With the interest rate cut approaching, BTC rebounded strongly, and good market news emerged in an endless stream. Has the bull market started?

We still need to pay attention to the band risks and focus on the potential and space for real income agreements.

Crypto Market Summary

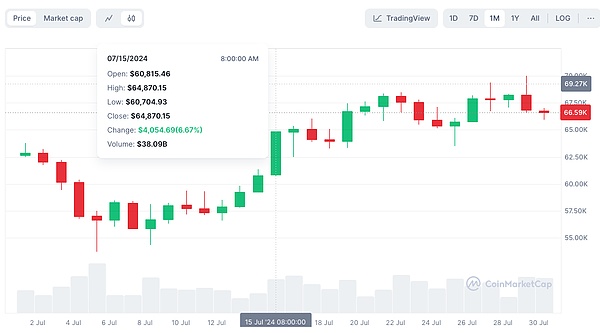

1. From July 15 to July 28, BTC rebounded strongly, rising to a maximum of $69,000 (July 27), closing up 12.56%. ETH rose to a maximum of $3,543 (July 22). After the Ethereum spot ETF was officially approved for listing and trading on July 23, ETH experienced a short rise, then began to fall, closing at $3,269, up 2.44%. It is expected that the outflow pressure of Grayscale Ethereum ETF will be smaller than that of Bitcoin ETF at the time, and the overall scale and growth rate of Ethereum ETF will be lower than that of Bitcoin spot ETF, so that the increase of Ethereum will also be smaller than that of BTC at the time. After the listing of BTC spot ETF, the price of BTC broke through the historical high two months later, with an increase of 62%.

2. The agency expects that the Federal Open Market Committee (FOMC) will continue to keep interest rates unchanged, but the interest rate cut may enter the substantive discussion stage to further prepare for a policy shift as early as September.

3. Former US President Trump gave a speech at the Bitcoin 2024 conference, ensuring that the United States will become the world's crypto hub and a Bitcoin superpower. The US government currently holds about 212,847 bitcoins, worth about $15 billion. Although Trump has announced many promises that are good for the cryptocurrency industry, it remains unclear whether the promises will be fulfilled.

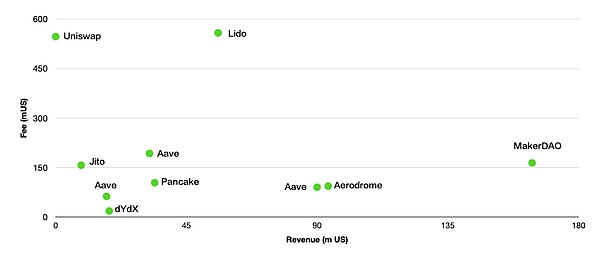

4. Web3 still lacks a narrative that can drive a sharp rise in the market. Coinbase Research predicts that the price trend of cryptocurrencies will remain volatile in the third quarter of 2024. Protocols with real revenue may become the dominant narrative in the market for some time to come. Among the protocols with higher protocol revenue, MakerDAO, Aerodrome, AAVE, GMX, and Pancake all connect tokens with protocol fundamentals through staking dividends, token repurchase and destruction, etc., which is worthy of attention.

1. Market Overview

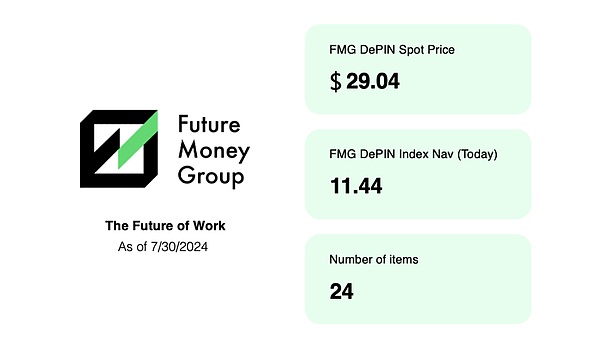

1.1 FutureMoney Group DePIN Index

The FutureMoney Group DePIN Index is a high-quality DePIN portfolio token index constructed by FutureMoney, which selects the 26 most representative DePIN projects. The initial value of the index is 10, with January 5, 2024 as the base period. As of July 30, the net value of the index is 11.44, up 14.4% from the beginning of the period and down 0.69% from July 15.

1.2 Crypto Market Data

From July 15 to July 28, the market value of stablecoins increased by $2.27 billion, an increase of 1.51%, exceeding the increase of 0.95% in the previous cycle. Bitcoin's share of the total crypto market value increased from 53.64% to 55.7%.

From July 15 to July 28, Bitcoin spot ETFs continued to see inflows. According to CoinShare data, the inflows of Bitcoin in digital asset investment products have further grown healthily, reaching $3.6 billion so far this month.

