The Bank of Japan decided to raise interest rates at today's monetary policy meeting, raising interest rates from about 0 to 0.1% to 0.25%, bringing Japan's short-term interest rates back to the level of about 0.3% in December 2008. Coupled with the interest rate increase in March this year, Two consecutive waves of interest rate hikes will affect Japanese household deposits, mortgage rates and corporate borrowing rates.

At the same time, the Bank of Japan announced a plan to reduce the amount of long-term government bond purchases. The amount of Japanese government bond purchases per quarter will be reduced by 400 billion yen. By the first quarter of 2026, the monthly bond purchase will be reduced to 3 trillion yen, which is 3 trillion yen compared with the current monthly purchase. The size of the debt was reduced by half to about 6 trillion yen.

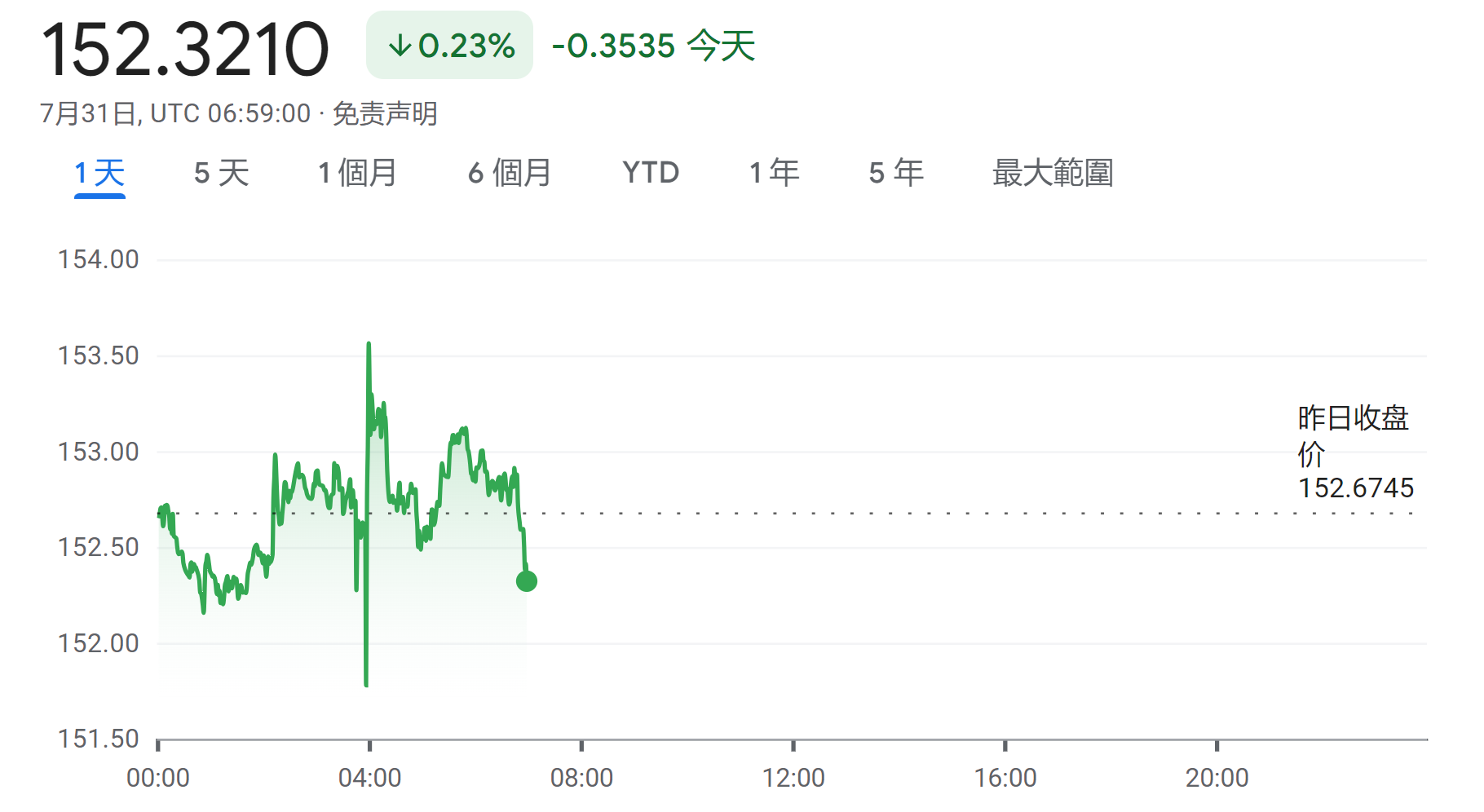

After the announcement of the decision, intraday fluctuations in the Japanese yen exchange rate intensified. The US dollar/yen exchange rate first appreciated 0.74% to 151.64 yen per US dollar, and then depreciated. It once depreciated 0.73% to 153.88 yen, and later the depreciation converged to 0.23%. It was quoted at 152.32 yen.

The Bank of Japan stated in a statement that from the perspective of sustainably and stably achieving the 2% inflation target, it is appropriate to adjust the degree of monetary easing. If the Japanese economy and prices in the future are in line with the development expected by the Bank of Japan, it will "continue to raise the policy interest rate." , adjust the degree of monetary easing."

Bloomberg reported that the above-mentioned decision shows the determination of Bank of Japan President Kazuo Ueda to normalize monetary policy. The ultra-loose monetary policy over the past many years has put the Bank of Japan under pressure. Japan was the last country in the world to have negative interest rates until March this year. Ending the negative interest rate policy, this interest rate hike has intensified market speculation that there will be another interest rate hike this year.

In its updated quarterly inflation outlook, the Bank of Japan maintained its core inflation forecast, predicting that price growth for the entire forecast period to March 2027 will remain around 2%. The inflation rate forecast dropped slightly from 2.8% to 2.5% to reflect the government's move to resume energy subsidies. The inflation rate forecast for next year was raised from 1.9% to 2.1%, and will remain unchanged at 1.9% in 2026.

Is the era of cheap yen over?

