1. Influence of traditional factors:

Research shows that crypto asset prices are significantly affected by traditional risk and monetary policy factors.

Contractionary monetary policy accounts for more than two-thirds of Bitcoin’s sharp decline in 2022.

Since 2023, crypto risk premium compression, independent of the strong equity market backdrop, has been the primary driver of crypto returns.

2. Drivers of Bitcoin Returns:

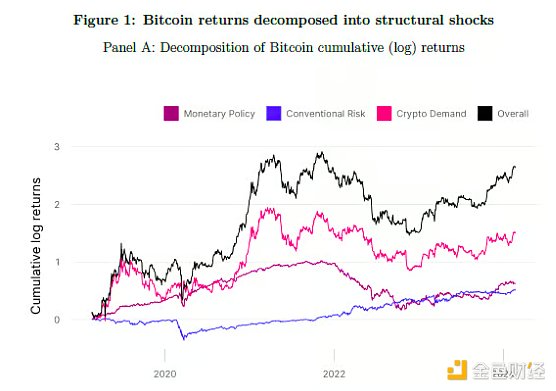

Bitcoin returns can be decomposed into three main structural shocks: traditional monetary policy shocks, traditional risk premium shocks, and crypto-specific demand shocks.

In 2020, positive traditional risk premium shocks and loose monetary policy supported Bitcoin prices.

In 2022, the decline in Bitcoin prices was primarily driven by a negative monetary policy shock and a negative Bitcoin demand shock, although falling traditional risk premia continued to support prices.

3. Encryption specific factors:

Crypto-specific factors, such as adoption and risk premium shocks, play a dominant role in explaining the variation in Bitcoin’s daily returns.

The crypto adoption shock captures changes in the intrinsic value and adoption rate of cryptocurrencies, while the crypto risk premium shock represents changes in the risk compensation that investors require for holding crypto assets.

4. Stablecoins as safe-haven assets:

The study provides evidence supporting the safe-haven properties of stablecoins within the cryptoasset space. During periods of market stress, stablecoin market capitalization tends to increase.

5. Event Study:

The paper conducts event studies focusing on major market events such as the COVID-19 market turmoil, the FTX crash, and the launch of BlackRock’s Bitcoin spot ETF. These case studies highlight the importance of crypto-specific factors in driving cryptocurrency prices and flows during major market events.

Lessons learned:

1. Interconnectivity with traditional financial markets:

Understanding the drivers of crypto returns requires considering both traditional financial market factors and crypto-specific factors.

The evolving relationship between cryptocurrencies and traditional financial markets underscores the need to continually monitor both areas.

2. Impact of monetary policy:

Cryptocurrency prices are very sensitive to changes in monetary policy, especially contractionary measures.

Cryptoasset investors should pay close attention to central bank policies, as these can have a significant impact on crypto market dynamics.

3. The importance of crypto risk premium:

The compression of crypto risk premiums is a key factor driving crypto returns, highlighting the role of investor risk appetite and market sentiment in the crypto space.

Future research and investment strategies should take into account the varying degrees of risk premium in crypto markets.

4. Policy impact:

Policymakers should take into account the significant spillover effects of traditional markets on crypto markets when designing regulatory frameworks.

Understanding the drivers of crypto returns can help develop more effective regulatory policies and ensure market stability.

5. Investor strategy:

Investors should understand the different factors that drive cryptocurrency prices and their potential diversification benefits relative to traditional asset classes.

The insights from this paper could help investors better hedge their portfolios and manage the risks associated with crypto assets.

Future research could extend this analysis by incorporating a broader range of cryptocurrencies and exploring the impact of regulatory changes on cryptocurrency markets. In addition, developing more complex models that can capture the time-varying nature of the relationship between cryptocurrencies and traditional asset classes may provide further insights.

Read the original PDF of “What Drives Crypto Asset Prices” here