On July 23, the Ethereum spot ETF was officially approved for listing and trading. Affected by user redemptions after the Grayscale Ethereum Trust Fund ETHE was converted into a spot ETF, the overall Ethereum spot ETF was in a state of outflow.

From the buying perspective, traditional funds have less motivation to allocate Ethereum spot ETFs than BTC spot ETFs, and the social influence of Ethereum spot ETFs is also smaller than that of Bitcoin. Therefore, it is expected that the scale and growth rate of Ethereum ETFs will be lower than those of Bitcoin spot ETFs, so that the increase in Ethereum will also be lower than the performance of BTC at the time.

Citigroup predicts that the inflow of funds into the Ethereum spot ETF will only account for 30%-35% of the inflow of funds into the Bitcoin spot ETF, which means that in the next 6 months, $4.7 billion to $5.4 billion will flow into the Ethereum spot ETF.

1.3 The actual impact of the MT.Gox sell-off is small

MT.Gox will distribute a total of 141,600 BTC. About 59,000 BTC have been distributed since July 15, and another 79,600 BTC will be distributed soon. According to the German government's 48,000 BTC sell-off in late June, coupled with the "miner surrender" selling pressure, the market eventually absorbed the selling pressure and rebounded from $53,000 to more than $68,000 soon after. After Mt.Gox distributed 59,000 BTC, the price of Bitcoin rose instead of falling, and the trading volume did not rise significantly, indicating that the actual selling pressure was less than expected.

Mt.Gox will distribute a total of 142,000 BTC. On July 5, Mt.Gox distributed 3,000 BTC for the first time, and there are still 139,000 BTC to be distributed. In the last biweekly observation, we predicted that the number of one-time distributions would be about 75,000. Considering the high dispersion of BTC distributed by Mt.Gox, most early investors are long-term holders. According to the estimated selling ratio of 50% (37,500) and the selling time of 3 months, an average of 12,500 coins are sold each month. Therefore, although the total amount of Mt.Gox repayments is huge, it is expected that its market impact will be much smaller than the German government's sale, and according to the price trend of the German government's sale, the market can withstand such a large-scale sale.

2. Crypto Market Hotspots and Narratives

2.1 Real Income Narrative

Although the ETH spot ETF has been successfully listed and Trump has brought many favorable plans to the crypto industry, Web3 still lacks a narrative to drive a substantial rise in the market. Coinbase research report predicts that cryptocurrency price trends in the third quarter of 2024 will remain volatile, and protocols with real revenue may become the dominant narrative in the market for some time to come.

On July 25, Aave proposed to initiate fee conversion, returning part of the net excess income to its key users. Founder Marc Zeller said that the proposal may lead to the re-staking of the Aave protocol, providing users with additional income opportunities. After the news was released, AAVE broke through $100, with a 24-hour increase of more than 14%. In addition to Aave, MakerDAO, Aerodrome, GMX, and Pancake, which are protocols with higher protocol income, have all connected tokens with protocol fundamentals through staking dividends, token repurchase and destruction, etc., which is worth paying attention to.

2.2 MATR1X brings new highlights to Web3 games

MATR1X's platform governance coin $MAX was launched on OKX Jumpstart on July 29, and was traded on multiple exchanges including OKX and BingX on August 5. $MAX is the most noteworthy target during this period, and MATR1X is also expected to bring new highlights to Web3 games.

MATR1X is a comprehensive platform that integrates popular games, public chain infrastructure, Web3 game distribution platform, e-sports events and other game sectors. It has launched four 3A-level games, including shooting, battle royale, card placement and MOBA. These games have the potential to become killer applications of Web3. MATR1X's Web3 game distribution platform, similar to Steam, helps more high-quality games to be released, making it possible for the platform to continuously launch popular games. MATR1X's Web3 e-sports platform is also a major innovation. Through e-sports events and the Watch 2 Earn model, it lowers the threshold for e-sports enthusiasts to enter Web3.

III. Regulatory Environment

At the Bitcoin 2024 conference, Trump delivered a speech and put forward a series of policy recommendations in support of Bitcoin and cryptocurrency, including not selling Bitcoin, firing the SEC chairman to end the crackdown on the industry, establishing a Bitcoin Presidential Advisory Committee, predicting huge growth in the Bitcoin market, supporting Bitcoin mining in the United States, becoming the first Bitcoin president to strengthen the United States' leadership in the field, believing that Bitcoin is not a threat to the US dollar but to government policy, and ending the issuance of digital currencies by central banks to avoid competition with cryptocurrencies.

Arthur Hayes believes that Trump may win the election by courting the young, politically active and upstart cryptocurrency community. Therefore, Trump has made a series of promises to improve his image among cryptocurrency supporters, and once in office, the cryptocurrency-related promises may not be fulfilled at all.

The data comes from: Coinmarketcap, Coinshare, Sosovalue, Bloomberg, Coinglass