Tether, the manager of the dollar-pegged USDT stablecoin, reported a record profit of $5.2 billion in the first half of 2024 and an unprecedented amount of U.S. government bonds held by it, according to a July 31 announcement .

Tether said its U.S. Treasury portfolio is now worth about $97.6 billion. The company's growth in U.S. Treasury holdings reflects the continued growth of Tether's stablecoins, which Tether said are pegged 1:1 to liquid U.S. dollar-denominated assets. The data is based on a certification from independent accounting firm BDO.

The chart shows the market share of USDY and BUIDL in tokenized treasury products. Source: Bluechip

According to Binance, USDT’s total market capitalization is approximately $114 billion, slightly less than Tether’s total reserves (over $118 billion).

Tether said that Tether's treasury reserves exceed the size of all governments except 17 governments in the world, including Germany, the United Arab Emirates and Australia. In terms of purchasing three-month US Treasury bonds, Tether also ranks third after the United Kingdom and the Cayman Islands.

“ Given USDT adoption, [Tether] sees potential to become number one next year,” the company said.

The announcement also revealed that Tether’s consolidated net assets (the sum of all the company’s assets minus all its liabilities) were $11.9 billion as of June 30. Tether issued approximately $8.3 billion in the second quarter.

Tether’s balance sheet enables the company to “continue to lead the stablecoin industry in terms of stability and liquidity, and bring its expertise to diverse sectors such as artificial intelligence, biotech, and telecommunications,” said Tether CEO Paolo Ardoino.

Tether said it has been reinvesting some of its profits in adjacent industries, including sustainable energy, bitcoin mining, data, artificial intelligence infrastructure, peer-to-peer telecommunications technology, neurotechnology and education.

Stablecoins such as Tether and rival USD Coin are rapidly gaining popularity, with total payment volume surpassing Visa to more than $4 trillion.

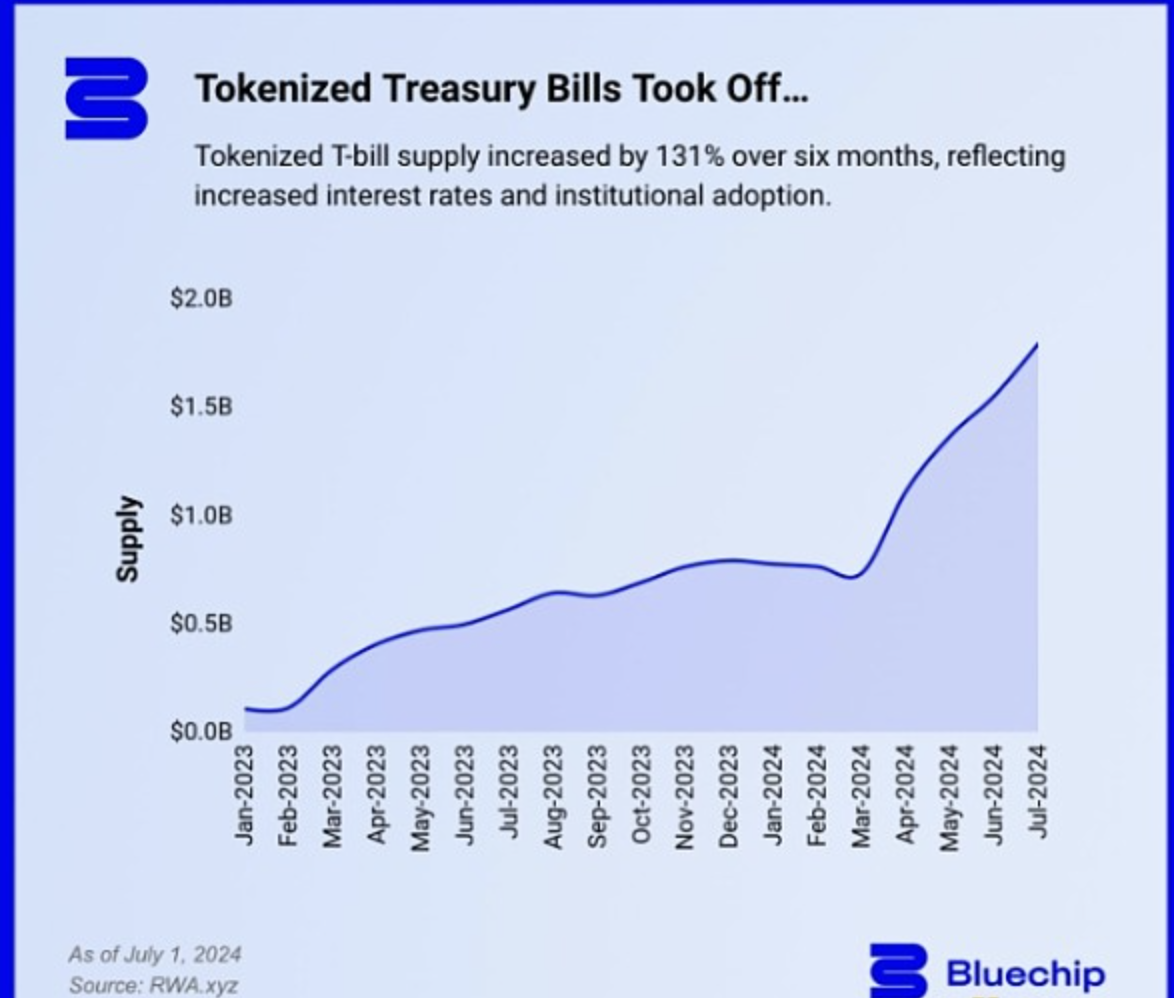

Combined with tokenized real-world assets, cryptocurrencies are becoming a major source of demand for U.S. Treasuries. Research strategist Tom Wan believes the tokenized U.S. Treasury market will reach $3 billion by the end of 2024.