Kazuo Ueda's hawkish tendencies could provide a turning point for the yen as traders expect U.S.-Japanese currency interest rate differentials to continue to narrow. After falling 12% against the dollar in the first half, the yen has gained about 5% against the dollar this month, while the Fed Any comments suggesting the possibility of a rate cut in September will support expectations of narrowing interest rate differentials and help the yen rise.

However, as the currency interest rate gap between the United States and Japan is still quite large, the rise in the yen may be limited. Charu Chanana, head of capital market currency strategy at Saxo Capital Markets, said that the Federal Reserve will announce an interest rate decision in the early hours of Thursday. If the Fed does not make a clear decision by then, With interest rates cut in September, pressure on the yen may continue.

Looking forward to the follow-up trend of the yen exchange rate, Lin Qichao, chief economist of Cathay Pacific Bank, analyzed that the future appreciation of the yen depends on three factors. First, the Federal Reserve will cut interest rates more than expected (it will cut interest rates by 3% this year); second, the Bank of Japan The interest rate hike will be larger than expected (the likelihood of a rate hike in October), and the pullback in the third stock market will expand.

In Lin Qichao's view, although the super sweet price of 161 yen is gone forever, the probability of the yen exchange rate rising above 150 in the short term is still low, and the current yen price is still "six points sweet."

Will arbitrage financial opportunities be blocked?

In addition, it is worth noting that if the yen continues to appreciate sharply in the future, as the arbitrage opportunities for carry trade (Carry Trade) gradually shrink, the arbitrage financial avenues in the market may be blocked. Carry trade is mainly about borrowing at low interest rates. Currency is then used to invest in higher-yielding assets, or to hold currencies or bonds with higher interest rates to earn interest differentials.

Reuters pointed out that due to low volatility and wide interest rate differences between central banks, arbitrage transactions have been extremely popular in the past two years. In terms of 10-year borrowing interest, Japan is about 1%, Switzerland is only 0.5%, and Australia is at least 4%. % or more, and in Mexico it is close to 10%. Traders usually borrow Japanese yen or Swiss francs at the lowest interest rates, and then invest in assets with higher returns such as Mexican government bonds and U.S. technology stocks.

However, as the Japanese government was suspected of spending nearly 40 billion US dollars to prevent the depreciation, the yen began to appreciate sharply. Speculators in the market have greatly reduced their short positions on the yen to the largest single-month position since March 2020, with net short positions. Positions remain at just $8.61 billion, 40% below the nearly seven-year high in April.