Yesterday , a message "Hong Kong Bitcoin and Ethereum Spot ETF Net Subscription and Net Redemption Volume is 0" sparked discussion in the community. The author initially thought it was fake news. After all, the trading data of Bitcoin Spot ETF in the US stock market changes every day. It’s basically US$1 billion. No matter how bad Hong Kong is, it shouldn’t be too bad, right?

As a result, after observing the data of SoSoValue in the mobile zone, we found that it is really so sluggish, and the situation of hanging eggs for many consecutive days often occurs, as shown below:

- We can see that the Hong Kong Bitcoin Spot ETF has been at zero for four of the past five trading days (total net inflows)

- The Hong Kong Ethereum spot ETF is even worse. The last time it recorded a net inflow was July 16.

Mainland investors’ views

Dong District interviewed cryptocurrency investors living in mainland China and asked them about their reaction to the Hong Kong crypto ETF market. They basically showed a lack of interest. Some netizens commented that "Hong Kong ETF seems like a joke" and "the transaction volume is more than 5 million US dollars a day"... reflecting that Hong Kong cryptocurrency ETF seems to be very unattractive to investors and has a more limited impact on the market.

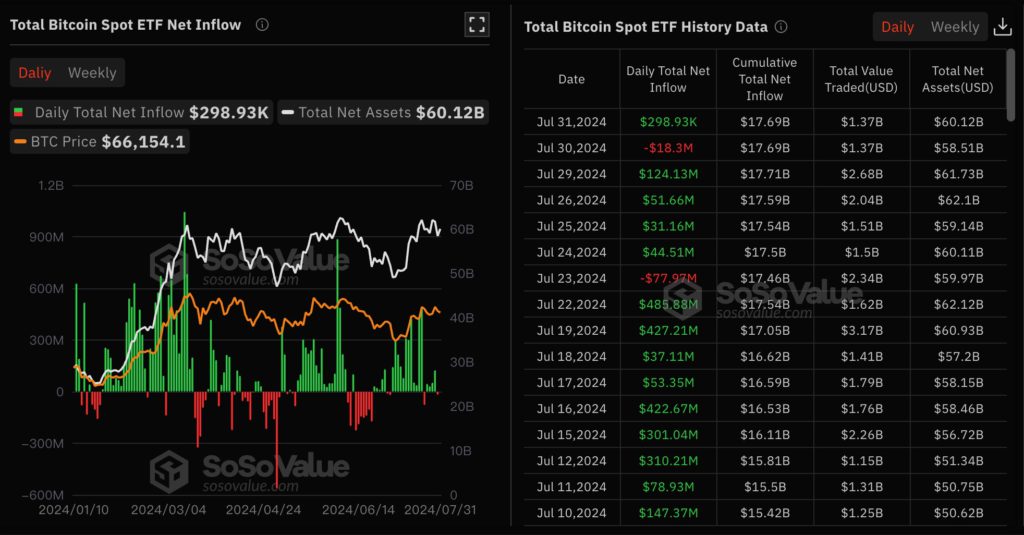

U.S. Bitcoin Spot ETF status in the past two weeks

In contrast, demand for cryptocurrency ETFs in the U.S. market appears relatively active.

- On July 31, the US BTC spot ETF had a net inflow of US$298,930, with a total cumulative net inflow of US$17.69 billion, a total single-day turnover of US$1.37 billion, and a total net asset value of US$60.12 billion, accounting for 4.72% of the Bitcoin market value.

- The total net inflow of the U.S. ETH spot ETF on July 31 was -77.21 million U.S. dollars, the cumulative net inflow was -4.8318 billion U.S. dollars, the total single-day transaction volume was 472.5 million U.S. dollars, and the total net asset value was 9.08 billion U.S. dollars, accounting for the market value of Ethereum is 2.34%

Can the dream of Hong Kong Web3 Center come true?

After reading the above, we can find that the current performance of the Hong Kong cryptocurrency ETF market is quite sluggish and has little impact on the global market. There are many possible reasons for the cold market:

- First of all, the average fee rate of Hong Kong ETFs is 0.85% to 1.99%; while the management fees in the United States are 0.15% to 1.5%

- Next, the trading volume and depth are better on US exchanges

- Third, in terms of safety, investors may still trust large U.S. issuers more

In general, if Hong Kong’s cryptocurrency ETFs want to continue to improve their market position in the future, they may still need to make great efforts. Hong Kong's dream of becoming a Web3 center still requires continued observation.